Gazprom EU Exports Have Summer Bonus

Russian pipeline gas export monopoly Gazprom sent a record amount of gas to Europe in 2018, which reached an all-time high of 168bn m³ (or +2% than in 2017). In December flows were up (+7%) vs November and up 0.6% vs 2017.

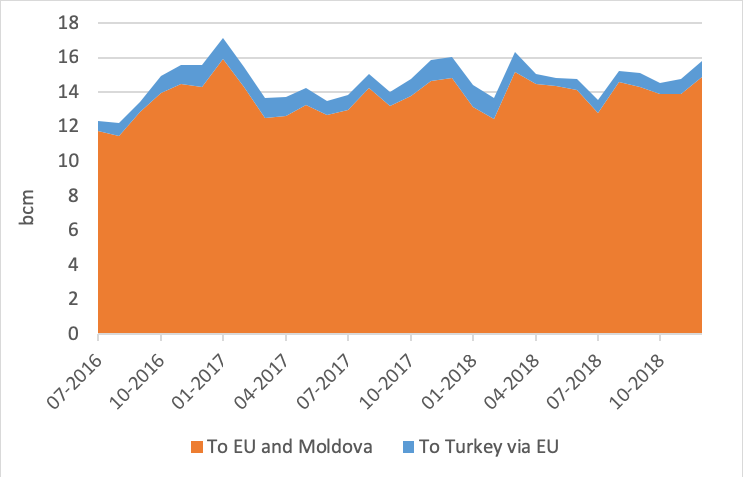

Gazprom Western monthly exports

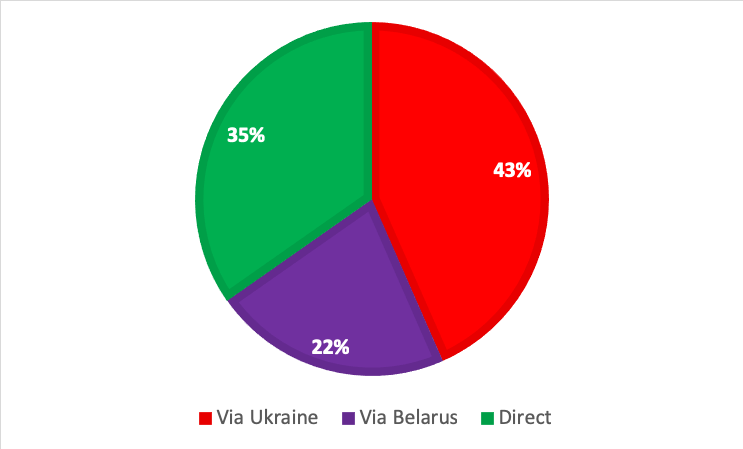

Looking back at 2018 on a full year basis, even if the direct routes (Nord Stream 1, Finland, Estonia and Latvia) are preferred, Ukraine stills accounts for 43% of the deliveries.

Gazprom Western Exports: Full Year split by routes

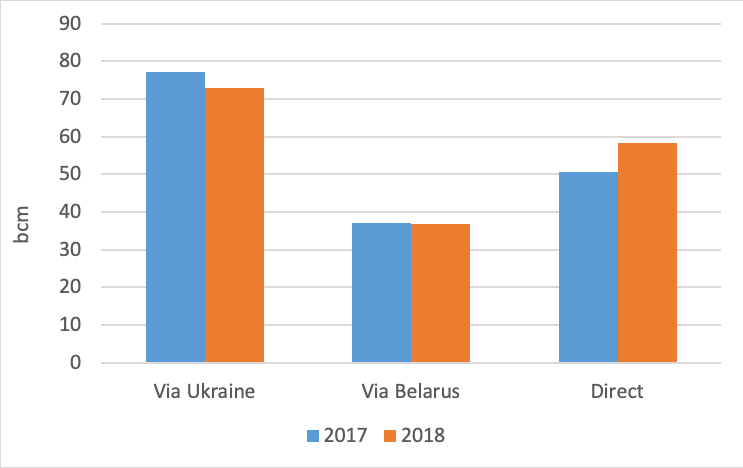

In December, all routes were more used (from 5.7% via Belarus to 7.8% via Ukraine).

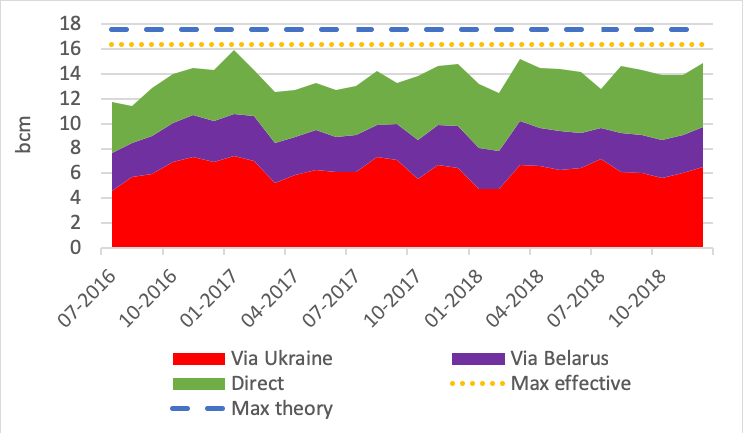

Split of Gazprom’s EU monthly exports

Gazprom Western 2018 Exports: split by routes

This can be explained by the high use of direct routes that leaves little room for Gazprom to reduce further transit via Ukraine, at least until Nord Stream 2 comes on-line.

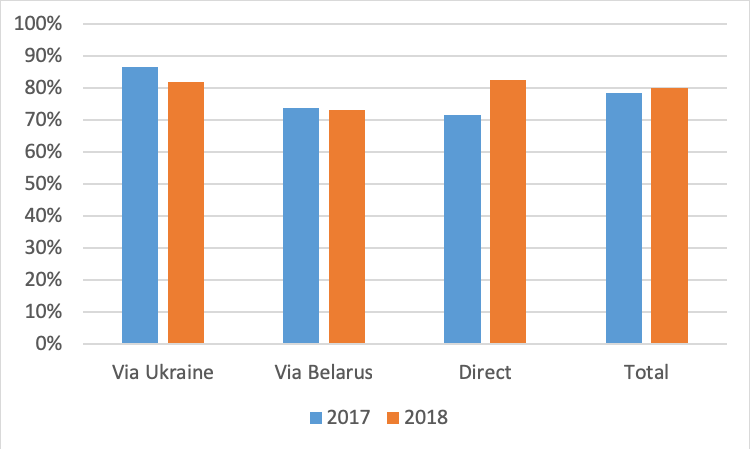

The percentages are calculated using:

- the maximum monthly effective volume via Ukraine (7.4bn m³/month);

- the theoretical maximum via Belarus (50.4bn m³/yr,the sum of Yamal Europe (34bn m³/yr), Beltransgaz to Lithuania (11bn m³/y) and Poland (5bn m³/y); and

- the theoretical maximum for direct routes (71bn m³/yr, the sum of Nord Stream 1 (55bn m³/y) and Finland (8bn m³/y), Estonia (2bn m³/y) and Latvia (6bn m³/y)

Gazprom Western Exports: Full Year supplies by routes

An interesting point that happened in 2018 is that Gazprom’s exports to Europe were higher in summer (84.7bn m³ in Q2 & Q3) than in winter (83.5bn m³ in Q1 & Q4). This can be explained by the need to replenish depleted stocks in Q2 at time when LNG was moving to Asia. This is a testimony of Gazprom’s flexibility that can now fine tune its answer to EU customers by selling gas not only via long term contracts but also via auctions or via its European subsidiaries. The interesting question that needs to be looked into once Gazprom will produce its full-year results is to check if summer prices were higher or lower than winter prices…

Thierry Bros

January 10, 2019

Advisory Board Member of Natural Gas World