Dong to Phase out Coal by 2023

Danish state-run Dong Energy has pledged to phase out coal from its power stations by 2023. It also reported gains from gas contract renegotiations in its 2016 results, February 2.

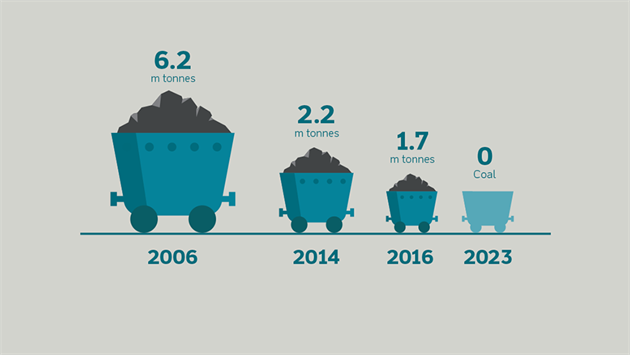

“The future belongs to renewable energy sources, and therefore we're now converting the last of our coal-fired power stations to sustainable biomass,” said CEO Henrik Poulson. Dong said it had already reduced coal consumption by 73% since 2006.

Denmark's annual emissions of greenhouse gases were reduced by 25mn metric tons of CO2 between 2006 and 2016, and Dong's share of that cut was some 53%. As a result of its phase-out decision now, Dong expects its share of Denmark's total reduction to remain at this level from 2016 to 2023.

Dong pledges to phase out coal, which it burns at Danish power plants, by 2023 (Graphic credit: Dong Energy)

Also February 2, Dong announced a 4Q 2016 profit of DKK 3.5bn ($507mn), reversing a loss of DKK 15.3bn in the same quarter of 2015. Its full year 2016 profit of DKK 13.2bn ($1.9bn) also marked a turnaround from its 2015 net loss of DKK 12.1bn.

Two weeks ago Dong said it expects to have sold its oil and gas division by the end of this year. It announced a 4Q 2016 loss of DKK 0.5bn from that division, compared to a loss of DKK 15bn in 4Q 2015 when it declared impairments of DKK 14.8bn.

Gas contract renegotiation gains

The company also said it successfully completed the renegotiation of another long-term, oil-indexed gas purchase contract in December 2016, and that total one-off payments in 2016 from the renegotiation of its gas purchase contracts amounted to DKK 4.3bn ($623mn), even more than it had anticipated for the year when it reported its 1H earnings in August.

Mark Smedley