Gazprom Unlikely to Win a Price War: Analyst

Devaluation of the Russian ruble has affected the economic performance of Gazprom. However, the cost of West Siberian gas delivered to the European Union is still high and it leaves very limited room for price reductions.

Some analysts believe Gazprom is ready for a full-scale price war. James Henderson1 estimates the cost of Russian gas at the German border at approximately $3.5/mn Btu (the report does not specify if it includes export duty or not). Bloomberg2 quotes Alexander Kornilov, an energy analyst at Aton in Moscow, saying that Gazprom spends about $2/mn Btu producing gas in Siberia and delivering it to western Europe.

In my view, Gazprom cannot afford any price reduction.

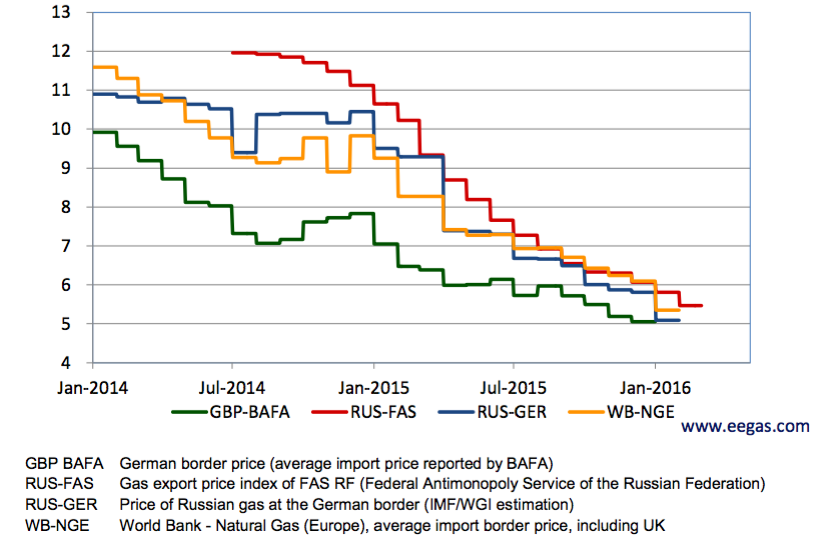

The International Monetary Fund estimated the price of Russian gas at the German border in January 2016 at $5.09/mn Btu. The state takes 30% of the price in the form of export duty and Gazprom gets the remaining 70% or $3.56/mn Btu. If the above mentioned cost of $3.5/mn Btu is net of export duty, then Gazprom is unable to reduce the price below the current level. $3.50/mn Btu net of export duty leaves $2.45/mn Btu.

The most recent financial report of Gazprom for the period of January-September 20153 gives the cost of transit services purchased from Nord Stream as rubles 54.099bn or $917mn.

European pipeline operators' Transparency Platform4 for the Opal 5 and NEL6 report the volume of gas shipped by the Nord Stream pipeline in January-September 2015 at about 300,000 GWh or slightly above 1000 TBtu. It results in the Nord Stream transportation cost of $0.92/mn Btu and the netback cost in the St-Petersburg area at $1.53/mn Btu ($2.45 - $0.92 = $1.53).

Note that Russia's Federal Antimonopoly Service (FAS) 7 reports the wholesale price of gas in the St Petersburg region at rubles 4,215 or $71.42/'000 m³ (FAS standard) or $2.28/mn Btu (net of VAT).

If the cost of $1.53 were correct, sales of gas in that part of Russia would have generated Gazprom a profit of 49%. Exports to Germany at the price of $5.09 and the cost of $3.50/mn Btu would have resulted in a lower profit rate of 45%. Looking at these numbers one can ask an obvious question: Why does Gazprom report losses instead of hefty profits?

How much does it really cost to export Russian gas to Europe?

Using the reported total cost of gas production segment of Gazprom in January-September 2015 and the corresponding volume, one can calculate the average production cost at rubles 1,656 or $28.07/'000 m³ (IFRS standard of Gazprom) and convert it to $0.88/mn Btu8. Note that the average cost of the same period of 2014 was equal to $1.28/mn Btu.

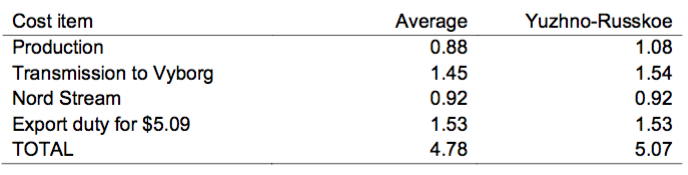

Table 1. Estimated Cost of Russian Gas Export, $/mn Btu

Note: Calculated costs for the period of January-September 2015

Figure 1. Selected Gas Prices in Europe, $/mn Btu

One of the gas sources for the Nord Stream Pipeline is the Yuzhno-Russkoe field9. Special companies Gazprom YRGM Trading and Gazprom YRGM Development purchase and sell gas produced in the Yuzhno-Russkoe field in volumes proportional to the German partners' stake in the field development project.

Using the numbers of E.ON10 and the financial report of Gazprom, I calculate the average price of Yuzhno-Russkoe gas in January-September 2015 at $1.08/mn Btu. The corresponding price of 2014 is $1.45/mn Btu. Note that the average price of Q3-2015 went up to $1.30/mn Btu.

Apparently, the Yuzhno-Russkoe volumes are delivered to the inlet of the Nord Stream pipeline. Using Gazprom's revenue from sales of gas transportation services to YRGM Trading and YRGM Development, I calculate the average transportation cost in January- September 2015 at $1.54/mn Btu (compared with $2.46 in the same period of 2014).

The official FAS tariff sets the cost of transporting gas from the Zapolyarnoe field (about 50 km from Yuzhno-Russkoe) to the Vyborg metering station (inlet of Nord Stream) at rubles 2,630/'000 m³ (including VAT). Depending on the calorific value of gas, it can be converted to $1.25-$1.40/mn Btu11.

Gazprom has discontinued publishing quarterly pipeline gas balance making it more difficult to calculate the transportation costs. Nevertheless, I estimate the average cost of transporting gas to the Russian border at about $1.45/mn Btu.

The overall costs are summarized in Table 1. Note that the domestic costs started to grow in the second half of 2015 and I expect the growth to go on at a faster rate.

German partners of Gazprom pay one of the lowest prices in continental Europe. FAS calculated the average price of Russian gas in Europe at $5.45/mn Btu (in February 2015), so there still is a tiny space for the profit.

However, there is no room for a price war.

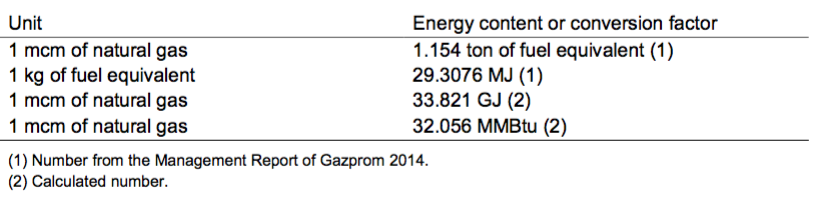

Conversion factors and exchange rates

Unfortunately, many analysts ignore the conversion factors and notes of the official documents of Gazprom and the Russian governmental agencies. One should keep in mind that power plants, residential consumers and many other buyers of natural gas pay for the energy content and not for the volume.

Ignoring the energy content of natural gas is like adding water to wine without changing the price per bottle.

The calorific value of 1000 m³ can be easily calculated using the numbers of the company's management reports12.

Table 2. Calorific Value and Conversion Factors

Note that FAS uses a different conversion factor from Gazprom: 1000 m³ = 31.35mn Btu.

Russia's Central Bank13 reports the average US dollar exchange rate for January-September 2015 at rubles 59.02 and the corresponding rate for 2014 at rubles 35.37.

Mikhail Korchemkin

East European Gas Analysis Malvern, PA 19355

USA

This analysis was originally published by East European Gas Analysis

1 Henderson, J. (2016) "Gazprom – Is 2016 the Year for a Change of Pricing Strategy in Europe?", Oxford Institute for Energy Studies - https://www.oxfordenergy.org/publications/gazprom-is-2016-the- year-for-a-change-of-pricing-strategy-in-europe/

2 http://www.bloomberg.com/news/articles/2016-02-19/russia-has-room-to-play-saudi-oil-game-with-gas-in- eu-veb-says

3 http://www.gazprom.com/f/posts/12/001311/gazprom-ifrs-3q2015-en.pdf

4 https://transparency.entsog.eu/

5 https://opal-gastransport.biz/ivo/home?1

6 https://nel-gastransport.biz/ivo/home?1

7 http://fas.gov.ru/documents/documentdetails.html?id=13809 - the price for non-residential customers.

8 http://www.eegas.com/rep2015q3-cost_e.htm

9 https://www.nord-stream.com/the-project/pipeline/

10 http://www.eon.com/content/dam/eon-com/Investoren/Captial_Market_Story/20160105_Capital_Market_Story.pdf

11 Unlike the price, the transportation tariff is not adjusted to the calorific value of gas.

12 http://www.gazprom.com/f/posts/91/415561/2014-mgt-report-en.pdf

13 http://www.cbr.ru/statistics/print.aspx?file=credit_statistics/ex_rate_ind_15.htm