French Gas-Fired Power Spikes in 2017

French gas demand in 2017 appears to have been stable year on year, but power plants used much more. The main gas grid operator GRTGaz also said plans for a single French pricing hub are on target.

GRTgaz, the larger of France’s two main gas transmission operators, said January 17 that gross demand during 2017 on its network rose by just 0.4% to 43.25bn m3 (465 terawatt-hours). It’s generally estimated that GRTgaz handles five-sixths of gas flows in France, with smaller southwest France system TIGF handling the rest.

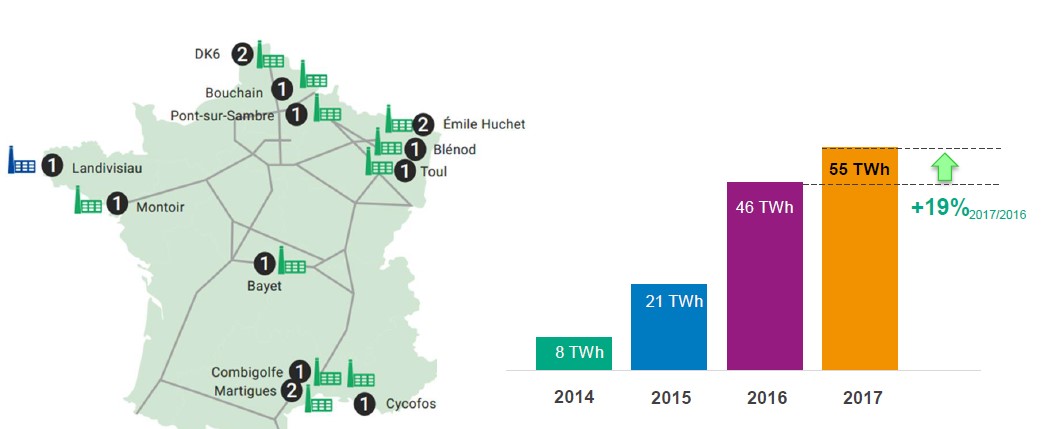

Industries and power plants directly connected to the GRTgaz area increased gas use by 5.5% to 17.7bn m3 last year – of which power generators used 5.15bn m3, up 19% from 4.3bn m3 in 2016, and 0.75bn m3 two years before in 2014 (see graphic below).

This unprecedented use of gas-fired power plants, said GRTgaz, was due to nuclear plants being offline longer and low levels of water for hydro-generation. In late 2016 and January 2017, 9 GW of France’s 63 GW nuclear capacity were offline for safety checks in what became an usually bitterly cold first half of January 2017. This was coupled with disruptions to Algerian LNG exports to France that led to a spike in southern French wholesale gas prices lasting weeks. France is heavily reliant on nuclear plants for its power supplies, so in early 2017 had to import electricity from all its neighbours.

During 2017, in contrast, smaller gas customers (residential, offices and shops and smaller industry) connected to distribution networks in the GRTgaz area consumed 25.55bn m3 in 2017, 2.9% less year on year as the average temperatures were higher.

GRTgaz said LNG regasified into its system was the most for five years, that there had been high transit gas flows to Spain and Italy, and that north-south flow capacity inside France was more than 99%-used for over 33% of the year.

It also said that the creation of a single market zone in France – so merging the Peg and TRS zones to provide a single wholesale price – is on target for completion by the end of 2018.

Across France, 75 natural gas vehicle (NGV) refueling points were in service end-2017, a quarter more than in 2016, which will double this year as 78 more NGV refueling stations are due to open, said GRTgaz.

It also noted that biomethane injected into its grid doubled last year to 38mn m³, avoiding the release of 76,700 metric tons of carbon dioxide; 44 units injected the biogas and 60% of them were farm-based. It said the national target is to inject 8.4bn m3 (90 TWh) of bio and other ‘green’ gas – including power to gas – into the French grid (GRTgaz /TIGF) in 2030.

Increase in gas used in power generation in the French GRTgaz grid area excluding the southwest French TIGF zone (Graphic credit: GRTgaz)

Green plants are in operation, blue ones are planned, number shows how many units per site; 55 TWh-gas equates to 5.15bn m3