France Anxious About Low LNG Sendout

France’s main gas grid operator GRTgaz has reported record demand for this winter during recent days. It also raised its level of alert regarding sendout from LNG terminals to 'red' early afternoon March 1.

The system operator covers about five-sixths of French gas needs, ahead of smaller TIGF and a couple of other small French gas grids.

GRTgaz said February 28 that, on that morning, demand on its system reached 12.7mn m3/hr, slightly ahead of this winter’s previous record set the day before.

It said its teams had been busy all week, given the icy weather conditions, and also because of low sendout from the two LNG regasification terminals at Fos-sur-Mer near Marseille, and also the "particularly low levels of gas in storage for this time of the year."

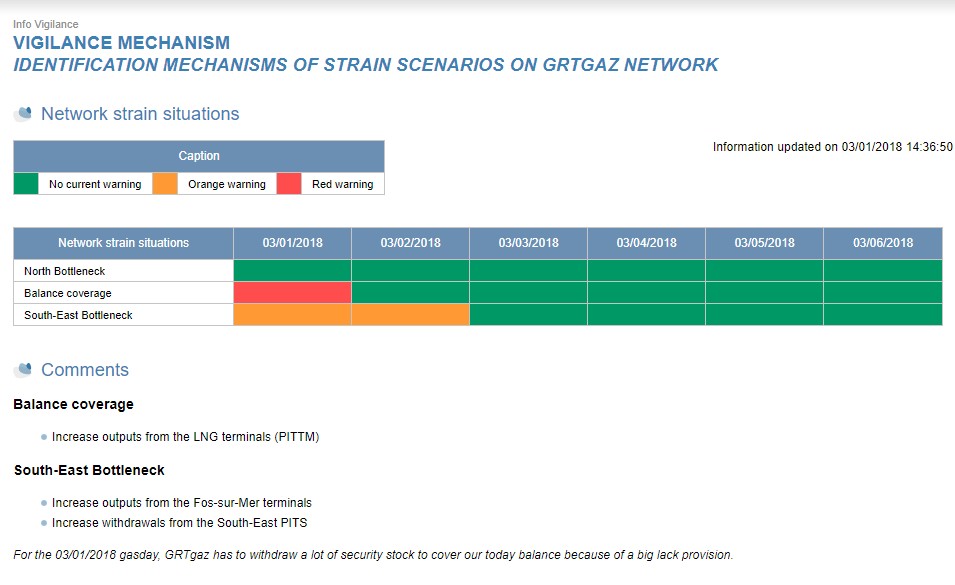

On March 1 towards early afternoon, GRTgaz raised the level of alert from green to red for 'balancing cover' – adding that it needed additional sendout volumes from all its regas terminals. There are terminals at Montoir in the west and Dunkirk in the north. It maintained the level of alert for its southeast zone at amber for both March 1 and 2. There is no alert covering GRTgaz's northern network operations (see graphic below).

The operator said it will be obliged to draw heavily on its security stocks to cover the balance of the March 1 gas day, due to a "wide deficit in supply." GRTgaz told NGW March 1 that deliveries of Norwegian gas by pipeline had been affected by difficulties at the Kollsnes gas process and export plant in Norway, but added that GRTgaz had not yet needed to ask industrial users to reduce consumption. That contrasts with the situation in Great Britain.

In terms of daily demand on its system, GRTgaz told NGW March 1 that it has gradually declined from the winter’s high of 261mn m3 (3 TWh) on February 27, to the expected 259mn m3 on February 28, and 227mn m3 forecast for March 1 – and well behind the historic record of 295mn m3 (3405 GWh) six years ago on February 8 2012. This contrasts with the rising gas demand in Great Britain at the same time.

France had problems in December 2016 and January 2017 heavy gas consumption due to cold weather, low gas stocks, and lower than expected imports to its Fos LNG terminals – exacerbated by reduced exports from Algeria's Skikda liquefaction plant.

Regulators and network operators in France hope that such shortfalls will be easier to overcome, once France's separate gas balancing market zones are merged into one in autumn 2018; the programme involves major investment in north-south pipeline capacity.

Situation in terms of GRTgaz alerts just before 2.37pm French time (Graphic courtesy of GRTgaz)