European Hub Prices at 10-yr Low: Rystad

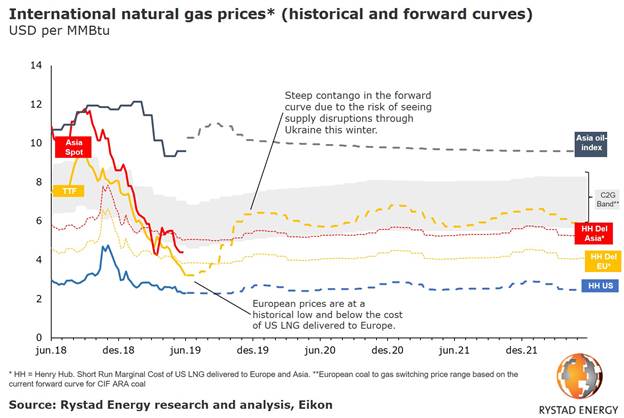

European natural gas prices are at a historical low, thanks to competition between Russia and the US, and below the cost of shipping gas from the US to Europe, according to analysts at Rystad Energy. In May, prices remained just above this floor, fetching around $4.20/mn Btu. But this floor seems to be crumbling, if not collapsing, now that the front month gas price for delivery at the Title Transfer Facility (TTF) has hit a fresh low of $3.20/mn Btu – the lowest price since the TTF began trading on the Dutch market in March 2010, according to Rystad Energy in a paper published July 2.

“It’s a buyer’s market, and Europe is buying,” said gas market research head, Carlos Torres-Diaz. “The clear winners from the war between these two gas powers [Russia and the US] are the European end consumers, who benefit from record-low natural gas prices, and power prices which have dropped more than 30% in the last six months.”

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

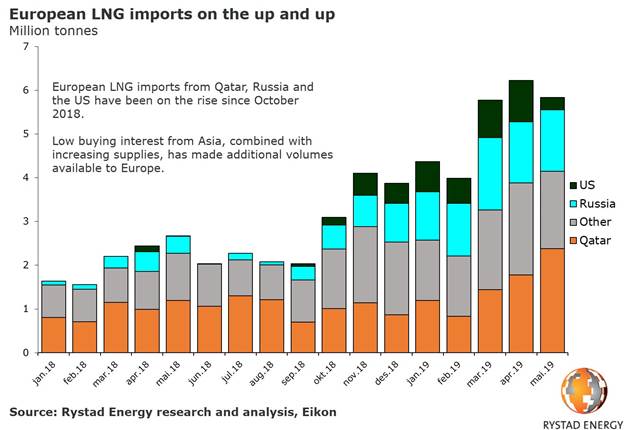

Russia has traditionally been Europe’s main gas supplier. In 2018 Russia delivered 201bn (Russian) m³ of gas to European countries, or 38% of Europe’s total natural gas demand. However the US, armed with its new liquefaction capacity and surging gas production, is trying to muscle into this market, too.

“As two of the world’s largest gas producers, Russia and the US are natural competitors in what seems to be a race to the bottom, not only in the lucrative Asian market but now also in Europe. Both countries have sent increasing amounts of gas to Europe despite the low price environment,” Torres-Diaz observed.

Russia can send supplies to the European market both through pipelines and via LNG vessels. That gives the gas giant in the east a clear geographical advantage over its western counterpart.

Pipeline exports from Russia were up 8% from last year during the first five months of 2019. LNG exports from Yamal, a peninsula in northwestern Siberia, increased 380% in this period.

“From an economic point of view, greater supply volumes from Russia make sense given the lower cost. And it comes at a time when Russian giant Gazprom wants to maintain its reputation as a reliable supplier to the European market, while the current the political climate pushes Europe to diversify its energy supply,” Torres-Diaz notes.

That is not the case for US gas exporters, which still need a higher European market price to cover their operational costs when selling LNG to Europe.

“Some US exporters are not covering their operational costs. Nevertheless, US exports to Europe during the first five months of 2019 increased by 6.9bn m³ versus the same period last year,” Torres-Diaz remarked.

[Russian cubic metres are measured at a higher temperature than the standard cubic metre and so they contain a little less energy - Editor.]