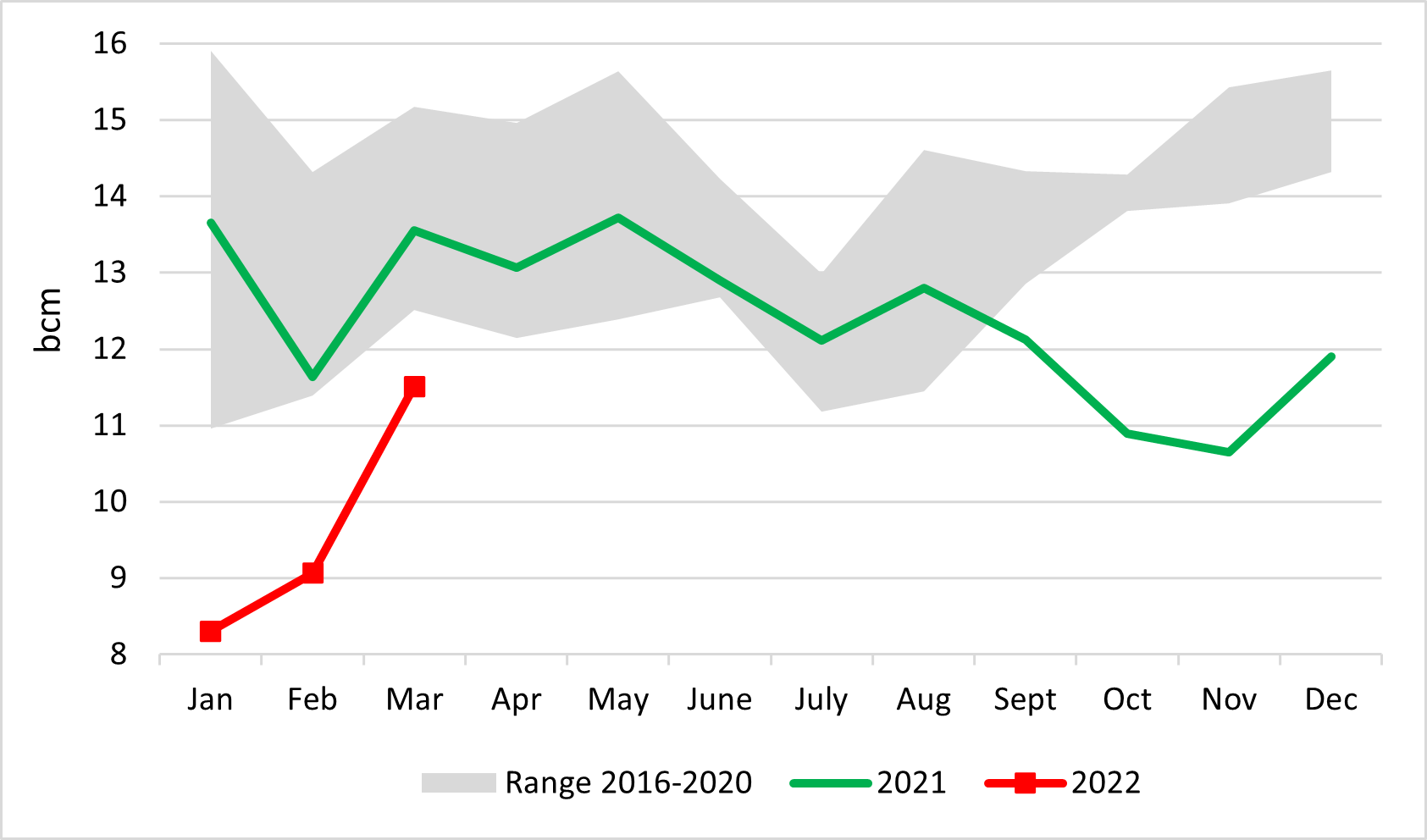

European utilities max out on Russian gas despite war

Gazprom’s flows increased in March as European utilities, which requested only the minimal amount of gas from the Russian supplier in January as spot prices were lower than contractual prices, started to nominate more in-the-money Russian pipe volumes as soon as the war in Ukraine started. Between January and March, flows have increased by a staggering 39%, with Ukraine transiting the contracted long-term volumes.

Gazprom's monthly exports to Europe

Source: Gazprom, Entsog, thierrybros.com

As we noted in recent monthly analyses, “we should be asking European utilities why they were only requesting what could be considered the minimum contractual amount of gas in January?” This jeopardised European security of supply and could backfire as European public opinion is highly supportive of Ukraine.

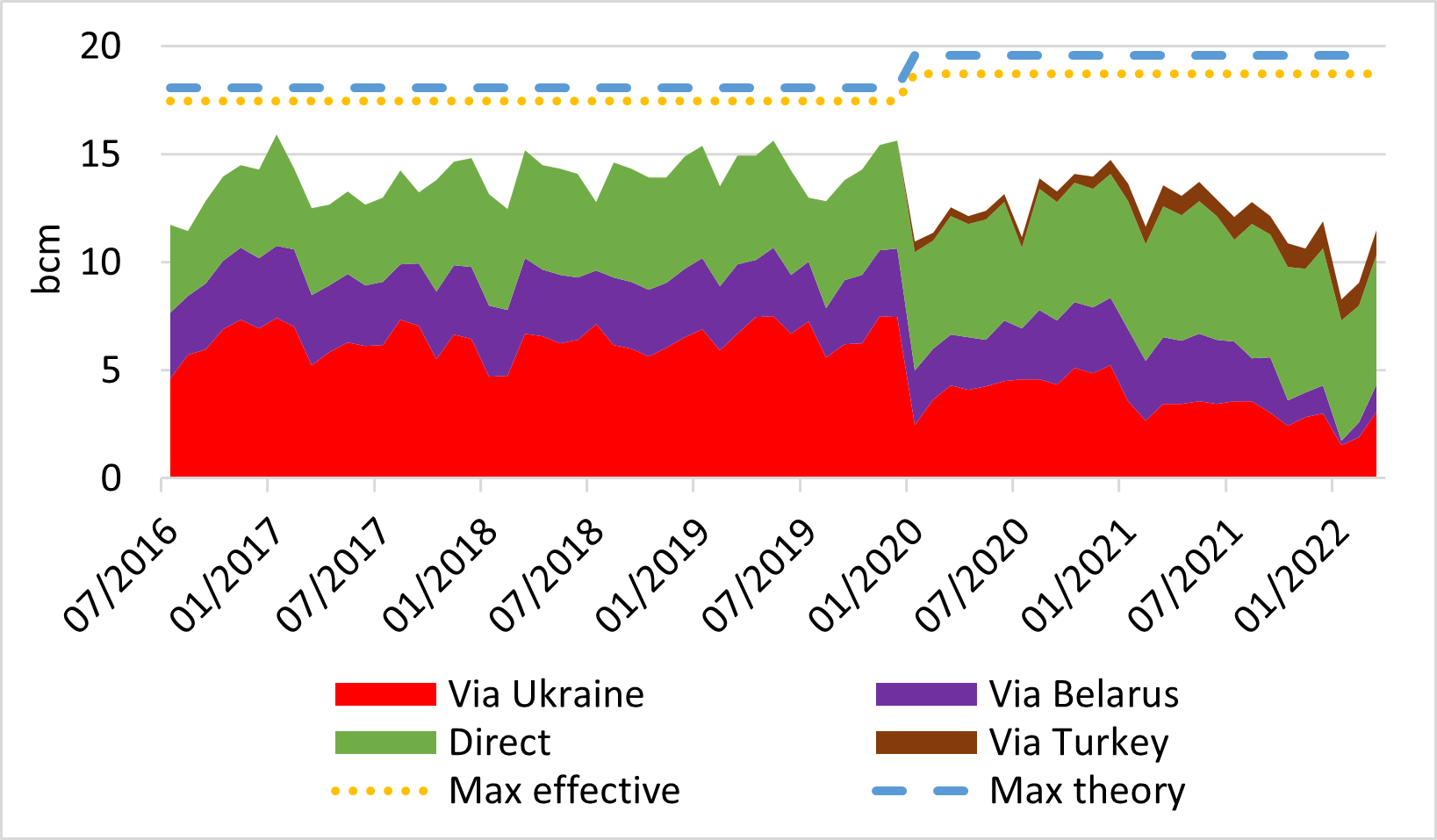

Split of Gazprom's monthly exports to Europe via route

Source: Gazprom, Entsog, thierrybros.com

Outside the contractual structure, Russian president Vladimir Putin has requested that gas supply under long-term contracts should be paid in rubles instead of the usual euros and US dollars. European utilities refused to do so, pushing Putin to threaten to cut off supply. This so far has not happened, as it could be a very risky strategy for Gazprom: it would lose its European revenues (€0.5bn/day), and it would push its European buyers to move away forever from Russian gas and to sue the company for billions of dollars in damages.

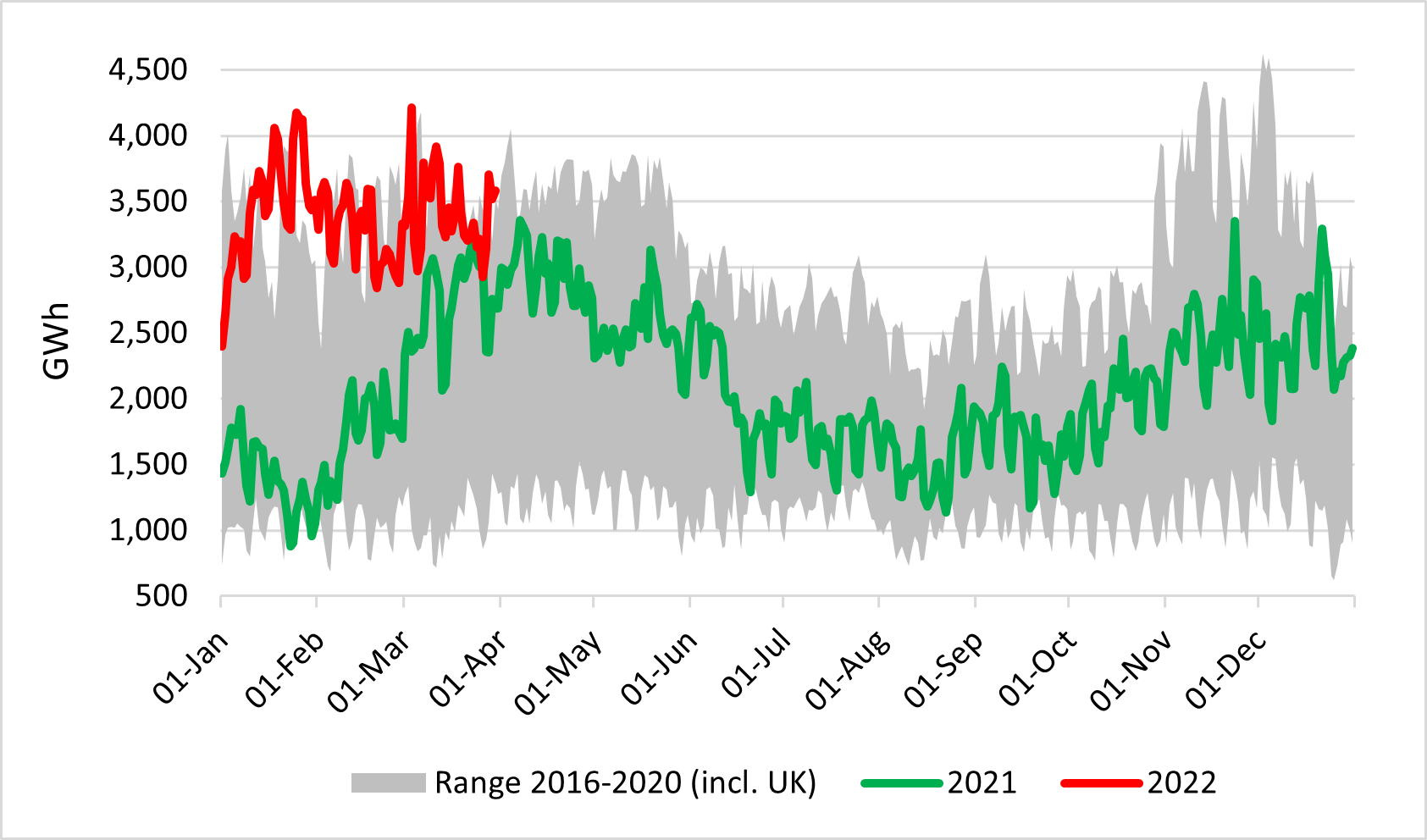

LNG send-outs are not at a record high, showing that the system still has some upside flexibility to attract if needed additional cargoes.

EU LNG send-outs, excluding Malta

Source: GIE, thierrybros.com

With a minimum level of 25.5% achieved on March 19 and injections ongoing since then, the storage trend seems to show that the market has already factored in the EU plan to get storage utilisation up to 90% by October 1. Even if the winter-summer spread does not incentivise the refilling of storage, the risk of not meeting this target when states have permanent sovereignty[1] over natural resources and by extension gas storage is too high to guess estimate the state reaction that could lead up to full nationalisation of such facilities if the target is not achieved. We can nevertheless expect European utilities faced with this new obligation to ask for subsidies.

EU gas storage utilisation

.png)

Source: GIE, thierrybros.com

The three-step embargo on Russian energy imports that I suggested back in March is now being discussed by Poland, which had put in place the diversification strategy ahead of the war. We shall see how much traction it will gain in the EU.

Dr Thierry Bros

Prof Sciences Po & Energy Expert

April 5, 2022