Gas Transition News [GasTransitions]

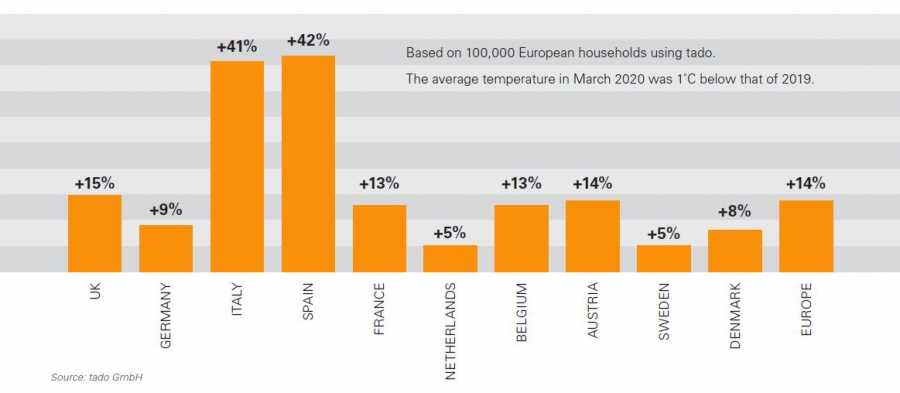

Corona lockdown pushes up heating demand across Europe

If the corona crisis is having a devastating effect on the transport sector, this is not the case in the heating sector. The lockdowns in Europe have in fact significantly pushed up heating demand across Europe, according to Tado, a German producer of intelligent thermostats.

As Clean Energy Wire reports, in Germany, where lockdown measures started on 22 March, “the use of heating energy went up 9% compared to a year earlier, the company’s analysis of more than 100,000 customers in Europe found. In Italy and Spain, where restrictions started on 9 March and 14 March respectively, heating demand rose by more than 40 percent.”

"The weather plays a minor role here, as outside temperatures differed from the previous year by only 1°C on average," Tado said in a press release. "The increased consumption of heating energy is largely due to the fact that the population spends more time at home during the corona crisis."

Clean Energy Wire also notes that “the extensive suspension of Germany’s industrial production in a bid to slow the spread of coronavirus will have a substantial impact on the country's energy consumption, industry association BDEW has said. Industrial customers account for between 40 and 45 percent of Germany’s electricity and natural gas consumption, but measures to contain the virus, collapsing supply chains and withering demand at home and abroad are expected to lead to a sharp decline in power consumption and, by implication, of greenhouse gas emissions.”

U.S. researchers find way to store hydrogen at much lower pressures

A research team led by Northwestern University has designed and synthesized new materials with ultrahigh porosity and surface area for the storage of hydrogen and methane for fuel cell-powered vehicles, reports Science Daily.

The designer materials, a type of a metal-organic framework (MOF), can store significantly more hydrogen and methane than conventional adsorbent materials at much safer pressures and at much lower costs, notes the report.

"We've developed a better onboard storage method for hydrogen and methane gas for next-generation clean energy vehicles," said Omar K. Farha, who led the research. "To do this, we used chemical principles to design porous materials with precise atomic arrangement, thereby achieving ultrahigh porosity."

“Adsorbents are porous solids which bind liquid or gaseous molecules to their surface. Thanks to its nanoscopic pores, a one-gram sample of the Northwestern material (with a volume of six M&Ms) has a surface area that would cover 1.3 football fields.”

The new materials also could be a breakthrough for the gas storage industry at large, Farha said, because many industries and applications require the use of compressed gases such as oxygen, hydrogen, methane and others.

Farha is an associate professor of chemistry in the Weinberg College of Arts and Sciences. He also is a member of Northwestern's International Institute for Nanotechnology. The study, combining experiment and molecular simulation, was published on April 17 by the journal Science.

Science Daily notes that hydrogen- and gas-powered vehicles currently require high-pressure compression to operate. “The pressure of a hydrogen tank is 300 times greater than the pressure in car tires. Because of hydrogen's low density, it is expensive to accomplish this pressure, and it also can be unsafe because the gas is highly flammable. Developing new adsorbent materials that can store hydrogen and methane gas onboard vehicles at much lower pressures [means] the size and weight of the tank can be optimized.”

"We can store tremendous amounts of hydrogen and methane within the pores of the MOFs and deliver them to the engine of the vehicle at lower pressures than needed for current fuel cell vehicles," Farha said.

Uniper joins forces with Siemens to dercarbonise power generation

German power producer Uniper has signed a cooperation agreement with Siemens to undertake projects aimed at decarbonising its power generation and promoting “sector coupling”. The company said in a press release that “it is important to look at the energy, mobility and industry sectors together, because they all can and must contribute to reducing greenhouse gases.”

One focus of the planned cooperation is the production and use of "green hydrogen". The scope of the new cooperation agreement also includes the evaluation of the potential of Uniper's existing gas turbines and gas storage facilities for the use of hydrogen. The companies will seek “to define what role hydrogen can play in the future evolution of Uniper's coal power plants.” Uniper recently announced that it would close or convert its coal-fired power plants in Germany by 2025 at the latest. Uniper’s coal-exit plan is instrumental to make the company achieve its objective of becoming climate neutral in its European power generation by 2035.

Siemens Gas and Power is helping its customers achieve their decarbonisation goals. “Brownfield transformation" projects are designed to decarbonise coal-fired power plants and significantly reduce CO2 emissions from gas-fired power plants, including the integration of storage solutions through to the use of "green gas”.

Uniper has set itself the goal of reducing CO2 emissions in the European generation segment from 22 million tons today to net-zero emissions by 2035. Uniper already produces around 24 terawatt hours of carbon-free electricity with its hydroelectric and nuclear power plants in Germany and Sweden. Under its new strategy it now intends to gradually increase the share of “green” gas or “green hydrogen” in its conventional gas business, in both power generation and energy trading.

Uniper is “a pioneer in the use of power-to-gas technology … having been one of the first to implement such kind of projects,” says the press release. The company has already built the first power-to-gas plant in Falkenhagen in 2013, followed by another one in Hamburg in 2015. Uniper added a methanisation plant to the Falkenhagen plant in 2018.

In addition, Uniper “is pushing forward cross-sector industrial projects together with refineries and the automotive industry with various real-life laboratory projects, which could make it possible to enter hydrogen production at market conditions in the near future.”

“After the coal phase-out and the switch to a secure gas-based energy supply, the use of climate-friendly gas will be a major step towards successful energy system transformation; therefore, the decarbonization of the gas industry, including gas-fired power generation, is essential if Germany and Europe are to achieve their climate targets,” said Uniper CEO Andreas Schierenbeck. “We are ready to invest and have set the strategic course to significantly accelerate the decarbonisation of our portfolio. In doing so, it is important to bundle energies, act openly in terms of technology, and work with proven high-technology partners like Siemens."

BNEF’s reality checks on hydrogen economy – “$150 billion in subsidies needed”

A new report from Bloomberg New Energy Finance, Hydrogen Economy Outlook, published on 30 March, offers a positive perspective on the potential of hydrogen, but with important reality checks.

BNEF notes that “with the cost of wind and solar continuing to fall, the question is whether the cost for electrolyzers and renewable hydrogen can follow.” There are encouraging signs, says the report. “The cost of alkaline electrolyzers made in North America and Europe fell 40% between 2014 and 2019, and Chinese made systems are already up to 80% cheaper than those made in the west. If electrolyzer manufacturing can scale up, and costs continue to fall, then our calculations suggest renewable hydrogen could be produced for $0.8 to $1.6/kg in most parts of the world before 2050. This is equivalent to gas priced at $6-12/MMBtu, making it competitive with current natural gas prices in Brazil, China, India, Germany and Scandinavia on an energy-equivalent basis, and cheaper than producing hydrogen from natural gas or coal with carbon capture and storage.”

However, producing hydrogen is only part of the story. Transporting and storing hydrogen will require “massive infrastructure investment”, notes BNEF. “If hydrogen were to replace natural gas in the global economy today, 3-4 times more storage infrastructure would need to be built, at a cost of $637 billion by 2050 to provide the same level of energy security. Storing hydrogen in large quantities will be one of the most significant challenges for a future hydrogen economy. Low cost, large-scale options like salt caverns are geographically limited, and the cost of using alternative liquid storage technologies is often greater than the cost of producing hydrogen in the first place.”

Hydrogen’s low density also makes it expensive to transport via road or ship. Pipeline transport may be a better option: “Hydrogen flows nearly three times faster than methane through pipes, making this a cost-effective option for large-scale transport.” Nevertheless, “for hydrogen to become as ubiquitous as natural gas, a huge, coordinated program of infrastructure upgrades and construction would be needed, as hydrogen is often incompatible with existing pipes and systems,” notes BNEF, putting a bit of cold water on the idea that existing gas infrastructure can be easily converted to hydrogen.

Hydrogen “is likely to be most competitive in large-scale local supply chains,” notes the report. “Clusters of industrial customers could be supplied by dedicated pipeline networks containing a portfolio of wind- and solar-powered electrolyzers, and a large-scale geological storage facility to smooth and buffer supply. Our analysis suggests that a delivered cost of green hydrogen of around $2/kg ($15/MMBtu) in 2030 and $1/kg ($7.4/MMBtu) in 2050 in China, India and Western Europe is achievable. Costs could be 20-25% lower in countries with the best renewable and hydrogen storage resources, such as the U.S., Brazil, Australia, Scandinavia and the Middle East. However, cost would be up to 50-70% higher in places like Japan and Korea that have weaker renewable resources and unfavorable geology for storage.”

“Policy support” will be critical to make hydrogen happen, according to BNEF. “Reaching a delivered hydrogen cost of $1/kg will require massive scale-up in demand as well as cost declines in transport and storage technologies. And while hydrogen is a hot topic right now, there is little government policy currently in place to help this happen. Policy measures are generally focused on expensive road transport applications, and programs are poorly funded. The more promising use cases in industry are only funded with one-off grants for demonstration projects. For the industry to scale up, demand needs to be supported with comprehensive policy coordinated across government, and the roll-out of around $150 billion of cumulative subsidies to 2030.”

Even at $1/kg, carbon pricing will be needed “for hydrogen to compete with cheap fossil fuels in hard-to-abate sectors. This is because hydrogen must be manufactured, whereas natural gas, coal and oil need only to be extracted, so it is likely always to be a more expensive form of energy. Hydrogen’s lower energy density also makes it more expensive to handle.”

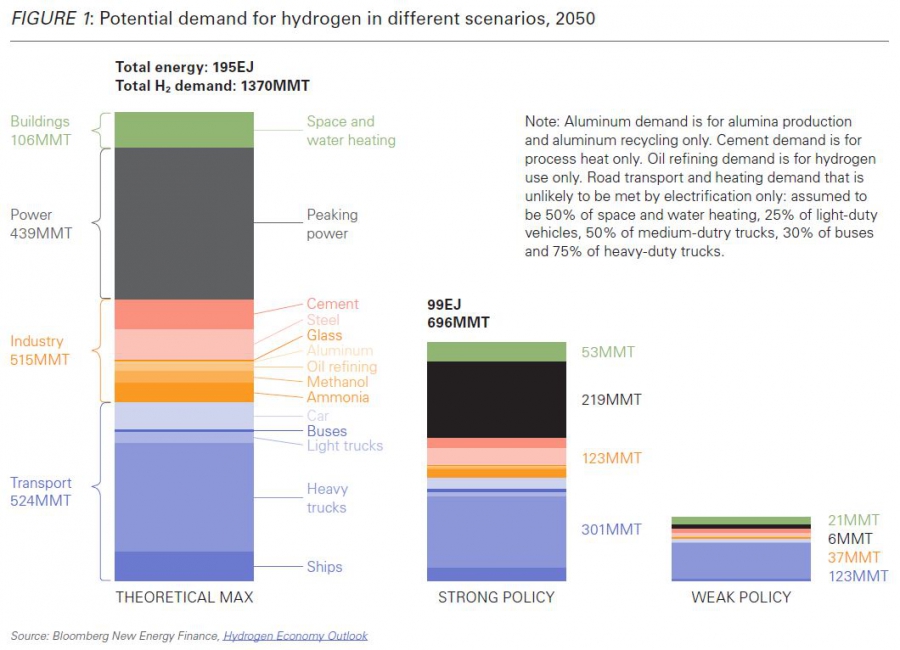

If “supportive but piecemeal policy is in place,” notes BNEF, some 187 million tons of hydrogen could be produced by 2050, which would meet only 7% of projected final energy needs in a 1.5 degree scenario. If “strong and comprehensive policy” is in force, then 696 million tons could be produced, enough to meet 24% of final energy needs. This would require $11 trillion in investment. Annual sales of hydrogen would be $700 billion. If “all the unlikely-to-electrify sectors in the economy used hydrogen, demand could be as high as 1,370MMT by 2050.”

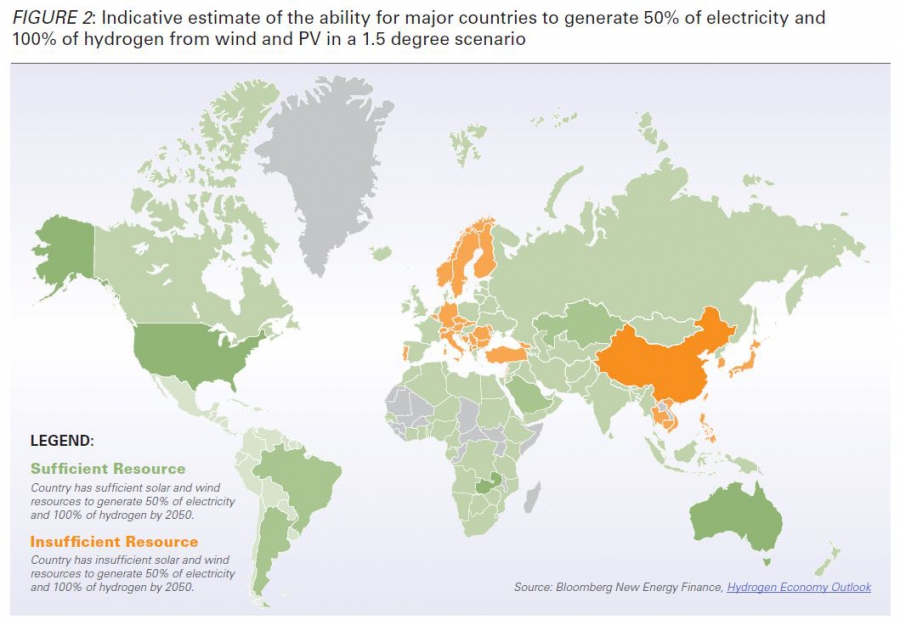

To achieve 696 million tons of green hydrogen production will require around 31,320 TWh – more than is currently produced worldwide from all sources. “Add to this the projected needs of the power sector – where renewables are also likely to expand massively if deep emission targets are to be met – and total renewable energy generation excluding hydro would need to top 60,000TWh, compared to under 3,000TWh today. China, much of Europe, Japan, Korea and South East Asia may not have enough suitable land to generate the renewable power required (Figure 12). As a result, trade in hydrogen would be necessary.”

“Blue” hydrogen may also need to stay in the mix: “Although more expensive, hydrogen production from fossil fuels with CCS may still need to play a significant role, particularly in countries like China and Germany that could be short on land for renewables but are well-endowed with gas and coal.”

BNEF notes that “Hydrogen has experienced a hype cycle before, and right now, there is still insufficient policy to support investment and to scale up a clean hydrogen industry. But with a growing number of countries getting serious about decarbonization, this could change.”

Investors should watch out for the following key events to help determine whether a hydrogen economy is emerging: 1) net-zero climate targets are legislated, 2) standards governing hydrogen use are harmonized and regulatory barriers removed, 3) targets with investment mechanisms are introduced, 4) stringent heavy transport emission standards are set, 5) mandates and markets for low-emission products are formed, 6) industrial decarbonization policies and incentives are put in place and 7) hydrogen-ready equipment becomes commonplace.

Blue hydrogen plant planned in The Netherlands

A number of public and private partners have signed an agreement to prepare a feasibility study for the construction of a “blue hydrogen” planned in the North Sea port town Den Helder in the Netherlands. The feasibility study should be ready in June. If the outcome is positive, the plant should be operational in 2024 or 2025.

The hydrogen would be produced from natural gas and the CO2 would be stored in empty gas fields I the North Sea, according to the plan, in which oil producer NAM (a joint-venture between Shell and ExxonMobil) and national gas transmission system operator Gasunie are involved.

The Dutch cabinet published a “hydrogen vision” at the end of March in which it underlines the importance of hydrogen for the future energy system. The policy document promises €35 million per year support scaling up hydrogen production. The cabinet distinguishes four “pillars” in its hydrogen strategy: legislation, cost reduction, the establishment of “hydrogen clusters” in ports, transport, power production and agriculture, and “an international strategy” to align Dutch initiatives with international developments. The use of hydrogen in buildings will be “limited” until at least 2030, the cabinet thinks.

Gaseous fuels are expected to account for 30-50% of final energy use in 2050, according to the document, but these should be decarbonised gases (hydrogen, biomethane).