Europe bets on green hydrogen to fix energy woes

As the cost of blue and grey hydrogen surge in line with rising fossil fuel prices, the feasibility of green hydrogen as an affordable and secure source of renewable energy in Europe is growing, Rystad Energy research predicts.

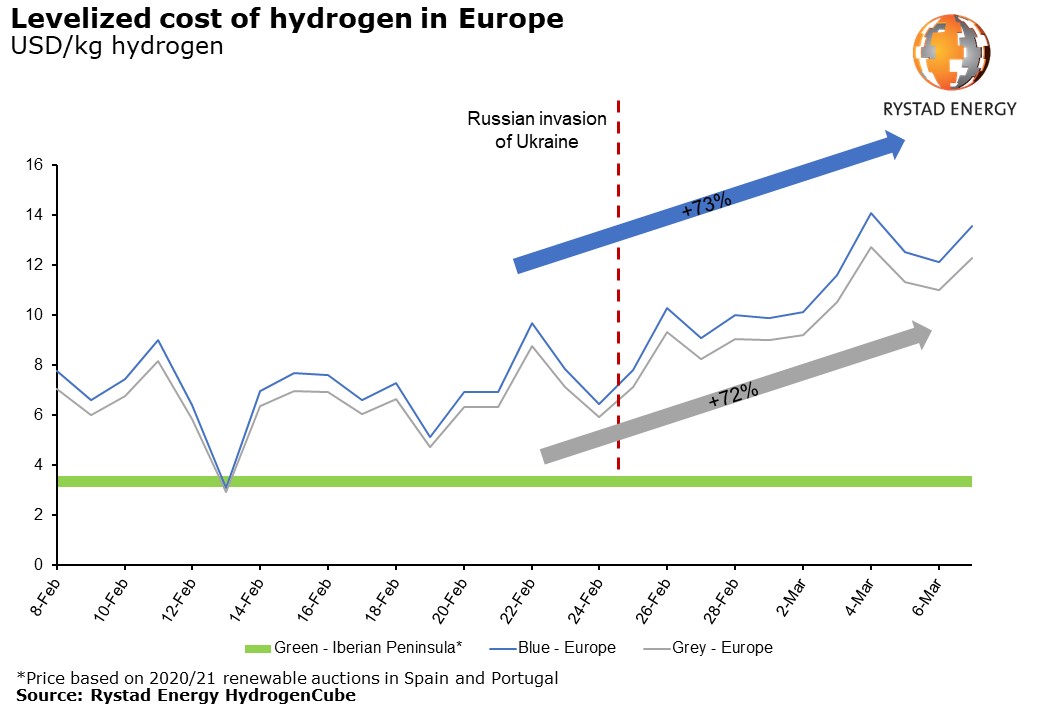

Green hydrogen production was already set to take off this year globally and pass the 1-GW-milestone in 2022. However, the war in Ukraine has turbocharged the sector. Green hydrogen’s potential win comes at the expense of its fossil fuel-linked blue and gray alternatives, whose costs have increased by over 70% since the start of the war in Ukraine, rising from about $8/kg to$12/kg in a matter of days. The EU has announced plans for a €300 million funding package for hydrogen as well as the Hydrogen Accelerator initiative from REPowerEU aiming at reducing the region’s dependence on Russian gas with a further wave of support packages for green hydrogen specifically likely to emerge. Individual member states have also accelerated their domestic plans. Since the Russian invasion of Ukraine, the economics of green hydrogen have become increasingly attractive with lower production costs of $4/kg (particularly in the Iberian Peninsula) compared to $14/kg for blue and $12/kg for gray in other part of Europe.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Green hydrogen promises energy security as well as potential new regional economies for renewable energy. While some countries are focused on domestic usage, others are focusing on exports, suggesting that we may be moving from a world where energy is sourced in a few key regions, to a world where production is more spread-out. The decade ahead is a make or break one for the green hydrogen sector – if production can be increased as planned to more than 10 million tons globally by 2030 and costs cut to $1.5/kg or less, then the industry will become a permanent fixture of the global energy mix.

“While industry and governments are heading in the right direction, their challenge is to lower the risks for green hydrogen investors and create incentives necessary to scale up quickly both the demand and supply. Fundamentally, a world where green hydrogen fulfills the role currently played by oil, gas and coal will look very different,” says Minh Khoi Le, head of hydrogen research with Rystad Energy.

Regional and country breakdowns

For Europe in particular green hydrogen is an attractive alternative, with Germany already planning to produce 25 gigawatts (GW) by 2040 and Spain on track to produce more than 4 GW by 2030.

However, besides industry applications where hydrogen is already a key feedstock, the amount of hydrogen required to replace gas and coal in Europe’s power sector is enormous – its own gas and coal usage is set to represent 1,020 TWh and 602 TWh in 2030 and 2040, respectively, in Europe’s power mix base case. If this was to be generated by hydrogen alone it would require about 54 million tons of hydrogen in 2030.

Europe is currently on track to produce 3 million tons green hydrogen per annum by 2030 so the gap is considerable. The new RePowerEU target put it at 15 million tons for Europe, so significant ramp up can be expected. While it is challenging and unlikely for hydrogen to be used as a complete replacement fuel for thermal power plants, mixing hydrogen with natural gas or co-fire ammonia and coal to generate power can be a step toward reducing the use of fossil fuel. This approach has been successfully tested in Europe, China and Japan and would require no major infrastructure changes providing the hydrogen content is less than 20%.

India has announced a new policy on green hydrogen which is set to boost production. Costs are already low at $5 to $6 per kg and are expected to drop by 40% under the country’s new guidelines – eventually reaching $1/kg by the end of the decade. The planned production is earmarked for domestic use.

In Africa, Mauritania is taking a regional lead with its 40 GW AMAN project aiming to export hydrogen and derivatives to Europe and other markets. In Latin America, Chile too has plans to become a major exporter with capacity of 24 GW by 2030, and in Central Asia, Kazakhstan is planning a 30 GW facility. Foreign direct investment and financial support will be key to getting these projects off the ground with abundant renewable potential, space for mega facilities and low labor costs weighing on the positive side.

Green hydrogen dominates

Green hydrogen is set to dominate over fossil-derived production with carbon capture and storage (blue hydrogen). In 2021, 188 electrolysis projects were announced versus 24 for fossil-based low-carbon methods.

Turquoise hydrogen, which is derived from natural gas or biomethane intro hydrogen and solid carbon, does not require expensive capital expenditure in carbon capture and storage solutions. Despite only having a handful of commercial scale projects in the pipeline, more than $1 billion in funding has been promised to the sector.

Ammonia as a carrier

Ammonia is quickly standing out as one of the key carriers for hydrogen. Existing infrastructure for the 150 million tons used by the fertilizer industry each year can facilitate global trade. With the emergence of ammonia engines, demand for it as a shipping fuel is expected to quickly rise, doubling the current 150-million-tons-level from 2040.

Demand from the power sector is less certain. State owned utility giant China Energy successfully trialed a 35% ammonia mixing for a 40 MW coal-fired boiler. Japan and South Korea have set a target of 20% ammonia mixing by 2025 and 2035, respectively. If this were increased to 35%, then overall demand for ammonia could double to above 300 million tonnes as early as 2030.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.