FLNG – Huge Growth Planned Through to 2018

Douglas-Westwood has been tracking the FLNG sector, its vessel designs and concepts for three years and presents forecast capital expenditure for the next seven years in the latest edition of its “The World FLNG Market Report”. DW’s forecasts capital expenditure over the period 2012 will total $29 billion.

There are two main sectors that form the Floating LNG industry:

- Floating Liquefaction – a specialised Floating Production, Storage and Offloading vessel with LNG liquefaction topsides (LNG FPSO). Other hull types such as semi-submersibles and Spars have been suggested.

- Floating Regasification – this can takes place on a vessel located either offshore or alongside. There are two main types of floating regasification vessels – Floating Storage and Regasification Units (FSRU) which remain stationary on location or Regasification Vessels (RV) which can also act as LNG carriers.

It is important to note that at present there is no industry standard definition of FLNG. Many sources that refer to FLNG simply mean LNG FPSOs, while others consider FSRU as an umbrella term to include all types of Floating Regasification vessels.

Parties looking to progress FLNG developments include both the vertically integrated majors such as Shell and smaller independent service providers including Flex LNG, Höegh, BW Offshore and SBM).

Floating Liquefaction

The key drivers of the floating liquefaction sector are the desire to monetise stranded offshore gas fields and the relative costs of an onshore liquidation terminal. A modular design allows the FLNG vessel to be built in lower cost environments then towed to location. Positioning the liquefaction facility on field reduces the requirements for costly upstream facilities and long pipelines to shore which would be required for an onshore development.

While principally aimed at offshore gas reserves, floating liquefaction has also been considered for onshore fields, with projects in Papua New Guinea and Western Canada in development.

Design Challenges

The vast majority of systems on a floating liquefaction vessel will be the same or similar to those used on conventional oil producing FPSOs. There are, however various equipment designed or adapted specifically for these vessels:

a) The insulated storage tanks, which need to utilise a specialised LNG containment system which is sloshing resistant.

b) Topsides modules that include gas pre-treatment and liquefaction processing equipment.

c) Offloading cryogenic liquid offshore in difficult sea conditions is a potentially hazardous task. Much research has been put into the development of safe and efficient offloading systems for LNG FPSOs.

Prelude Development

Shell is currently developing two floating liquefaction design concepts, a large-scale generic facility which is expected to be able to produce around 3.6mmtpa of LNG and a smaller facility of around 2mmtpa.

In July 2009 it was announced that Samsung Heavy and Technip had won the contract to design and construct up to ten of Shell’s 3.6 mmtpa units, the first of which will be used Australia from 2017 on the Prelude development off.

Other possible locations for both sized vessels include Egypt, West or East Africa, Indonesia, Iraq and Venezuela.

Containment System

Shell will utilise an adapted version of GTT’s membrane design which is used on a large number of LNG carriers and regasification vessels.

In this membrane system prismatic shaped LNG tanks are fully integrated into the hull and effectively form an inner hull within which the containment system fits.

By introducing two rows of tanks, the liquid motions in the tanks are significantly reduced and resonance between the liquid motion and ship motion avoided. This reduces the risk of sloshing-related damage to an absolute minimum.

Liquefaction Processing Technology

The Prelude vessel measuring 488 x 74 metres, be the world’s largest offshore floating structure.

Prelude’s liquefaction process trains will use Shell’s Dual Mixed Refrigerant (DMR) technology. The design makes use of two compressor strings which ensures that if one compressor fails, the whole train does not stop – it can continue running at a reduced capacity. The first application of this technology in a baseload LNG terminal was the Sakhalin II project in Russia.

|

Prelude Statistics |

|

|

Size: |

488 x 74 metres |

|

Displacement: |

600,000 tonnes |

|

LNG Capacity: |

3.6 mmtpa |

|

Condensate Capacity: |

1.3 mmtpa |

|

LPG Capacity: |

0.4 mmtpa |

|

Storage: |

220,000m3 |

|

Field (s) |

Prelude, Concerto, Cruz |

|

Water Depth: |

250 metres |

Leasing

Under Prelude’s business model, the feedstock owner, Shell will operate the floating liquefaction vessel and be responsible for obligating any contractual arrangements with offtakers. While this is likely to form the business model for large integrated companies such as Shell, other operators are looking to leasing in order to spread risk.

Under the leasing model, the owner of the LNG FPSO does not own any rights to the feed gas or the LNG as it is processed, liquefied, and stored. Instead, the leasing contractor receives a fee for providing the services.

Leasing is extremely common in the conventional FPSO sector and there is considerable scope for crossover within the FPSO and floating liquefaction leasing sectors. Companies involved in both sectors include BW Offshore, SBM Offshore and Teekay.

Leased LNG FPSO designs differ from Prelude in the following ways:

- Smaller physical size

- Smaller liquefaction capacity – Most of the designs range between 2 and 3 mmtpa. This compares to Prelude’s 3.6 mmtpa of LNG, plus condensate and LPG.

- Simpler liquefaction technology – nitrogen expander or single mixed refrigerant compared to Shell’s double mixed refrigerant.

Correspondingly these vessels are expected to have lower capital cost than Prelude, which has been estimated at around $3 billion.

Floating Regasification

Floating regasification vessels are the most developed form of floating LNG system and there are currently nine such facilities in operation worldwide. These are located in Argentina, Brazil, Dubai, Kuwait, the UK and the USA. A further one in the US Gulf of Mexico is being decommissioned.

Floating regasification is proving popular with LNG developers for the following reasons:

- Shorter lead times – The construction times for floating regasification vessels are considerably shorter than for onshore terminals.

- Temporary fixtures – Floating regasification vessels can be used as temporary terminals, either as an initial phase before the start-up of an onshore terminal or for periods of peak demand. These vessels can easily moved from location to another.

- Cost – For small to medium sized volumes, floating terminals are often cheaper than the equivalent onshore development

The floating regasification market is set to increase rapidly over the next decade as more countries utilize the technology. The cost and construction time advantages are proving alluring even in countries such as India and China, which have traditionally favoured onshore development solutions. Indonesia, with its stranded gas fields and rapidly growing cities, is a focus for both floating liquefaction and regasification terminals.

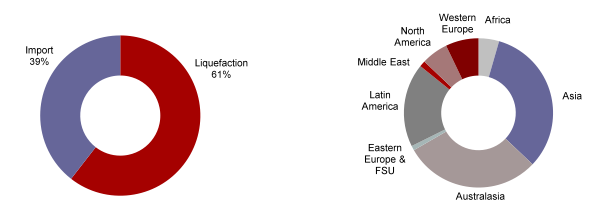

Figure 1 : FLNG Capital Expenditure by Type and Figure 2: by Region

Source: Douglas-Westwood

Market Forecast

Historically the global FLNG market has only consisted of import terminals; however this is expected to change over the next seven years. As Capex associated with a floating liquefaction vessel is more than triple that of a typical floating import terminal, liquefaction vessels are expected to dominate the global Capex of $29 billion forecast over the 2012 to 2018 period (Figure 1).

Asia, which is a focus area for both floating liquefaction and regasification, is expected to account for a third of the forecast Capex (Figure 2). There are two key floating liquefaction projects in this region – Petronas FLNG and Inpex’s Abadi development. Both of these projects are in the early stages of development, with the former undergoing FEED studies. Start-up is therefore likely to fall towards the end of the period.

Many Asia countries are considering floating regasification vessels in order to import gas to rapidly growing cities. Even China, which has traditionally advocated onshore terminals, is considering positioning a series of vessels along its coastline. Future floating regasification Capex from this region is likely to come from countries such as Bangladesh, China, India, Indonesia, Pakistan, Sri Lanka and Vietnam.

Australasia is currently the only region in the world with an approved FLNG liquefaction project – Shell’s Prelude floater. Offshore gas fields and deep subsea trenches such as the Timor Sea Trench make this region a key focus area for floating liquefaction project developers.

About the Author

Lucy Miller

Lucy has conducted market analysis on a variety of DWL’s commissioned research projects for clients in the oil and gas sector, as part of commercial due-diligence and published market studies. As the Lead Author of Douglas-Westwood’s published market studies ‘The World FLNG Market Report’ and ‘The LNG Market Report’ Lucy has considerable knowledge on the sector. Lucy has also completed a number of LNG-related research projects for clients including equipment manufacturers & suppliers and major contractors. Her analysis has been quoted by Bloomberg, Citigroup, Upstream, Penn Energy and World Oil among others. Lucy has a background in the offshore oil and gas sector and previously worked for FoundOcean Ltd. She has a degree in Economics and Geography from the University of Leicester.