Eni Nears 2mn boe/d, G&P in Profit

Eni achieved record upstream production late 2017 and its Gas & Power segment returned to underlying profit “a year ahead of schedule,” CEO Claudio Descalzi said in its 2017 results February 16.

He added that the Italian company had started its “most significant projects in record time, in particular the jewel in our crown, Zohr,” offshore Egypt.

The Italian major made a 4Q net profit of €2.1bn ($2.6bn), up from €340mn in 4Q2016, while its full year 2017 profit was €3.43bn – reversing a 2016 loss of €1.46bn.

Gas & Power division’s adjusted net profit was €51mn in 2017, reversing a 2016 loss of €330mn; for 4Q it was €113mn positive, versus a year-before loss of €31mn and 3Q2017 loss of €139mn. Eni also said it achieved its best full year results for eight years from Refining & Marketing.

Upstream production averaged 1.89mn barrels of oil equivalent/day in 4Q, its highest quarterly output in the last seven years, and up 1.9% on 4Q2016. The latest quarter’s production was made up of 861,000 b/d liquids (down 5%) and 5.63bn ft³/d gas (up 8%). Full year 2017 production at 1.82mn boe/d was 3.2% higher than 2016, which split out as 852,000 b/d liquids (down 3%) and 5.26bn ft³/d gas (up 10%). That meant gas represented 53% of Eni’s 2017 production. Production peaked at 1.92mn boe/d in December 2017, an all-time high for Eni.

Upstream’s operating profit more tripled in full year 2017 to €7.67bn, and its adjusted net profit grew to €2.73bn (from €508mn in 2016). Average realised prices for Eni in 4Q2017 were $3.89/mn Btu for gas, up 11% year on year, and $57.64 for liquids, up 29%.

Eni forecasts 3% growth rate in 2018 full year upstream production, driven by ramp-ups of fields started up last year mainly in Egypt, Angola and Indonesia, plus satellite phases of giant fields offshore Libya, Angola and Ghana.

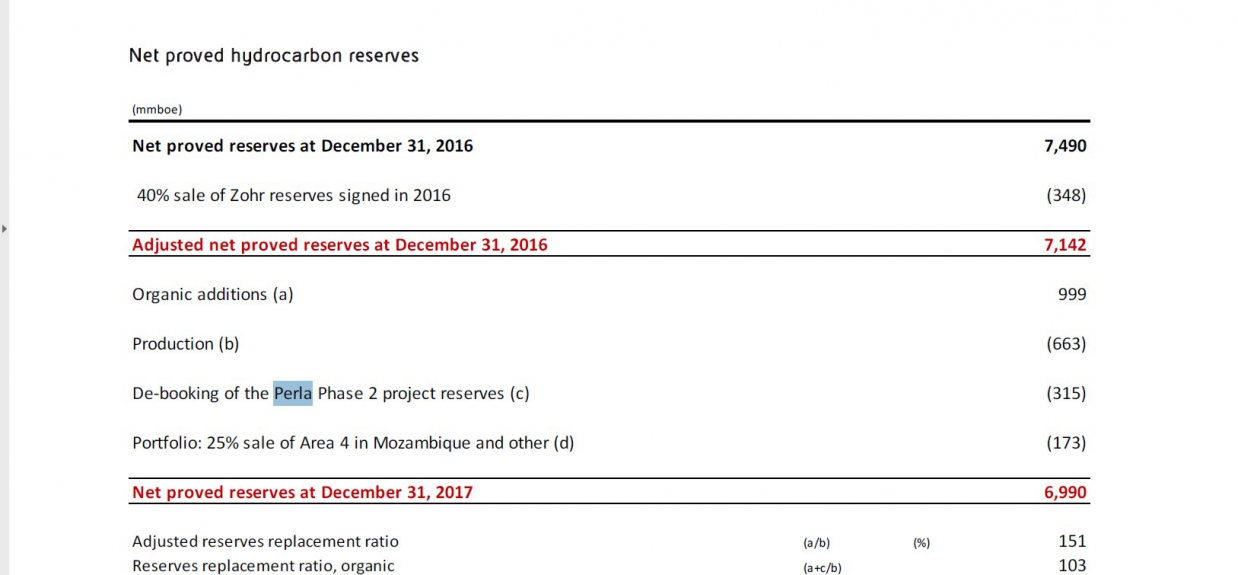

Divestiture of stakes in Zohr (40% to Rosneft and BP), Mozambique Area 4 (25% to ExxonMobil) and smaller interests, plus Perla debooking in Venezuela, reduced Eni’s net proven reserves from 7.49bn boe at end-2016 to 6.99bn boe at end-2017. Nonetheless during 2017, it added 1bn boe of new resources, of which 0.8bn boe came from in-house exploration at a discovery cost of about $1/boe. Eni's reserves replacement ratio was 151% in 2017, or 103% when debooking of 315mn boe Perla gas reserves is included (see table below).

Gas sales worldwide declined by 6% in full year 2017 to 80.8bn m3, holding up better in its Italian home market (down 3% to 37.4bn m3) than elsewhere in Europe (down 10% to 38.2bn m3) largely thanks to its divestment of sales businesses in Belgium and Hungary, while gas sales in the rest of the world were 5% lower at 5.2bn m3. The lower volumes partly reflected Eni's scaling back of its more onerous take-or-pay obligations, as a gas buyer in Europe. Eni's power sales for full year 2017 were 5% lower at 35.3 terawatt-hours.

For Gas & Power, it expects adjusted pre-tax earnings (Ebit) of €300mn following renegotiation of long-term supply contracts, reduction of logistic costs, and synergies from upstream integration in the LNG business.

Extract from Eni full year 2017 results (Credit: Eni)