Gazprom exports to Europe recover in March on higher Ukrainian transit

Gazprom’s exports were up 15% in March versus the previous month, but down a massive 80% versus the same month last year. Gazprom’s export volumes are staying within the expected range of 0.9-4.5bn m3/month, with this month seeing an increase via Ukraine (+31%) versus the record low witnessed in February. Volumes transiting via Ukraine still represented, in March, only 35% of the contracted volumes.

After more than a year of war in Ukraine, it is important to note that still 60% of Gazprom’s exports to Europe are transiting via the Ukrainian grid.

Russian pipe exports to Europe are on par with Russian LNG exports to Europe. If both monthly flows stay at the actual level, we could end up 2023 with 40bn m3 of Russian gas (50% via pipe and 50% via ships).

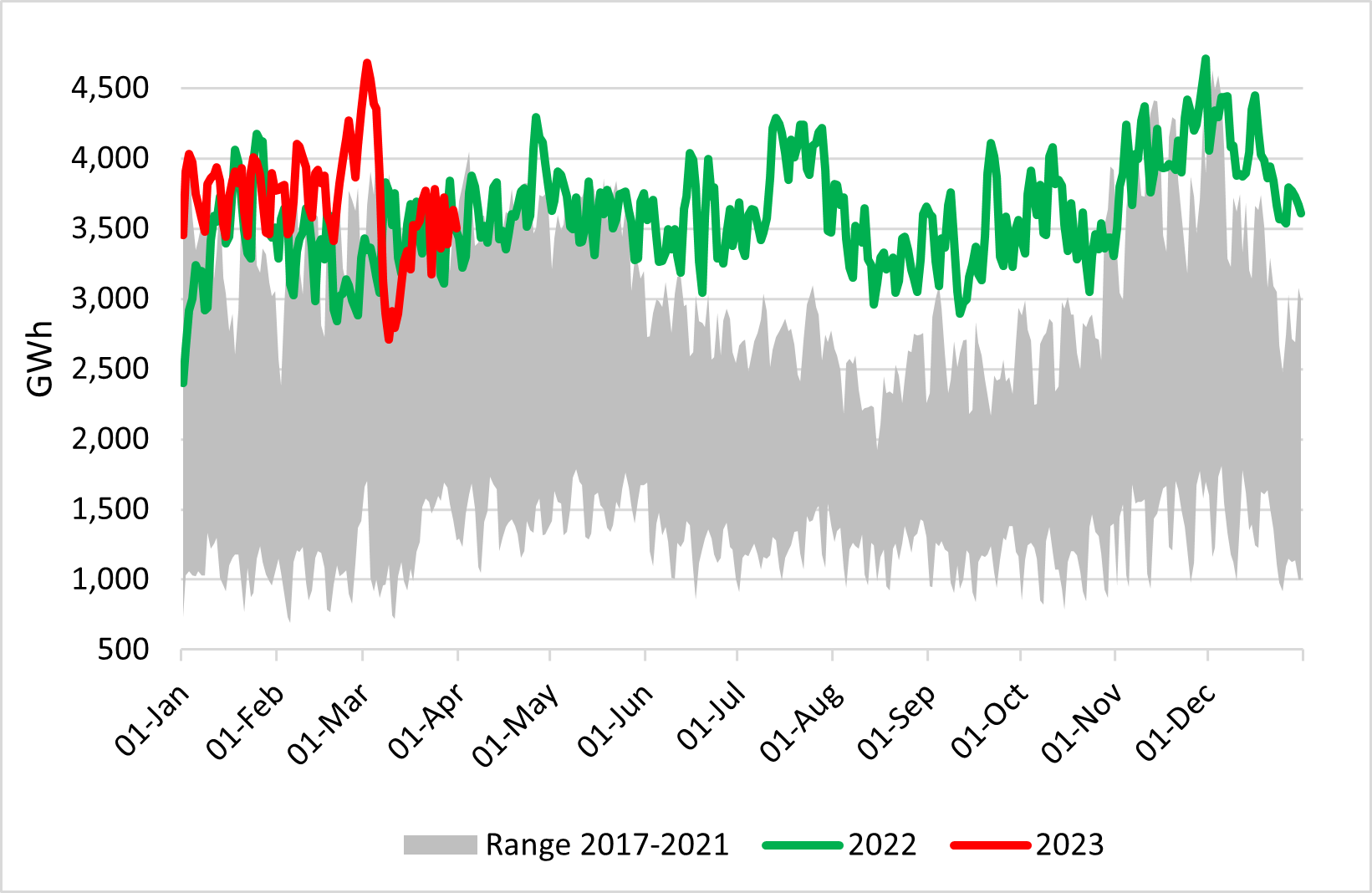

Gazprom’s monthly gas exports to Europe

.png)

Source: Gazprom, Entsog, thierrybros.com

Gazprom’s export volumes should stay much lower than witnessed last year until the end of summer. Depending on the refilling storage season, the Kremlin could revise its position at the end of summer to create further uncertainties in the European gas market. But for now, with spot prices down below pre-war level, the market feels confident.

Split of Gazprom’s monthly gas exports to Europe via route

.png)

Source: Gazprom, GTSOU, Entsog, thierrybros.com

After material growth yr/yr for the last 12 months, March 2023 LNG regasification send-out was only 2% above March 2022. Hopefully this could be explained by strikes in France where send-out is 58% lower than last year, as we should continue to need more LNG rerouted to Europe to mitigate the future expected Gazprom’s exports reductions.

EU LNG send-out (excluding Malta)

Source: GIE, thierrybros.com

With EU storage above historical range since January 15, the supply-demand balance looks more relaxed, and TTF prices continue to stay below €50/MWh as security of supply should be put on the back burner for the coming months. But with CO2 prices above €90/mt, gas-fired power plants are now more profitable than coal ones and this could boost demand. Europe cannot be complacent as: 1. China gas demand is picking up after the end of the country’s zero-COVID policy and 2. Russia could still use energy as a weapon. On March 30, the EU Council extended the member states’ voluntary 15% gas demand reduction target, for one year until March 31, 2024. This revised regulation includes a new provision to address the specific issue of increased gas consumption of gas in a member state due to a coal-to-gas switching used for district heating, in determining the reference gas consumption. But with reduced wholesale gas prices compared with last year, the price signal could play in the opposite direction for industries this summer versus last summer.

EU gas storage utilisation

.png)

Source: GIE, thierrybros.com

EU storage utilisation dropped to 55.6% of capacity on March 21 (versus 25.5% on March 19, 2022). Filling them to the new minimum requirement of 90% requires 37bn m3 of gas and could be achieved in August even with Gazprom flows more likely to be at the actual level (1.7bn m3/month) vs 11.9bn m3/month witnessed in summer 2022. But with a potential EU embargo on Russian LNG, EU storage refilling will be more challenging and costly as in summer 2022, the EU received 1.7bn m3/month of Russian LNG.

Dr. Thierry Bros

Energy Expert & Professor

April 3, 2023