Gas technologies and net zero carbon [LNG Condensed]

Natural gas technology is often described as ‘mature’, which is another way of saying that it lacks potential for further efficiencies and development, the comparator being renewable energy. Wind and solar have shown steep downward cost trajectories in recent years with substantial potential for further cost gains. However, as a recent report by the International Gas Union, Gas Technology and Innovation for a Sustainable Future, shows, this is a significant misrepresentation.

Gas use encompasses a suite of technologies, from liquefaction to gas-fired generation, heat, cooking fuel, transport and increasingly, over the next few decades, hydrogen and key aspects of carbon capture, use and storage (CCUS). Gas technologies have shown substantial gains in efficiencies in their mature applications, but they also need to evolve to cope and deliver the new applications that a future sustainable energy system will require.

As the International Energy Agency (IEA) pointed out in its report Energy Technology Perspectives 2020, published in September, one third of the technologies required to meet net zero carbon targets are not commercially available. Delivering a sustainable future needs innovation today and this in turn requires government support: immature technologies need steering through the pre-commercial stages of development; and new technologies need networks so that consumers and companies can use them. This is true for renewables and emerging gas technologies alike.

Gas technologies’ maturity in key areas is, in fact, positive because these technologies are deployable today on a large scale and could have a substantial impact in displacing higher carbon fossil fuels early on.

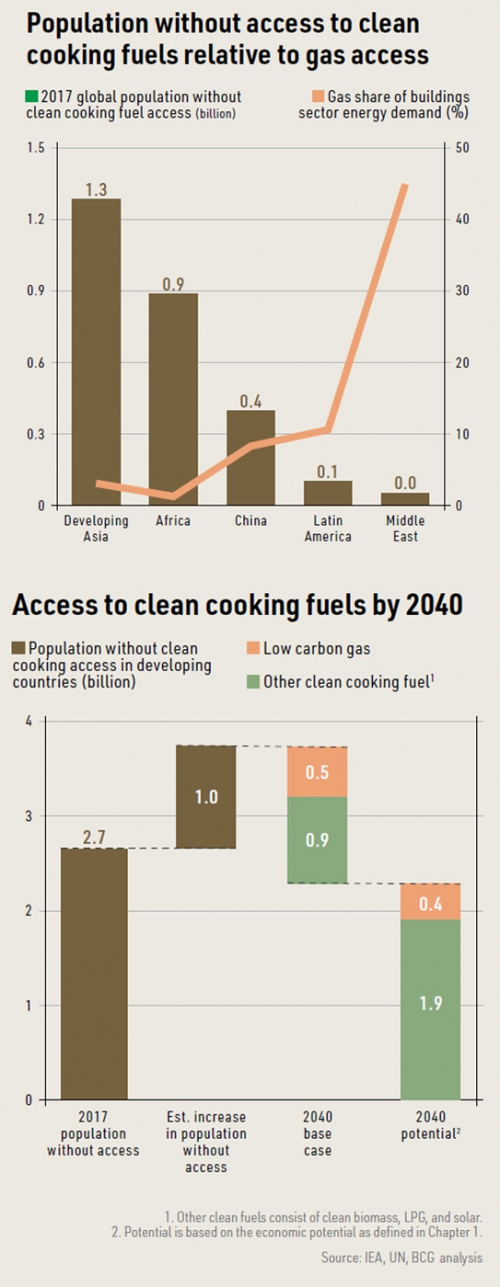

In addition, given the long-term policy focus on climate change and addressing the coronavirus pandemic, access to energy and solving fuel poverty have slipped down the agenda. Yet billions of people around the world still lack basic energy access, leaving them dependent on traditional biomass for cooking, which is harmful to health.

According to the IGU report, natural gas has the economic potential to provide clean cooking fuel for up to an additional 1bn people by 2040, about one-third of the global population estimated to still be lacking gas access at that time. Natural gas can thus play a critical role in reducing global energy poverty and achieving long-standing sustainable development goals.

Switching to gas

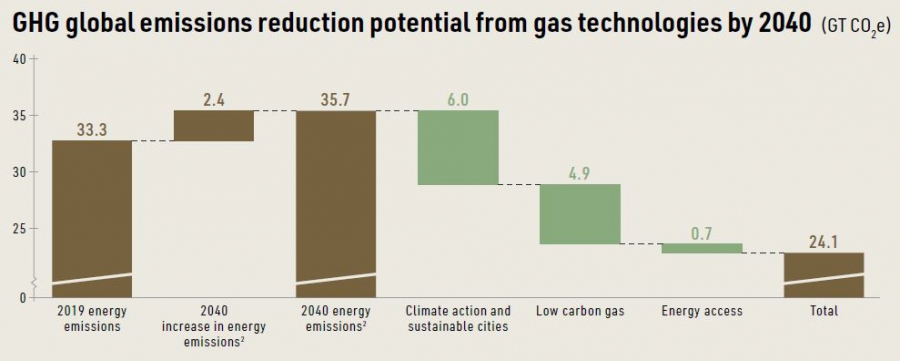

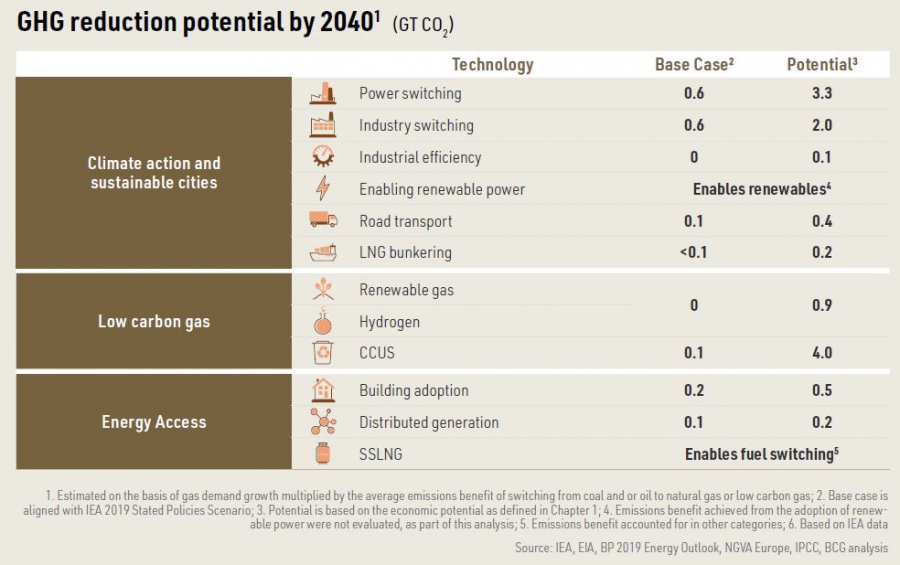

According to the IGU report, which provides a comprehensive review of gas technologies in 12 different mid and downstream areas, increasing access to gas to its full economic potential could deliver 30% of the greenhouse gas (GHG) emissions reductions required to meet the goals of the Paris Agreement on Climate Change.

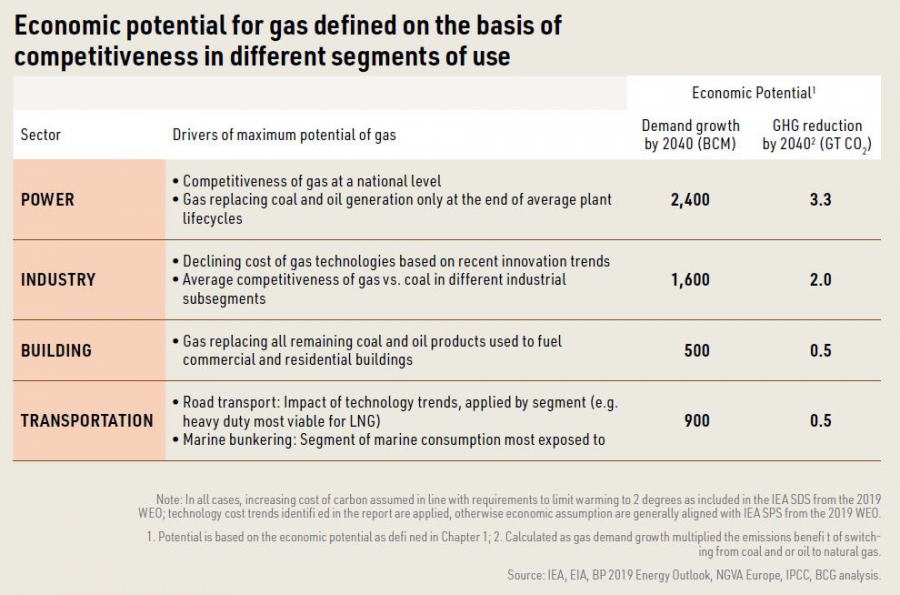

The single biggest opportunity lies in the power generation system because a combined-cycle gas turbine (CCGT) plant emits about 400 kg/MWh gross of CO2, substantially less than the 900 kg/MWh emitted by a super critical coal plant. Particulates and nitrogen oxide emissions are much lower from CCGTs, while sulphur oxide emissions are virtually eliminated.

Moreover, the efficiency of CCGTs has shown steady improvement, rising from 50% in 1990 to 64% today, while capital costs have remained stable. Studies suggest larger plant sizes and improved turbines could deliver a 25% cost reductions, the report says.

Coal remains dominant

A number of European countries are phasing out coal-fired generation and competition from renewables and cheap shale gas are transforming the US power system, but the picture in the rest of the world, where there is less access to gas, is very different.

In 2019, coal was used to generated 9,824 TWh worldwide, compared with 6,297 TWh from gas with renewables, not including large hydro, at 2,805 TWh. Moreover, Asia Pacific’s use of coal in power generation continues to rise. Combating this increase requires more renewable energy, but also increased access to gas to make coal-to-gas switching possible to deliver a potential estimated 3.3 gigatons (Gt) of emissions reductions worldwide by 2040.

However, it is not just in the power sector where gas can deliver significant GHG emissions savings. The IGU estimates that in industry, where GHG reductions are hard to achieved economically, the higher efficiencies and lower costs of gas technologies could provide 2 Gt of CO2 reductions by 2040.

The report argues that in industry natural gas is the most efficient energy source for process heat generation and the least-emitting feedstock for petrochemicals other than biofuel inputs, which are in short supply. According to the report, efficient electrification technologies for industrial applications can cost up to five times more than gas on a levelized basis.

Full cost accounting

Coal is in heavy use because it is cheap and abundant, but the IGU argues that this takes into account neither its GHG emissions impact nor its effect on local air pollution. The report says that if the external costs of air pollution from coal use in China are incorporated into the Levelized Cost of Electricity, gas would be cheaper than coal.

If a carbon price of $40/mt were added to address the GHG emissions advantage of gas over coal, burning coal for power in China would be 30% more expensive than gas.

A carbon price of well above $50/mt is required to align with the Paris Agreement on Climate Change’s 2 °C trajectory, the report says. This would make gas the cheaper fuel in all regions, overcoming one of the main barriers to its adoption.

Net zero pathways

Across the various pathways to net zero carbon outlined by bodies such as the IEA or the UK’s Committee on Climate Change, low-carbon gas technologies play a critical role. Importantly, these technologies – renewable gas, hydrogen production with CCUS and natural gas plus CCUS – are available today, yet their deployment remains low.

Improving deployment depends on innovation: for example to reduce the cost of upgrading biogas to biomethane, which can be fed directly into the natural gas system. The report says six different processes have been developed for biogas to biomethane conversion, all of which promise greater efficiencies and lower costs if deployed at scale. Scale and learning effects could reduce the capital costs of renewable gas production by between 45% and 65% and operational costs by 10%-20% by 2050.

Moreover, BECCs – bio-energy plus CCUS – cannot be delivered without gas technologies, yet almost all net zero carbon pathways assume significant GHG reductions from negative emissions technologies such as BECCs.

Similarly, CCUS has been identified as a critical technology to realise net zero carbon targets. This will require significant innovation in gas technologies to reduce costs. Progress is already being made. According to the IGU report, the efficiency of solvent-based capture processes has improved by up to 50%. Moreover, new approaches to oxy-fuel processes, which involve burning natural gas in a high oxygen environment, improves combustion and provides a pure CO2 stream, which, in turn, is cheaper to capture. Such innovations could transform the cost of CCUS, the IGU says.

Estimates of the costs of low carbon gas technologies vary widely – some forms of low carbon hydrogen and RG are already competitive with conventional natural gas, while others, like CCUS plus natural gas combustion, would require a carbon price of $50/mt or more to be competitive. However, even these higher-cost low-carbon technologies are already competitive compared with other means of achieving low or near zero emissions, the report argues.

For example, in high heat applications in industry, hydrogen and CCUS have been shown to be the most cost-effective way of reducing GHG intensity. Electrifying high temperature processes in industry is very costly because of the required heat intensity and high energy consumption of industrial applications. All three low carbon technologies are viable alternatives.

Similarly, in the building sector, low cost sources of renewable gas, produced from waste, are cost competitive with electric heating in cold climates or commercial applications. Usually, this is in countries with high power prices and heating requirements and with established gas infrastructure.

SOFCs

Solid oxide fuel cells (SOFCs) are another interesting area of innovation. SOFCs can be integrated with gas microturbines or reciprocating engines to improve overall system efficiency.

The electrical efficiency of SOFCs is already 50%, but integration with a turbine to recover heat and pressure exhaust can raise efficiency to 70%. Add on combined heat and power (CHP) -- so that the residual waste heat can be used -- and the potential rises to 80-95% efficiency, compared with conventional CHP efficiencies of 50%-70%.

SOFCs are versatile, being small and scalable. They can be used to provide power and heat for a single home, or scaled up to match the largest CHP systems in use today.

SOFCs are relatively expensive, but as with many energy transition technologies, costs are expected to fall as manufacturing capacity grows. Research sponsored by the US Department of Energy shows costs could drop by 70%, if there is a ten-fold increase in production capacity, according to the IGU.

Access to gas

Realising the economic low carbon potential of gas faces one all-important critical barrier – if there is no gas available its use as a clean cooking fuel, or in efficient CHP processes, industry or hydrogen production is simply not possible.

This is where LNG, both large and small-scale, is making a difference. For countries lacking upstream gas resources, and dependent on coal for a large part of domestic electricity supply, LNG imports are proving a flexible and quick alternative.

Floating storage and regasification units can be installed faster than onshore LNG terminals and both act as bulk break points for the onward transport of LNG to remote areas by road. Small-scale LNG supply chains can reach beyond existing gas transmission networks, bringing cleaner fuel to regions dependent on coal and diesel for power and traditional biomass for cooking.