Flowback Water Driving Flurry of Activity in Water Treatment

The growth of hydrofracking in the Marcellus and other plays has caught the attention of dozens of water technology companies, many of them small startups. Their hopes are driven by a combination of tightening regulations, the lack of disposal wells in some plays, and the industry’s realization that water reuse is becoming increasingly important in plays like Eagle Ford in Texas, which saw an interruption in activity last summer due to the ongoing regional drought. Even disposal well operators see advantages in some level of treatment to extend the capacity of their wells. Water companies used to scraping by selling equipment into other markets have found that in the gas industry they can operate as a service, charging high prices per volume to dispose of, or treat and resell, water.

Flowback water, which exits a well in the first weeks after a frack job, can contain extremely high salt, heavy metals, radioactivity, fouling biological activity, scalants, and volatile organics. Water treatment can address some or all of these issues depending on an operator’s requirements. Common technologies include electrocoagulation and various forms of advanced oxidation, which remove or passivate metals without affecting simple salts. As additives used in hydrofracking transform to accept higher salt levels, these technologies are increasingly popular. Water volumes and the need for mobile equipment that can follow the drilling activity favor small units, encouraging small companies to enter the space. WaterTectonics, an electrocoagulation company with an exclusive contract with Halliburton, has been quite successful in the space, and many others with a variety of treatment techniques are trialing their equipment. In some cases the key innovation will not be in water treatment at all, but in removal of volatile organic compounds (VOC’s) which are subject to a new set of U.S. EPA rules.

When salt levels must be cut, most treatment companies turn to traditional energy-intensive thermal techniques. Membrane-based reverse osmosis, which is common in seawater desalination, is prone to fouling in high salinity flowback water and cannot treat the highest salt levels, though at least one company, GeoPure Hydro, is deploying RO units.

The explosion of treatment companies comes at a difficult time for the shale gas industry. With North American gas prices at record lows, activity has slowed dramatically. Ongoing public distrust in the technology has closed other promising markets: Vermont, New York and France have all banned hydrofracking activities, at least temporarily. Expect a shake-out in water treatment companies that cannot adapt to operators’ increasing focus on wet fields that produce oil as well as gas. Longer term threats to water treatment include water-free fracking techniques. One fast growing company, GasFrac, which uses gelled propane in place of water, has grown to a $160 million business since its first job in 2008, beginning in western Canada and moving aggressively into Texas in the last year. By eliminating the high-volume flowback water, waterless fracking dramatically reduces total water volumes used and treated, and may eventually enjoy friendlier relations with environmentalists. Water treatment companies will have to watch these innovations closely, and well operators may be well-advised not to bring treatment technologies in-house as the industry continues to rapidly evolve.

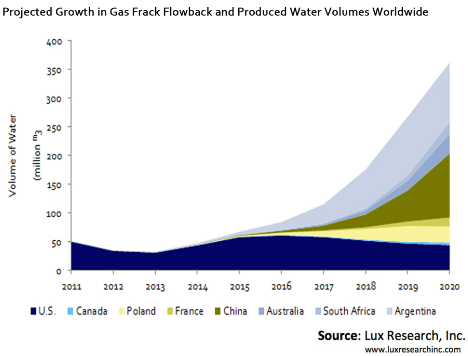

Assuming the industry does continue to use water for most fracking, the industry is poised to go international in the coming decade. A recent study by Lux Research shows that as American plays mature, opportunities multiply overseas. While activity to date has concentrated in North America, China and Argentina are prime growth areas with huge gas shale reserves. Reserves in both countries are in arid regions where a lack of water, more than environmental concerns, will drive reuse. China’s Turpan Basin, one of the country’s two largest deposits, is in a desert. Chinese players are already inking deals with international players, including one between the China National Petroleum Corporation and Shell.

While many of today’s water treatment startups in the shale gas industry will fail or be acquired for different applications, expect continued healthy interest in water treatment and in novel technologies that can address specialized additives or contaminants that prevail in specific plays or regions. The burst in innovative water treatment is already benefitting the gas industry by reducing contamination, enhancing well performance, and making operations less dependent on local water supplies.

Brent Giles is a Senior Analyst who leads the Water Intelligence service at Lux Research. Lux Research provides strategic advice and on‐going intelligence for emerging technologies. Through their unique research approach focused on primary research and their extensive global network, they deliver insight, connections and competitive advantage to their clients. Visit www.luxresearchinc.com for more information.