EC Clears Vattenfall Sale to EPH

The EU Commission cleared the acquisition September 22 of Vattenfall’s lignite business in eastern Germany, including 7,595 MW net of lignite-fired power plants, by the Czech utility group EPH and its partner PPF. Vattenfall said it expects the ownership transfer to be completed in the coming weeks.

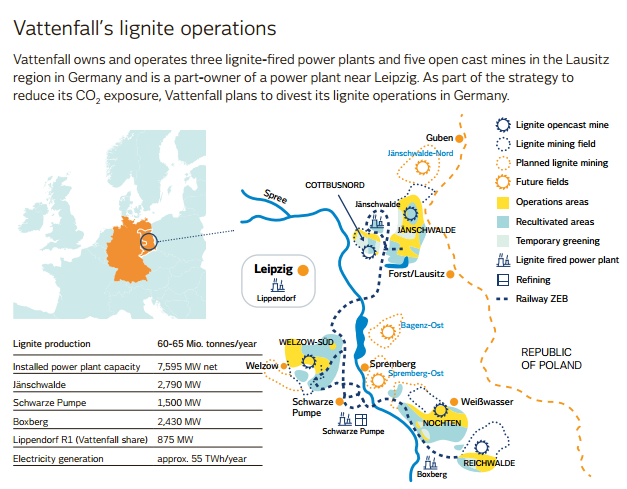

Swedish state-owned Vattenfall said its €1.7bn cash sale, announced in April, includes the Janschwalde, Boxberg, Schwarze Pumpe and Lippendorf block R power plants, open cast mines Janschwalde, Nochten, Welzow-Sud, Reichwalde, the recently closed mine Cottbus Nord, and the Schwarze Pumpe carbon capture and storage (CCS) project. The latter, of 30 MW capacity, was the first large pilot CCS venture in Germany but Vattenfall decided in 2014 not to scale it up. Vattenfall booked a $1.8bn impairment charge for the assets in its 2015 earnings.

Vattenfall retains its other power generation assets in Germany, including windfarms, nuclear and co-generation; a new 300 MW gas-fired co-generation plant that cost €500mn is due to open this year at Lichterfelde near Berlin. It said in April that the lignite divestment would mean that the carbon-neutral generation share of its German power generation would increase from 50% to 75%, due to the loss of the environmentally-polluting lignite plants.

Vattenfall's lignite operations and power plants in eastern Germany (Graphic credit: Vattenfall's 2015 annual report)

EPH has power generation, gas transmission and storage, gas and power distribution assets, and some mining assets spread across the Czech Republic, Slovakia, Germany, Italy, the UK, Hungary and Poland. PPF is a Jersey-based international private equity group. The commission was notified of the deal on August 18; it assessed the impact of the proposed deal on markets for lignite mining and supply, the supply of pulverised lignite in Germany, and power generation and supply, and judged it would not adversely affect competition in the relevant markets.

On September 20, the commission cleared UK utility Centrica's acquisition of Danish gas and power trader Neas Energy; the £170 mn deal was announced in April.

Mark Smedley