Fluxys: Connecting Markets and Gas Trading Places

Fluxys, the Belgian based gas transmission infrastructure company for the Northwest European market, has been nominated as TSO of the Year for the European Gas Conference Awards.

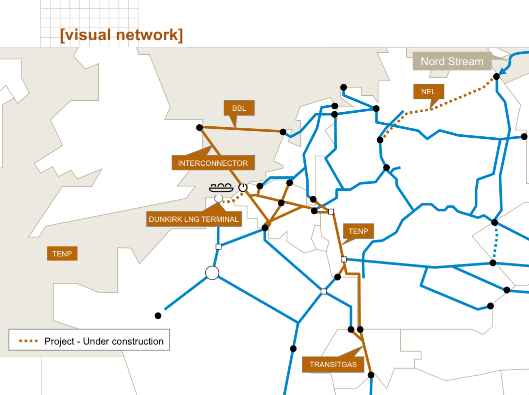

Fluxys builds and operates infrastructure for natural gas transmission, natural gas storage and terminalling of liquefied natural gas (LNG). The Zeebrugge area in Belgium is one of the main landing points for natural gas in Northwest Europe, its reception capacity of about 50 billion cubic metres per year corresponding to around 10% of the total border capacity needed to supply the European Union. The Zeebrugge area harbours the Zeebrugge LNG terminal, the landing point of the UK-Belgium Interconnector pipeline, the landing point of the Norway-Belgium Zeepipe and the Zeebrugge gas trading point. Elsewhere in Northwest Europe Fluxys currently is partner in the Interconnector and BBL pipelines linking the UK with mainland Europe, the Dunkirk LNG terminal in France, the NEL and TENP pipelines in Germany, and the Transitgas pipeline in Switzerland.

Natural Gas Europe was pleased to have the opportunity to discuss the operation of Fluxys, with its CEO, Walter Peeraer,

How would you describe the mission statement for Fluxys

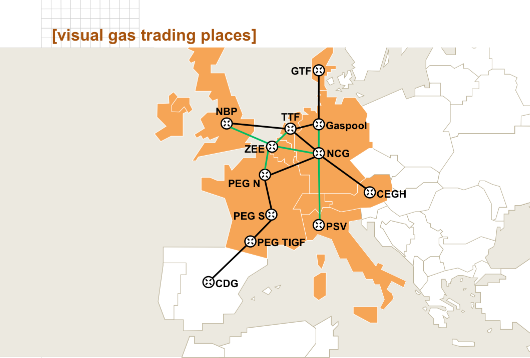

It is the company’s vision to play a key role in integrating the Northwest European gas market and linking it into the South European gas market. In this vision the gas system is to evolve into a tool with sufficient capacity and a wide spectrum of services for producers and suppliers to flexibly supply their customers with gas from any border point and easily exchange gas between trading places.

As you look back on 2011, are there specific milestones or achievements that Fluxys achieved?

2011 saw two milestones in Fluxys’ development. Early in 2011, Caisse de dépôt et de placement du Québec joined Publigas as shareholder and brought into the Board additional expertise in infrastructure and financing. In addition, CDPQ shares our long-term vision of developing and integrating the Northwest European market and jointly with majority shareholder Publigas has substantially increased our capital base with a view to our international development. The second milestone undoubtedly is our acquisition of Eni’s interests in the German-Swiss TENP/Transitgas link. Through this takeover we have become a European transmission system operator with a tentacular cross-border infrastructure. We link through our system the markets of the UK, Belgium, The Netherlands, France, Germany, Switzerland and Italy. And there is huge potential for the future as well. Making the TENP/Transitgas link bi-directional will pave the way for easy gas transfers between the gas trading places in the Northwest and the South of Europe.

What is Fluxys’ role in ensuring energy security for the domestic Belgian market? What steps have you taken in this respect?

Our role is to provide the entire community of suppliers with a delivery system connected to all gas sources available for the European market. Whether they are LNG players or pipe gas suppliers, they need to be able to make their gas flow to end-users in Belgium. Fluxys has achieved this diversification of supply possibilities by building a network integrating an LNG terminal and no less than 18 interconnection points with adjacent networks and systems. Now we focus on continuing to develop the network in line with changes in supply configurations. In this respect Fluxys finalized in 2011 the last stage of commissioning additional east/west capacity allowing for additional volumes of gas entering or exiting the network at the Belgian/German border. We also keep on developing our services model, with for instance the launch of long-term contracts for storage with security of supply requirements in the event of emergencies, which was a huge success as demand exceeded by half the capacity on offer. As for transmission we are making investments in additional compressor capacity and ICT tools to change in late 2012 into a fully integrated Entry/Exit system offering the community of shippers greater flexibility in booking and using capacity in the Belgian network.

As the operator of the Zeebrugge terminal, how do you view the impact /role that LNG will have on the European gas market. What steps are you taking in anticipation of this?

LNG currently accounts for approximately 25% of gas imports into the EU and will continue to play an important role in security and diversification of supply. It is also becoming important from a competition point of view. LNG with flexible destination for instance creates links between continents and the volumes of flexible LNG are on the rise. It is also interesting to see that NBP-indexed LNG from the UK finds its way to the continent through the link between the NBP and the Zeebrugge trading point. Provided that liquidity on continental gas trading places further deepens, this is a feature which over time could create greater flexibility in long-term gas pricing.

For the Zeebrugge LNG terminal our focus is on increasing the utilization flexibility we offer: flexibility in reception of cargoes and flexibility in take away capacity from the terminal. Q-max ships can dock at the terminal since September and work has started to build a second jetty allowing for reception of more cargoes and also offering the possibility to accept small-scale LNG ships. As for take away capacity, we successfully have launched re-loading of LNG ships and truck loading for transport of LNG by road, and we actively support a number of initiatives to launch LNG as fuel for ships and long-distance transport trucks. However, the major source of flexibility we offer is the possibility for gas from the terminal to be traded at the Zeebrugge trading point or to be redelivered in the UK, France, the Netherlands, Luxemburg and Germany at a sharply competitive transmission price. And we are set to further intensify this role of Zeebrugge as an LNG gateway into Northwest Europe through our partnership in the Dunkirk LNG terminal and our project with GRTgaz to build a connection between Dunkirk and the Zeebrugge area: we will offer optimum destination flexibility for gas coming from the Dunkirk terminal or elsewhere in France.

What opportunities do you see for Fluxys in 2012?

Our first priority is thoroughly managing our growth. For our core activity in Belgium 2012 will be a year of continued focus on investing in a safe, reliable and performing network. In our international activities our attention will go into integrating the TENP and Transitgas businesses, developing forward and reverse flow capacities as well as monitoring and making available our expertise in the construction of the Dunkirk LNG terminal and the German NEL pipeline in which we became a partner in 2011. At the same time we keep our eyes open for new opportunities that fit in with our strategy. Our approach is to connect markets through extending our infrastructure with branches and networks directly or indirectly connected into it so as to develop into a backbone system for the Northwest European gas market. In this respect we are interested in increasing our share in Interconnector UK and, like many others, in participating in E.ON’s process to divest its Open Grid Europe assets.

What do you believe is the most immediate challenge TSOs facing the European market?

First of all the industry has to make policy makers endorse natural gas as essential to a clean, competitive and secure energy future beyond 2050. Currently there seems to be a trend to consider natural gas merely as an energy of transition until 2030-2035, with a blurred future beyond that horizon, as if choosing for renewables is choosing to walk away from natural gas. At the same time policy insists on huge investments to connect markets and achieve integration. In the knowledge that regulators as a rule of thumb only allow for depreciation periods of 50 years, this is a major paradox which begins to make the risk of stranded assets wander around TSOs like a ghost. And this shouldn’t be the case. Because natural gas and renewables go hand in hand to achieve secure supplies with lower carbon emissions. Natural gas is the enabler of renewables, today and in the long run, and it is a safe, affordable and flexible alternative to high carbon energy sources.

Another challenge for TSOs is finding external financing for gas infrastructure in the disturbed and volatile financial markets of today. Banks have become increasingly reluctant to support industrial risks, even in the regulated infrastructure business which was traditionally considered as a safe haven. Bringing them round the table and getting commitments for important tickets is more challenging than ever. As a result, other financing sources such as private and retail bonds, and equity and pension funds have been privileged by most gas infrastructure companies in recent years as more practical and accessible funding alternatives. We will probably have to wait a long time before seeing the traumatized bank sector reverting back to its basic role of sustaining the real economy.

On a regional basis, how are TSO in North Western Europe working together to prepare to the anticipated increase in natural gas demand?

There are no certainties as to how gas demand in North Western Europe will evolve towards a 2030 or 2050 horizon. But there is a strong case for arguing that capacity demand will increase: capacity for bringing additional gas from further away gas fields into a market with decreasing domestic production, capacity for supplying new gas-fired power generation in base load or back-up for power generation from renewables and capacity to interconnect and integrate markets. However, building new capacity is highly capital intensive and TSOs face the challenge of keeping the right level of investment to ensure competitive tariffs. They need to avoid both underinvestment and overinvestment and stepping up inter-TSO cooperation is the way forward to make efficient investments and develop synergies from a regional market point of view. Fluxys has been coordinating investments in cross-border capacity with other gas infrastructure companies for several years now. And in the meantime a lot of progress has been made in the infrastructure planning process within the European Network of Transmission System Operators for Gas and the Northwest Gas Regional Initiative. But joint infrastructure planning is not enough. TSOs also need to intensify cooperation to develop cross-border services to optimize the utilization rate of the hardware in place. As with infrastructure planning this requires a mindset taking a supranational perspective at what the community of suppliers is looking for, and this is a mindset required not only for TSOs but also for the national regulatory bodies involved in the process.

How do you view developments in the pipeline market such as the launch of Nord Stream and the proposed Southern Corridor gas pipelines?

From our perspective as a TSO for the North Western European market, we welcome adding new supply corridors because it supports security and diversity of supply. It is also an opportunity to step up the process of connecting gas trading places, multiplying arbitrage opportunities and enhancing liquidity. And as we make this European backbone of gas trading places stronger, we provide the market with a better tool to maintain and even increase the competitiveness of gas prices. For Fluxys the launch of Nord Stream and the proposed Southern Corridor gas pipelines strengthens the rationale for making the German-Swiss-Italian link bi-directional: it will connect the Northwest European markets with the markets in the South of Europe and create a link in the European backbone which is currently missing.

Learn more about Fluxys at its website LINK The European Gas Conference and Awards are being held 24-27 January 2012, Vienna LINK

Fluxys successfully has developed into a European TSO linking through its cross-border infrastructure and capacities the markets of the UK, Belgium, The Netherlands, France, Germany, Switzerland and Italy.

Making the TENP/Transitgas link bi-directional will pave the way for easy gas transfers between the gas trading places in the Northwest and the South of Europe.