Explaining Putin’s rubles-for-gas decree

On February 27, the president of the European Commission, Ursula von den Leyen, announced that the EU and its G7 partners had decided to “paralyse” the assets of the Russian Central Bank.[1] On the March 13, Russian finance minister Anton Siluanov stated that Russia had lost access to almost half of its international liquidity reserves due to Western sanctions – to $300bn of its $640bn of total reserves.[2]

This has created the negative precedent, including for energy. On March 22, former US Ambassador to Moscow, Michael McFaul, wrote in his Twitter that “Russia should continue to export oil to democratic countries, but recipients should hold payment for these energy resources in escrow accounts until Putin ends the war. Then it's Putin's decision whether to cut off oil supplies or not.”[3] So it was de facto proposed that Russia should continue its energy export for free.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Therefore on March 23, Russian president Vladimir Putin at a government meeting first referred to this precedent of de facto expropriation of Russian international liquidity reserves by saying that “now everyone knows that obligations in US dollars and Euros may not be executed”. And then he gave order to the government “within the shortest possible time to implement measures to transfer payments, starting with natural gas supplies to so-called unfriendly states, to Russian rubles, which means to stop using all compromised currencies in such transactions.” He confirmed that “Russia will by all means continue to supply natural gas according to volumes and prices, and on pricing principles fixed in the contracts signed earlier. … Changes will refer only to currency of payments which will be changed to Russian rubles.” He said that it is necessary to create for all foreign buyers an “understandable transparent procedure for payment transactions including purchase of rubles at our internal currency market”. He asked the government to provide a corresponding directive to Gazprom to make changes in acting contracts and asked Bank of Russia with the government to define the order of such transactions within a week’s time.[4]

This was timely done and on March 31, the presidential order #172 “On special order of executing by the foreign buyers of their commitments to the Russian suppliers of natural gas” was signed, establishing new payment procedures for Russian gas to unfriendly states (according to their earlier published list) as of April 1.

A Kubler-Ross road to mutual understanding

It had the effect of an explosion in the West. And had created a wave of immediately negative comments from high-level European politicians on this new order of payments for Russian gas for “unfriendly states”. This was the normal first step – denial - in a five-step-way of “acceptance of inevitable” according to the Kubler-Ross change curve (denial, anger, bargaining, depression, acceptance).

Many observers and most politicians said that the transition to “payments for rubles” had occurred. I think that it was just a straightforward interpretation of the first portion of Putin’s words as of March 23 “to transfer payments … to Russian rubles”, and “stop using compromised currencies”, and “currency of payments … will be changed to Russian rubles” which really can be interpreted in such a way. This is why most commentators and politicians have immediately refused on behalf of their states to “pay in rubles” and have called it violation of acting contracts since they were signed mostly in euros and US dollars. But they, most probably, did not consider the second portion of Putin’s words that “Russia will by all means continue to supply natural gas according to volumes and prices, and on pricing principles fixed in the contracts signed earlier,” which means the same contractual currencies.

In my view, Russia’s action is not fomenting tensions but, per contra, it softens this “Caribbean crisis” in European gas since it diminishes two types of risks and presents a mirroring (reciprocity) effect of earlier similar actions of the commission’s DG COMP against Gazprom.

Protection against currency risks

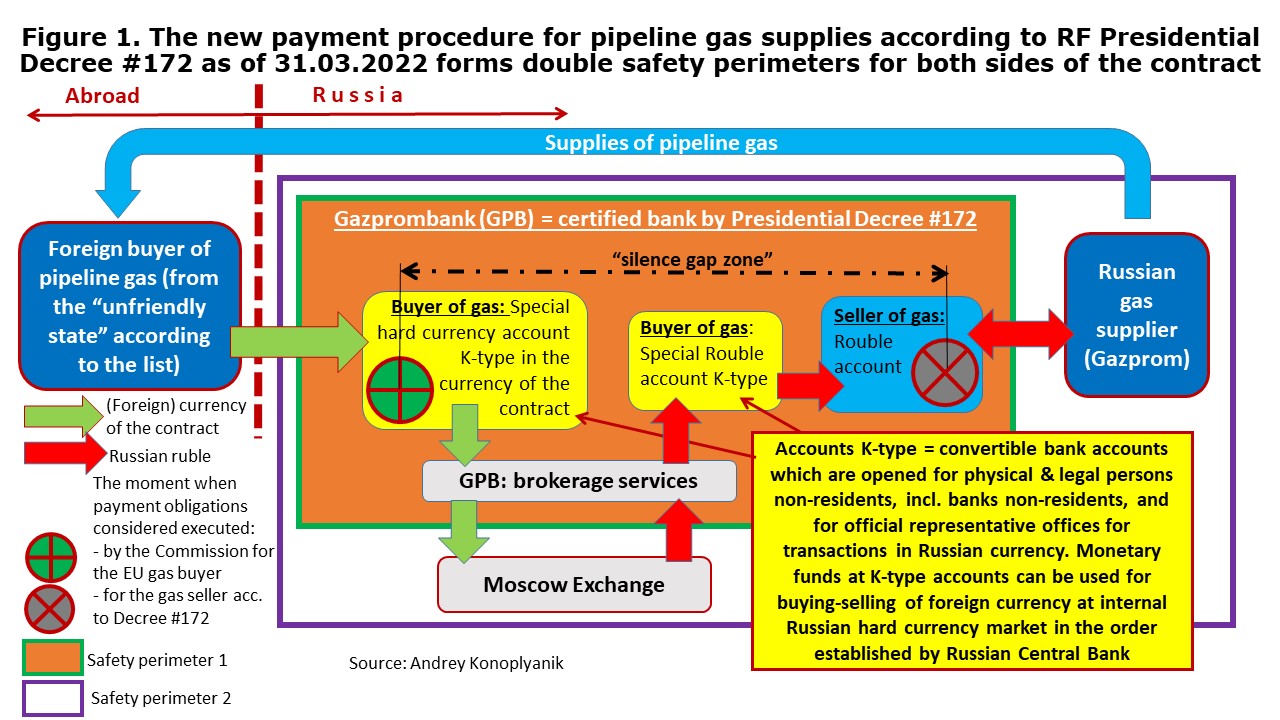

Under the new procedure, the gas buyer from an “unfriendly state” should open two special K-accounts, in currency of the contract and in rubles at Gazprombank (GPB). Their payment obligations are considered to be executed in full when the payment in currency of the contract (euros or US dollars) to GPB are converted into rubles at the Moscow exchange by GPB as an agent and transferred to Gazprom’s ruble bank account in the same GPB (see Figure 1). This new procedure is aimed at diminishing risk for both contractual parties of non-payments for Russian gas due to possible actions of the Western states that can again freeze (the precedent has occurred) Russian hard currency if gas payments continue to be received at the bank accounts in foreign banks abroad.

New payment procedure creates two safety perimeters for both the seller and the buyer of pipeline gas. First safety contour is organised because payment transactions are moved to Russian jurisdiction which excludes the risk of further Western expropriation(s), this time of payments for gas. The second safety contour is established because all elements of the new procedure are done within one financial institution (GPB), so transaction costs are minimised and transaction risks are zero out (Figure 1).

So it is just the order of payments that has changed which nullify currency risks for both Gazprom, the seller, and its European counter-agents, the buyers, of Russian gas. Now execution of the contract is considered not at the moment when the payment for delivered gas in contractual currency arrived at currency account of the seller in the foreign bank located outside of Russia’s jurisdiction, as in the past, but when ruble equivalent of the currency payment for delivered gas arrives at Gazprom’s ruble account in GPB (Figure 1).

So for the gas buyers from “unfriendly” European states, factually almost nothing has changed, except that they will face some modest incremental costs for opening and operating two K-accounts at GPB; it is also logical to charge them commission for conversion from contractual currency into rubles by GPB. But these modest incremental costs remove the risk of freezing the payments in foreign banks in “unfriendly” states and/or their forced transfer to escrow accounts, as was proposed, or any other type of currency risks for both parties to the gas supply contract.

Current picture

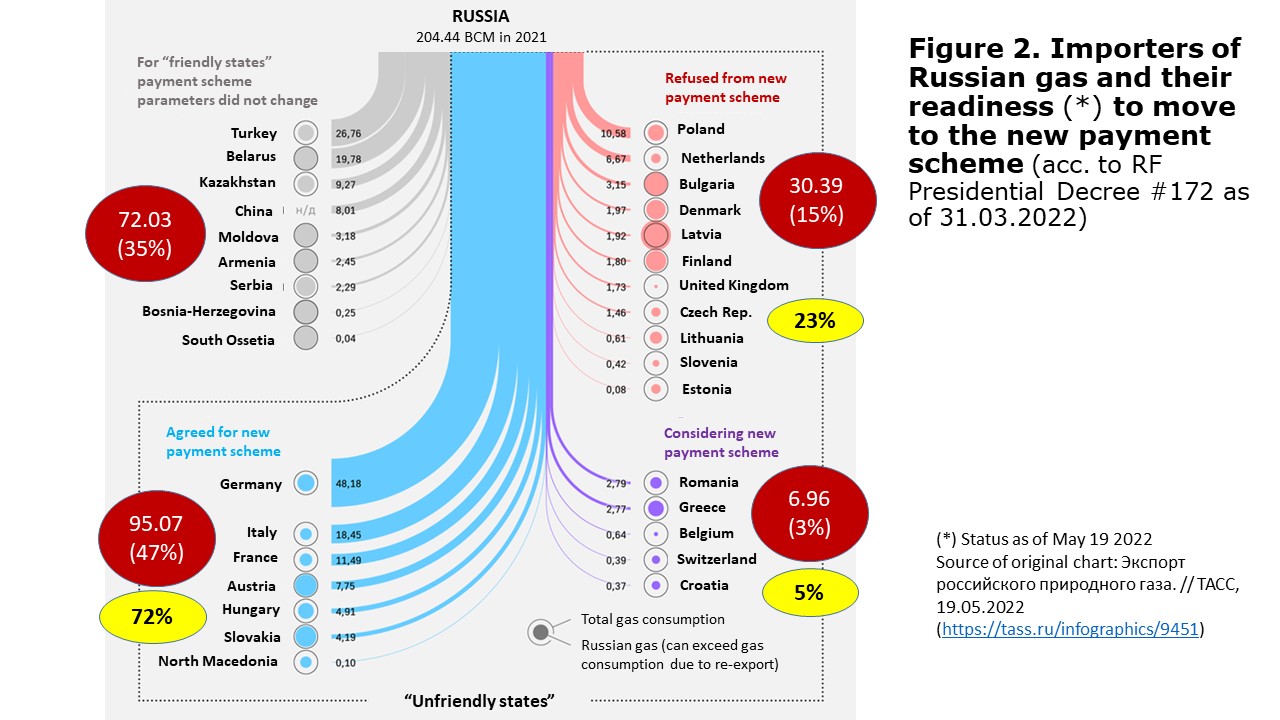

On May 19, Alexander Novak, deputy prime minister responsible for energy in the Russian government, noted that about half of 54 companies that have contracts with Gazprom have opened bank accounts in GPB to pay for gas according to the new scheme. Some of them have already made advanced payments, some have paid for already supplied gas.[5]

The provisional picture as of that date is presented at Figure 2. The “unfriendly states” accounted for two thirds of overall Russian gas exports in 2021. Among those the states with more than three quarters of EU gas imports have either already moved to the new payment scheme (72%) or have been considering such a transfer (5%). 11 states which account 15% of overall Russian gas export, or 23% of gas export to “unfriendly” states, have refused to pass to the new scheme. In April-May three cancellations of contractual supplies of Russian gas were already executed (to PGNiG in Poland and Bulgargas in Bulgaria on April 27, and Gasum in Finland on May 21) because the governments of these states gave orders to their state companies to refuse to shift to the new payments procedure. This is important to be underlined: it was the political decisions that were taken by the three governments and translated for economic execution to their state companies for obligatory implementation (like it was obligatory for state-controlled company Gazprom to implement its major stakeholder’s - the Russian state – decision).

Finally, the commission has commented that the new system would not contradict the sanctions regime if the first transaction in the new multistep payment procedure is made in contractual currency, be it euros or US dollars. But the fact that the first payment is to be made in the currency of the contract was clear if not from the first Putin’s statement on this topic as of March 23 (which, fair to say, gave the room for interpretations), but for sure from the very Decree #172 as of March 31. So it took almost two months for the political authorities of the EU and most of its member-states to pass through all five steps of Kubler-Ross change curve. The commission, nevertheless, has put a caveat, that EU companies should inform Gazprom after making currency transactions to their newly opened currency K-account in GPB that their payment obligations are thus fulfilled in full. And the rest of the procedure is in sole and exclusive responsibility of the Russian party. This can be called a “face-saving” for the EU approach since it is clear that this “rest of procedure” to be done within Russian jurisdiction and within authority of the one single authorised Russian bank (GPB) – I call it “silence gap zone” (see Figure 1) - creates zero risks for finalisation of transaction to the point when ruble equivalent of contractual currency payment is placed on Gazprom’s ruble account in this same GPB. And thus, the transaction is now fully and legally finalised according to the new payment procedure.

This means that currently the new balance (how long it will last within current consecutive waves of sanctions on Russia?) is reached in regard to new payment scheme based on high interdependency of the two parties: one third of EU gas market covered by Russian gas is sort of balanced by the fact that it accounts for one third of Gazprom’s production. Such interconnection can’t be broken (and should it?) nor at once, nor in the nearest future without huge negative consequences for both sides.

Diminishing merchandise risks

In the payment scheme existing prior to Decree #172, payments for gas from the buyer came to the foreign bank account of the gas supplier. From there one part of the sums was transferred to Russia - to be converted into rubles to pay taxes and made ruble transactions in the domestic market. Another part was left abroad to be used for purchases of imported goods and services by the gas supplier directly from its foreign bank accounts.

Now sanctions have blocked/stopped many Russian import goods purchases. This means there is no sense to leave money abroad since the gas supplier faces physical impossibility to use them - it can’t just buy what is needed for US dollars or euros from its foreign accounts. And this is beyond the above-mentioned currency risk.

If Gazprom needed to buy now alternative goods and services for domestic consumption instead of sanctioned ones, say to substitute their purchases in Europe and/or US by Asian goods and services, there is no sense to buy them in these Asian states for their national currency (in, say China and/or India for yuan or rupee) via euro or US dollar accounts. It is much more reasonable for both new partners to move to direct “ruble-yuan” or “ruble-rupee” transactions instead of making transactions via the third currency, which leads to incremental transactions cost and additional bank commissions (on top of risk that euros or US dollar transactions can be blocked/frozen). Such direct transactions will be automatically moved from the jurisdictions of “unfriendly states” to Russia’s domestic jurisdiction or to the jurisdictions of the “friendly” states, diminishing what I call merchandise risks.

A threat to US dollar dominance

And, further on, what is important in the long-term: transition in the new contracts directly to ruble payments (or to payments in alternative currencies), and not only in gas but in other Russian export commodities (the current scheme should be considered as a transition tool), should expand the ruble’s niche and that of other currencies in global trade and diminish the US dollar role as the universal currency in global commodities. This is within the national interests of many states, both exporters and importers. China and Saudi Arabia have been discussing purchases of oil with payments in yuan. Even the EU was trying to deviate from US dollatts by announcing in its 2020 Hydrogen Strategy that it aims to develop global hydrogen market based on the euro (though, of course it will not be a global market of hydrogen as a commodity, like oil or gas, but a global market of hydrogen equipment with the aim of the EU to dominate in it with “made in the EU” equipment priced in euros).

The speaker of the Russian State Duma, Vyacheslav Volodin, wrote recently in his Telegram channel that “it would be wise, where it should be profitable for our state, to expand the list of exported goods for the rubles: fertilizers, grain, agricultural oil, mineral oil, coal, metals, wood, etc.”[6]. This is the draft program of further actions which will result, with collective efforts, in further diminishing the US dollar zone of global trade. Russian agricultural exporters are already looking for transfer to export in rubles since they are facing problems with currency transactions in result of sanctions.[7] So anti-Russian sanctions have stipulated Russia to move away from the US dollar and the euro in its export supplies to the ruble and national currencies of the third states, thus narrowing both the US dollar and euro zone in global trade as current actions and a long-term aim.

Doctrine of state enforcement

Most political comments have interpreted the self-defense action of the Russian state as further evidence of Russia using gas as an “energy weapon”, as if it is a unilateral violation of “sanctity of contract” principles.

But any sovereign state has a “right to regulate”. There is an internationally accepted “doctrine of state enforcement”. Presidential decree #172 has obliged Gazprom as a state-controlled company (which acts as an economic agent of its sovereign state) to act according to such “state enforcement”. I would like to recall that the European Commission has more than once in the past used the same “doctrine of state enforcement” in its relations with Gazprom, and in a more radical form. Just two most well-known examples of DG COMP claims on Gazprom reflect the same doctrine:

-In 2022, that Gazprom violated competition rules in East Europe by using oil-indexation formulas in its long-term contracts. Pricing formulas were subsequently adapted and spot quotations were added and these now dominate formulas (reflecting 80% of the price nowadays).[8]

-In 2003, after the second EU energy package was adopted, that destination clauses in Gazprom's long-term contracts violated new EU legal rules. The commission stated that destination clauses prohibit the free re-selling of gas within the EU of Russian gas purchased at the delivery points at the EU border, though such destination clauses were protecting the producer's resource rent from unfair redistribution in favour of the buyer [9]. Nevertheless, destination clauses were eliminated from Gazprom's acting long-term contracts in line with the new changes in EU legislation. [10]

In my view, the Russian state has the similar rights to act accordingly by using the “doctrine of state enforcement” to update the payment procedure for Russian pipeline gas, especially since aimed at the diminishment of currency risks for both parties in the unpredictable Western sanctions environment. Thus this is softening the “Caribbean crisis” in European gas. And most of the buyers of Russian gas have either already agreed to shift to the new payment procedure or are considering doing so. (see Figure 2).

Prof. Dr. Andrey Konoplyanik (www.konoplyanik.ru) is an Adviser to Director General of Gazprom export LLC. He headed the Russian delegation at negotiations on the ECT in 1991-1993, and served as Deputy Secretary General of the Energy Charter Secretariat in 2002-2008. The views here expressed are solely and exclusively those of the author.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.

[7] https://agrotrend.ru/news/24240-rossiyskiy-prodovolstvennyy-eksport-gotovitsya-pereyti-na-rubli/

[9] A.Konoplyanik. Russian Gas to Europe: From Long-Term Contracts, On-Border Trade, Destination Clauses and Major Role of Transit to …? (“Journal of Energy and Natural Resources Law”, 2005, vol.23, N 3, p. 282-307) (http://www.konoplyanik.ru/ru/publications/articles/396_Russian_Gas_to_Europe_From_Long-Term_Contracts_On-Border_Trade_Destination_Clauses_and_Major_Role_of_Transit_to.pdf)

[10] А.Конопляник. «Правовые аспекты процедуры недискриминационного конкурентного доступа к свободным мощностям транспортировки (ДЭХ, TAG и ЕСГ)», с.142-156. – в кн.: Нефтегаз, энергетика и законодательство (выпуск 8/2009). (Информационно-правовое издание топливно-энергетического комплекса России и стран СНГ (ежегодник). – Москва, «Нестор Экономик Паблишерз», 2009, 160 с.) (http://www.konoplyanik.ru/ru/publications/b62/090817-konoplyanik2009.pdf)