Gazprom Ramps up August Exports to Europe

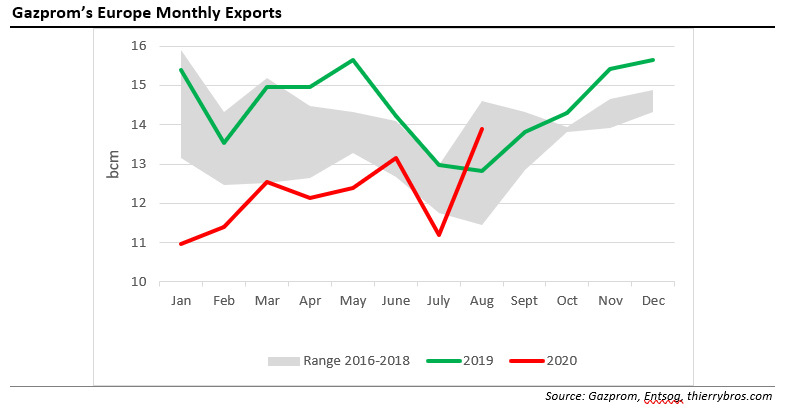

Gazprom’s flows were up massively in August 2020 compared with July (+24.2%); they were even – and for the first time this year – above last year's (+8.3%).

Gazprom was not immune to the low prices; during its August 31 conferece call, it disclosed it received a record low price of just $110$/’000m³ for its gas sold in Europe. Gazprom also mentioned that during Q3 gas market started to rebound.

The Covid-19 pandemic will continue to restrain EU import needs even if the low prices do make gas burn more attractive…

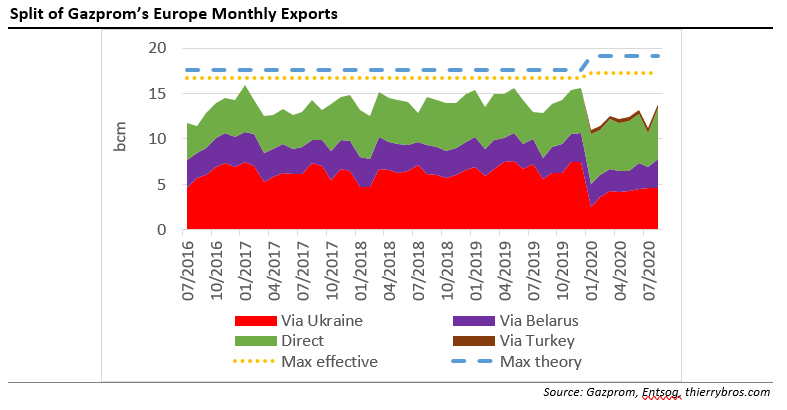

The highest increase over last month was for the direct flow (+50.4%) as between 14 to 26 July, Nord Stream was closed for its annual maintenance.

The transit deal signed December 29 between Gazprom and Naftogaz provides for 65bn m³ to cross Ukraine this year. As that volume is based on a uniform flow of 178mn m³/d[1] or 5.5bn m³/month, any lower historical flow cannot be offset by higher contracted flows later. With lower contracted transit flows, this means that the maximum contracted volume through Ukraine can now only be 54bn m³, although Gazprom will pay for the transit of 65bn m³ regardless.

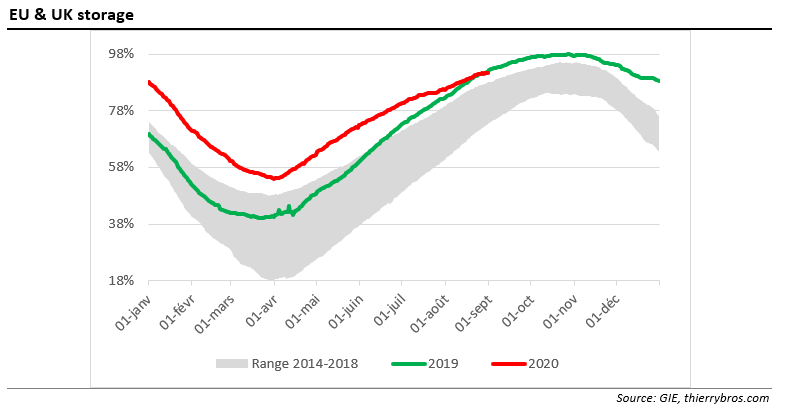

As for storage, with European facilities now 91% full, we are back to 2019's record.

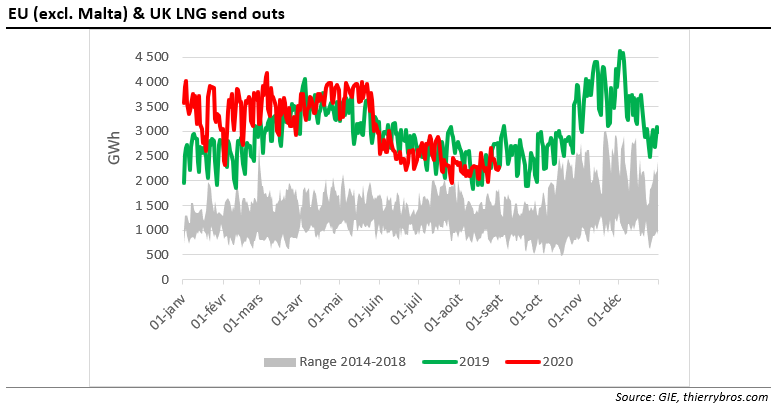

As we have been writing since early this year and contrary to consensus, Gazprom is no longer the only producer to swing supply. For the first time ever, Gazprom might have only half the global spare capacity. All producers are sharing the burden of reducing volumes to the EU and this translates into less pipe gas (in H1 20) – and, since June lower LNG imports. We should expect LNG send outs to continue to be below last year level until winter starts.

If we have passed the bottom in terms of Dutch hub prices, then Gazprom’s strategy of reducing export volumes in Jan-July 2020 (-17.9bn m³ or -17.6%) relative to last year and then to increase exports in August looks more profitable/less costly than the slower-moving LNG suppliers who are delivering less gas just when prices are starting to recover…

Thierry Bros

September 2, 2020

Advisory Board Member, Natural Gas World

.PNG)