Gazprom’s exports to Europe slightly up in April

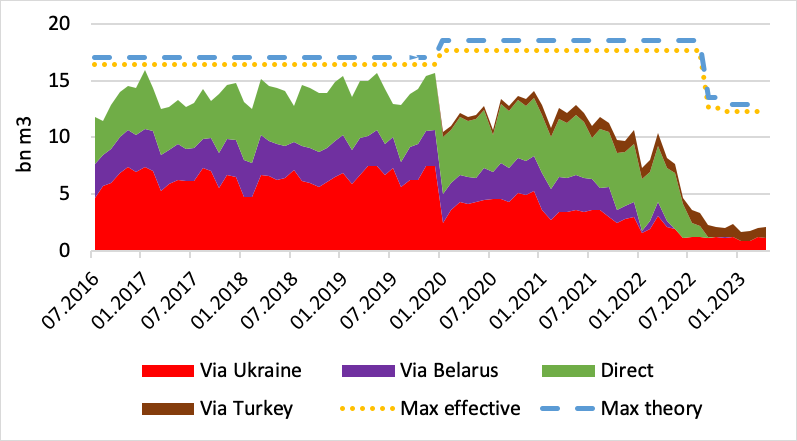

Gazprom’s exports were slightly up (+3%) in April versus last month but down a massive 75% versus a year earlier. Gazprom’s export volumes are staying in the expected range forecasted to be between 0.9 and 4.5bn m3/month, with this month an increase via Turkey (+19%) and a drop via Ukraine (-7%).

After more than a year of war in Ukraine, it is important to note that more than half of Gazprom’s exports to Europe are still transiting via the Ukrainian grid. Russian pipe exports to Europe are on par with Russian LNG exports to Europe. If both monthly flows stay at the actual level, we could end up 2023 with 40bn m3 of Russian gas (50% via pipe and 50% via ships).

Gazprom’s monthly gas exports to Europe

.png)

Source: Gazprom, Entsog, thierrybros.com

Gazprom’s export volumes should stay much lower than those witnessed last year until the end of summer. Depending on the refilling storage season, the Kremlin could revise its position at the end of summer to create further uncertainties in the European gas market.

Split of Gazprom’s monthly gas exports to Europe via route

Source: Gazprom, GTSOU, Entsog, thierrybros.com

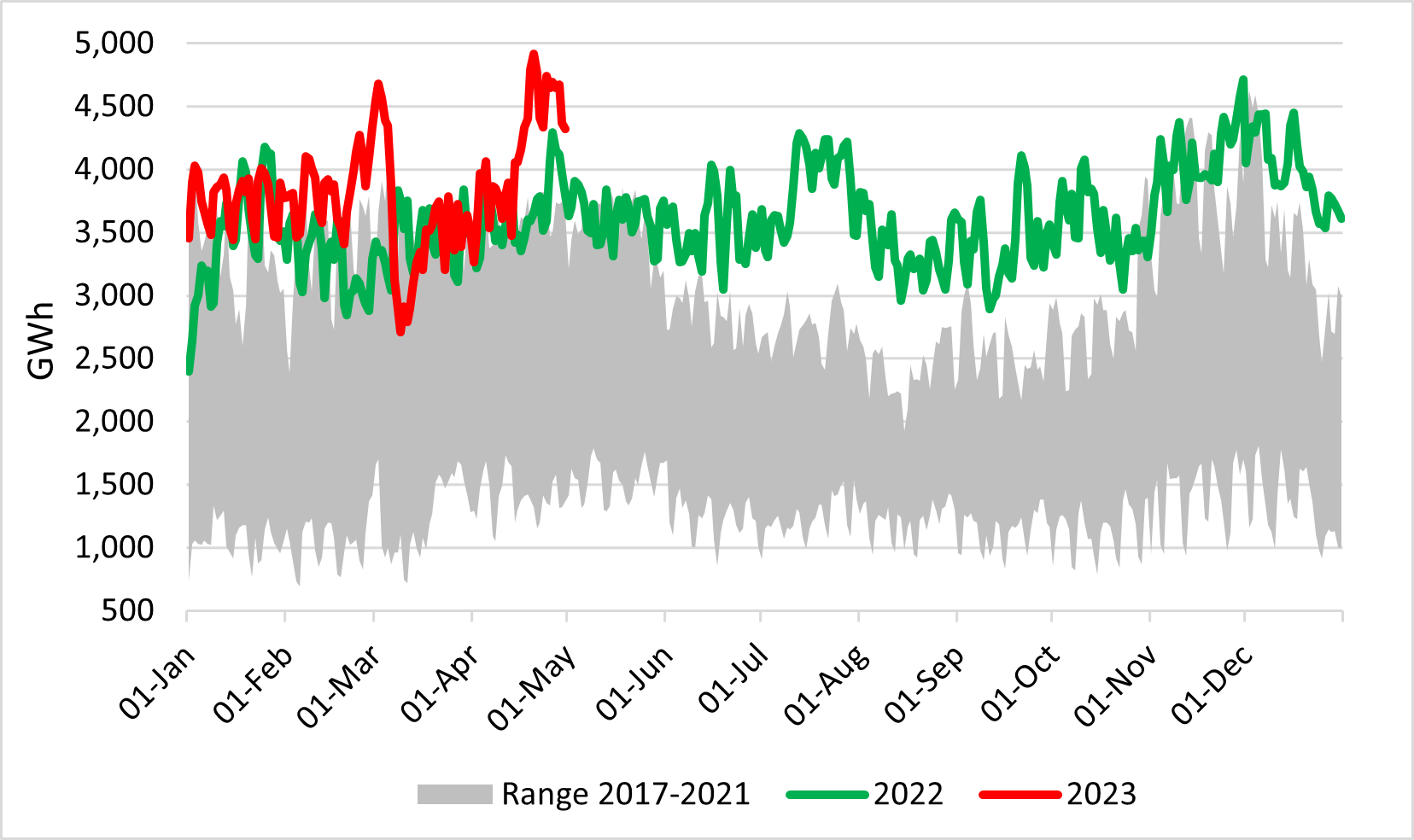

April send-out were at an all time high with a maximum daily recorded on April 20.

EU LNG send-out (excluding Malta)

Source: GIE, thierrybros.com

In April, Russia's government approved the sale of Shell's 27.5% stake in Sakhalin-2 (10.8mn metric ton/year of capacity) for $1.2bn to Novatek. Novatek acquired some LNG production capacity for a $391/mt bargain. Strangely it is a privately-owned Novatek and not Gazprom (50% state owned and already the majority owner in Sakhalin-2) that got access to this deal. Novatek now owns 50.1% of Yamal LNG (17.4mn mt/yr) and 27.5% of Sakhalin for a total equity capacity of 11.7mn mt/yr and can arbitrage all year long European versus Asian markets. It could change the LNG dynamic next winter.

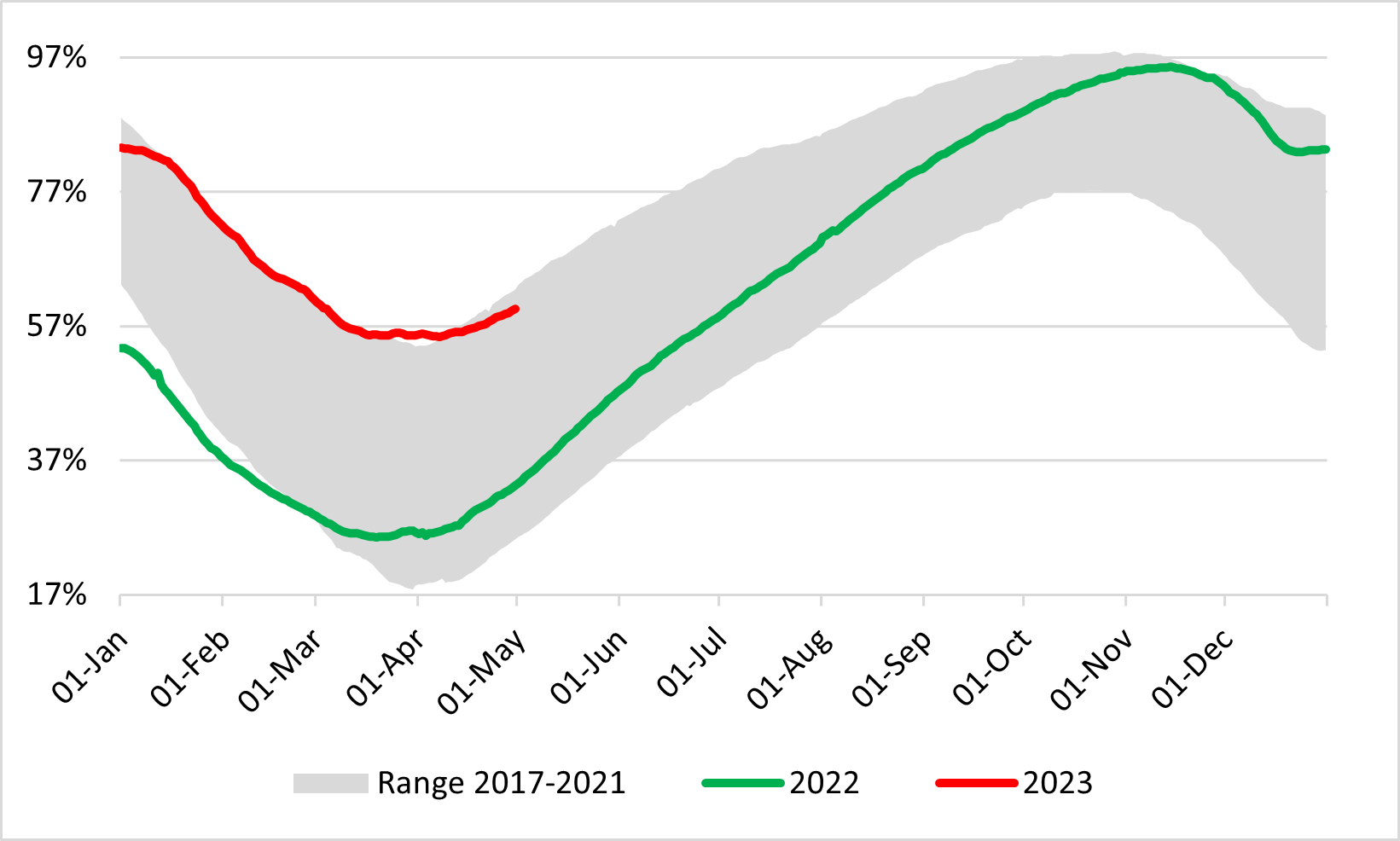

EU gas storage utilisation

Source: GIE, thierrybros.com

EU gas storage dropped to its lowest level (55.4% full) on April 7 (versus 25.5% on March 19, 2022) and ended April at 59.6%. After having spent most of 2023 at record level, storage is now back in its historical range even with record LNG send-out.

Filling them to the new minimum requirement of 90% requires another 33bn m3 of gas and could be easily achieved if we compare to history (71bn m3 last year). Unfortunately, Gazprom’s export volumes should stay much lower than those witnessed last year until the end of summer (-15bn m3). EU gas demand was 19bn m3 lower in summer 2022 versus summer 2021 as prices were much higher. Those three factors alone are transforming what looks at first as an easy refilling period into the same as last year.

The actual low refilling rate could perhaps be linked to industry relying on the new joint purchasing mechanism to provide 15% of EU gas storage filling obligations. It could be a perfect new case of misadministration. After having pushed over-the-top storage refilling in 2022 leading to skyrocketing prices, European policy leaders could provide the industry, in 2023, with two contradictory injunctions: a minimum refilling target (90% of storage capacity) and a joint buying obligation (13.5% of storage capacity) leaving the industry unable to achieve any of them. In short, Brussels is playing Russian gas roulette again in 2023. Remember, the probability to lose is increasing each time you play.

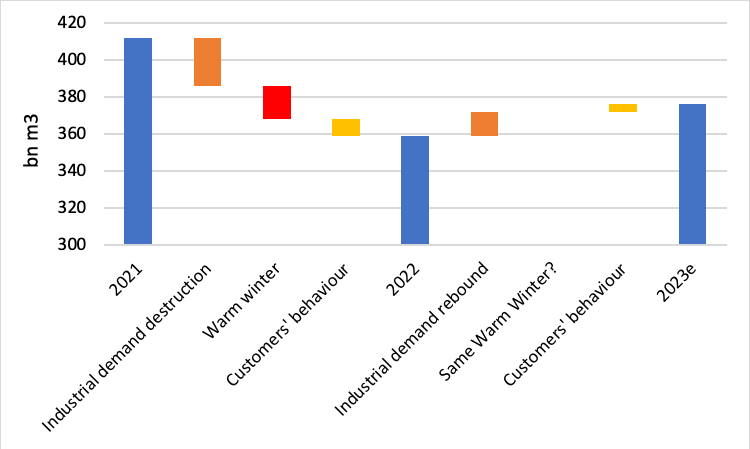

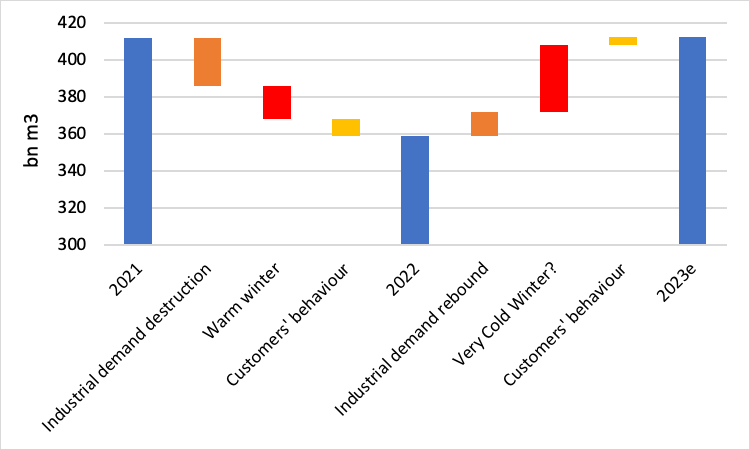

We can now estimate that out of the 13% drop in EU gas demand in 2022 versus 2021:

•50% came from industry;

•33% came from warm winter;

•17% came from change in customers’ behaviour .

If we look at past experience, we can expect ½ of industry demand destruction to be permanent (plants closing down, fuel switching permanent investment and relocating outside EU) but the other ½ should hopefully come back with lower prices. On new customers’ behaviour forecast is trickier as historical data is unavailable. Some demand reduction came from better insulation, smart metres, etc. and some from too high prices. So, let’s take the same metrics as for industry: 50% reversion to be expected with lower prices.

Assuming the same warm winter, we should see, just by a rebound effect, a growth of 5% in 2023 versus 2022.

From 2021 to 2023e with another warm winter

Source: thierrybros.com

On the other hand if we assume a very cold winter, the theoretical growth is 15%, back to the 2021 level. A level of supply that cannot be achieved even with the increased regas capacity.

From 2021 to 2023e with a very cold winter

Source: thierrybros.com

In short, 2023e demand is likely to be higher than 2022 with a minimum 5% growth to kick in soon. And if we were to face a very cold winter, prices will again have to skyrocket to entail continued industrial demand destruction and customer’s behaviour changes. As the winter is now over, the coming months should start providing an answer vis-à-vis industrial demand rebound.

Dr. Thierry Bros

Energy Expert & Professor

May 1, 2023