Country focus: Albania [Gas in Transition]

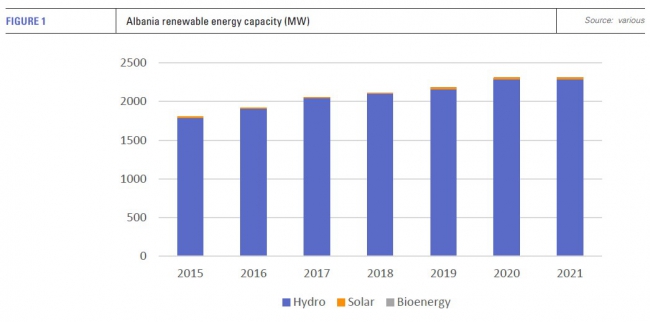

Albania is set to become a new entrant to the LNG market next year. Currently, the country’s electricity system is dominated by hydropower, which accounts for about 94% of generation from 2,289 MW of capacity. The remainder is met by burning crude oil. The country’s hydro system has no pumped hydro facilities; it therefore lacks any effective form of energy storage.

Variations in rainfall and thus available hydro generation mean the country is highly dependent on power imports. Concern that less rainfall and higher temperatures in the future will increase this variability and reduce the overall contribution of hydro power to the country’s electricity system have prompted a twin strategy of re-introducing gas and building up renewable energy capacity.

Cleanish energy system

The power system’s reliance on hydro means that, nominally, it is very low carbon (see figure 1). Environmental groups see the reintroduction of natural gas as a backward step, but this tends to ignore the level of power imports, their source and the drain this creates on the country’s economy and particularly the financial condition of state power utility and distribution operator KESH.

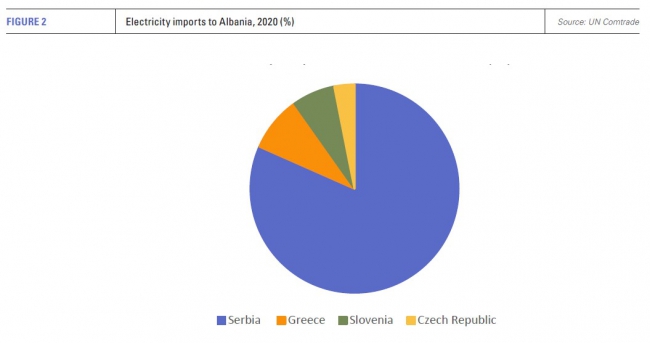

In 2020, for example, net imports reached 31% of total electricity consumption. Electricity is imported predominantly from Serbia, with smaller shares coming from Greece, Slovenia and the Czech Republic (see figure 2). Serbia accounted for 81% of Albania’s electricity imports in 2020. High distribution system losses do not help and point to major potential savings from energy efficiency investments.

Serbia sources about 70% of its electricity from domestically-mined low-quality lignite. The introduction of gas-fired generation in Albania could therefore displace imported CO2-intensive power and stabilise the country’s overly hydro-dependent domestic generation.

This stabilisation would also facilitate the incorporation of variable renewables such as wind and solar, leading to a reduction in net electricity imports and, potentially, the seasonal export of low carbon power to Albania’s neighbours.

Gas developments

Albania’s Gas Master Plan sees gas use rising from minimal levels today to about 2.4bn m3/ year by 2030. The country has an existing gas pipeline network of 498km, but most of it needs repair and is non-operational.

Nonetheless, the country’s gas options are improving. In July last year, the ministry of infrastructure and energy and gas system operator Albgaz signed an agreement on construction of the Fier South Facility, an interconnection point with the Trans-Adriatic gas Pipeline (TAP), which runs for 215 km through Albania en route to Italy. The bidirectional exit point is expected to take two to three years to complete.

In January 2021, the government also signed a memorandum for the construction of an LNG import terminal, which is to be connected through the Fier-Vlore pipeline with the TAP pipeline and would allow gas generation from the Narta power plant at Vlore.

The Narta power plant has not had a happy history. It was completed on the coast of southern Albania in 2005. Originally built with international funding as an oil-fired generator, it has a capacity of 98 MW. The plant was designed to provide emergency power in the event of drought or other impediment to the country’s hydro power production.

The Narta power plant has not had a happy history. It was completed on the coast of southern Albania in 2005. Originally built with international funding as an oil-fired generator, it has a capacity of 98 MW. The plant was designed to provide emergency power in the event of drought or other impediment to the country’s hydro power production.

The plant has never operated, owing to problems with its cooling system. Last year, an agreement was signed with ExxonMobil to convert it to run on regasified LNG.

The Vlore LNG terminal will provide an additional piece of critical infrastructure, strengthening the country’s energy supply and security. The terminal has won significant interest from Spanish LNG terminal operator Enagas, which in June signed a memorandum of understanding on cooperation with Albgaz. This has developed into a strategic cooperation agreement signed in October, which will explore the possibility of Enagas taking a stake in Albgaz. Enagas owns a 16% shareholding in TAP.

FSRU bagged

Albania has also been successful in chartering a Floating Storage and Regasification Unit (FSRU) for the Vlore terminal. FSRUs are in increasingly short supply as a result of a swathe of charters for north-west Europe intended to boost LNG imports in the face of a near total cessation of Russian gas pipeline imports. A report from the International Energy Agency published in October suggested that FSRU demand globally now outstripped supply, including those under construction and on order, by about three units.

US company Excelerate Energy is expected to deploy its FSRU Excelsior after the vessel completes its current contract off Israel at the end of this year and undergoes some modifications. Both the terminal and the Vlore power plant are expected to be in operation from the second quarter of next year. The FSRU Excelsior was built in 2005 and has a capacity of 138,000 m3.

The agreement also included provision of two power barges – effectively floating generators. These will be sited near the Narta power plant at Vlore to take advantage of the existing transmission infrastructure. They are expected to provide short-term emergency power.

Albania has wider plans for its LNG imports. In July last year, Excelerate, Italy’s Snam and Albgaz signed an agreement to explore ways of linking the Vlore LNG terminal with other natural gas infrastructure in the country. LNG imports would increase regional alternatives to gas imported via Russia’s TurkStream pipeline, which has largely supplanted gas flows through the TransBalkan pipeline. Snam also signed an agreement in March 2021 for development of an underground gas storage facility in the Dumre area with capacity of up to 800mn m3.

In addition, there are some prospects for a rejuvenation of domestic gas supply. In May, it was reported that the Delvina Gas Company had applied to restart production from existing wells on the 234 km2 Delvina Block. At present, domestic gas production is limited to the southern part of the country, where small volumes of gas are produced from the Divjaka and Frakull fields, as well as some associated gas from oil production around Ballsh.

Gas production in Albania peaked in 1982 at just under 1bn m3. However, a significant improvement in domestic gas production is dependent on new drilling and new distribution infrastructure, given the aged state of existing fields and pipelines.

Renewable energy development

In addition to its gas master plan, the government is keen to develop new sources of clean, domestic electricity generation. Hydro power could and is being developed further – there is an estimated 1.5 GW of hydro projects as yet undeveloped and 615 MW of additional potential, but public opposition is rising, centred on the local environmental impacts of new projects.

There is also significant wind and solar power potential, although very little has been developed to date. Estimates vary, but solar potential of up to 2.4 GW looks realisable, as does around 4.2 GW of onshore wind, while Albania’s 450km coastlines also offers offshore wind potential. At the end of 2021, the country had no operating wind farms and only 22 MW of solar power, according to data from the International Renewable Energy Agency.

The country’s climate targets aim for a rise in renewable energy’s share of gross final energy consumption from 38% in 2020 to at least 42% in 2030.

The government in the last 18 months has stepped up its renewable energy development. At the forefront are plans by Italy’s VoItalia to build solar power plants at Karavasta (140 MW) and Spitalle (100 MW). Three 50-MW solar farms are also reported to be under development by private companies without subsidy in the Fier region.

There are signs that the country’s nascent wind sector is beginning to gather momentum. In April last year, the government gave a green light to an Albanian-Italian joint venture for what will be the country’s first wind parks. Built by Biopower Green Energy and Marseglia Group, the two Lezhe wind farms will have a total capacity of 234 MW. The project was initiated in 2008, but took 13 years to get to the point of construction.

In addition, the government has opened bidding for an additional 100 MW of onshore wind and a number of Turkish companies have submitted applications for small-scale wind farms. There is also a project for 69.3 MW being promoted by EU Green Energy at Dropull in Albania’s south. The government is expected to launch an offshore wind tender next year.

Developers cite very slow and complex permitting procedures as a major impediment to development, as well as a state preference for continued hydropower development and grid limitations frustrating solar and wind power connections.

As a result, getting the Vlore plant into operation is a priority, given the dispatchable power it can provide and the existence of effective transmission capacity. The poor state of Albania’s transmission system will be a challenge for all electricity generation sources, but a combination of variable renewables and gas/LNG should provide much greater security in the future, working alongside the existing hydro capacity to displace carbon-heavy power imports.

Albania’s energy mix

- In March 2021, US companies Excelerate and ExxonMobil agreed with Albania’s government to study the construction of an LNG import terminal and upgrades to the Vlora thermal power plant.

- In July 2021, Excelerate and Snam signed a preliminary deal to build a pipeline linking the Vlora terminal with other gas infrastructure in Albania.

- In July 2021, Albania signed with the Trans-Adriatic Pipeline company on building an exit point for the pipeline.

- In May 2022, Albania’s Delvina Gas applied to restore gas flow from existing wells at the Delvina block.

- In October 2022, Enagas expressed interest in obtaining a stake in Albania’s gas transmission system operator Albgaz.