From the Editor: This energy transition? It’s an oil thing [Gas in Transition]

Back in July, the World Petroleum Council, active since 1933 to promote dialogue within the oil sector, rebranded itself as WPC Energy, removing the obvious reference to petroleum, which is widely considered the main villain contributing to climate change.

At the same time, it added a new tagline, The World Forum for Energy Transformation, and said the new identity reflects its “commitment to lead the global transition to a low-carbon energy system, achieved through a diverse and sustainable mix of energy sources.”

But it chose not to rebrand the 24th edition of its triennial World Petroleum Congress, which is considered by some the Olympics of oil and gas gatherings. And while WPC2023 in Calgary carried the tagline Energy Transition: The Path to Net Zero, the discussions across four days were heavily oil-centric.

At the last WPC, held in Houston in late 2021 (delayed a year by Covid), natural gas was afforded its own panel session as part of a gathering targeting innovative energy solutions. Tellurian founder and chairman Charif Souki and others discussed whether natural gas, including LNG, could deliver on the promise of a clean and affordable transition fuel.

WPC2023, however, offered no such bully pulpit for natural gas. None of the sessions focused on the cleanest fossil fuel; most explored decarbonisation opportunities available to the crude oil and oil sands sector.

There was one technical session on innovations in LNG and floating LNG, and Milton Catelin, the International Gas Union’s Secretary-General, took part in a panel discussion discussing climate solutions from the oil and gas industry.

But across the main plenary sessions and CEO strategic sessions, gas was barely mentioned save in passing. Its highest profile came on the first day, when Alberta energy minister Brian Jean called it “a magical fuel” during a panel discussion with his Newfoundland and Saskatchewan counterparts, and on the second day, when Enbridge executive vice president Byron Neiles asked Canadian prime minister Justin Trudeau “to embrace LNG exports.”

Oil falling short

What WPC2023 did offer – in keeping with its heritage – was a dialogue on what the oil industry can do, should do and is doing to decarbonise the global energy sector. Across most silos, what oil is doing is pretty much what gas is doing. And across many of the sessions, the opinion seems to be that what oil is doing isn’t enough to get the world to net zero by 2050.

To be fair, the decarbonisation challenges facing the oil sector are much greater than those facing natural gas. In 2021, IEA data shows, oil contributed 32% of global greenhouse gas (GHG) emissions, compared to a 22% contribution from natural gas.

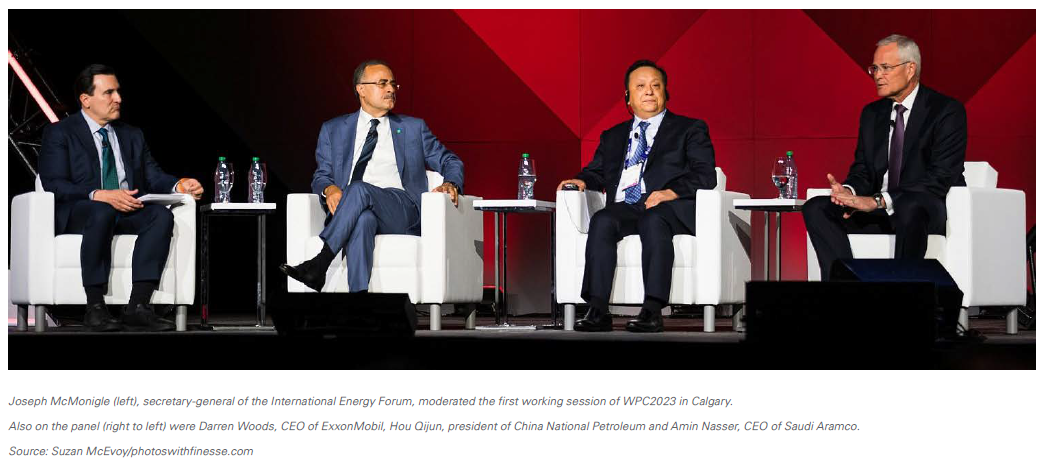

But Amin Nasser, CEO of Saudi Aramco, the world’s largest oil producer and a panelist at the first working session of WPC, said he sees many “shortcomings” in the approach being taken to the energy transition, with coal demand at record levels and expectations that oil demand could reach 110mn barrels/day by 2030.

That’s distinctly at odds with the International Energy Agency (IEA), which recently forecast that world oil demand would peak with the next decade. “This notion is mostly being driven by policy rather than markets,” Nasser said.

On the same panel, Darren Woods, CEO of ExxonMobil – which happens to be the world’s largest independent oil producer – said the world underestimates the challenges of moving off an energy system dominated by the consumption of more than 100mn barrels/day of oil.

“We have got to come up with solutions to see the transition happen,” he said. “There seems to be somewhat of a wishful thinking that we are going to flip the switch and we will go from where we are today to where we will be tomorrow.”

The oil sector holds the same view as its gas colleagues that net zero is only possible if existing energy systems, built on oil and gas over the last century, are melded with renewables like solar and wind and emerging new energies like hydrogen.

CCS in oil critical for net zero

And across all sectors of the existing energy system, carbon capture, utilisation and sequestration (CCUS and CCS) is emerging as a key technology critical to achieving net zero by 2050 and securing the future relevance of oil and gas.

The gas sector discussed CCS and CCUS at both the recent World Gas Conference in South Korea last spring and the LNG2023 event in Vancouver this past July.

For the oil sector, WPC2023 was a coming out of sorts for CCS and CCUS, although as executives have said in the past, the oil and gas industry in Canada has been doing CCS for years, capturing poisonous hydrogen sulphide gas from oil and gas wells and storing it in deep underground salt domes or saline aquifers.

And enhanced oil recovery, which uses captured CO2 to boost recovering from aging oil fields, has been a feature of oil developments in Canada and the US for at least the last 30 years.

What is new for the oil sector, however, is the growing understanding that its future relevance depends on a steep rise in CCS and CCUS investments around that world that can help it abate its emissions.

“We cannot achieve net zero by 2050 without carbon capture and sequestration,” Nasser said, echoing messages from the gas industry at both LNG2023 and WGC2022. CCS is feasible and can be done, he said, but government support – ideally in the form of a global carbon credits market – is needed.

“But if you look across the globe, it is only certain pockets of the world where it is available. You need to scale up – by 2050 we need to have 120 times more in terms of assets than we have today.”

Natural gas has been saying that for a few years. WPC2023 is further proof that the transition – if you want to call it that – cuts across all energies, and all solutions will be needed to achieve a lower-carbon future.