[NGW Magazine] France prepares for single market

Creating a single French gas market is the main focus for GRTgaz, the country’s main transmission system operator (TSO); Terega, the TSO for southwest France once owned by Total; and the national energy regulator, CRE.

But not long into the New Year, CRE and its Spanish counterpart CNE will have to decide whether to sanction a new cross-border gas interconnector across the Pyrenees mountains, called South Transit East Pyrenees (Step) – a slimmed-down version of its more ambitious predecessor, MidCat.

The Context: Ending Isolation

Spain for decades has been a ‘gas island’ with a heavy reliance on imported LNG. It wants to mitigate that isolation and dependency by integrating the Iberian gas market with that of northwest Europe. France though has historically been less keen to develop cross-border trade – this may be because Spain and Portugal have under-used LNG import capacity which, if more intensively used, may lead to less throughput at French LNG terminals.

In the past France also objected to MidCat’s costs. But it has slowly dawned in Paris that a series of winter supply shortfalls in southeast France, and its longer-term need for more peak gas-fired generation capacity as its nuclear plants retire, have exposed the weakness of its existing gas transmission system. As it presses on to remove bottlenecks in the French gas grid – to enable TRF’s launch – so it now seems closer to accepting the need for a ‘release valve’ to/from Spain.

On the home straight to TRF’s launch

France’s CRE in late July released its rulebook for the introduction and later operation of France's single gas market zone, setting out how capacity restrictions should be managed; the operation of congestion removal mechanisms; and procedures for monitoring the levels of gas storage downstream of congestion points.

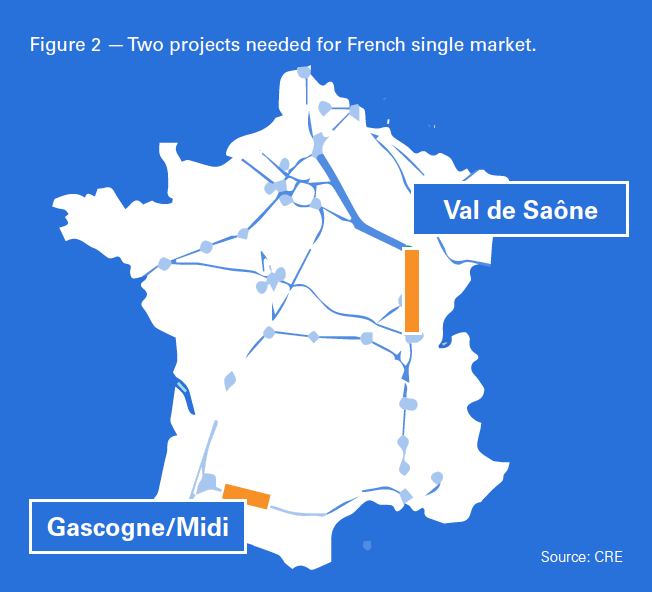

That July 24 CRE document also included proposals from GRTgaz and Terega for making upgrades and improvements to key infrastructure, should it be delayed – notably the strategic north-south Val de Saone project which is intended to remove the bottleneck that causes price spikes and allow LNG to flow from the two Mediterranean terminals into the north of the country.

According to GRTGaz, that expansion would be considerable: it would add around 250 GWh/d (8.6bn m³/yr) to the current north-south capacity of 360 GWh/d on average, meaning 610 GWh/d by 2019.

CRE ruled that GRTgaz and Terega must both confirm via their websites, and by September 1 at the latest, if they are ready to proceed with the November 1 date.

Key to whether they will be ready is whether two key French gas infrastructure projects – GRTgaz’s Val de Saone upgrade, and to a lesser extent Terega’s Gascogne-Midi pipe – will be ready on time.

GRTgaz confirmed readiness for November 1 on August 29, saying “For end users, this implementation will have several benefits: a single price of gas; a more competitive, liquid and dynamic French market better interconnected with the main European and world marketplaces; and reinforced security of supply in France”.

For customers, it says there will in future be a single wholesale price-point for gas in France, thanks to the suppression of the existing north-south price spread, making the French market “more competitive, liquid and dynamic” and better connected with European and world gas markets.

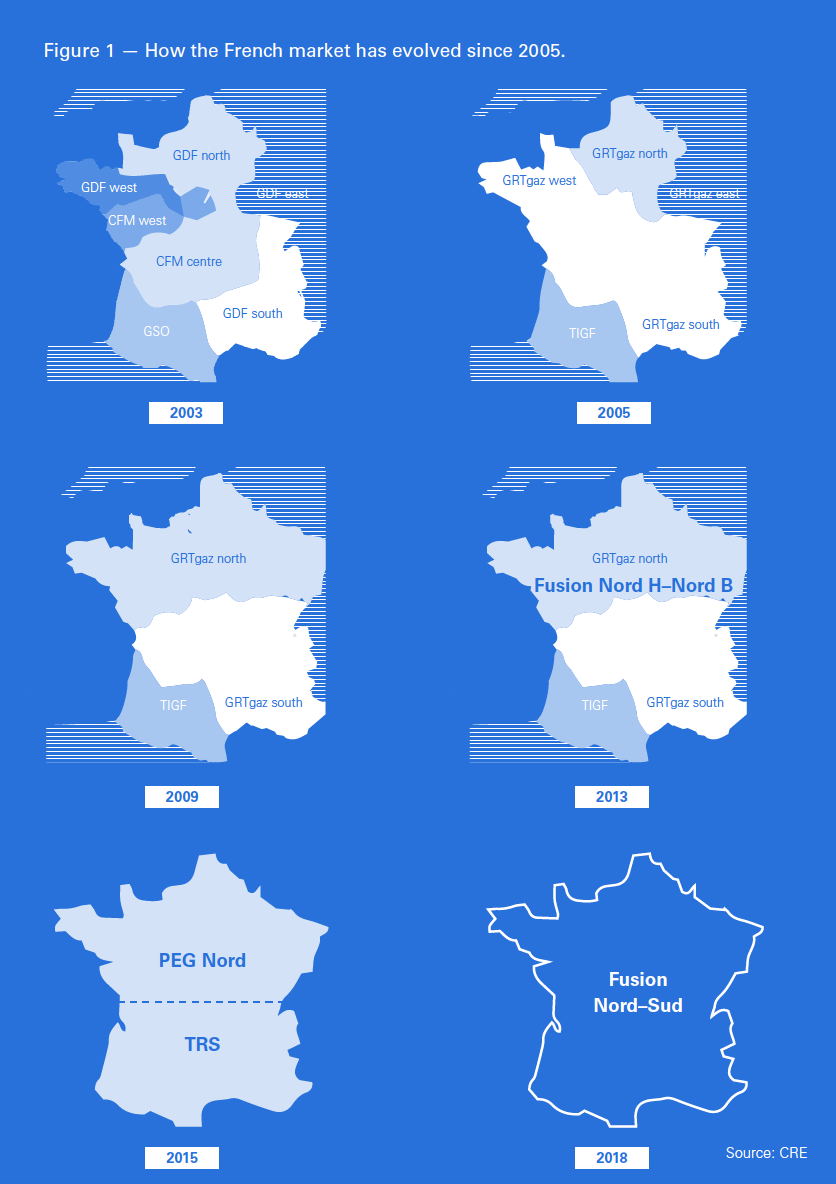

CRE first floated the idea of a single market in 2014, but the switch from two hubs to one is the culmination of a gradual transition from the more numerous French gas hubs that began in 2005.

GRTgaz took its final investment decision on Val de Saone in mid-2016. Costing €671mn at that stage, it involved building a 1.2-metre north-south 188-km gas pipeline in eastern France from Voisines (in Haute-Marne) to Etrez (in the region of Ain).

The southern section (Palleau-Etrez) has been in service since the end of July, while construction of the northern section (Palleau-Voisines) was completed July 4. GRTgaz is 75%-owned by French utility giant Engie and 25% by SIG, a consortium of three French funds.

Terega told NGW August 3 that, on its network, the Gascogne-Midi project will be completed by November 1 in time for the introduction of the TRF; the €152mn project consists of the building of a 61.8-km section of new pipe linking Lussagnet to Barran, and the addition of a new 7-MW compressor at Barbaira – all in southwest France.

Since February 2015, Terega has been owned by Snam (40.5%), Singapore state-owned GIC (31.5%), and French firms EDF Invest (18%) and Credit Agricole Assurances (10%).

Step Needs Regulatory Approval

Enagas, the Spanish national gas TSO, and Terega in southwest France both acknowledge that, if Step is sanctioned, it will represent their biggest pipeline construction project during 2019-21. But the project still requires approval from both the French and Spanish regulators CRE and CNE.

Step was actually born from the flat refusal in mid-2016 of France’s CRE to countenance the high costs to French gas consumers of its predecessor project, MidCat.

The original MidCat had a price tag of €3bn ($3.4bn) and, back in 2015, was expected to have 7.4bn m³/yr firm capacity and to be built by 2020. But France’s CRE objected to how two-thirds (€2bn) of its cost would fall on the French gas market, particularly the involvement also of GRTgaz, with as much as 600 km of new pipe to be built in France.

The scaled-back Step project not only has a reduced price-tag and capacity, but also means less new pipe is required, and will not start up now before 2022.

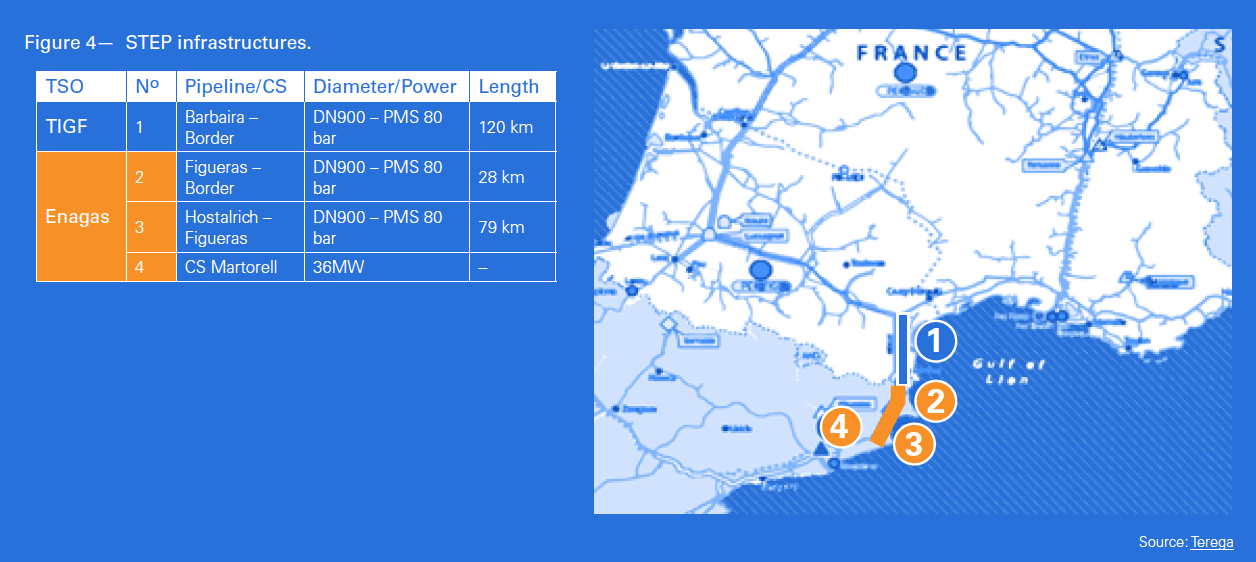

By then, Step will consist of a new 120-km gas pipe on the French side of the border within the network of Terega costing €290mn, plus 107 km of new pipe in Spain costing €152mn – so 227 km pipe in total costing €442mn ($503mn).

A so-called high-level group involving representatives from France, Spain, Portugal and the European Commission concluded in January 2018 that Step was sufficiently mature, and invited the TSOs to present an investment request to the three countries’ regulators. This investment request submitted by the TSOs in April 2018 was completed in July 2018 proposes a financing scheme of the project.

Sources tell NGW, with that investment proposal finalised, CRE and CNE have six months to take their decision – so until early 2019.

Step will, at minimum, comprise 120 km of new pipe in France between Barbaira and the Spanish border, as well as uprating of the Barbaira compressor station. In Spain it will consist of one pipe between Hostalrich and Figueras (79 km) and another from Figueras to the French border (28 km) and a compressor station in Martorell, Barcelona.

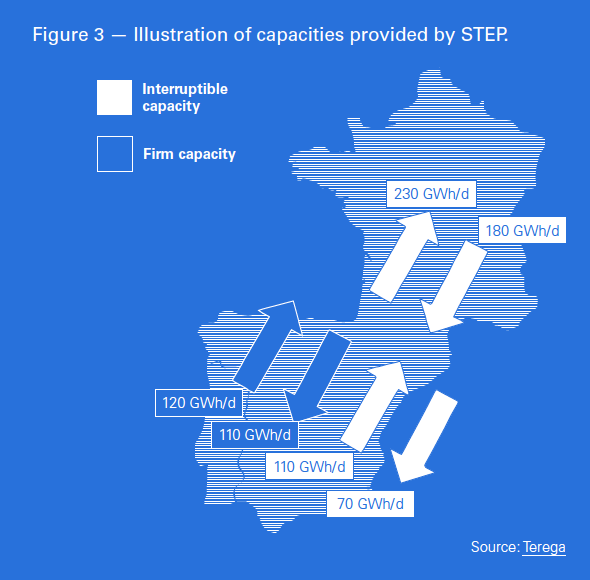

Actual capacities envisaged are now:

- on both sides of the border: Interruptible cross-border capacity up to 230 GWh/day (or 21.4mn m³/d) Spain-to-France and 180 GWh/d France to Spain;

- and on the Spanish side only: firm cross-border capacity of 120 GWh/d from Spain to France and 110 GWh/d from France to Spain (see figure 3).

Despite both Enagas and Terega issuing market consultations in March 2018, no capacity bookings have yet made – as Step still requires that crucial nod from both energy regulators.

In Terega’s market consultation document, it said that Step will “bring [to Iberia] additional gas flows from northwest Europe” predominantly Russian and Norwegian gas; and as a bi-directional pipe will sometimes help southern France – such as when storage levels are depleted, LNG supplies disrupted, or (as in February to March this year) the wider European market is tight.

However, following a Lisbon meeting in July – which followed up on the Jan.2018 High-Level Group – remarks by French President Emmanuel Macron were much more supportive towards the idea of a gas interconnection across the Pyrenees than before, with 2019 expected to be a significant year for securing permits, final engineering studies, and the expected regulatory and financial green-lights.

Is MidCat dead?

Despite the ruthlessness of France’s CRE in getting MidCat pruned down to Step, it is curious that both projects still co-exist on the list of EU Projects of Common Interest.

However, whereas MidCat originally was looking at completion by 2020, now it is described as a project that would be undertaken between 2022 and 2024 – only after Step’s completion.

Iberian sources believe the rationale is now to let Step be developed, then decide how much of MidCat might then be added – as a kind of ‘Step 2’. French consumers though may be happy that can has been kicked a long way down the road.

Step is now project of common interest (PCI) number 5.5.1, planned for completion by 2022, according to the latest European Commission listings, while MidCat becomes 5.5.2.