Will European energy crisis put climate on the backburner?

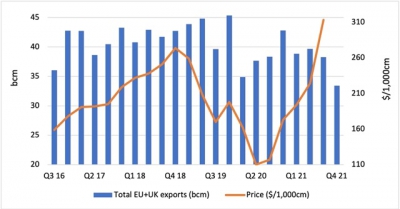

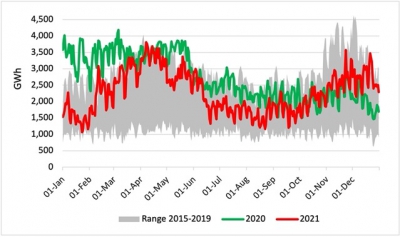

Gazprom’s gas flows to Europe in December reached their lowest point for the month in at least six years, with supplies up 12% month on month but down 19% year on year.

Gazprom Monthly Exports - Europe

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

_f400x238_1641223663.jpeg)

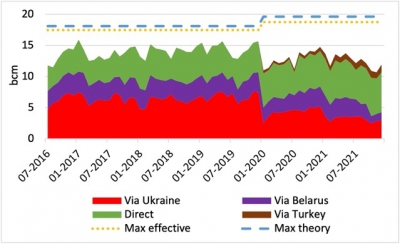

Since September, Gazprom has significantly curtailed its exports to Europe, prioritising instead supplies to the domestic market and Turkey, which is now connected with Russia directly via the TurkStream as well as Blue Stream. Russian gas demand reached an all-time record of 1.7bn m3 on December 23, leaving only 0.4bn m3 of the country's supply available for Europe. Russian exports in the final quarter of 2021 also represented a record low for the period.

Gazprom's Quarterly Europe Exports & Prices

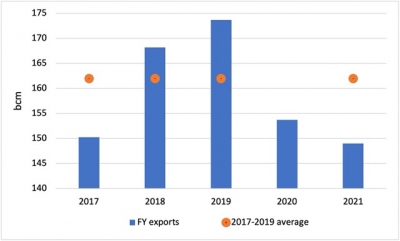

Gazprom's supplies to Europe during the whole of 2021 were also 13bn m3 or 8% lower than the pre-coronavirus average between 2017 and 2019. As Gazprom and its European customers have provided little information, it is difficult to understand the reasons for the recent sharp reduction in flow. But on December 23, during a press conference, Russian president Vladimir Putin made it clear that Gazprom was flowing gas into Yamal until Poland, but not further away as “German and French companies didn't ask for any gas."

Gazprom's Europe Exports (2017-2021)

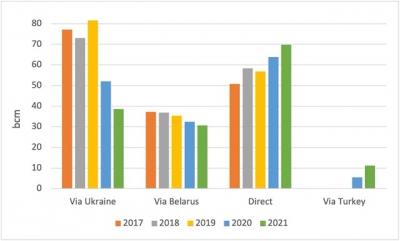

The transit deal signed in December 2019 between Gazprom and Naftogaz provides for 40bn m3/year of transit volumes in 2021-2024. In 2021, Gazprom decided not to book any additional capacity via this route. The reduction of flows between 2021 and 2022 was 13bn m3. Hence why I argued, back in April, that the ENTSOG Summer Outlook was flawed as it did not take into account this reduction in contracted transit flow.

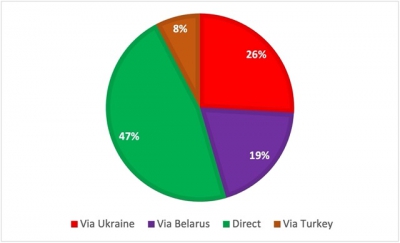

Split of Gazprom's Europe Monthly Exports

On the other hand, Gazprom sent a record amount of gas to the EU using the TurkStream in December. The TurkStream's second string was fully utilised for delivering gas to Europe, as Gazprom had envisaged when it proposed the pipeline as an alternative to the South Stream, cancelled in 2014.

Gazprom's Europe Exports by routes (2017-2021)

Gazprom's Europe Exports split by routes in 2021

LNG send-outs in Europe in December were up 6% month on month and 38% year on year, as record prices made Europe a more attractive destination for cargoes. In the whole of 2021, European LNG regasification was down by 17bn m3 versus last year, but up 6bn m3 compared with the historical pre-coronavirus average. As worldwide production is at full capacity, only LNG can react to the spike in prices, with cargoes being rerouted. The question is whether we will see record LNG volumes in the first quarter of 2022 that can help ease Europe's energy crunch.

European (excl. Malta) LNG Send-outs

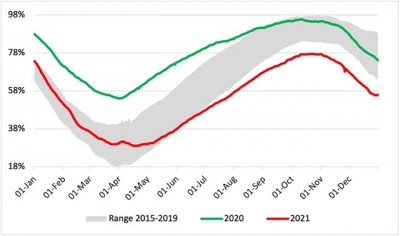

Storage facilities started the withdrawal period on October 21 at a worryingly low utilisation level of 77%. Since December 29, thanks to mild weather, a very little amount of gas was reinjected and facilities ended the year 56% full. There was 23bn m3 less gas in stock at year-end than the average, and 9bn m3 less than the former record low.

European Storage

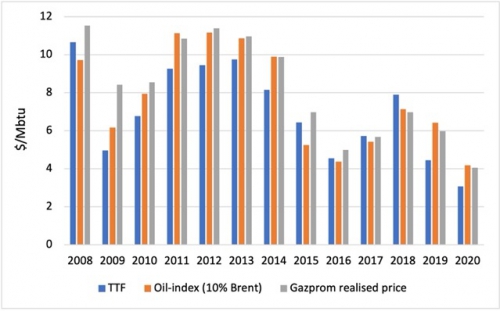

For policymakers that want to revert to oil indexation in gas supply contracts, it is perhaps worth noting that, until 2021, consumers did benefit from the shift to spot, gas-on-gas pricing. If the European Commission's narrative about gas had been less negative over the last two years, we might have seen major producers like Russia continue overinvesting in supply, and the energy crisis that has tilted the balance against consumers for the first time in more than a decade might have been avoided.

Gazprom's Annual Realized Price in Europe vs TTF and Oil-Indexation

Meanwhile, the Nord Stream 2 saga continues. The new German foreign minister Annalena Baerbock expressed her opposition to the pipeline on December 12. On December 16, the German regulator reported that it would not take a decision on whether the Nord Stream 2 operating company could be certified as an independent transmission operator in the first half of 2022. On the other side, the Russian government is considering a request by Rosneft to supply gas via Nord Stream 2. This potential legislative change could signal that Gazprom has no more spare production capacity, and/or it could be an attempt to make Nord Stream 2 compliant with EU regulation. This change, dreamed by the EU for many years, should be an unique opportunity for the commission to re-engage with the Russian government at the top political level. With both Nord Stream 2 lines now under working pressure and fully ready for operation, the main question is when the pipeline will start pumping gas into the German grid.

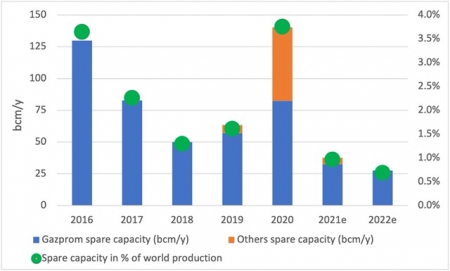

In his year-end speech, Gazprom CEO Alexey Miller provided some interesting insights. Global gas consumption grew by 150bn m3 in 2021, and Gazprom satisfied over a third of this additional demand, he said. Gazprom's output in 2021 was 515bn m3 – its highest point in the last 13 years. Hence Gazprom’s spare production capacity was at best 32bn m3 on an annualised level in 2021. In the Q4 2021, Gazprom produced 136bn m3 of gas, or 1.48bn m3/day. As we know that the previous quarterly record was 118bn m3 in Q3 2021 and that Gazprom's maximum capacity is 1.5bn m3/d or 138bn m3 in a quarter, we can safely assume that Gazprom had no spare capacity in Q4 2021. As storage facilities were full in Russia in November, we can deduce that the reduction in supply to Europe was not a hidden political agenda but the consequences of extremely high demand in Russia.

We have assumed for years that Gazprom would always be holding enough spare capacity to balance any unexpected events. Not only has Gazprom no spare capacity right now, but its overall production capacity has in fact not changed over recent years, despite the launch of gas supplies to China via the Power of Siberia in December 2019. In other words, while production capacity to supply China has increased to 10bn m3/year in the last two years, the capacity to supply Europe has fallen by the same amount. This is why Gazprom needs to fast-track the development of the Kharasveyskoye field in the Arctic, due online in 2023 and set to produce 32bn m3/yr of gas at full capacity. As this is not going to significantly relax the overall supply-demand balance in the medium term, Putin has asked European buyers to sign new long-term contracts to underpin Gazprom's investment in additional fields on Yamal.

World Gas Spare Production Capacity on an Annualised Level

It is also worth noting that there is currently no connection between the Russian fields that supply China with gas and those in west Russia that cater for the European market. But in the future, Gazprom plans to integrate these eastern fields into the national supply system. Hence, without any additional long-term contracts, some capacity historically dedicated to the European market could be used to serve China.

As we need more gas in Europe both to ease the current energy crunch and tackle the climate crisis, we need to incentivise the three top exporters – Russia, the US and Qatar – to invest significantly to expand their exports. This could be a great opportunity for the European Commission to play a central geopolitical role by engaging with Russia to find a global EU-Russia agreement.

The grand EU ‘Green Deal’ or ‘fair energy transition’, launched by Ursula von der Leyen when she took the helm of the commission back in December 2019, has turned in front of her own eyes into an unfair climate disaster where energy consumers are paying more and the EU's emissions are worsening. This energy crunch shows that gas is needed in the energy transition. 2021 ended with a month of record prices, as lofty aspirations were followed by cold reality:

-

On an energy basis, gas in Europe and Asia is now three times more expensive than oil. Instead of oil providing a cap, in a new normalised environment, we could see oil providing a floor to European and Asian gas prices as gas is cleaner than oil.

-

Instead of the coal phase-down envisaged at COP26, coal demand is in fact growing.

-

In the electricity market, with the sudden closure of two additional nuclear plants in France, failed demand reduction is turning into painful demand destruction.

-

Even while carbon permits trade at a record level at the EU emissions trading system, the bloc is failing to fast-track emissions reductions as too many allowances are provided for free.

With the energy crisis now expected to last for the rest of 2022 at least, the question is whether governments will put the climate crisis on the back burner. The commission may have ended the year by publishing its Fit for 55 gas package, but the European Council failed to even mention energy after their December 17 meeting. While attention has been fixed on averting a 2030 climate crisis, Europe now finds itself in the midst of its worst energy crisis.

Happy New Year,

Dr Thierry Bros

Professor at Sciences Po & Energy Expert

January 3, 2022