Europe ready for winter 2023/24 [Gas in Transition]

With Europeans in October basking through an unexpectedly extended summer, they might be worried by a changing climate, but in the short term, this is what Europe needs – a delayed start to the winter heating season with the prospect of a warmer-than-average winter to come.

El Niño appears to be playing a major part in the warmer weather. According to the US Climate Prediction Center (CPC), in August, sea surface temperatures were above average across the equatorial Pacific Ocean. Tropical atmospheric anomalies are also consistent with El Niño, and the CPC in mid-September predicted that the phenomenon would continue through the northern hemisphere winter with a greater than 95% chance through January-March 2024.

This suggests warmer than average temperatures in the US, keeping US gas consumption low. This is good news for Europe, which continues to rely heavily on imports of US LNG to make up for its lost imports of Russian pipeline gas. In the second quarter of 2023, the US supplied 46.4% of EU LNG imports, according to Eurostat.

In Europe, the effect of El Niño is milder, wetter weather at the beginning of winter and colder, dry weather towards the end. There are, of course, no guarantees – the best that can be said is that the development of a strong El Niño increases the probability of certain weather outcomes.

European gas stocks in good shape

Europe should welcome the warm weather because of the impact it has on winter heating demand and the reduced call on limited gas stocks.

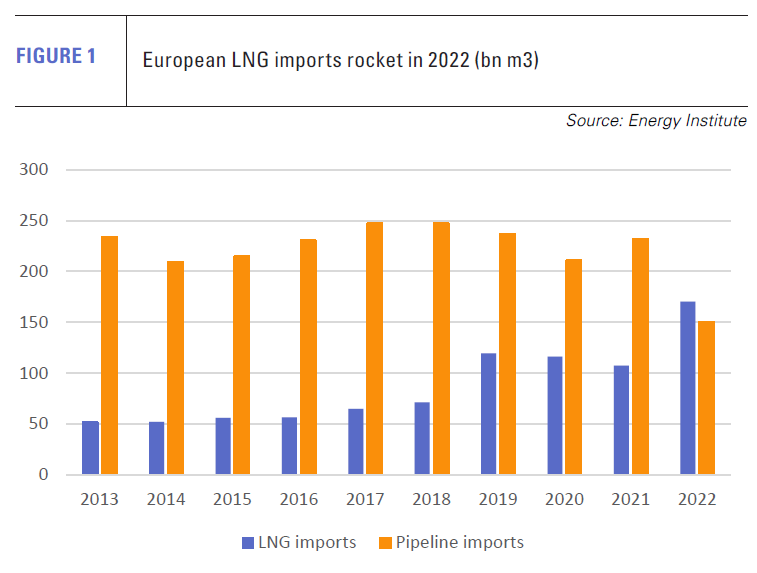

These are in good shape, but their capacity is finite. Helped by a high level of carried over stocks from last winter, owing in large part to much increased LNG imports (see figure 1), EU gas inventories hit 90% of capacity ten weeks early on August 16. Continued conservation efforts and curtailed demand have meant gas prices have been more moderate, compared with 2022 (still high based on long-term averages), allowing restocking to take place fairly easily.

Moreover, with European inventory levels close to tank top, the pace of the region’s LNG imports has moderated, allowing more space for other countries, notably in Asia, to rebuild their own stocks ahead of winter. Flat forward prices for LNG in Europe have meant LNG cargoes floating off Europe’s shores, in the hope of high winter prices, have moved elsewhere. This, in turn, has freed up LNG carriers, taking the heat out of the charter market.

Effective response has built confidence ahead of winter 2023/24

This is an extraordinary outcome, considering that Russian gas pipeline imports to the EU have been substantially lower in 2023 than even last year. Imports via Nord Stream I have been nil, of course, as it is out of operation, but last year it was running at full capacity until week 23. Imports via Poland along the Yamal pipeline, are also nil, compared with some small volumes to week 18 last year.

Ukraine transits have bumped along at low levels, again much less than in the first half of last year. TurkStream has been outperforming 2022, but only from around week 24.

Europe’s other pipeline gas suppliers have been able to step up their game, but the strains may be beginning to show. Norwegian gas imports jumped last year and this was sustained until week 33 of 2023, when volumes slumped. The extension of planned maintenance works and some unplanned outages both for gas processing plants and on producing fields now suggest the recovery in import volumes will be weaker than expected.

Europe’s other pipeline gas suppliers have been able to step up their game, but the strains may be beginning to show. Norwegian gas imports jumped last year and this was sustained until week 33 of 2023, when volumes slumped. The extension of planned maintenance works and some unplanned outages both for gas processing plants and on producing fields now suggest the recovery in import volumes will be weaker than expected.

Algeria gas exports to Europe have not performed so well, even if they hold longer-term potential. Exports were lower in 2022 than in 2021 and this year have also struggled to exceed 2021 levels, although they have done so more consistently from around week 30. A shift in direction – more gas to Italy and less to Spain on average – has also been helpful as Spain has excess LNG import capacity while Italy does not.

Meanwhile, imports from Azerbaijan jumped higher in 2022 and have been maintained pretty much at the same level this year, bringing much needed extra gas into southeastern Europe and Italy.

European LNG imports, meanwhile, have stayed at elevated levels, having last year leaped a massive 70%. In doing so, they have proved essential to averting disaster.

Market glut?

Some commentators are now talking of a market glut based on the strong position of Europe heading into winter and the prospect of weak winter heating demand. Up until now, market bears have usually kept this forecast for 2026-2030, when major new sources of LNG supply will come online in Qatar and North America.

However, talk of glut looks premature. Spot LNG prices are still comfortably above $10/mn Btu, which reflects the latent LNG demand which comes into the market as prices soften.

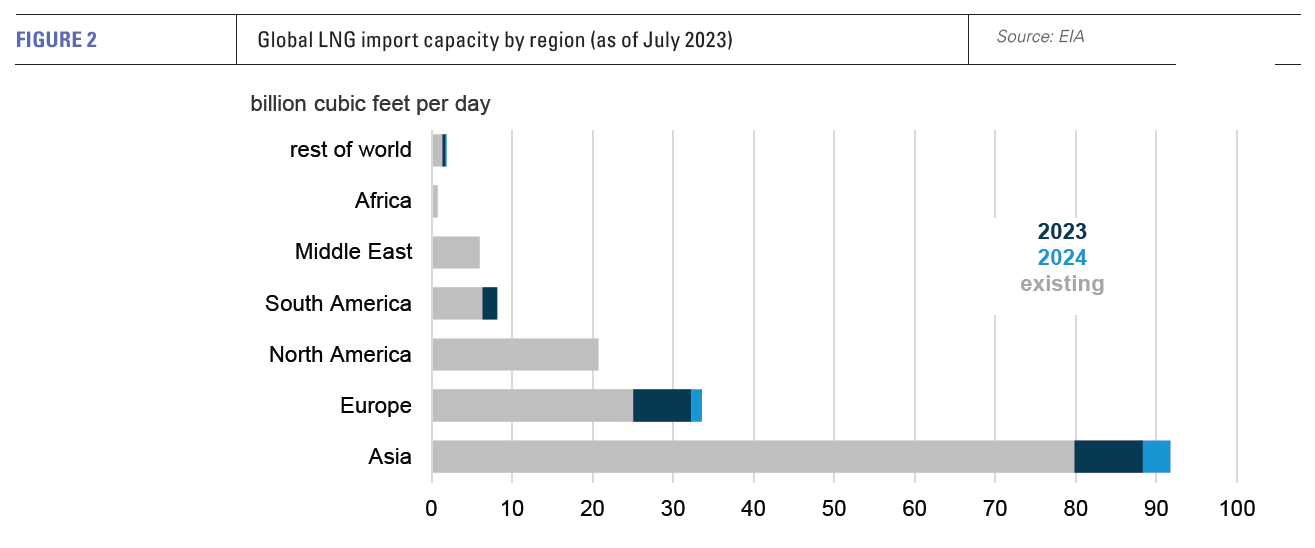

Moreover, the LNG market’s expansion on the demand side is not confined to the rapid expansion of European regasification capacity (see figure 2) in response to the Ukraine crisis.

Moreover, the LNG market’s expansion on the demand side is not confined to the rapid expansion of European regasification capacity (see figure 2) in response to the Ukraine crisis.

Part of the bearish narrative has been that LNG scarcity and price volatility during the European energy crisis has caused potential LNG market entrants to back off and instead place their faith in alternatives such as renewables.

However, as the US Energy Information Administration (EIA) noted in August, three new importers entered the LNG market this year, two of which, the Philippines and Vietnam, are in Asia. By the end of 2024, Antigua, Australia, Cyprus and Nicaragua should all join the club, while several other countries are also in the advanced stages of preparing for LNG imports.

Over the last ten years, regasification capacity globally has grown by 49% to reach 140.0bn ft3/d (1.2 trillion m3/yr, 863mn t/yr) across 48 countries. By the end of 2024, the EIA estimates there will be 55 countries importing LNG with a combined regasification capacity of 163bn ft3/d.

This growth is being led by Asia not Europe. Asia will account for 52% of the new import capacity, compared with Europe’s 38%.

LNG provides essential security of supply

The Ukraine crisis and spike in LNG prices may have delayed import expansion plans, but they have not been derailed. Europe’s response on the one hand has been effective, aided by some large slices of luck with the weather, supporting the view that the crisis is temporary. In addition, the LNG’s industry’s response in terms of new capacity has been substantial, even if it takes a long time to bring new projects into production.

As a result, the utility of LNG as the primary source of gas flexibility to resolve the European energy crisis is now being given more weight than concerns over exposure to a volatile international market for importers. A response has been seen in terms of Asian buyers, in particular, shifting to long-term contracts rather than spot purchases as a means of reducing their exposure to price volatility. However, the broad-based nature of the expansion of regasification capacity suggests more a period of market normalisation and, who knows, perhaps relative tranquillity, than a glut.