EU Climate Change Politics should not be Based on Deliberate Mistakes (GGP)

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.

When 139 parliamentarians rise as one against something that they describe as little known, but which leads to the “overthrow of the foundations” of the current major values (in this case – the very EU New Green Deal), this calls, as a minimum, for a more attentive look at the matter. Especially, since we can see the whole ocean in one single drop of the water…

This is exactly the case with the members of the EU inter-party coalition, consisting of mostly Greens and S&D MEPs and French national politicians, who issued a joint statement on September 8, reading: “The EU aims to become the indisputable climate leader and the world’s first climate-neutral region. … However, the little-known Energy Charter Treaty (ECT) is threatening the climate ambition of the EU domestically and internationally”.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Then follows the explanation: “Not only did the “raison d’être” of the ECT become obsolete since Russia's withdrawal from the Treaty in 2009. Today, the ECT is a serious threat to Europe’s climate neutrality target and more broadly to the implementation of the Paris Agreement. By protecting foreign investments in fossil fuels by means of the highly controversial Investor-State-Dispute-Settlement (ISDS) mechanism, the ECT protects foreign investments in greenhouse gas emissions and multiplies the cost of the ecological transition.”

Then the frightening magic of big figures, measured in trillions of Euros, follows. It intends to demonstrate to the reader the enormity of the threat: as if that continuation of ECT will lead to multi-trillion economic losses which exceed all EU investments within its post-Covid recovery package.

And, after such threat, the conclusion: “We ... require … that the provisions in the ECT that protect foreign investment in fossil fuels are deleted and thus removed from the ECT… If this is not achieved … we ask EU Member States … to jointly withdraw from the ECT... The ECT risks our climate future.” [1]

So, ECT, allegedly, threatens the EU’s New Green Course, which today is the Europe’s “everything.” And the main threat is rooted in the provisions on investment protection, in particular, the ECT arbitration provisions, which allow private investors to apply directly to international arbitration tribunals, bypassing national jurisdiction courts. So MEPs propose just to discriminate all fossil fuels industries, including most climate-friendly among them – the gas industry. But this is just the visible, above-water part of the iceberg.

Dangers beneath the surface

First of all, why now? Because on the day the letter was published, the second round of negotiations on ECT modernisation began. So it was sort of 'soft reminder' or 'gunboat policy' for the ECT member-states, a signal to them: the EU's 26 member states as ECT participants – minus non-EU UK and non-ECT Italy – plus the EU as a whole as a signatory as well compose half the current 53 contracting parties. The letter's signatories express their dissatisfaction with the ECT and are ready to abolish it, if other ECT member states do not wish to import the EU 'acquis communautaire'.

The EU, which has spoken with one voice in all the ECT forums since 2003, can block any unwelcome decision, but it cannot guarantee acceptance of all decisions that it wants since most require consensus of all contracting parties. The 'gunboat' policy is intended to draw them all into line and export the EU acquis communautaire.

I will not debate whether ECT is well-known or “little-known” – it has been an integral part of international law since 1998. For international energy professionals this – the only legally-binding, energy-specific international multilateral treaty – is a well-known instrument of investment and trade protection in energy. Maybe it is “little-known” for those in Europe and beyond it, who are too young to remember the 1990s and the 2000s, when it was one of the key international legal instruments. And it was the EU that introduced its forerunner in 1990 – the famous 'Lubbers plan' – and for a long time it supported the Treaty, at least until 2003 when the Second EU Energy Package was introduced (I’ll come to this later). Or they are just deprecating the subject, perhaps that explains why June 25, the 30th anniversary of the plan, went unremarked in Brussels – even though the EU is still a member of the ECT.

But let’s come to the substance of the MEPs letter which, whether by accident or design, is based on mostly incorrect facts, statements and perceptions. Responsible politicians should not act like this…

Terra Incognita

Let us start with the fact that ECT does not separate fuel and non-fuel industries. One of the key MEPs' statements – that ECT relates to fossil fuels only – is basically wrong, as a glance at ECT Article 1 'Definitions' makes plain. It refers, inter alia, to the EU-based Combined Nomenclature of “Energy Materials and Products (EMP).”

ECT “Annex EM” lists them all, including item 27.16 “Electrical energy” from all sources (which means renewable hydro, solar, wind, etc.) and items 26 and 28 “Nuclear energy”. Even some of decarbonized gases indirectly mentioned under items 27.05 “producer gas and similar gases” [2], though of course new technological developments which introduce new energy sources into economic life (like, say, hydrogen) requires regular clarification of EMP list and this also what ECT modernization is aimed for. This is why in 2019 Energy Charter Secretariat (ECS) has proposed to establish a special Legal Task Force on Hydrogen as part of the Programme of Work (PoW) for the 2020-2021 period in line with the aims of the ECT Modernization process, inluding to update EMP list and related issues.

In a recent interview the secretary-general of the International Energy Charter, Dr Urban Rusnak, said: “The Paris Agreement and UN Sustainable Development Goals require huge investment in sustainable energy sources. But the Paris Agreement does not protect energy investment, trade or energy transit. This is where the ECT can play a key role. The renewable energy revolution is quite new. It will require more connectivity, international energy trade and grid connections across different jurisdictions. This is all facilitated by the ECT. The treaty also protects trade in materials and equipment, for example for solar panels and wind turbines." [3]

To remove investment protection provisions (ECT Section III) would mean to remove them for all projects. This would drastically increase the cost of raising debt capital, which account, on the average, for 70% of capital investments in the fuel and energy projects. This would result in making energy — from both renewable (RES) and non-renewable sources — more expensive for consumers. And even more expensive, since the much higher investment risks in energy will redirect money to non-energy industries. This would push down the supply of primary energy from all sources, including RES.

Moreover, the ECT's investment protection mechanisms, targeted at foreign investors and their investments means historically, first and most, EU investments abroad. This was the predominant aim of the EU at the negotiating phase of the ECT in early 1990s, along with the “national treatment” of investments at their post-implementation phase in all ECT countries. Non-EU member Norway with its most-favoured nation investment regime is the only exception.

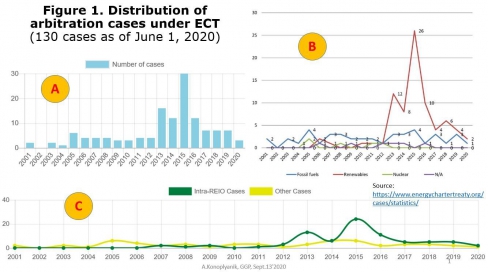

This, means that both foreign and domestic investors and their investments can be equally protected by the ECT (see Figure 1-C).

I doubt if all of these MEPs have even read the ECT they are fighting against, based on my own experience of Russia. After it signed the ECT at the end of 1994 and began ratification process, those parliamentarians who most actively opposed it had not read it and were sometimes fighting against clauses that the ECT did not contain. Their objections were based on what they had heard about it, not on first-hand knowledge of the text.

MEPs' letter repeats mistakes in OpenExp report

MEPs accuse the ECT of protecting fuel industries and fossil fuels investors, which means the international oil companies and so on, blaming them for greenhouse gas emissions. But any professional knows, of course, that putting all such companies “in the same basket” (say, gas together with coal) is just not professional. The letter de facto equated the ECT with the protection of fossil fuel industries/companies. But it cannot substantiate this claim with figures showing the scale of the emissions from these industries. And MEPs make no mention of the pollution from even RES-electricity, which arises from its equipment manufacturing upstream value chains, including the mining of rare-earth minerals, even though these primary industries are today mostly far beyond the EU (such as in China).

The figures and the statements in the MEPs' letter about the ECT's focus on fossil-fuels are taken from the presentation (to which the letter has a reference) based on alarmist OpenExp report [4], sponsored by the European Climate Foundation. The author of the report/presentation, according to Euractiv [5], was a former employee of the ECS. I will set aside the ethics of a former ECS employee who produces a 56-page report against his or her former employer.

The foreword to the OpenExp report wrongly says (and which was then endlessly repeated in the MEPs letter) that the “ECT's purpose is to protect foreign investment in fossil fuels (my italics – AK) through an Investor-State-Dispute (ISDS) mechanism.” And then “shifting ‘Overton window’ in desired direction” logic follows (by which I mean that a chain of slightly economically incorrect statements lead to the desired but unjustified political perception). “The accession of new countries, especially those with important fossil fuel reserves, means those countries at worst will be locked into a carbon intensive energy system that will prove an economic burden as well as having impacts on human health in decades to come….

Many commentators believe that the cost of this carbon intensive energy system is far more onerous than investing heavily in modern renewables, storage, green hydrogen and regional clean energy markets.”[4] So each sentence amplifies the errors of the initial fallacy. It also looks like a repetition of the well-known – and no less alarmist at that time – “Limits to Growth” Report (1972) commissioned by the Club of Rome.

The MEPs letter, further to the OpenExp report, de facto denies technological and institutional progress since it assumes that the old-style industrial-type development path will continue in all “new countries”. It just ignores possibilities (including some that already exist) for producing clean energy from fossil fuels. In particular, clean (ie no CO2 emissions) hydrogen produced from natural gas, uses a tenth of the energy (according to BASF) [6] than renewable hydrogen, produced by electrolysis – termed 'green' it is the costly mainstream of EU new green energy policy – and it does not need costly CCS technologies if the so-called “blue hydrogen” is considered (in EU terminology this means methane steam reforming (MSR) plus CCS). According to the EU Hydrogen strategy adopted July 8, CCS could double the cost of hydrogen produced by MSR [7].

RES claims present the bulk of ECT-based ISDS cases

OpenExp Report introduces very detailed analysis of 130 ECT-based ISDS which clearly shows that both the statements of the MEPs and the conclusions of the report are wrong. They claim the ECT protects fossil fuel industries, but the report’s figures shows that only 25% of ISDS claims (per energy product) directly refer to fossil fuels (oil, gas and coal), and 75% refer to electricity, of which 71%, in turn, refer to solar (reflecting investment-damaging changes in incentives to RES), 4% to hydro, 2% to biomass, 5% to nuclear and only 17% to fossil fuels [4].

So direct and indirect reference to fossil fuels equal to only 27.5% of 130 ISDS claims, according to the Report which draws quite opposite conclusions from its own data: it says the ECT prevents the EU from going green, and it locks-in non-EU in fossil fuels.

ECS statistics of ECT-based arbitration cases show that most claims are related precisely to RES development projects: out of 131 investment arbitration cases instituted under the ECT as of 1 July 2020, majority concerns renewable energy sources (78), followed by fossil fuels (42) and nuclear (5), while in the rest of cases, it has not been possible to identify particular energy sources [3]. RES development projects, mostly those in the EU, account for €21bn of a total €36.5bn worth of total declared ECT-based claims since the first such claim in 2001 till mid-2020 [8] (See Figure 1-B).

This means that, contrary to the MEPs' statement, ECT today first of all protects RES, not fossil fuel industries, from unilateral worsening of investment climate by host countries, primarily EU-members. Moreover, the OpenExp report explains in detail in Box 1 on p. 16 how Spain (the key respondent state with 48 ISDS cases as of January 2020) faces the highest number of ISDS claims which are all related to the governmental guarantee of rate of return of investment in renewable installations, which changed after the investment was made [4].

Most of ISDS ECT-based claims are against the EU Notably, 81 out of total 131 ECT-based investment protection claims were filed by investors from EU countries against other EU countries and the EU as a whole (Figure 1-C) [8]. In other words, the ECT turns out to be a tool for protecting energy investments in EU countries against unilateral actions by EU governments that worsen the conditions for these investments after such investments are made. Apparently, that’s the crux of the matter.

The crux of the matter

Back in 2009, the Russian Federation proposed updating the ECT, but in the same year it withdrew from the treaty’s provisional application. And in 2018, Russia withdrew from ECT by revoking its signature; both actions were big mistakes, from my view. That leaves Russia unable to influence the course of the ECT modernization process and the resultant updated international rules for trade and investment in energy, even though energy will remain one of the core elements of the Russian economy and its international role for years to come.

A similar situation happened when GATT-1947 was negotiated: the then USSR was invited to become one of the “founding fathers”, but it refused, so GATT’s rules were developed without taking USSR's interests into account. Then it took a long 13 years in the 1990-ies for post-Soviet Russia to join WTO (successor of GATT-1947).

In 2019, the European Commission was given a mandate to conduct negotiations on ECT modernization [9]. But the ECT ceased to suit the EU after the adoption of its Second Energy Package in 2003, when the latter’s more liberal provisions conflicted with the ECT.

The contradictions became more pronounced after the adoption of Third Energy Package in 2009. With that, the EU laws and those of its member countries turned out to be subordinate to ECT as an instrument of international law, since all these countries had signed and ratified ECT both individually and as part of the EU. Therefore, investors from ECT member countries now enjoy the right to challenge, for example, anti-investment decisions/actions by EU countries and the EU as a whole in international arbitration tribunals, bypassing EU courts.

But the EU has always wished to see ECT as a tool for protecting EU investors outside the EU and for this purpose to maintain multilateral ECT (now including 53 countries) consistent with the changing EU internal law. That means a reversal of the relationship and the subordination of the ECT to the EU's “acquis communautaire.”

So the mandate that EU Council gave to the EC for negotiations on ECT modernisation stated that “it shall … ensure that any rule or commitment agreed upon by the European Union should be in line with the EU legal framework.”[9] Negotiating Directives means ECT provisions on investment protection must be brought “in line with the EU reformed approach on investment protection, it should be clarified that investment protection provisions cannot be interpreted as a commitment by the Parties not to change their laws, including in a manner that may negatively affect the investor’s expectations of profits.” But this is really the case of mostly all ISDS with the EU, as a number of cases in Spain illustrate most clearly!

Contract law vs public law

This approach reflects the natural conflict between “public law” (a government's intended “right to regulate”) and “contractual law” (sanctity of contracts). Few years ago we had intensive discussions on a balanced solution of the dilemma with our EU colleagues. For instance, during informal Russia-EU consultations on the open issues of the Third EU Energy Package (TEP) of mutual importance, one of the debated issues was initial intention of the EU regulators to require that all existing Russian long-term gas export contracts were terminated within six months after TEP was incorporated into national laws: TEP introduced a new architecture based on market zones with (sometime to be liquid) hubs. All those LTCs were to be transferred from their historically-existing delivery points “on the border” to the newly created virtual hubs.

One of the arguments of EU colleagues referred to the “right to regulate” of the sovereign state – public law prevails. We, Russian experts, referred then to sanctity of contracts and agreed with the prevalence of public law over contractual law and the “right to regulate’ of the sovereign state – but in the relation to new contracts, and not for unilateral application of “right to regulate” to the existing contracts before their expiration date. It took some time to persuade our EU colleagues of this. It seems that MEPs are appealing for the similar approach as our EU colleagues-regulators tried to introduce in the mentioned case.

The European Commission maintains that ECT has become outdated, in particular due to the use of international arbitration tribunals established in each case at the investor’s choice. Instead, it proposes to use a permanent “multilateral investment court”, which the EU has been trying to create since 2015 on the basis of rules to be formulated out of the EU’s existing bilateral free trade agreements. Well, new rules have not yet been formulated, but it is already proposed to enshrine them. On the basis of the EU rules.

It appears we are witnessing a repetition of the situation that was formed by Russia in 2009 when some representatives of my country proposed abrogating the ECT in favour of a new treaty yet to be drafted and adopted that would replace ECT. But for this purpose ECT member countries were to abrogate the treaty that they had already ratified. Back then ECT member countries turned down that tempting proposal. Aren’t the EU lawmakers about to run into the same trap now?

The MEPs state that “The ECT is neither consistent with the European Green Deal, nor with the proposed EU climate law and national carbon neutrality targets, nor with the EIB energy lending policy and the EU taxonomy for sustainable investment. Phasing out fossil fuels from the ECT investment protection mechanism is for us a prerequisite for the negotiations on the modernisation of the ECT”. [1]

In 2004 I managed to bring together Russian and the EU delegations at the Annual Energy Charter Conference to agree to the inclusion in the Conference decision for the first time the clause that the Energy Charter process and its documents shall evolve in line with international energy markets. This meant ECT CPs have to identify and address new risks and challenges that crop up from time to time and so negotiate new ways of protecting investments at a mutually acceptable level.

But this cannot be done by a policy of threats using “arguments of force” instead of “force of arguments”. Such approach can just invalidate the good idea of green development. In early USSR history, during its tragic Gulag period, they say, it was the popular slogan “With an iron hand we will force mankind into happiness!” It is impractical to expect that such an approach, as presented in MEPs letter, will work and will force the mankind into climate-neutral future.

Therefore, under the guise of striving for the widely advertised goal of achieving the EU’s climate neutrality and implementing the Paris Agreement, another attempt of “export of acquis communautaire” is under way. Incidentally, such attempts have continued incessantly since 2003.

Now it is driven by the allegedly climate-friendly endeavours of the green faction of EU Parliamentarians.

The cherry on the cake: NordStream 2 and the EU

And now the cherry on the cake. Back in 2019, a confidential internal EU report describing “numerous drawbacks” of ECT and ECS, which leaked to Brussels paper Euractiv, mentioned among the treaty’s drawbacks that the ECT was being used by the 'Russian project NordStream 2' in the first ever precedent of arbitration proceedings against the EU [10]. Maybe this is also one of the reasons for the MEPs' actions? After all, something similar, as they say, underlay Russia's withdrawal from the ECT: the Yukos case and the claim its shareholders filed against Russia.

At that time, when the multi-billion Yukos case referred to ISDS claim against Russia, these ECT provisions did not sound “controversial” for the Western community or to European politicians in particular. But they have begun to be treated as “controversial” and “obsolete” now, when a number of ISDS claims by EU investors against EU member-states and the EU in general appeared and have grown in quantity to become the majority of all ISDS ECT-based cases. This is at a time when a major international investment pipeline project, presented by its political opponents and economic competitors as just a “Russian” one, raised an ECT-based ISDS claim against the EU.

But those who present NordStream 2 as just a “Russian political project” demonstrate big gaps in their knowledge. First, this project is based not on political agreements between states, but on the multi-billion investments already made by six major energy companies, five of which present the EU. Second, the project directly involves more than 120 companies from more than 12 EU countries. [11] So if the MEPs abolish the existing investment protection at the post-investment phase of the project, EU companies and EU citizens will be the biggest losers.

The MEPs' proposal has the effect of additional sanctions against any investment energy project (in case of NordStream 2, further to the US extra-territorial sanctions against it), since contrary to generally-accepted political opinion, the post-investment phase actually starts when the final investment decision (FID) is taken, and not when the project starts up.

It should have been understood by the MEPs that any direct investment made (including in energy) has already created in advance of its development huge multiplier effects with the placement of orders in affiliated industries. So, in addition to €8bn invested in construction of NordStream 2 per se, European companies have invested additionally half of this sum in developing new infrastructure to deliver this additional gas to EU customers deep inside the EU (€3bn in Germany and €750mn in Czech Republic) [11] to existing historical delivery points for Russian gas to Europe. So they can also become the object of future potential ISDS ECT-based claims (as the “domino effect”) to cover corresponding damages.

It seems, that in the promotion of EU New Green Deal, some of its supporters do consider that all means are acceptable – “the end justifies the means”. Including the use of incorrect facts, and even ignoring technological progress whereby fossil fuels can provide clean energy. The letter comes across as the voice of RES-electricity lobby based on the invalid perception that it is the only source of clean energy. But climate change politics should not be based on deliberate mistakes.

Prof. Dr. Andrey Konoplyanik (www.konoplyanik.ru) is an Adviser to Director General of Gazprom export LLC. He headed the Russian delegation at negotiations on the ECT in 1991-1993, and served as Deputy Secretary General of the Energy Charter Secretariat in 2002-2008. The views here expressed are the author's own.

[2] The Energy Charter Treaty and Related Documents. A Legal Framework for International Energy Cooperation. // Energy Charter Secretariat, September 2004, p.93-94.

[3] International Energy Charter Newsletter, II Quarter 2020, p.1

[4] “Modernisation of the Energy Charter Treaty: A Global Tragedy at a High Cost for Taxpayers”, OpenExp report, January 2020

[5] Frédéric Simon. ‘Obsolete’ Energy Charter Treaty must be reformed or ditched, lawmakers say, EURACTIV, 08.09.2020 (https://www.euractiv.com/section/energy/news/obsolete-energy-charter-treaty-must-be-reformed-or-ditched-lawmakers-say/)

[6] Dr. Andreas Bode (Program leader Carbon Management R&D). New process for clean hydrogen. // BASF Research Press Conference on January 10, 2019

(https://www.basf.com/global/en/media/events/2019/basf-research-press-conference.html)

[7] COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE COUNCIL, THE EUROPEAN ECONOMIC AND SOCIAL COMMITTEE AND THE COMMITTEE OF THE REGIONS. A hydrogen strategy for a climate-neutral Europe // EUROPEAN COMMISSION, Brussels, 8.7.2020, COM(2020) 301 final, p.4-5, footnote 26

(https://ec.europa.eu/energy/sites/ener/files/hydrogen_strategy.pdf)

[8] https://www.energychartertreaty.org/cases/statistics/

[9] Council of the European Union. Negotiating Directives for the Modernization of the Energy Charter Treaty. Brussels, 02 July 2019

(https://data.consilium.europa.eu/doc/document/ST-10745-2019-ADD-1/en/pdf)

[10] Frédéric Simon. EU asserts ‘right to regulate’ as part of energy charter treaty reform, EURACTIV, 16.07.2019

[11] Press-service Nord Stream 2 AG