Fight over future of natural gas in the US intensifies [GasTransitions]

In March, the US Environmental Protection Agency (EPA) announced that it was freezing enforcement on environmental regulations due to the coronavirus pandemic and would not “seek penalties for violations of routine compliance monitoring, integrity testing, sampling, laboratory analysis, training, and reporting or certification obligations in situations where the EPA agrees that COVID-19 was the cause of the noncompliance.”

As LeeAnn Baronett writes in an article for the Colorado-based think tank Rocky Mountain Institute (RMI), this announcement came five days after industry association American Petroleum Institute (API) had sent a letter to the EPA asking it “to temporarily lift some compliance obligations during the coronavirus pandemic, including regulations around methane emissions from oil and gas operations.”

However, Baronett points out that “there is nothing new” about this attempt from the oil and gas industry to weaken methane regulations. Under the Trump administration, and at the instigation of lobby groups like API, the EPA has been busy weakening environmental regulations, such as fuel economy standards for cars. In August last year, writes Baronett, “the EPA proposed a rule that would eliminate federal requirements that oil and gas companies install technology to detect and repair methane leaks.” There has been no decision on this proposal yet.

Attorneys general

The question is whether the gas industry is really helped by weaker environmental regulations in the longer term. There is strong pushback against the industry at the state and local level, where many decisions are made in energy policy. And it is getting stronger.

Baronett notes that “25 attorneys general, including those from states with major oil and gas operations like Pennsylvania, Colorado, and California, sent a letter to the EPA stating that the proposed revisions to the EPA’s methane regulations will significantly degrade air quality and impact public health. Over the last several years, these states have been working on their own to enact regulations that protect their residents from pollution that is harmful to their health and our environment.”

Indeed, even some major energy companies, including Shell, ExxonMobil, BP and Equinor objected to the EPA’s proposed methane rule. Equinor left industry lobbying group Independent Petroleum Association of America because of disagreement on climate policy, and methane policy specifically.

In a feature article published 14 April on Yale Environment 360, a publication of the Yale School of Forestry and Environmental Studies, Jonathan Mingle reports that there is a growing movement in the US to ban natural gas and “electrify everything”. He notes that cities across the US – where over 60% of homes are heated with gas or other fossil fuels – are instituting bans on natural gas in new construction.

Two factors are driving the move towards all-electric solutions, notes Mingle: “Electricity generation produces far fewer greenhouse emissions than it once did. And electric appliances have become more efficient, user-friendly, and reliable.”

Mingle writes that “gas bans have spread with a speed that has taken even some of its most ardent proponents by surprise. Last July, Berkeley became the first city to adopt an outright prohibition on gas connections in most new buildings. A raft of other California cities followed with their own versions, including Menlo Park, home to some of Silicon Valley’s biggest tech companies, and San Jose, the tenth largest city in the nation. In November, the movement leapt beyond California when Brookline, a large suburb of Boston, became the first municipality in Massachusetts to pass an all-electric requirement for new buildings.”

Retiring pipelines

According to Mingle, “Dozens more US cities are contemplating their own gas bans or all-electric mandates, motivated primarily by climate concerns. In Seattle, a proposed ban on natural gas systems in new construction is being considered by the city council. Bellingham, Washington is considering outlawing gas heating in new and existing buildings. In March, the city council of Takoma Park, Maryland passed a resolution to achieve net-zero emissions by 2035; the next step will be developing specific ordinances, including one potentially phasing out gas appliances. Last week, Ann Arbor, Michigan unveiled a similar plan.”

In Maine, notes Mingle, a law was passed last year setting a target of 100,000 heat pumps installed in the state’s homes by 2025. That is one out of five of all homes in the state. Meanwhile, cities like Philadelphia and Washington, D.C. are coming up with their own transition plans for decarbonizing their gas utilities. These include “exploring options for retiring gas pipelines and fully electrifying heating and water heating, and identifying the lowest-cost route to meeting carbon targets.”

The gas industry is trying to stem the anti-gas tide with countercampaigns. Gas industry trade groups have launched advertising campaigns opposing city-level gas bans across the country. “The American Public Gas Association, which represents local gas distribution utilities, has characterized city bans as ‘extreme’ and ‘a heavy-handed approach [that] eliminates consumer choice, stifles innovation, and diminishes the flexibility to respond to GHG [greenhouse gas] emissions goals, with the least-cost solutions for consumers’.”

Gas utilities, developers, and home-builders associations have also lobbied and testified against some cities’ all-electric mandates, “citing the importance of preserving ‘energy choice’ for consumers, and contending that they will drive up electric bills for ratepayers and overall costs for developers, restaurants, and other businesses.” The American Petroleum Institute, reports Mingle, has announced “it will restructure its field offices around the country, in part to better push back against the national spread of the gas ban movement.”

Multitude of risks

Two energy and environmental groups, Energy Innovation and As You Sow, published a report in March 2020 – Natural Gas: A Bridge to Climate Breakdown – aimed at utilities and investors, warning them that the continued use of natural gas in the power sector is leading to a “multitude of risks”.

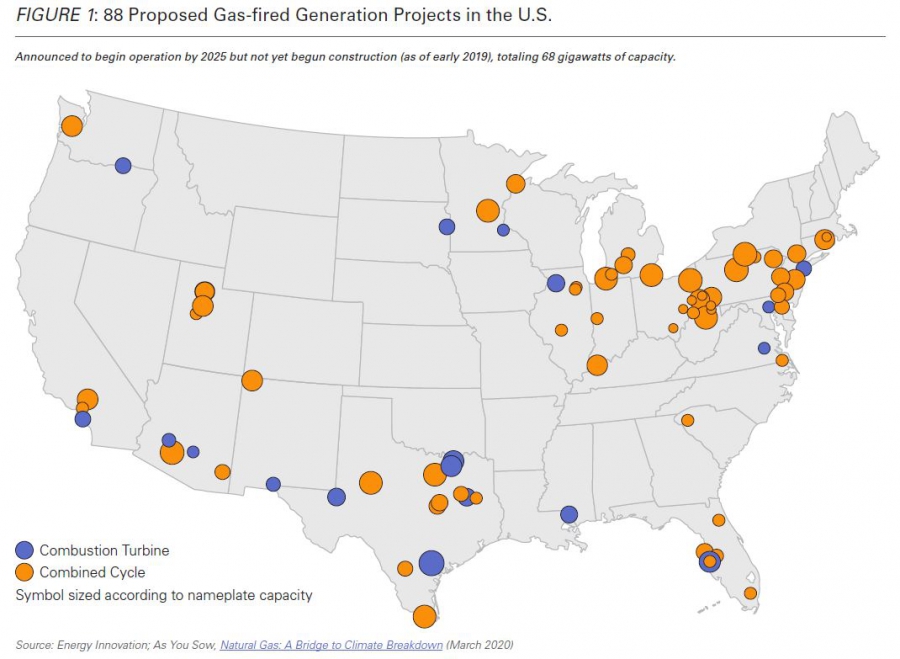

Most power utilities in the US are currently still investing in gas-fired power stations, notes the report. The US Energy Information Administration (EIA) projects that 50 GW of new GCC plants will be built in the period 2019-2024 (figure 1). The Rocky Mountain Institute claims the US is on track to spend $1 trillion on new gas-fired power plants and fuel by 2030.

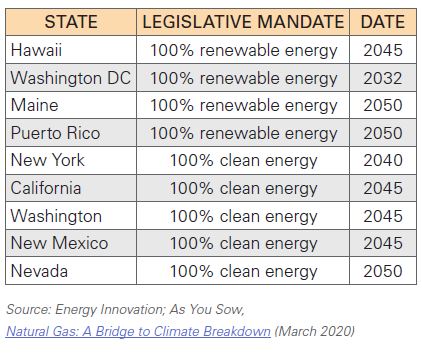

This, say the authors of the report, will be unsustainable. “Given the plethora of clean energy commitments from states and municipalities, coupled with significant cost declines projected for clean alternatives, these gas infrastructure assets will either become stranded or need to be retrofitted with expensive and relatively unproven carbon capture and storage (CCS) technology to remain viable,” they warn.

They write that not only have many cities issued bans on natural gas in new construction, also several states have adopted ambitious renewable energy and clean energy (this includes nuclear power) commitments, “and more governors elected in the 2018 mid-terms are pushing to set ambitious targets (see table). In addition to such state-level goals, more than 130 cities have committed to 100% clean energy in their power grids, and six are already powered by 100% renewable generation.”

Growing resistance

Like the article on Yale Environment 360, the report notes there is growing resistance to natural gas, both among the public and among big business.

The authors cite research from Edison Electric Institute (EEI) showing that “70% of utility customers support the statement that ‘in the near future, we should produce 100 percent of our electricity from renewable energy sources such as solar and wind’. Due in part to utility unresponsiveness to large customer demands for clean energy, once captive customers are seeking ways to directly purchase clean energy, circumventing utilities and eroding their ratepayer base. As a result, customers large and small are challenging the traditional monopoly model to access clean energy.”

In addition, “Community choice aggregations (CCAs) have emerged as a solution for communities seeking a way to access clean energy. These programs enable local governments to buy power for residents and businesses from alternative sources, essentially bypassing local utilities. Currently, CCAs are authorized in nine states … and five more states are actively investigating the introduction of legislation.”

Large corporations are also getting in on the action. “For example, over 200 companies, including … Ikea, Apple, Facebook, and Google, have joined the RE100 initiative and committed to procuring 100% renewable energy. Uptake is rapidly growing, and in 2018, 121 corporations in 21 different countries signed 13.4 GW worth of clean energy contracts. This nearly doubled the previous record set in 2017. … Some of the largest tech companies in the world, including Microsoft, Apple, and Salesforce, sent a letter to Dominion Energy, the main utility in Virginia, rebuking it for including so much natural gas in its latest integrated resource plan, and demanding more solar and wind.”

Utilities do show “signs of movement”, says the report. “Xcel Energy, PSEG, Duke Energy, Dominion Energy, DTE, Arizona Public Service, and NRG have all set noteworthy net-zero by 2050 emissions goals.” Yet “many of these same utilities’ continued investment in new natural gas infrastructure is at odds with their emission reduction commitments. For example, Duke, Dominion, Southern, and AEP’s business plans actually indicate a slowdown of their decarbonization plans between 2017 and 2030—a slowdown tied to significant gas investment plans.”

Big threat

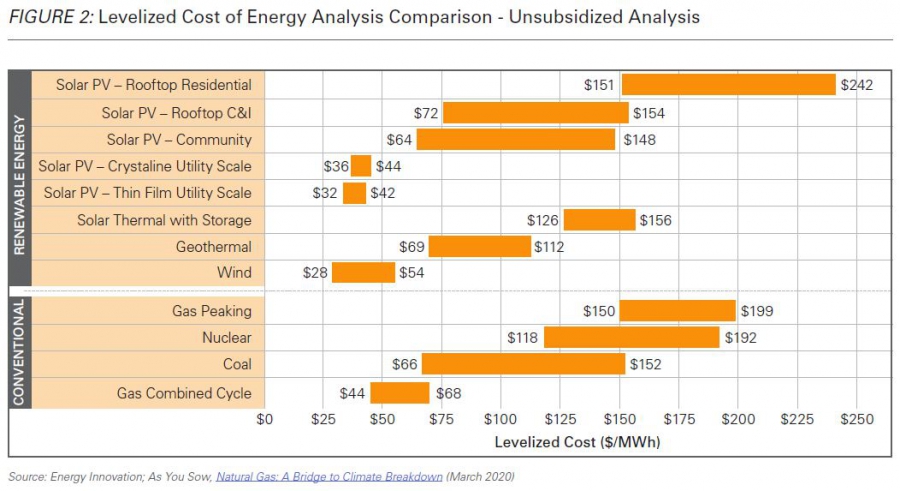

The big threat for natural gas, say the authors, is that renewable generation technologies are increasingly “threatening the economics of new gas”. Today, “new unsubsidized wind costs $28-54/MWh, and solar costs $32-44/MWh, while new combined cycle natural gas costs $44-68/MWh (Figure 2). In short, in almost all jurisdictions, utility scale wind and solar now offer the cheapest source of new electricity, without subsidies.”

Although the authors concede that “the levelized cost of energy (LCOE) only tells part of the story, the economics for clean energy resources remain compelling when utilities compare portfolios of clean energy resources to new natural gas plants. NV Energy’s recent procurement of 1,200 megawatts (MW) solar and 580 MW of four-hour battery storage already beats new natural gas on price. NV Energy paid $20/MWh for solar and $13/MWh for enough battery storage to shift 25% of daily energy, resulting in a total cost of $33/MWh per MWh delivered (including federal tax credits).”

According to the report, “this economic tipping point is starting to play out in utility investment decisions, particularly as utilities seek to replace uneconomic coal generation with new resources. In the upper Midwest, Xcel announced plans to retire its remaining coal-fired capacity a decade ahead of schedule and replace it mainly with at least 3,000 MWs of solar by 2030 and 1,850 MWs of wind by 2022. Xcel CEO, Ben Fowke, noted that low wind prices make more business sense than gas for the company.”

Another example: “Northern Indiana Public Service Company (NIPSCO) recently determined through its planning process that it could replace all its coal plants almost entirely with wind and solar resources at lower cost when compared to other options such as natural gas.”

Major financial institutions “are reaching similar conclusions, demonstrating renewable technologies are superior investments over natural gas. Morgan Stanley found that a move from coal-fired generation straight to renewable energy generation would save customers $8 billion annually. The research found that over 70 GWs of coal generation will become uneconomic to run over the next decade, presenting regulated utilities with an investment opportunity of between $93-184 billion to replace these coal assets with low-cost renewables, achieving a ‘triple-bottom-line’ benefit to customers, the environment, and shareholders.”

Natural gas-hydrogen plant

Utilities have another choice as well: they could replace natural gas with hydrogen. Indeed, according to many experts, if they decide to do without gas (and without nuclear), they probably have no choice but to turn to hydrogen. “At a renewables penetration of about 60%, RH2 [green hydrogen], or comparable long duration storage, will be necessary for grid reliability,” University of California, Irvine, Chief Scientist of Renewable Fuels and Energy Storage Jeffrey G. Reed recently told the prominent US power sector magazine Utility Dive.

Such a high level of renewables presentation is coming, Reed added. “Many states in the US are working towards 100% zero-carbon commitments.”

The US currently produces some 10 million tons of hydrogen, of which 1.4% is renewable, according to Navigant Research. According to an August 2019 report from Bloomberg New Energy Finance, this could go up to 275 million tons by 2050. The price of green hydrogen in the US could drop from $2.50-$6.80/kg today to as low as $1.40/kg by 2030 and $0.80/kg by 2050, equal to about $6/MMBTU.

UC Irvine, notes Utility Dive, has a more conservative outlook, “forecasting $2/kg in 2050, which is $16/MMBTU and would produce $0.10/kWh electricity from a combined cycle power plant. Current gas prices in the US are around $1.90/MMBTU, so there is still a significant cost difference.” Nevertheless, as Utility Dive notes, “an offer has already been made recently for delivery of green hydrogen in 2022 by H2V energies to Los Angeles Department of Water and Power (LADWP) at $2.67/kg.”

One significant development in the US is a drive to convert gas-fired power plants to hydrogen. The Los Angeles Department of Water and Power (LADWP) is one of the forerunners here. “In Utah, they are building a 2x840 MW combined cycle natural gas-hydrogen plant, the Intermountain Power Project, which will be able to burn a 70% natural gas/30% hydrogen blend when it goes online in 2025. What is more, it will be prepared to be retrofitted so it can be made to burn 100% hydrogen by 2045, which will be needed to meet the Los Angeles zero-emissions mandate. The plant has a direct 2.4 GW high voltage transmission connection to L.A.”

Another unique feature of this plant, which is replacing an 1800 MW coal power plant: it will interconnect with wind, geothermal, hydropower and solar facilities, and “will be built over underground salt caverns that are ideal for storing hydrogen at high temperatures.”

Stranding assets

Reed of UC Irvine notes that green hydrogen will allow utilities to avoid totally stranding natural gas power plant assets. He adds that “leading manufacturers like Mitsubishi and Siemens know it is not technically daunting to retrofit natural gas plant turbines for green hydrogen.”

Utility Dive notes that Mitsubishi already has natural gas units in operation which use up to 90% hydrogen. The turbines it will bring to the market “will be engineered to burn 30% hydrogen blends by 2025 and they will eventually be retrofitted to burn 100% hydrogen by basically swapping out combustion system parts during planned maintenances, at costs similar to replacing other parts.”

Mitsubishi Marketing VP Todd Brezler told Utility Dive. “By 2030, electrolyser costs will be down enough to make renewable hydrogen cost-competitive and turn potentially stranded natural gas system assets into assets that can provide carbon-free power.”

Another matter of course is where to get all the green hydrogen that will be needed. Utility Dive does not discuss this.

The Rocky Mountain Institute (RMI) in the US noted recently that “successfully growing the green hydrogen economy” would require producing 20,000 TWh of renewable energy in the US by 2050. That’s almost as much as total US power production today, which is around 24,000 TWh. RMI expects that growth in population and wealth will require an additional 23,000 TWh per year in the US, which means that current power production will have to triple. This means, according to RMI, that there is a great opportunity here for “blue hydrogen” – but that will require the buildout of extensive CCS facilities.

Further reading: The Fuel Cell & Hydrogen Energy Association (FCHEA) published a Road Map to a US Hydrogen Economy in November 2019.