European Shale Development… While Europe Slept

Shale development is a European economic imperative. Yet, only a handful of countries are seriously contemplating shale development at this time. The failure to act now in preparation for a post-2020 economy displays strategic short-sightedness and does not bode well for mid-and long-term EU economic well-being and competitiveness.

In contrast, North America has embraced shale development. As a result, the price of natural gas in the US has declined to less than one-third the price of natural gas in Europe. This has been a boon to the US economy and helped US manufacturers achieve significant competitive advantages over Europe in some industry sectors - with the prospects of even greater advantages ahead.

Boon to US Economy

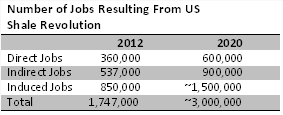

More than 1.7 million additional jobs have resulted from the US shale revolution, with 20 percent being direct employment and the balance being indirect and induced jobs. (Indirect jobs are in supply chain industries, and induced jobs result from workers spending their income.) IHS forecasts that the number of shale-related jobs will reach nearly 3 million by 2020. [Table 1] A World Economic Forum report highlighting the employment multiplier of the unconventional oil and gas industry in the US noted that on average, the industry's employment multiplier exceeded three (unconventional gas 3.2/ unconventional oil 4.1), meaning that for each direct job created, more than three additional indirect and induced jobs are also created. IHS estimates that in terms of value-added contributions to US GDP, upstream unconventional energy activity exceeded $237 billion in 2012, and as industrial activity and capital expenditures expand, the industry's contribution will exceed $416 billion annually by 2020.

Table 1: [Source: IHS]

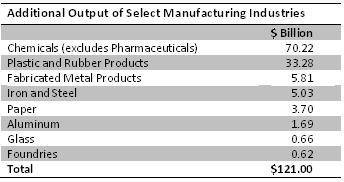

The potential effect on US manufacturing is spread across sectors. The American Chemistry Council (ACC) analyzed the effect of the US shale revolution on eight key US manufacturing industries that are large consumers of natural gas as an energy source and for feedstocks (raw materials for manufacturing organic chemicals), and estimated that $121 billion in additional industry output during the 2015-2020 period will result from new plant and equipment investments. [Table 2] And the economic multiplier effect from the $121 billion in output from these sectors will, according to the ACC, generate additional hundreds of billions in output and nearly a million additional jobs.

Table 2: [Source: American Chemistry Council]

US Competitive Advantage

The shale revolution is creating a huge competitive advantage for US manufacturers, particularly in the petrochemical sector. Low-cost natural gas as an energy source has lead to lower-cost ethylene, a chemical used in thousands of products. PricewaterhouseCoopers reports that the US chemical industry's investment in ethylene production has increased capacity by 33 percent, and that volumes from natural gas separation plants will increase more than 40 percent over the next five years.

Effect on European Economy

So what does this mean for European industry? It means that it will lose manufacturing jobs because of diminishing economic competitiveness in key industries. BASF and Bayer have already said that they anticipate losing competitiveness against their US rivals because of rising energy costs in Europe and declining manufacturing costs in the US. The increasing gap threatens European competitiveness and is expected to remain until at least 2020, according to BDI, the leading German industry association.

The European Chemical Industry Council (Cefec) warns that energy intensive industries will be at a disadvantage if Europe does not improve its energy and feedstock costs. In October 2012, Cefic called for shale gas exploration, among other initiatives, noting that this could be "one of the many 'boosts' for competitiveness the chemical industry (and in particular the petrochemical and fertiliser industries) needs to continue supporting European value chains."

In November 2012, trade associations ORGALIME and CEEMET issued a manifesto highlighting the gap in energy costs and the dangers to various industry sectors, and cautioning against worsening the situation through EU carbon reduction strategies. The manifesto further stated that until EU policies change, "the competitiveness of key European manufacturers and their supply chain will be under threat and there is a very real risk that investment will shift to parts of the world with less stringent regulations."

American firms continue repositioning to gain greater market share. Over 50 major new projects have been announced by US petrochemical manufacturers. Dow plans to shut down some operations in Belgium, the Netherlands, Spain and the UK. Dow is constructing a new ethylene plant in Texas as a component of its $4 billion investment to expand ethylene and propylene production, and in December it restarted an ethylene plant in Louisiana that had been idle for four years. This is only part of what the Financial Timesreports is more than $90 billion worth of manufacturing investment in the US resulting from inexpensive natural gas.

While Europe Slept

Europe is still years away from realizing real benefits from domestic shale production. And shale development is not a panacea for Europe's energy, employment and manufacturing challenges; rather, it is just one component of much broader energy and manufacturing strategies. While shale's contributions will not be of the magnitude seen across the Atlantic, shale can still provide important economic benefits. It took a decade for the American shale revolution to reach its current state of development and it will likely take longer in Europe. Some politicians discount domestic shale development since it will not help resolve the current economic crisis. Corinne Lepage, a Member of the European Parliament, recently wrote in Le Monde that there was little justification to develop shale in France since shale exploitation could not occur until 2020 at best, and that domestically-produced shale gas would only decrease French energy imports by 10 percent. Fortunately for US industry, far-sighted individuals began early-stage US shale development over a decade ago - before the current economic crisis occurred rather than waiting until the crisis occurred. Nobody anticipated the magnitude of America's current shale boom. The same unknowns exist in Europe today.

In 1938, Winston Churchill assembled a collection of speeches calling for preparations to counter a remilitarized Germany. His book, While England Slept, painted a picture where strategic imperatives were minimized in favor of idealistic impulses and political expediency. Today it offers a pithy title idea for this essay, but more importantly it is also a cautionary against ignoring strategic dangers. Europe faces strategic economic dangers from its failure to develop a domestic shale industry.

Courtesy: ESCP Europe Business School Research Centre for Energy Management

Jim Seaton is an associate at ESCP Europe’s Research Centre for Energy Management and member of the Global Association of Risk Professionals and the Council on Foreign Relations.