Country Focus: Poland's Energy Plan Provides Key Role For LNG [LNG Condensed]

The weakness in the plan is the economics; LNG may well prove more costly than Russian gas; offshore wind is promoted over a near total decline in onshore wind; and the capital cost of new nuclear will place a massive burden on Poland’s state power companies.

The motivation for the plan is decarbonisation and a switch from the country’s heavy dependence on coal and lignite to lower carbon generation fuels, while at the same time reducing the country’s dependence on Russian gas.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

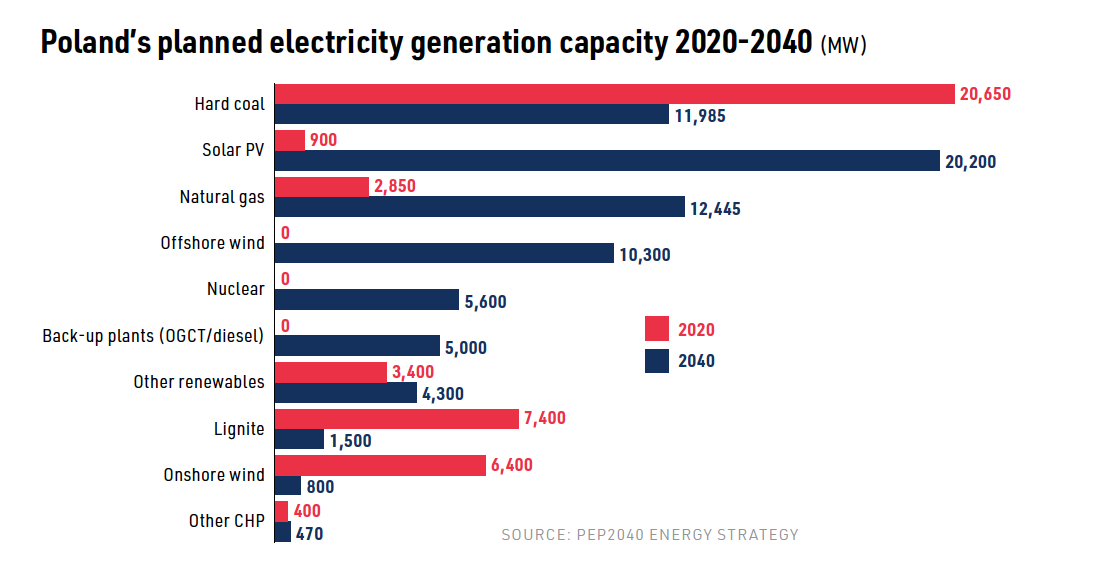

The plan envisages 5.6 GW of new nuclear by 2040 and a drop in coal and lignite-fired generation capacity from 28 GW to 13.5 GW over the same time frame. Solar leaps from near zero to 20 GW and offshore wind from zero to 10.3 GW, while onshore wind capacity falls from 6.4 GW to just 0.8 GW. This is despite a tender in November awarding 1 GW of new offshore wind at an aver- age price of $52/MWh, a price which left 45% of the auction budget unspent.

But in all this, natural gas — and LNG in particular — should fare well.

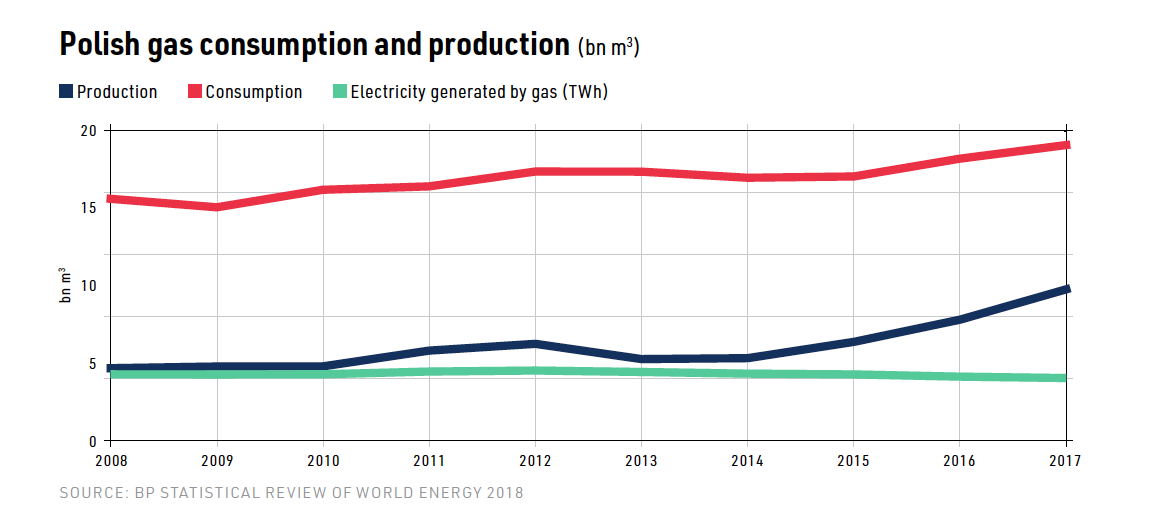

Poland has traditionally relied on Russian gas imports, bringing in 11.1 bn m3 in 2017, making up nearly 60% of its gas use. However, in 2016, the country’s first and so far only LNG terminal came into full operation at Swinoujscie on the Baltic coast. The onshore terminal has capacity of 3.6 mn tons/yr (4.9 bn m3/yr) and, in 2017, imported 1.26 mn tons, according to International Gas Union data.

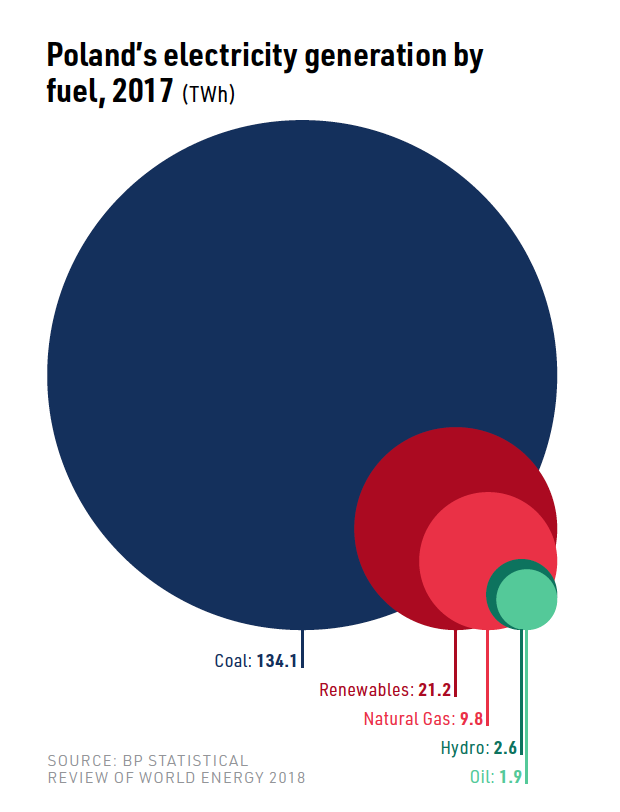

However, this appears to be only the start of Poland’s LNG ambitions. Poland’s gas use has been steadily creeping up over the last decade, rising from 15.6 bn m3/yr in 2008 to 19.1 bn m3/yr in 2017, when gas-fired plant generated 5.7% of the country’s electricity.

In 2008, gas-fired generation was 4.7 TWh, but this had more than doubled to 9.8 TWh by 2017. Domestic gas production has flat-lined around 4.0 bn m3/yr over the same period. A flurry of activity in search of economically-producible shale gas has burnt itself out largely without success. But under the PEP2040 energy plan, gas-fired generation capacity will rise from 2.85 GW in 2020 to 12.4 GW in 2040.

This will comprise combined cycle gas turbines and combined heat and power plants, with a further 5 GW of back-up plant also planned, which will be split between diesel and open cycle gas turbines. As a result, Poland’s gas-fired generation capacity is expected to more than quadruple over the next 20 years.

SOURCING THE GAS

The question then becomes where will the gas come from? The spice in this for the LNG market is Poland’s intention not to renew its contract with Russian state-owned gas company Gazprom in 2022. Instead, Poland’s state gas company PGNiG has signed a raft of new LNG supply agreements with US companies that exceed the country’s current LNG import capacity.

PGNiG in August last year signed a deal for 1.45 mn metric tons/yr of LNG from Cheniere Energy for 20 years. In October, it struck an agreement with Venture Global for 2 mn mt/yr over 20 years from the US company’s planned export terminal in Plaquemines Parish, Louisania. Then, in November, it agreed another 20-year supply agreement with Sempra Energy for 2 mn mt/yr from the planned LNG export facility at Port Arthur in Texas, which is expected to be on-stream in 2023.

Preparations were started in 2017 for an expansion of Swinoujscie’s import capacity to 7.5 bn m3/yr with plans for further growth to 10 bn m3/yr.

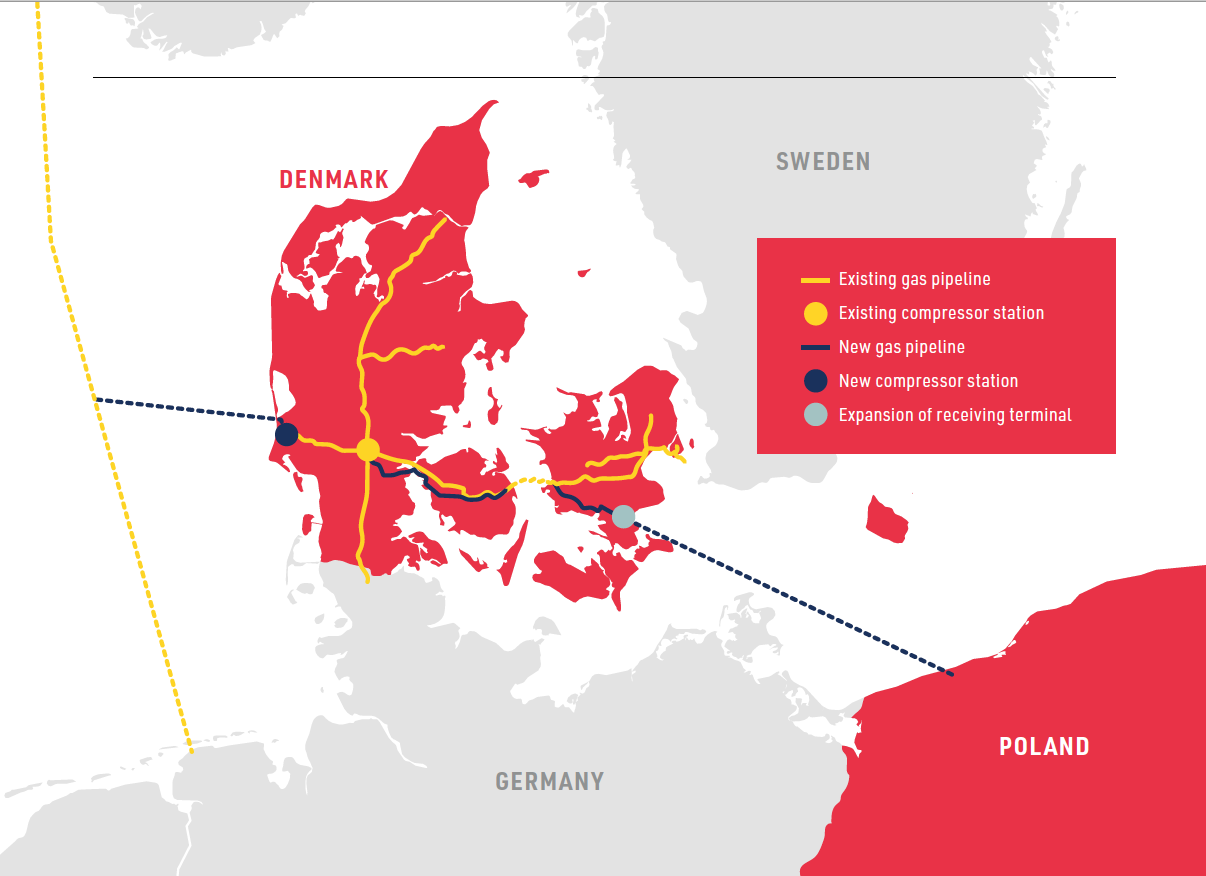

However, LNG is not the only import option being pursued. A final investment decision was tak- en by Denmark’s Energinet and Polish gas system operator Gaz-System S.A. in November last year to build the Baltic Pipe, which will link Denmark and Po- land directly with Norwegian gas fields, expanding gas transmission capacity to Poland by up to 10 bn m3/yr by October 2022 at a cost of $1.8-$2.4 billion.

The shift in import structure is thus likely to be quite radical, with LNG growth outstripping overall domestic demand growth for gas.

According to estimates made by the US Commercial Service, Poland sourced 6% of its gas as LNG in 2017, but this figure should rise to 37% in 2022, with 20% sourced domestically and 43% coming from Norway, eradicating both Russian gas imports and other EU imports, which are often originally of Russian origin.

LNG imports into Poland should also bene- fit from the expansion of pipeline interconnections between Poland and surrounding central and east European states also keen to reduce their dependence on Russian gas supplies.

These include new or expanded interconnections with Lithuania, Slovakia, Ukraine and the Czech Republic.

KEY UNCERTAINTIES

There are of course major uncertainties, both up and downside. European LNG facilities have typically been underutilised, with LNG import capacity used as a means of imposing a price cap on cheaper pipeline supplies. Commercial realities may dent Poland’s political antipathy to Russian gas imports..png)

Equally, on the demand side, the 2040 energy plan’s forecast sharp decline in onshore wind capacity is hard to explain. On a commercial basis, onshore wind is cheap and getting cheaper. The typical pattern would be not to close sites, but to repower then with larger turbines.

Again cost concerns may well see a reversal of this policy, which would imply less room in the power market for other generation sources such as gas. The timescale for phasing out coal and lignite plant is also certain to encounter political opposition.

Yet, on the upside, nuclear programs car- ry enormous risk and Poland has spent years flip-flopping over the wisdom of embarking on this path. Although the time-frame allocated to nuclear development appears realistic – some 13-15 years – the program may yet prove too expensive a burden for the Polish state to bear, and it is far from clear than nuclear plants would generate competitively-priced electricity.

Given the generally high capacity utilisation of nuclear plant once built, delay, partial completion or complete abandonment would leave a major gap in the country’s electricity generation forecasts.

_f193x247_1552386214.jpg) LNG Condensed brings you independent analysis of the LNG world's rapidly evolving markets.

LNG Condensed brings you independent analysis of the LNG world's rapidly evolving markets.

Covering the length of the LNG value chain and the breadth of this global industry, it will inform, provoke and enrich your decision making. Published monthly, LNG Condensed provides original content on industry developments by the leading editorial team from Natural Gas World.

LNG Condensed is your magazine for the fuel of the future. Sign Up Free below:

Volume 1, Issue 2 - February 2019

> Japan: future uncertainty, but potential upside

> Which ship engine should a new ship owner shoot for?

> Argentina to join LNG production club

> Poland’s 2040 energy plan provides key role for LNG

> LNG Canada — a game changer for Canada’s gas industry

> Conference Report: EGC Vienna

and more!

Sign up now to receive LNG Condensed monthly FREE