Europe's hydrogen economy has just become six times bigger [Gas Transitions]

The new study, Gas for Climate, which came out March 18, is a follow-up to a similar study done by Navigant last year and its findings are much more upbeat: it shows that substantially larger gas volumes (270bn m³ instead of 122bn m³) and much greater cost savings (€217bn/year instead of €138bn) are possible in 2050 than the previous study had projected. These new findings will no doubt be welcome news to the companies that commissioned the report: gas network operators Enagas, Fluxys, Gasunie, GRTgaz, Open Grid Europe, Snam and Terega, as well as the European Biogas Association and Consorzio Italiano Biogas.

Given the EU’s ambitious climate policies, which may leave little or no room for natural gas around 2050, gas network operators are currently facing an uncertain future. True, there has been a strong push in Europe in recent years to promote “renewable gas” (biogas, biomethane, “green hydrogen”) and “decarbonised gas” (“blue hydrogen”, based on natural gas with carbon capture and use or storage) as alternatives to fossil-based natural gas. The deputy-director general for energy at the European Commission, Klaus-Dieter Borchardt, recently told NGW he is optimistic that the European gas industry will be able to continue to play an important role in the zero-emission energy system of the future, by switching from natural gas to CO2-free alternatives.

He is not alone. Nearly all the EU member states meeting in Austria last September signed the Hydrogen Initiative, a political declaration “to maximise the great potentials of sustainable hydrogen technology for the decarbonisation of multiple sectors, the energy system and for the long-term energy security of the EU.” And the Linz declaration will get a follow-up next week: at the April 2 meeting of the EU Council of Ministers in Bucharest, the energy ministers of EU member states will be asked to sign a similar declaration, this time promoting “a Sustainable and Smart Gas Infrastructure” for Europe.

In a March 19 letter to parliament, the Dutch minister for the economy and climate Eric Wiebes wrote that the new Bucharest declaration will focus on “the decarbonisation of the gas system with green gas, synthetic gas and hydrogen, and the optimal use of gas infrastructure. The declaration mentions the benefits of gaseous energy carriers and calls for research on how to increase the share of renewable gas and how the existing infrastructure can be used to this end. Particular attention will be paid to the legislative framework.”

Elephant in the room

However, despite all this enthusiasm for alternative gases, there is an elephant in the room that the declarations don’t mention: the amount of renewable gas and hydrogen likely to be needed in the low-carbon energy system of 2050 will be much lower than the amount of natural gas used today.

Renowned gas expert Jonathan Stern of Oxford Institute for Energy Studies (OIES), observing that the potential of alternative gases in Europe is quite limited, recently warned that unless the gas industry starts developing blue hydrogen on a large scale, it faces an “existential threat”. Stern noted that among a number of studies that had looked at the potential of domestically produced renewable gas and hydrogen in Europe, by far the most ambitious one projected a maximum of 122bn m³ in 2050 – no more than about a quarter of current European natural gas demand. Most other studies had even lower numbers.

Ironically, that most positive study was the first Gas for Climate study produced by Navigant, which came out in February 2018. In that report the researchers concluded that the availability of domestically produced renewable methane (biogas/biomethane) would be 98bn m³ and for green hydrogen just 24bn m³ – a fraction of current EU gas demand which is between 450bn m³/yr and 500bn m³/yr.

In the new report, the Navigant researchers find that in an “optimised gas” scenario, some 110bn m³/yr (1,170 TWh) of renewable methane and 160bn m³/yr of green hydrogen – over six times last year’s amount – could be available in Europe by 2050, all domestically produced. What is more, compared with a “minimal gas” scenario, the optimised scenario is far and away the best option economically: it is no less than €217bn ($245bn)/yr cheaper. The first Gas for Climate study had arrived at €138bn/yr of cost savings. (See Report Highlights below for more details.)

Too optimistic

How did Navigant arrive at these much higher numbers, I asked Kees van der Leun, a director at Navigant who reviewed the study?

Van der Leun notes that the estimate for biogas and biomethane is not much different from last year’s. Navigant’s projections of available biogas did receive some criticism last year, in particular from the International Council on Clean Transport, who published a briefing in October 2018, which arrived at a much lower potential for renewable methane. According to the ICCT, the assumptions in the first Gas for Climate report about the potential of “sequential cropping” (harvesting more than one crop within one year, which makes it possible for farmers to produce feedstock for biomethane that does not replace food) were too optimistic.

But Van der Leun says Navigant’s view on the potential for sequential cropping is based on “an optimised concept developed in Italy in the Biogasdoneright project, an innovative way of farming, which increases agricultural productivity of existing farmland sustainably”. The potential of this kind of farming in northern Europe is more limited, Van der Leun admits, but he says the Navigant researchers found it can still make a significant contribution.

The biggest change in the new report, however, is the projection for green hydrogen, which has been increased from 24bn m³/yr to 160bn m³/yr. Van der Leun explains this change as follows: “In our first report we had limited ourselves to looking at the potential of ‘excess’ solar and wind power,” he says. “Then you get a much more modest number, although this kind of electricity is essentially free of charge. In the new report we looked at the possibilities of dedicated solar and offshore wind power, built to produce green hydrogen. Once all the demand for renewable electricity is satisfied, you can start building additional solar and wind power for the hydrogen market. Then you get to much higher numbers.”

In addition, says Van der Leun, last year’s report focused mainly on heating and electricity production. The new report includes industry and transport.

Solid biomass

A question one could reasonably ask about the approach Navigant takes in the Gas for Climate studies is whether it is fair to compare an optimised gas scenario to a minimal gas scenario which assumes a large amount of solid biomass in the system. “The minimal gas scenario requires 809 TWh/yr of (probably partly imported) solid biomass power,” notes the report, “nine times more than the 89 TWh in optimised gas.”

“It’s easy to beat biomass,” Van der Leun concedes. But, he adds, “we see no other reasonable alternative scenarios.”

What about a scenario with nuclear power? Gas for Climate assumes that nuclear power will be phased out altogether. “In EU scenarios nuclear will still contribute roughly 15% of power by 2050, compared with 30% today, but what we need in the system in 2050 is dispatchable power,” says Van der Leun. “Nuclear is not ideal for that. And it’s expensive too. I am sure that our optimised gas scenario would also look good if we compared it to a system with nuclear power.”

As to a 100% renewables system without biomass, Van der Leun does not regard that as feasible in 2050. “You will need dispatchable power in the system, for when there is not enough wind and solar production. Hydro is naturally limited too. We have projected what we regard as maximum contributions of solar and wind in our model.” He notes that wind contributes around 14% of European electricity demand today, sun around 5%. “You need to go to at least 150% of current demand if you include electricity production for hydrogen.”

Tough discussions

The new Gas for Climate estimates may be feasible in theory, but just how likely is it that they will be achieved in practice? For example, the report sees an important bridge role for blue hydrogen. But so far very little investment has been made in CCS in Europe. “With current CO2 prices, there is no business case for blue hydrogen,” Van der Leun agrees. “Governments will have to support this.”

Another question is whether 270bn m³/yr of alternative gases, if they arrive, will save European gas infrastructure companies. After all the companies will see their business go down by half compared with today.

“We believe they will still have an important role to play,” says Van der Leun. “Don’t forget, the infrastructure is already there. Maintaining the gas networks is not that expensive. But we may need to change the way we reward network operators from a volume-based system to some kind of capacity-based pricing system.”

Nevertheless, he adds, the news for the gas companies is not entirely reassuring. “You may think that our findings are convenient to them, but that’s hardly the case. We have had tough discussions with the companies. They are sticking their necks out by committing to net zero emissions. It’s not a good news show for them.”

Report highlights Gas for Climate II: going for gas is cheaper

The new Gas for Climate study by consultancy Navigant compares an optimised gas scenario with a minimal gas scenario.

The minimal gas scenario “decarbonises the EU energy system assuming a large role for direct electricity use in the buildings, industry and transport sectors, with some biomethane being used to produce high temperature industrial heat. Renewable electricity is produced from wind, solar and hydropower, combined with solid biomass power.”

The optimised gas scenario also “has a strongly increased role of direct electricity in the buildings, industry and transport sectors.” Yet “it concludes that renewable and low-carbon [“blue hydrogen”] gas will be used to provide flexible electricity production, to provide heat to buildings in times of peak demand, to produce high temperature industrial heat and feedstock, and to fuel heavy road transport and international shipping.”

In both the optimised gas and minimal gas scenarios “most buildings will by 2050 be heated by all-electric heat pumps, and both scenarios assume increased levels of district heating…. For heating of buildings, in the optimised gas scenario all buildings with gas connections today will continue to use gas by 2050, mainly biomethane and some hydrogen used during periods of peak demand in hybrid heat pumps, in combination with electricity. Gas consumption per building will be much lower by 2050 compared to today. The minimal gas scenario assumes that only all-electric heat pumps and district heating will be available.”

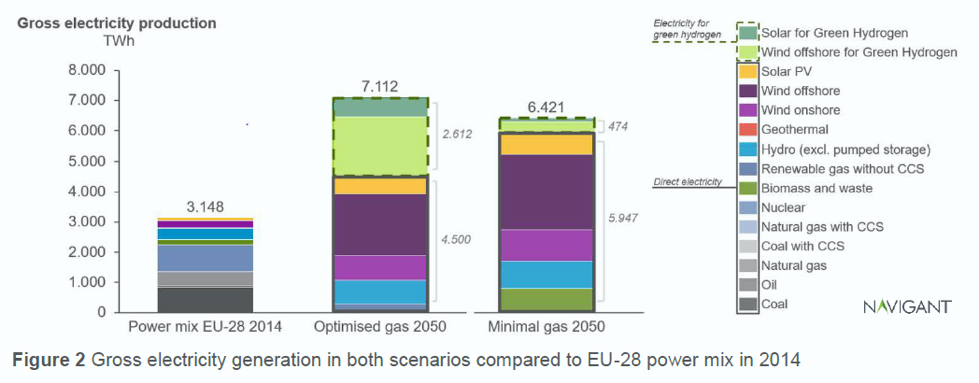

In 2050, the electricity mix could look as follows in the two scenarios:

Source: Navigant, 2019

Note that in the optimised gas scenario, it is possible to achieve net-zero emissions by 2050 with no remaining role for low-carbon gas. But the authors add that “because the costs of green and blue hydrogen can be similar by 2050, there could still be a role for blue hydrogen. The speed by which green hydrogen can replace blue hydrogen depends on how fast all direct electricity demand can be produced from renewables and how fast additional renewable electricity generation capacity is constructed beyond that.”

North Sea and southern Europe

The reason that Navigant came up with much higher projections for green hydrogen than in the first report is that they have enlarged the scope of their analysis by including dedicated renewable electricity production. “We found that there is large theoretical potential of offshore wind and solar PV, going beyond the estimated 2050 EU renewable power projection. This means that the technical potential for green hydrogen production is virtually limitless. However, there are considerations such as the land use change risks associated with an increase in non-rooftop solar PV and competing sea uses to offshore wind that will limit the green hydrogen potential.”

In the study Navigant focused on “the regions with the best combination of full-load hours (FLH) and levelized cost of energy (LCOE) for renewable energy sources: North Sea (offshore wind power) and southern Europe (standalone solar PV, or solar PV combined with onshore wind) (see Figure 15)….. With the expected technology maturity leading to reduced electrolyser system costs of €420/kW by 2050, green hydrogen from dedicated production in southern Europe (PV or hybrid) are estimated at €44–59/MWh and from North Sea wind power at €48–61/MWh. Given the uncertainties of 2050 costs, Navigant concludes that the cost of producing green hydrogen in either of these set ups will be similar.”

These production costs are much lower than the current costs of green hydrogen, which are between €90/MWh and 210/MWh. The cost reductions “come mainly from economies of scale, from cheaper electricity, and from improvements in system energy efficiency.”

With regard to blue hydrogen, Navigant finds that this “can be scaled up to very large quantities within a relatively short timeframe to 1,500 TWh, or 142bn m³/yr natural gas equivalent. However, limited political acceptance today is a barrier to scaling up CCS. To increase political acceptance, policy-makers can ensure that blue hydrogen plays a role as a bridge fuel to achieve net-zero emissions faster compared to a fully renewable system.” They further note that “in 2050, the estimated cost of blue hydrogen is comparable to green hydrogen.”

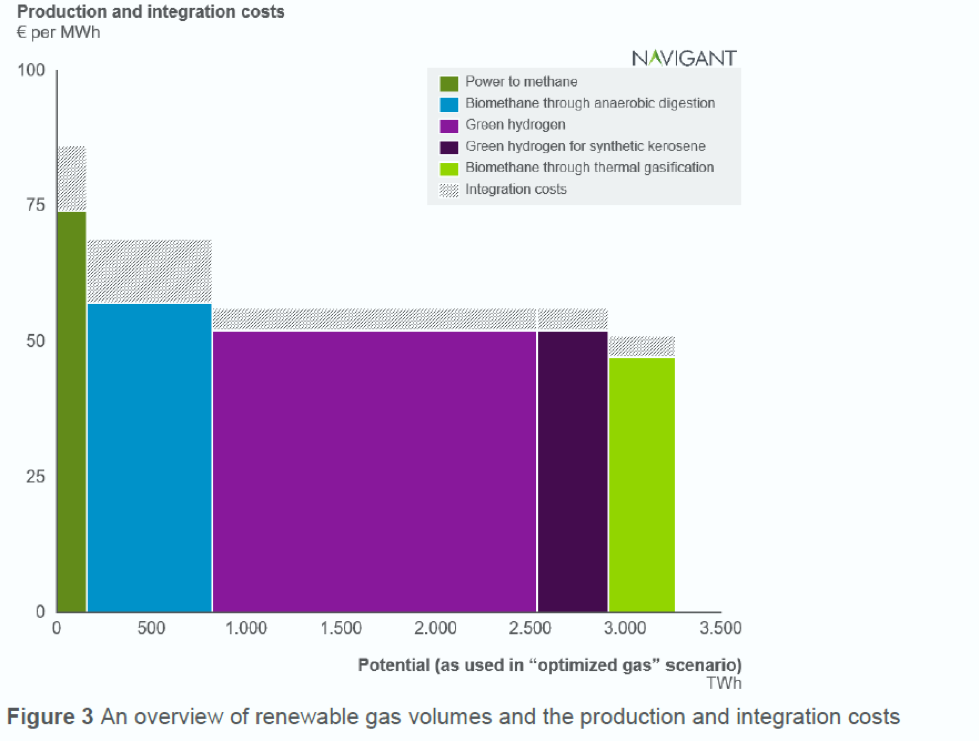

Biomethane and power to methane can supply up to 1,170 TWh/yr (110bn m³/yr) at strongly reduced costs, consisting of 1,010 TWh of biomethane and 160 TWh of power to methane, note the researchers. “Based on our assessment of potential biomethane cost reductions we conclude that production costs can decrease from the current €70–90/MWh to €47– 57/MWh in 2050. These costs reflect large-scale biomass to biomethane gasification close to existing gas grids, as well as more local biomethane production in digesters.”

The chart below shows the cost estimates for the various alternative gases:

Source: Navigant, 2019

Valuable role

Navigant expects gas transmission and distribution networks “to still have a valuable role by 2050, transporting biomethane and hydrogen. In both scenarios described in this study, volumes of gas used in networks are lower in 2050 than in 2019. Still, the use of gas in existing infrastructure will generate significant net energy system cost benefits.”

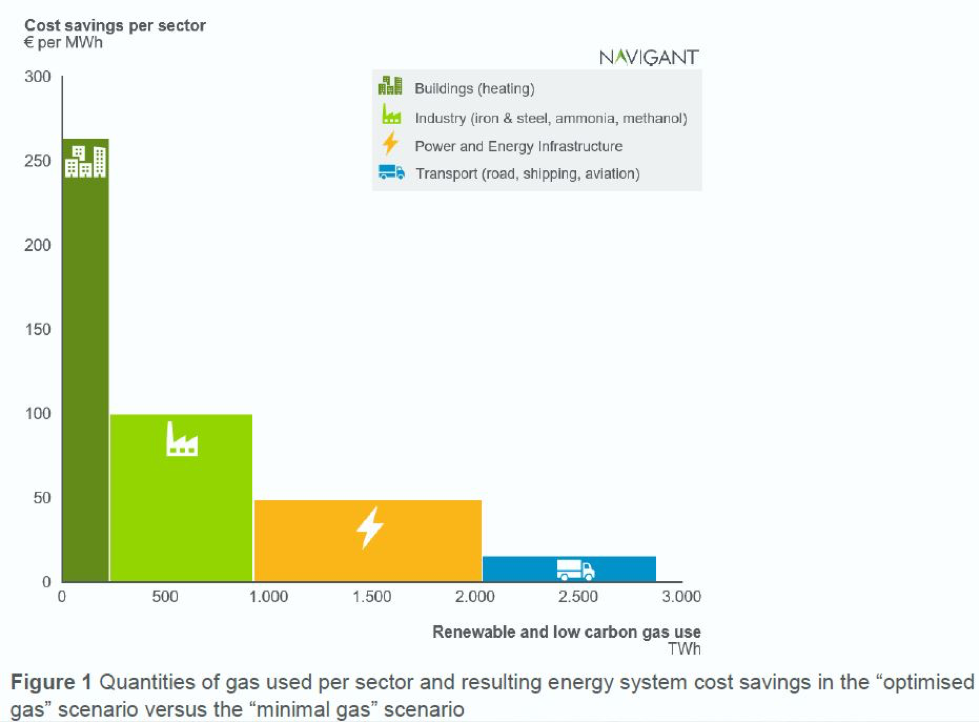

Compared with the minimal gas scenario, “the use of this gas through existing gas infrastructure saves society €217bn/yr across the energy system. Cost savings per unit of energy are highest in the heating of buildings, where renewable gas is used combined with electricity by means of hybrid heat pumps, in buildings that are connected to gas grids today. Also, the use of renewable gas in electricity production generates significant energy system savings because it avoids costly investments in solid biomass power or even costlier battery seasonal storage.”

The chart below shows how cost savings are realised in the optimised gas scenario:

Source: Navigant, 2019

Gas Transitions

How will the gas industry evolve in the low-carbon world of the future? Will natural gas be a bridge or a destination? Could it become the foundation of a global hydrogen economy, in combination with CCS? How big will “green” hydrogen and biogas become? What will be the role of LNG and bio-LNG in transport?

From his home country The Netherlands, a long-time gas exporting country that has recently embarked on an unprecedented transition away from gas, independent energy journalist, analyst and moderator Karel Beckman reports on the climate and technological challenges facing the gas industry.

As former editor-in-chief and founder of two international energy websites (Energy Post and European Energy Review) and former journalist at the premier Dutch financial newspaper Financieele Dagblad, Karel has earned a great reputation as being amongst the first to focus on energy transition trends and the connections between markets, policies and technologies. For Natural Gas World he will be reporting on the Dutch and wider International gas transition on a weekly basis.

Send your comments to karel.beckman@naturalgasworld.com