Russian gas flow cuts push Europe to brink of energy system breakdown

It was Russian president Vladimir Putin who kickstarted the EU transition away from Russian gas. After cutting or reducing gas flow to Bulgaria, Poland, Finland, the Netherlands and Denmark over April and May, Gazprom reduced flow via Nord Stream 1 by 60% in mid-June, presumably due to "delays receiving a turbine which had been undergoing maintenance in Canada."

This stopped flows to France and reduced flows to Austria, Italy and Germany. Whether there was a political motive or not, the market impact has been grave. Spot prices have been rising from height to new height since late June, and several EU member states have signalled they will restore coal-fired power generation, in conflict with the EU's climate goals.

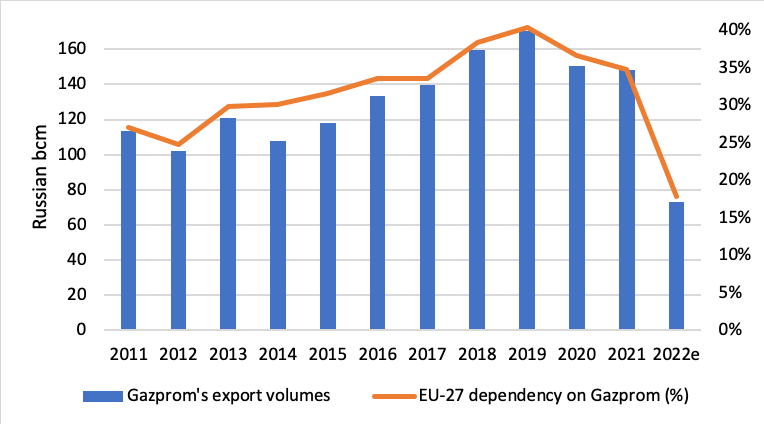

Over the course of 2022, Gazprom is forecast to provide less than 70bn m3 of gas to the EU, versus a pre-COVID annual level of 160bn m3. Unilateral cuts by Gazprom have reduced the company's exports by over 55%.

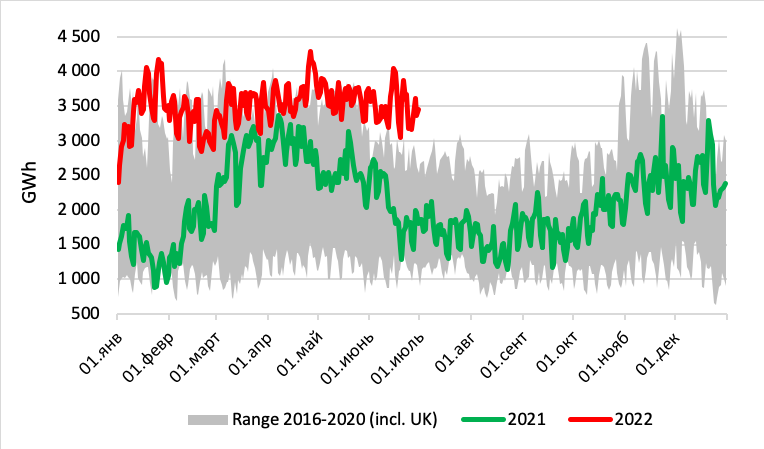

Gazprom’s Europe monthly gas exports in annual comparison

.png)

Source: Gazprom, Entsog, thierrybros.com

With Russian flow at a record low of only 4.7bn m3 in June, Europe is now at risk of a system breakdown, as 30% of pre-crisis Russian exports that have now been lost are non-replaceable. In July, the volume should fall to 4bn m3. The energy industry must be prepared for a Lehman Brothers' watershed, where a utility the size of Uniper, that is fully beholden to Russian gas flow, will likely go bust once Nord Stream 1 flow is fully cut. Policymakers simply cannot afford such a scenario, in the midst of the continent's worst energy crisis in memory. The bankruptcy of a single major utility will freeze energy trading, and it is this trading that has underpinned the resilience of the European energy system.

Nord Stream 1 will close down entirely when Gazprom undertakes its annual maintenance on the pipeline between July 11 and 21. TurkStream's maintenance ran from June 21 to 26, reducing monthly flow by 30% versus May. Flows via Ukraine were further reduced by 39% vs last month, and are not at only 35% of the contracted capacity.

Split of Gazprom’s Europe monthly gas exports by route

.png)

Source: Gazprom, GTSOU, Entsog, thierrybros.com

In June 2022, LNG send-out was 45% above the level a year earlier, but the system still has some upside flexibility to attract, if needed, additional cargoes.

EU LNG send-out (excluding Malta)

Source: GIE, thierrybros.com

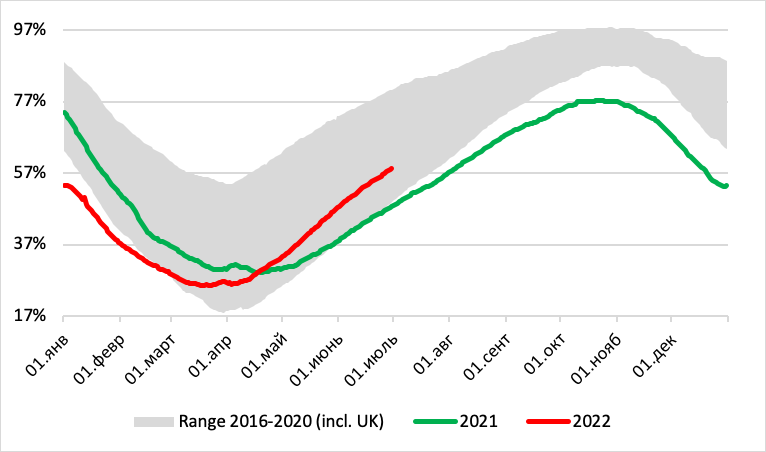

While EU storage at the end of June remained below the five-year average (58% versus 65%), recent trends demonstrate the market is pushing hard to lift storage up to the 80% level required by Brussels before November 1. But refilling rates have been affected by Gazprom's latest cuts. Europe managed to refill 3% of storage capacity in May, versus an average for the month of 11%, and this dropped to 1% in June, versus an average of 9%.

EU gas storage utilisation

Source: GIE, thierrybros.com

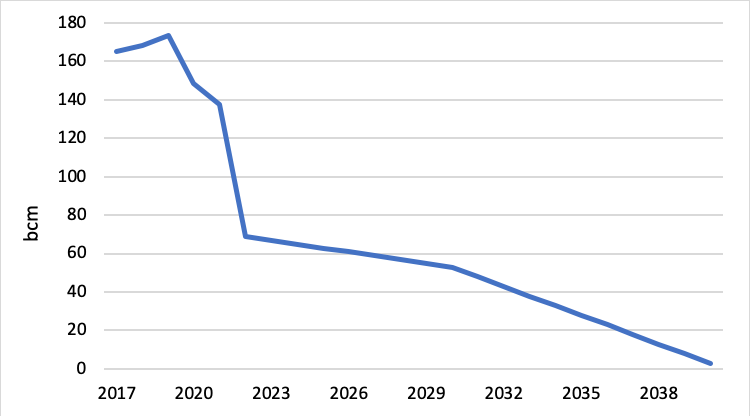

Taking into account all of Gazprom's contract suspensions, 2022 Russian exports to the EU could be as low as 70bn m3, down 51% on the level in 2021, where there was also no tangible storage refilling. With export curtailments, Gazprom's market share will likely slump from last year's 35% to just 18% for 2022e. This bodes well for European efforts to gradually freeze Gazprom out of the European gas supply market. Despite the near-term pain, consumers could benefit as the market settles down. It is thought EU gas customers shed around $100mn/day on Russian gas imports at current prices. Given that Austria's OMV's long-term contract with Gazprom will run until 2040, further political interventions, in the form of either a full cut from Russia or an embargo from the EU, will be needed to fully remove Russian gas from the EU's energy markets.

Gazprom gas exports to the EU and EU dependence on Gazprom

Source: GIE, thierrybros.com

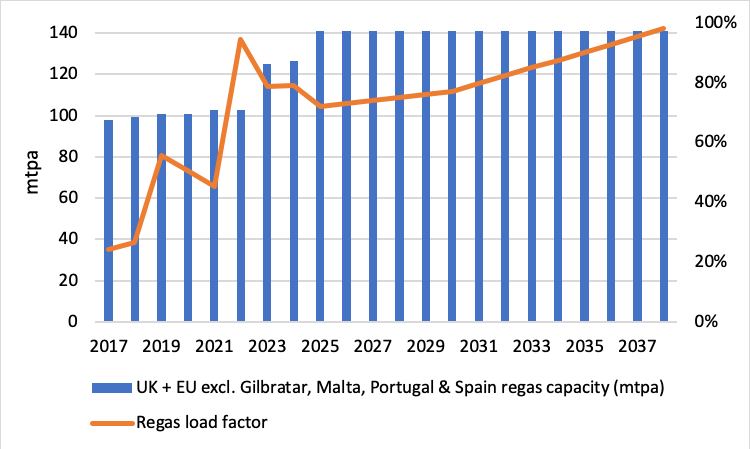

On the other hand, the regasification load factors of the UK and EU (excluding Gibraltar, Malta, Portugal & Spain) should jump from 45% in 2021 to 95% in 2022e. That could provide scope for some political interventions on the EU side. In reality, though, an embargo today is impossible as the EU lacks either the access to the desired LNG or the required regasification capacity.

Russian pipeline gas imports to the EU: historical flows & future long-term contracted volumes

Source: GIE, thierrybros.com

European countries are now scrambling to add more regasification capacity to bring Russian dependency to a complete end.

Regasification load factor if expired Russian contractual volumes are timely replaced with LNG

Source: GIE, thierrybros.com

Dr. Thierry Bros

Prof SciencesPo & Energy Expert

July 3, 2022