Gazprom flows slow EU storage refill

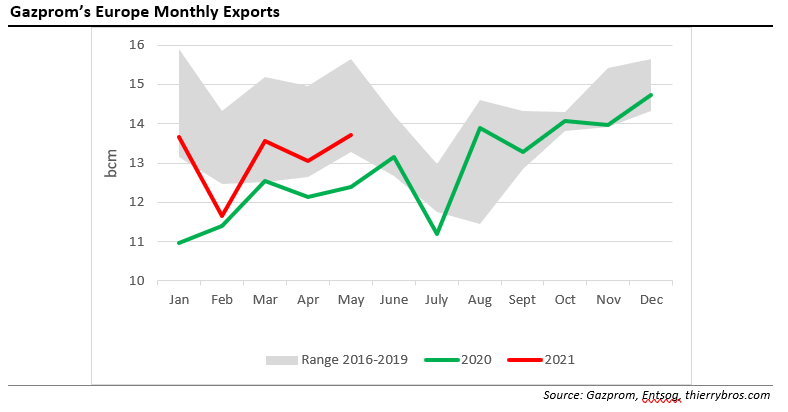

The transit deal signed in December 2019 between Gazprom and Naftogaz provides for 40bn m³ transit volumes for 2021. As the 40bn m³ is to be at a uniform flow of 110mn m³/d, any lower historical flow cannot be mitigated by higher contracted flows later.

For higher flows, Gazprom needs to book additional capacity to the operator Gas Transmission System Operator of Ukraine (GTSOU), as it did last year. But Gazprom seems, so far, unwilling to do so, with transit volumes via Ukraine capped at the maximum contracted allowances. The limited swing in exports is managed usiung all other routes.

.PNG)

Gazprom is now benefiting from higher prices but still seems reluctant to pay for additional capacity in Ukraine to benefit also from increased volumes. It could be viewed as a way for Gazprom to show the needs of Nord Stream 2…

With CO2 prices (EU ETS) now setting new records above €50/metric ton, we are entering a new world where most coal-to-gas switching can, as happened in the UK in 2016-2018, be achieved in the next two years. Markets are always more efficient than policies.

In May, LNG send outs were in Europe down respectively by 17% and 22% vs last month and last year.

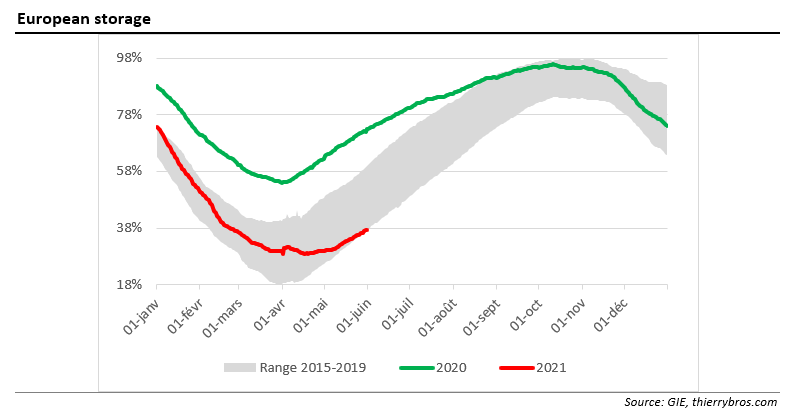

On April 16, Europe’s gas storage was at its lowest (29% full) before a delayed feeble injection period. The late cold spell and limited Russian and LNG flows are pushing storage lower than its 2015-2019 historical range.espectively by 17% and 22% vs last month and last year.

After the IEA Net Zero fantasy scenario where investors were warned of the need of no new final investment decision in oil and gas projects, this month European gas dynamic shows that, with less supply, as demand is inelastic, the outcomes are lower storage level on the physical side and higher prices on the financial side. It is not completely certain EU middle-class voters will be happy with this financial outcome…

With so much more storage to fill, will Gazprom continue to limit its flows via Ukraine to avoid booking extra capacity at the expense of more LNG berthing in Europe or would it react? The economic rational answer should be to supply more needed gas but the uncertainty strategy[1] is providing added benefits. Even if Gazprom should book more capacity in Ukraine, the company has an even bigger market power by deciding when to go ahead. Gazprom, as the ultimate timekeeper, will decide alone when to take traders and LNG producers by surprise…

Thierry Bros

June 1, 2021

Advisory Board Member, Natural Gas World

[1] As defined by Sadek Boussena and Catherine Locatelli in 2017 in “Gazprom and the Uncertainty of the European Gas Market: Towards a Market Share Strategy?” available in French at https://journals.openedition.org/rei/6513

.PNG)