Gazprom Exports to Dip in 2020: Analysis

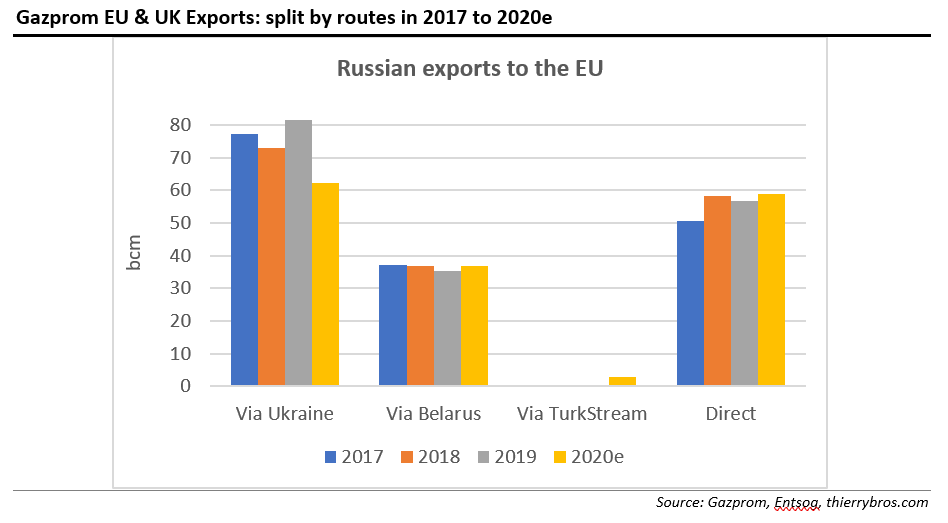

The transit deal signed on December 29 between Gazprom and Naftogaz provides for 65bn m³ to flow to the European Union* this year. At the rate of 178mn m³/day 1 or 5.5bn m³/month, a low flow this month cannot be offset by a higher flow next month. For higher flows, Gazprom would need to (directly as a registered shipper or again via Naftogaz) book additional capacity to the operator Gas Transmission System Operator of Ukraine (GTSOU).

The transit via Ukraine showed an unexpected collapse in January (2.7bn m³ instead of the expected ship-or-pay 5.5bn m³). Gazprom might be rebalancing the market by withdrawing more gas from its storage or creating uncertainties. “Gazprom is in a position to deploy a strategy designed to create uncertainty about the price of natural gas, rather than simply starting a price war,” as was perfectly defined by my friends Catherine Locatelli and Sadek Boussena in a visionary 2017 paper 2. In a fully liberalised market, the lower cost provider has always more market power as others have to price in extra risk… This also means that the maximum contracted volume 3 via Ukraine could now only be 63bn m³ for 2020.

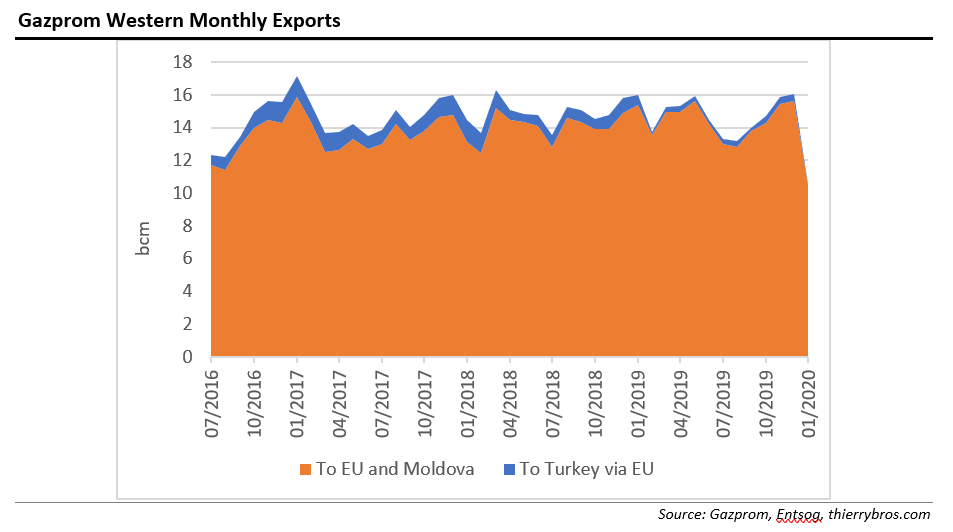

In less than a month, TurkStream supplied more than 1bn m³ (54% to the Turkish gas market and 46% to the Turkey-Bulgaria border) 4. We can therefore assume that at least 15bn m³/yr will now be rerouted away from Ukraine. Flows from EU to Turkey at the Strandzha-Malkoclar border stopped as of January 8. If, as we expect, those flows remain at zero for the next few months, we will remove the above graph from our monthly analysis.

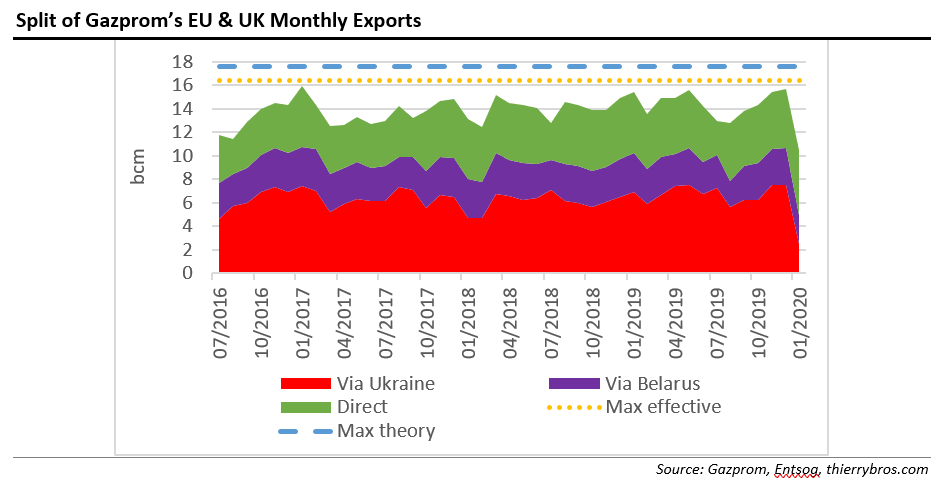

Gazprom’s flows were massively down both relative to December (-32.9%) and last year (-31.8%). The transit route via Ukraine is the most affected (-67% vs December 2019), while the direct flows are up (9.6% vs December 2019) thanks to the Eugal line 1 6 in operation which allows Gazprom to maximise Nord Stream 1 flows regardless of the Opal decision.

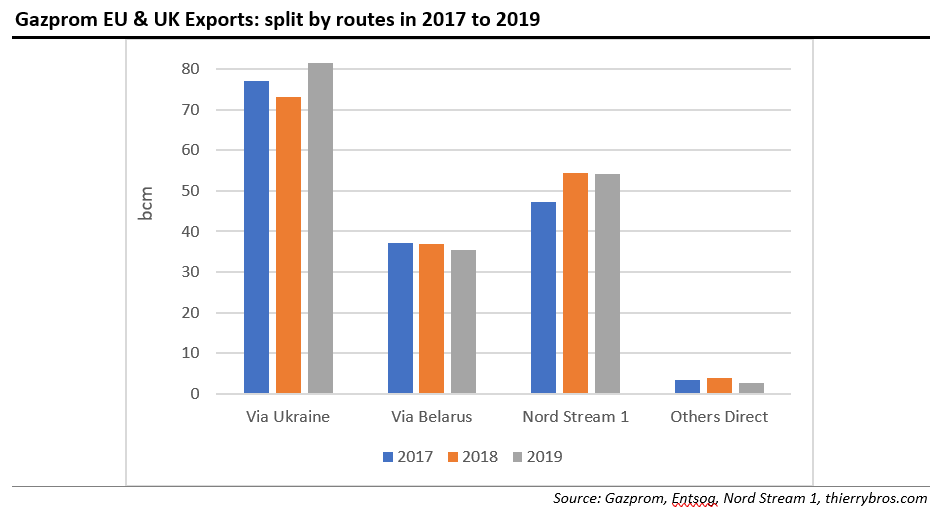

Transit for Ukraine accounted in 2019 for the highest share (47% in 2019 vs 43% in 2018) of Gazprom’s exports to the EU. The 8.5bn m³ increase should also to be compared vs the extra 6.6bn m³ that Gazprom put in storage in 2019.

In 2019, Nord Stream transported 58.5bn m³ to Europe 7 (-0.3bn m³ vs 2018 thanks to the Opal court decision). And with the Eugal line 1 in operation, Gazprom is in a position to maximise Nord Stream 1 flows regardless of the Opal.

.PNG)

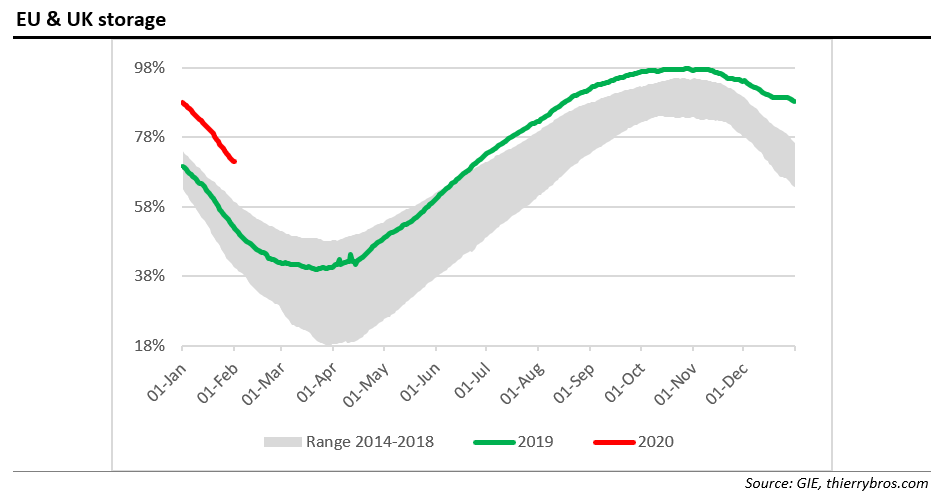

Interestingly this is the same maximum number for Gazprom to reduce its exports without negatively impacting its sales in volumes to the EU (using its 11.4bn m³ in storage at the end of 2019 and only refilling its proprietary capacity of 4.8bn m³ in 2020)…

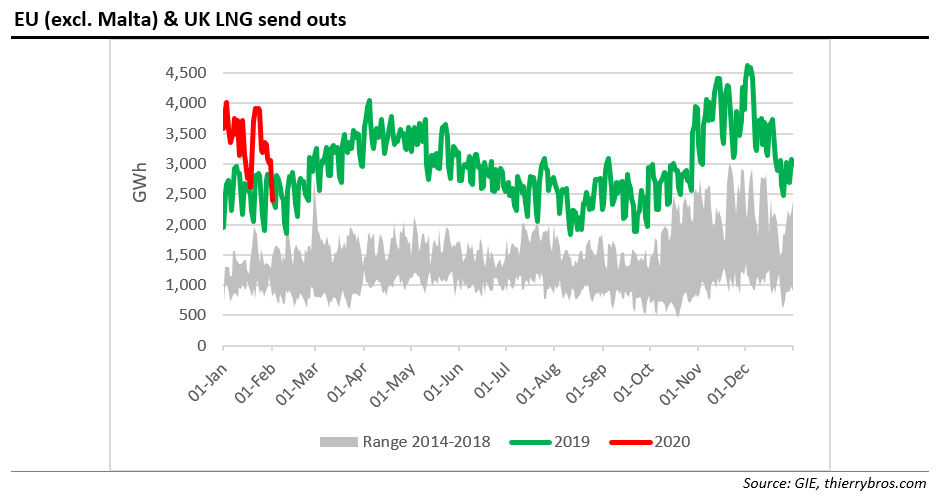

Gazprom is prepared to reduce its exports to rebalance the storage overhang situation but not to make room for unlimited LNG. This means that other suppliers will have to cut, either proactively or following a market signal (ie lower prices). After having already reduced production by 6.4bn m³ in 2019 vs 2018, Norway could cut again proactively this year (about 7bn m³). If this is not enough to rebalance the market, we could then expect a price reaction to avoid more LNG into the EU. Hence why we will also, from now, monitor monthly the EU & UK regas flows…

In January 2020, regas send-out was up 33% (+2.6bn m³) vs January 2019 but down 1% vs December 2019. If LNG regas send-out growth reaches 8bn m³ we should expect further price reaction as neither Norway nor Gazprom would want to take further pain in cuts.

Regarding NordStream 2, on January 11, Russia’s president Vladimir Putin stated: “I hope that by the end of this year, or in the first quarter of next year, work will be finished, and the gas pipeline will start operating.” After the Danish section is completed, the pipelines will have to be connected to the German sections. This can only happen between mid-May and the end of October, owing to environmental concerns. Could Nord Stream 2 be operational in Q2 21 instead of Q2 20?

The Nord Stream 2 saga is still not over and it could impact Ukrainian transit post 2021. If it does, Gazprom (like all other market participants) might wish to refill EU storage to the record level at the end of 2020. Stay tuned!

Thierry Bros

3 February 2020

Advisory Board Member of Natural Gas World

*Following Brexit and until the UE-UK new relations are set in the energy sector, we will continue to include the UK in our monthly analysis.

[1] https://interfax.com.ua/news/interview/635485.html

[2] Sadek Boussena, Catherine Locatelli. Gazprom and the complexity of the EU gas market: a strategy to define. Post-Communist Economies, Taylor & Francis (Routledge), 2017, 29 (4), pp.549 - 564. Available at https://hal.archives-ouvertes.fr/hal-01618494/document

[3] 65bn m³ – 2.7bn m³ under shipped in January = 62.3bn m³

[4] https://www.gazprom.com/press/news/2020/january/article498525/?from=mail

[5] Those flows were not accounted for in our monthly papers as the gas was not delivered to the EU but to Turkey.

[6] https://www.eugal.de/en/media-library/press-releases/press-release/news/eugal-first-string-ready-to-transport-gas-from-1-january-2020-1/

[7] https://www.nord-stream.com/press-info/press-releases/a-volume-of-585-billion-cubic-metres-of-natural-gas-was-transported-through-the-nord-stream-pipeline-in-2019-510/

[8] 65bn m³ – 2.7bn m³ under shipped in January = 62.3bn m³

[9] GIE data

[10] We assume 0 bcm demand growth and a drop of 8bn m³ in EU domestic production in 2020 vs 2019 .