Generators prioritise flexibility [NGW Magazine]

Switching from combined-cycle gas turbines (CCGT) to open-cycle gas turbines (OCGT) and other fast response units is becoming commoner in Europe and elsewhere.

The trend is a sign of the success of renewables, which demand more flexible back-up than CCGTs can provide, but it also means less efficient gas generation. CCGTs have been coming under pressure since 2016, when Germany’s 1.4-GW Irsching CCGT baseload plant – the world’s most efficient at the time – had to shut down units. Since then many more megawatts of intermittent renewable capacity have been added.

Other companies have been investing in these low-efficiency but high-response engines too and this is likely to become increasingly apparent across Europe, including in France where a planned reduction in reliance on nuclear could expand the role for gas back-up; and Germany, planning to phase out coal completely by 2038.

As well as conversion, newbuild OCGTs are in the pipeline, encouraged in the UK by the capacity payment system. “We’re all on benefits” said one industry source, referring to the subsidies for back-up power – in the form of UK capacity market payments – as well as government incentives for renewables. He pointed to the high failure rate in the UK retail energy side, where a number of companies have gone into administration, as proof that the money is in the generation side, although no anti-monopoly probes have found any evidence of wrongdoing.

Capacity payments in the UK were suspended following a European court ruling since last November. The UK state-aid case is still being decided but the government has previously said it is expecting a decision before the start of the next delivery year – ie October 2019. If it is reinstated, all back-payments are expected to be collected from suppliers and paid to generators.

New UK OCGT projects include the Progress Power 299-MW peaking plant. Owners, Drax Group, said it has a response time of 20 mins and will operate below 1,500 hours a year, which “will help the country to transition to a lower carbon economy,” as it helps accommodate more renewables.

There has also been growing interest in fast-response reciprocating engines, with leading Finnish manufacturer, Wartsila’s European vice president, Melle Kruisdijk, noting that flexibility was becoming critical “as a requirement for power systems to integrate growing amounts of renewable energy sources such as wind and solar… The more renewables, the more flexibility is required.” Sales to the UK in 2018 included two 50-MW power plants to Centrica. These gas-fired plants are based on five 34SG engines.

And in Germany, Wartsila won a contract in January to deliver a 90-MW gas-fired, combined heat and power plant (CHP) using its 31SG engine, on an engineering, procurement and construction basis to Dresden's local utility Drewag. Start-up is planned for 2021 and follows a similar deal last year for 100 MW CHP capacity for Kraftwerke Mainz-Wiesbaden, comprising 10 units of 10 MW, again the 34SG model. In both cases the engines can reach nominal capacity in two minutes and will allow the operators to sell reliable district heat and power and make revenues from short-term trading.

Any switch away from CCGTs will mean the average efficiency of gas fired generation will fall. But Kruisdijk said gas turbine peak efficiency was more important before renewables when CCGTs ran as baseload and flexibility was not an issue. In the past, higher efficiency meant lower fuel consumption, which was the main determinant of costs. Now, intermittent and prioritised renewables mean fewer operating hours for conventional power plants and more flexible use at differing loads, making full-capacity efficiency less critical. “Though efficiency remains an important parameter, it is flexibility that is really needed in the new power system. Flexibility will enable more renewables, and more renewables will bring down the costs of electricity,” he said.

Virtual power plants

Balancing or backing-up renewables is done at small scale with individual peaking units, and at the macro level as national transmission grids seek to balance total dispatchable supply and demand. It is also now being done at medium scale through virtual power plants (VPPs), which are made up of a network of plants, often including gas, renewables and storage, connected by computer networks. This enables them to work as a collective unit that can react almost instantly to system imbalances, improving flexibility and making national/regional balancing easier.

Cost reductions in renewables plus batteries are even squeezing out gas generators completely in some places where wind or solar are high and reliable, and land is cheap – for example, in the southwest US, tenders for solar+storage have come in at less than $30/MWh, with further falls expected. This could put gas-fired peaking capacity in some sparsely populated areas of the US at risk over the coming years. Wind and batteries (from Tesla) were similarly successful in Australia.

CCGTs still dominant

However, there is still plenty of room for CCGTs, especially in the short term. In the UK, CCGTs amount to over 25 GW of available capacity, while OCGTs are only 800 MW (casting some doubt over claims of a major switch so far). The displacement of coal by gas and renewables since 2016 has actually created more room for gas, boosting demand. This also may happen elsewhere in Europe as coal plants are closed.

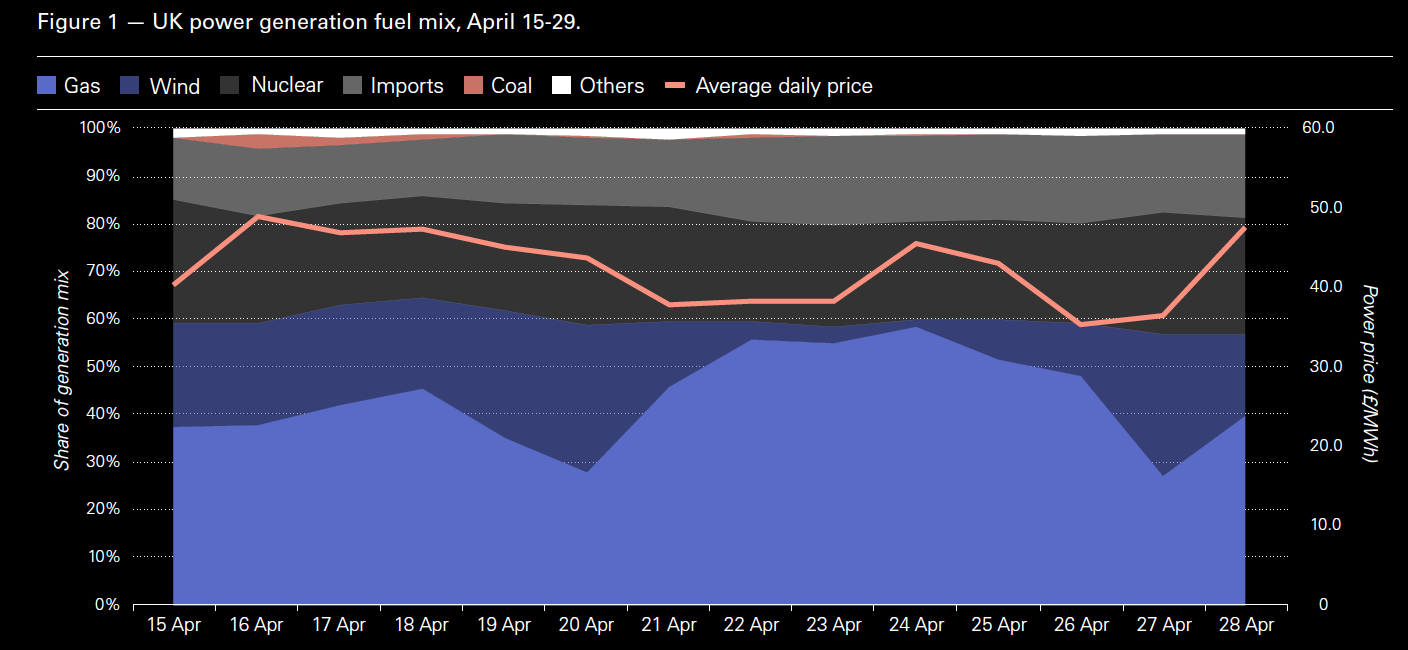

More important, there are still lengthy spells when winds – the UK’s dominant renewable – are very light and when gas rises above half of the total generation for periods of several consecutive days. The week of April 29, for example, was one such period: wind dropped over the weekend, and further to around 0.5 GW by midweek from a potential 12GW. This pushed the share of gas up to 57% for 24 hours up to 7am May 1. Wind only recovered to near normal levels of 6-8GW late on May 3. And from May 1 until at least May 8, when NGW went to press, the British grid had just gone a record seven days without needing coal-fired power.

The 57% is of a proportionately lower total, owing to off-grid wind and solar, which takes about 12 GW off demand during windy midday periods in mid-summer. But to reach zero-carbon, a lot more batteries, hydrogen or other low carbon alternatives will be needed to fill these multi-day gaps – eventually displacing the gas-fired CCGTs and OCGTs.

The UK electricity system operator is preparing for a grid that is not carrying not merely zero coal-fired electricity – it achieved a record of at least a week, as of May 8 – but even zero carbon by 2025, if the market can deliver it.

But it told NGW that gas generation will still be required as the market needs to meet the demand when the zero carbon generation outputs are not sufficient to supply the nations demands. “We also believe that gas will have a significant role to play in the balancing and operation of the network at times when demand from the network is greater than the zero-carbon output,” it said.

Knowing when you’re not wanted

The desire to switch to OCGTs is likely to be growing in part because the penalties for being online when there is too much power are rising, with system prices expected to turn negative far more frequently in future as renewable capacity rises. This provides an advantage for fast response capacity.

On March 24, a Sunday, negative system prices in the UK’s Balancing Mechanism occurred for 13 consecutive settlement periods, as low electricity demand and high levels of wind output led the system operator to reduce generation output from a variety of wind, CCGTs and biomass power stations. An OCGT would have been able to respond more quickly than the CCGTs, avoiding the penalties.

The frequency with which UK system prices turn negative is expected to increase, with latest forecasts from Cornwall Insight predicting a rising number of negative wholesale price occurrences in the future as intermittent renewables capacity rises – reaching 14% of half-hourly settlement periods turning negative on average by 2034. These negative prices lead to the paid curtailment of renewable output.

Hydrogen future

In the system now favoured by EU and UK governments as the best and cheapest route to zero-carbon by 2050, the unused renewable energy could instead be used to create hydrogen, saving on the cost of curtailment and the lost renewable energy. Engineering firms and engine producers are ready for the change. For example, Mott MacDonald is hosting a conference at the end of this month, hoping to aid co-ordination among UK industry for a switch to hydrogen, while the UK’s Cadent is pushing Hynet, Europe’s biggest hydrogen plan to date.

Kruisdijk also acknowledged hydrogen could be part of the longer-term low carbon solution, noting that its engines could already run on hydrogen or biofuels: “We see a possible future where synthetic liquid and gaseous fuels, generated through ‘power-to-X’ technology, are used to power engine-based power plants, developing a zero-emission future power system…. We believe renewables, batteries and engine technology can develop hand-in-hand towards a 100% renewable world.”

|

The costs of balancing: Cornwall’s view Negative imbalance charges normally occur at times of high wind output and rarely go below -£60 to -£70/MWh, as that is the value onshore windfarms typically require in order to recover their lost subsidy should they need to reduce output, Cornwall Insight’s Tim Dixon told NGW. While wind farms are often asked to reduce output when wind speeds are high, it's not always because there's too much generation to meet demand but actually because there are constraints in the wires linking Scotland and the rest of GB. As more wind farms are built north of the border, the UK will have to add more Scotland-England transmission capacity to bring more wind-powered electricity south, where the demand is. Until then, gas-fired generators are usually required to ramp up to offset wind that is turned down.

William Powell |