Exxon 1Q Earnings Double to $4bn

ExxonMobil reported net 1Q earnings of $4bn, up 122% from its $1.8bn in 1Q2016, it said April 28.

Upstream earnings of $2.3bn improved on higher liquids and gas prices, and were a full $1.5bn higher than 1Q2016. Upstream volumes were 4.2mn barrels of oil equivalent per day, down 4% year on year, mainly due to the impact of lower entitlements due to increasing prices.

Natural gas production of 10.9bn ft3/d was up by 184mn ft3/d from 1Q2016 as project ramp-ups were partly offset by field declines. Liquids production of 2.3mn b/d was 205,000 b/d lower due to lower entitlements and higher maintenance activity mainly in Canada and Nigeria.

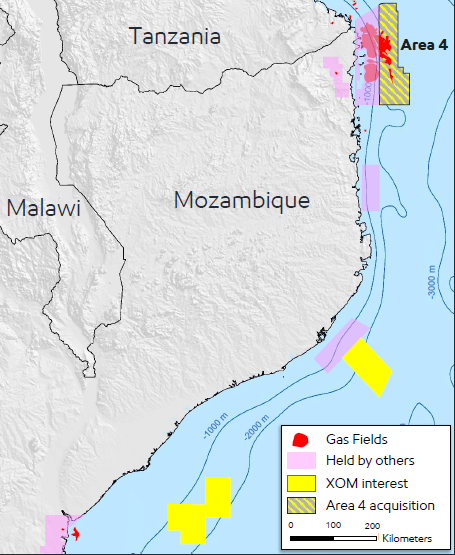

Eni-operated Area 4 offshore Mozambique (Map credit: ExxonMobil)

Mozambique: Coral FLNG "will progress"

Reviewing its March 2017 agreement to buy a 25% interest in the gas-rich Mozambique offshore Area 4 for $2.8bn from Eni, Exxon said the block includes six major discoveries totalling 85 trillion ft3 gas in-place, with each well capable of delivering over 100mn ft3/d at a competitive cost of supply. It said the eventual ambition of the Area 4 consortium is to “develop more than 40mn mt/yr of onshore LNG” – “a world class project.” Exxon is to lead the onshore LNG development, under the March agreement. Ongoing evaluation of three high-potential exploration blocks in the area is also planned.

“We look forward to finalising Production Sharing Contract [PSC] discussions with Mozambique,” said vice-president of investor relations, Jeff Woodbury, noting that the $2.8bn acquisition has yet to close.

Answering an analyst's question, he said that "the current expectation is that [the] Coral [floating liquefaction project] "will progress." (No final investment decision on Coral, intended to be developed before the ongoing plants, has yet been taken)

He said that Exxon saw similar characteristics for developing a future LNG industry in Mozambique, to those that it spotted in Qatar over 20 years ago, and a decade ago in Papua New Guinea (PNG). Talks to secure an onshore site for liquefaction plants were underway with the government, he added.

Woodbury also confirmed that ExxonMobil's $22bn capital expenditure guidance for 2017 includes the $2.8bn to be expended on Mozambique Area 4. But the US supermajor would stay alert to opportunities both upstream and downstream "as they come up", he added.

PNG and Australia

During 1Q2017, Exxon farmed into two offshore blocks near PNG LNG, and in March, train 3 of the Chevron-led Gorgon LNG complex in Australia started up, meaning it is now at full 15.6mn mt/yr capacity. Exxon (with QP) also executed Block 10 exploration and production sharing contract in Cyprus, with an obligation to drill two exploration wells, of which the first in 2018, noted Woodbury.

"Sanctions remain in place" in Russia "and we remain in full compliance", he added, noting that east coast assets [Sakhalin] are not included in them and had performed exceptionally well. Exxon has been reported in the past week to have lobbied hard to retain a waiver for its Sakhalin operations.

ExxonMobil's cash flow from operations and asset sales in 1Q2017 was $8.9bn.

Mark Smedley