Conditions Essential to Reaching FID on an LNG Project

According to an Ernst & Young survey of 365 projects with a proposed investment of above $1 billion in the upstream, LNG, pipeline, and refining segments of the oil and gas industry, 205 projects provided updated cost data, and 242 provided updated schedules. Of the projects surveyed, 64 per cent faced cost overruns and 73 per cent faced schedule delays.

Cost overruns and schedule delays among energy projects surveyed in 2014

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

|

|

Cost overruns |

Schedule delays |

Average budget overrun |

|

By region |

|||

|

North America |

58% |

55% |

51% |

|

Latin America |

57% |

72% |

102% |

|

Europe |

53% |

74% |

57% |

|

Africa |

67% |

82% |

51% |

|

Middle East |

89% |

87% |

68% |

|

Asia-Pacific |

68% |

80% |

57% |

|

By project type |

|||

|

Upstreama |

65% |

78% |

53% |

|

Pipelineb |

64% |

50% |

41% |

|

LNGc |

67% |

68% |

70% |

|

Refiningd |

62% |

79% |

69% |

Upstream projects reported an investment of $1,080 billion in 163 projects with an average project size of $6.6 billion. b Pipeline projects reported an investment of $348 billion in 46 projects with an average project size of $7.6 billion. c LNG projects reported an investment of $539 billion in 50 projects with an average project size of $10.8 billion. d Refining projects reported an investment of $607 billion in 106 projects with an average project size of $5.7 billion.

Estimated project completion costs at the time of the survey were, on average, 59 per cent above the initial estimate, representing an incremental cost of $500 billion. As the survey did not capture all project completions post-FID (final investment decision), the total incremental cost could be higher still. The survey assessed the 20 largest post-FID projects and found that 13 (65 per cent) had cost overruns, averaging 23 per cent of the approved FID budget. This problem was prevalent across all project types and global regions.

Another survey, conducted by Credit Suisse, found that 65 per cent of project overruns were caused by project management issues such as personnel, organization, and governance; 21 per cent by management processes and contracting and procurement strategies; and 14 per cent by external factors such as government intervention and environment-related mandates. Whilst factors that cause budget overruns or schedule delays are common in oil and gas projects, their impact is more profound on LNG and refining projects due to their scale, required supporting infrastructure, complexity, and cost.

A world-scale LNG plant with 10 million tonnes per annum of production capacity could easily require investments, along the value chain from wellhead to burner tip, of $30 billion. Based on the Ernst & Young and Credit Suisse surveys, and considering approximately $20 billion in investments are needed from the well up to and including the LNG ships, the risk of cost overruns and schedule delays could represent an additional cost of $4.6 billion.

An LNG liquefaction project will have direct or indirect investments, or contractual arrangements (supply, tolling, or leasing), covering upstream gas supply, gas transmission pipelines, gas processing, fractionation and liquefaction plant, storage tanks and marine facilities, and ships to deliver the LNG to regasification terminals.

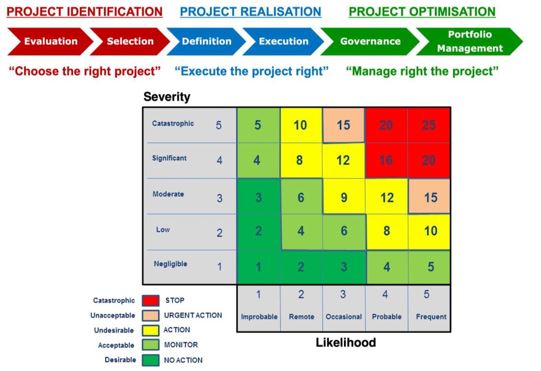

Essential to reaching FID on an LNG project is the treatment of risk: assessing and quantifying its likelihood and potential severity, and developing a mitigation strategy with clear accountability. LNG projects have a long business development cycle— which may span a decade from resource discovery through the conceptual phase, preliminary design and engineering, front-end design and engineering, and contract award, execution, and operation—and involve many teams from different partners and contractors. This increases the complexity of the overall task and its risk-management component.

Along the business development lifecycle of an LNG project, each development phase has an overriding focus—from selecting the right project to be developed within a portfolio, to correctly executing the selected project, and finally managing the project in an optimal manner to deliver the results as originally planned. A strong commitment to continuous planning and risk management along the project development lifecycle is essential for successful operation of an LNG project.

LNG Project Lifecycle Risk Management Framework

Identification and management of LNG project risks cover a wide spectrum of TECOP (technical, economic, commercial, organizational, and political) issues. The following is a non-exhaustive list of these issues.

- Technical: exploration and production (subsurface and facilities), project scope, technologies, supporting infrastructure, maintenance, and operations

- Economic: reserves, production, market prices, market demand, lifecycle cost, development schedule, taxes, levy, royalties, and financing cost

- Commercial: partners and shareholders, economic conditions, competition, contracts, procurement, legal framework, customers, financing, and insurance

- Organizational: joint venture participants and agreement, competencies, human resourcing, zone positions, development of local talent, knowledge management, information technology systems, procedures, policies, project management, and execution plan

- Political: host government, bodies of government, regulators, legislators, tax authorities, permitting agencies, industrial and community relations, shareholders, and geopolitical factors.

LNG projects require periodic, structured, and clear steps to identify, analyse, assess, monitor, and manage risks to ensure they are addressed by those best able to mitigate their adverse effect. Well-established risk mitigation strategies involve avoidance, acceptance, transfer, and control. LNG projects are well known for mitigating risks through their shareholder participants and venture structure, selection of project business model (upstream and midstream integrated, tolling, and free-on-board or delivery-at-terminal sales), and wide range of contracts covering all aspects of upstream gas supply, construction, and operation of the LNG plant, sale and delivery of LNG, financing and taxation, as well as, government fiscal arrangements (benefits, royalties and taxes), and dividend payments.

Nowhere is LNG project risk management more important than at the core of venture management and shareholder decision- making to ensure key risks have been satisfactorily addressed before a decision is taken. In an LNG project, an explicit list should be developed of conditions that must be met before key decisions are sanctioned, contracts are awarded, or an FID is reached. This is an effective way to maximize shareholder alignment and manage potential competing interests (in country or elsewhere) or secondary agendas. A non-exhaustive list of these conditions follows.

Exploration and production/gas supply:

- Sufficient proven natural gas resources for 25 years

- Shareholder and government approval of upstream gas supply plans for at least 10 years

- Presence of upstream gas supplier shareholders and government funding

- Stability of upstream fiscal terms secured for duration of gas supply to project

- First gas supply/infrastructure projects matured, Engineering, Procurement and Construction contracts negotiated and ready for award

- Agreements for gas supply to LNG plant executed. LNG plant/shipping:

- All relevant authorizations, licenses, and permits secured including LNG export permit

- At least 70 per cent of unconditional long-term take-or-pay LNG sales and purchase agreements executed

- Sufficient LNG shipping capacity negotiated under time charter and/or acquisition ready for award

- Long-lead items identified, supplier’s delivery schedule verified, and contracts ready for award

- Engineering, Procurement and Construction contracts and contractor performance bond negotiated and ready for award

- Project development schedule critical path and key remedial actions identified

- Information and communication hardware and software acquisition and training approved

- Health, safety, and environment plan for staff and contractors approved

- Key local communities and stakeholders engaged and supportive of the project

- Due diligence of key contracts, final economic plan, premises, and results conducted and approved

- Stability of midstream fiscal terms secured for duration of project

- Shareholder and government approval of plant financing plan. Project implementation:

- All relevant shareholder and company agreements, policies, and procedures approved

- Human resources plan, succession management and local talent development approved

- Plant flawless start-up and operation plan and training and operating manuals agreed

- Shareholder zoned positions nominations approved and key staff ready to be deployed

- Knowledge management, strategic and financial planning processes defined and agreed

- Project implementation team, strategy and identification of key causes of cost and schedule overruns with preliminary mitigation plans approved

- Government and community relations staff identified; plan approved for periodic engagement to debrief communities and authorities on progress and unforeseen issues

- Project risk management strategy established that includes periodic risk assessment, impact analysis, mitigation strategy, accountability, and performance monitoring.

The list of essential conditions will vary from project to project, depending on location, business model, and shareholders involved. But it should cover all key areas of risk that could compromise the project’s potential to create value or its ability to deliver the long-term results premised in the final project economics.

LNG project implementation performance post-FID may still disappoint due to externalities beyond the reasonable control of staff, contractors, and shareholders. A well-prepared list of essential conditions, agreed to and fulfilled before the FID, can be a powerful aid to maximizing shareholder alignment, encouraging agile decision-making, and avoiding precipitated decisions. This can provide staff and contractors with additional time and resources to meet agreed decision thresholds, avoiding greater cost and/or schedule overruns during the project implementation phase, which are so detrimental to long-term value creation for all stakeholders.

The question is—do LNG projects face greater risks and uncertainty today to reach an FID? With a 55-year track record of development and implementation of LNG projects in the most remote and challenging locations, with various technological innovations from the well to the burner tip, and wider utilization of LNG as a form of natural gas distribution for power generation, industrial and residential use, and transportation on land and sea, there is less technical uncertainty in the development and implementation of LNG projects.

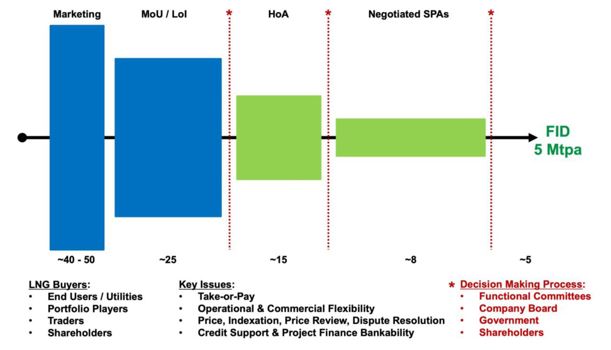

However, as LNG project FIDs continue to evolve from the traditional supply point to a destination point to a portfolio of supply to a portfolio of demand, the critical path to reaching FID in LNG projects has become the underpinning of the commercial and financial agreements of the project.

LNG Project Business Development – Commercial Maturity Stages From Letter of Intention to FID

With greater optionality for LNG buyers and sellers to fulfil their essential conditions to reach the FID of their LNG project, export or import, comes the need to develop and mature a greater number of sale and purchase options in parallel up to the point of FID. Buyers and sellers have a wide list of operational, commercial, and financial criteria to satisfy before a medium- to long- term agreement capable of attracting project finance can be executed.

LNG project developers without sufficient balance sheet capacity and needing to raise substantial project finance mitigate this risk by maturing a larger number of potential LNG buyer agreements up to FID. This requires additional human resources in commercial, legal, and financial functions, and a structured decision-making process involving project staff, advisors, shareholders, and governments to ensure alignment.

Large international oil and gas companies with substantial balance sheet capacity and activities along the natural gas value chain have, in principle, the ability to reduce the time required to reach an FID by incorporating the new LNG supply into their global trading portfolios and executing new medium- to long-term LNG supply agreements when buyers and market conditions are more favourably aligned.

The ability of large shareholders to underpin an LNG project FID with their own supply portfolio will require balance sheet capacity, reducing the need for project financing at FID, providing additional time to reduce project completion and commercial risk, and affording the opportunity to pursue project financing later, increasing the chances of securing more competitively priced loans.

The decoupling of LNG project construction contract awards, execution of medium- to long-term LNG sales and purchase agreements, and project financing by large international oil and gas companies comes at a price—greater internal complexity involving capital allocation decisions, and a bias towards larger LNG projects with opportunities for value creation in the upstream, midstream, and downstream components to justify the larger enterprise.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.