Clean energy innovation: fact or fantasy? [NGW Magazine]

The International Energy Agency’s Special Clean Energy Innovation report, released July 2, warns that the amount of new technology needed to meet the net-zero target in 2050 is virtually a fantasy.

IEA head Fatih Birol said there is a “stark disconnect today between the climate goals that governments and companies have set for themselves and the current state of affordable and reliable energy technologies that can realise these goals.”

It said they were insufficient on their own to bring emissions to net-zero by 2050 without jeopardising energy security.

This raises the question: can clean energy innovation alone deliver? Given Birol’s warnings and the IEA’s own Clean Energy Progress’ (TCEP) report that says only six out of 46 clean energy technologies and sectors under development were ‘on track’ with the IEA's Sustainable Development Scenario (SDS), the answer is likely to be “no.”

In fact, the IEA analysed more than 400 clean energy technologies and concluded that although renewable technologies in use now can deliver a large amount of emissions reductions, they are not enough on their own.

With the current – even before the Covid-19 pandemic – and planned level of investment in clean technologies, this is unlikely to happen. IEA’s World Energy Investment (WEI) report pointed out that the overall share of global energy spending that goes to clean energy technologies has remained about one-third of global energy spending for the last ten years. To achieve the Paris Agreement climate goals, it needs to treble in the next ten years.

Birol said: "Without decarbonising the transport sector there is no chance whatsoever of meeting climate targets…. Around half of emissions reductions that are needed still require major innovation of clean technologies. Whatever we do with renewables will not be enough on their own and it will be all but impossible to meet net zero by 2050."

The IEA’s recommendation in its recently published Sustainable Recovery plan is to upgrade existing nuclear and hydropower plants in countries where licensing and approvals processes are in place, together with coal-to-gas switching and the conversion of gas to hydrogen.

The challenge

The IEA states: “There are no single or simple solutions to putting the world on a sustainable path to net-zero emissions. Reducing global CO2 emissions will require a broad range of different technologies working across all sectors of the economy in various combinations and applications.” Not just in Europe, but globally, especially in Asia led by China and India where most energy demand growth is taking place.

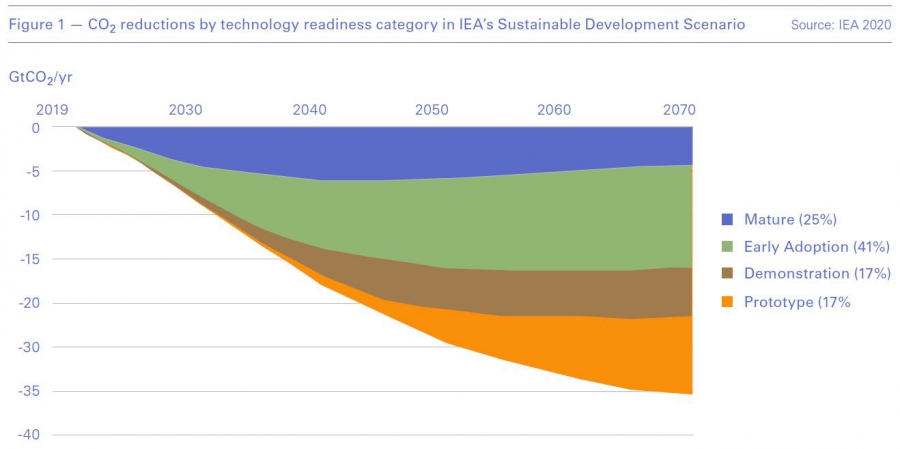

The IEA says that around 35% of the cumulative CO2 emissions reductions needed to shift to a sustainable path come from technologies at the prototype or demonstration phase. A further 40% of the reductions rely on technologies not yet commercially deployed on a mass-market scale (Figure 1).

Clearly, technologies at an early stage of development play an outsize role. As NGW among others has pointed out for some years, even the IEA’s midcase outlooks rely heavily on the widespread use of carbon capture and sequestration, for example.

The IEA gives examples of how challenging this is. For hydrogen to contribute effectively to emissions reductions, an average of two new hydrogen-based steel plants would be required to begin operating every month between now and 2050. The technology for these plants, however, is only at the prototype stage. At the same time, 90 bioenergy plants that capture and store their own CO2 emissions would have to be built every year. Today, there is only one large-scale facility in operation.

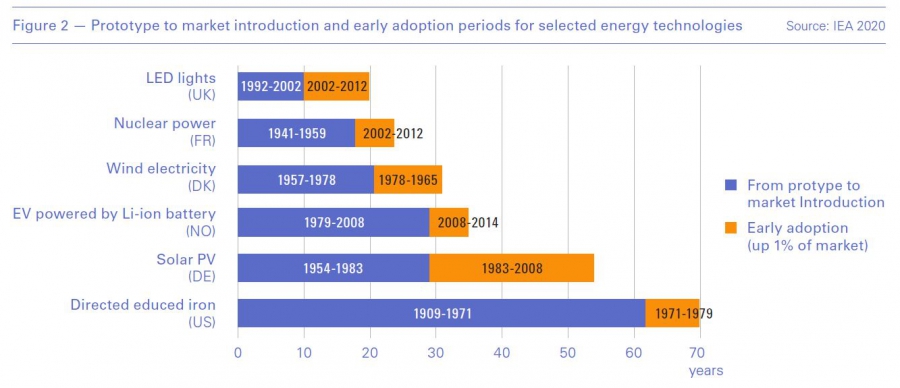

Another challenge that the IEA vividly demonstrated in its report is the time it takes for inventions to go from the laboratory to the market (Figure 2).

Bringing major new energy technologies to market on a large scale after the first prototype took between 20 and almost 70 years. For example, the adoption of light-emitting diodes in buildings was done in the shortest amount of time, while nuclear power was introduced in France 18 years after the initial prototype. In both cases, government intervention accelerated innovation.

From prototype to health and other regulatory clearance to commercially competitive production takes years and many projects fall by the wayside – although Eni is still persisting with experiments in nuclear fusion, which has always been five or ten years away from being deployed.

Covid-19 has only compounded the difficulty by soaking up money that might have been available for clean energy investment.

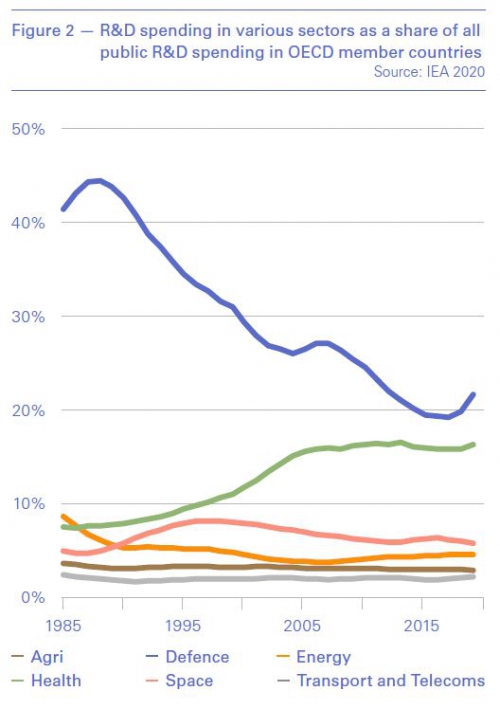

Even before the pandemic, investment in research and development (R&D) was not sufficient to deliver clean energy innovation on the scale and in the time required to achieve net-zero by 2050. Energy R&D spending has been losing ground to other public R&D spending in recent decades, with health and defence now receiving around five times more R&D funding than energy in OECD member countries. In addition, since 1985, energy has accounted for a diminishing share of public R&D funds (Figure 3).

With diminishing R&D investments, it makes it that much harder to develop the next-generation innovations needed to deliver clean energy.

The IEA says that there is an opportunity now to address this technology deficit, through measures that form part of post-Covid-19 economic recovery packages. But it may not be happening at the required scale – quite the opposite. The risk is that the economic damage done by Covid-19 may lead to reductions in R&D budgets and investment. With energy industry spending expected to be down by 20% this year, or by $400bn, this is quite likely.

The IEA states that governments have a pivotal role to play that goes far beyond simply funding R&D. They can set overall national objectives and priorities, invest in essential infrastructure, and enable major demonstration projects to go ahead. But this does not appear to be happening at the required scale and pace, not even in Europe – where it is talked about the most – let alone in Asia where coal is still being burned in large quantities.

The IEA warns that “failure to accelerate progress now risks pushing the transition to net-zero emissions further into the future.” In fact, the whole report is riddled with such warnings. The size of the challenge is clear.

IEA’s proposals

The IEA proposes five key innovation principles for governments aiming to achieve net-zero emissions goals while maintaining energy security. These principles primarily address national policy challenges in the context of global needs, but are relevant to all policy makers and strategists concerned with energy technologies and transitions:

- Prioritise, track and adjust the processes for selecting technology portfolios for public support;

- Raise public R&D and market-led private innovation;

- Address all links in the value chain and ensure they are advancing evenly towards market application;

- Build enabling infrastructure, by mobilising private finance through sharing investment risks;

- Work globally for regional success.

Through these, all countries around the world could pursue a more secure and sustainable energy future, by accelerating transitions to cleaner and more resilient energy systems.

Even the EU is being forced to dilute its conditions for dispensing the proposed €750bn recovery fund. The compromise looks likely to be one where governments may be obliged to reform and invest to boost longer-term sustainable growth, but based on their own priorities and without intrusive oversight. So far the record is mixed. In most EU countries and the UK, state aid has been focused on health, shoring up employment and helping ailing companies and small business, without any serious green conditions attached.

The private sector is focusing on surviving Covid-19 and over the next few years the priorities will be recovering liquidity, cash-flow, debt re-payment and re-building business.

A role for gas?

Birol says that without much faster clean energy innovation, achieving net-zero goals in 2050 will be all but impossible, which at least suggests that natural gas will have a role to play complementing clean energy.

But many non-governmental organisations oppose this on principle; and many lenders are following the same line of thought: unabated gas has to become obsolete and there is no half-way house for that absolutist approach.

One solution is the conversion of natural gas to hydrogen. There are many technologies necessary to produce, transport, store and consume hydrogen, available today at different stages of maturity, with some facing specific technical challenges.

The European Commission (EC) presented on July 8 a strategy to develop renewable ‘green hydrogen’, for installation between 2030 and 2050 for sectors otherwise hard to decarbonise or where electrification is difficult or impossible.

The potential is there, but the challenge is cost and specifically the costs of electricity and electrolysers – both of them need to come down substantially – and time to reach the required scale. Even if the EC’s target to produce 10mn metric tons green hydrogen by 2030 is achieved, this will be less than 10% of the forecast global hydrogen demand at that time. In the meanwhile, blue hydrogen technology – given the head-start it has – will be developing further, becoming more competitive. Equinor’s H2H Saltend project in the UK is a good example.

The EC has accepted the need for a phased, gradual approach where a halfway house of ‘blue hydrogen’ – produced from conversion of natural gas and surely greener over its life-cycle than the so-called green hydrogen – will play a role during the “transition phase”. This is an improvement on the ‘electrons-only’ approach that the gas industry had been fearing. But details are lacking. So-called ‘turquoise’ hydrogen, whereby solid carbon for easy disposal or use by pyrolysis is the by-product of separating hydrogen from methane at high temperature, is apparently ignored.

Given the time required to develop new, commercially competitive technologies (Figure 2), and EC’s hydrogen strategy roadmap, blue hydrogen – which is already proven technology – is likely to have an important role to play for the next 20 to 30 years. With the EC leaving the door open, there is still a lot to fight for.

Apart from Europe, where the message is mixed and lacks clarity, the longer-term future of natural gas looks good elsewhere: in Asia, Africa, Eurasia and the Americas.

Natural gas and the required infrastructure are already there. It is plentiful and cheap, readily available and reliable, and easy wins may be had by displacing diesel and coal. Botswana, Mozambique, Morocco and South Africa are among the major resource holders able to benefit from fuel switching, and save on imports as Tanzania and Cameroon have.

Most reputable forecasts see a role for natural gas well into the future. This includes the IEA in its 2019 World Energy Outlook (WEO2019), which expects natural gas to retain a critical role in global primary energy demand to 2040, with its share growing by about 20% in the sustainable development scenario, mostly driven by Asia.

What is needed is policy certainty to ensure that the required investment to maintain gas supplies at the required levels well into the future remains available. Asia is doing just that.

Challenges

The major emitting sectors – aviation, shipping, heavy-duty trucks, iron, steel, cement and chemicals – do not yet have commercially available solutions for deep decarbonisation. As the IEA says, “there are no single or simple solutions to putting the world on a sustainable path to net-zero emissions."

Green hydrogen has the potential to provide some of the answers, but while it benefits from increased political support, as the new EC hydrogen strategy demonstrates, there are still many challenges linked to both economic and technological uncertainties to be overcome before it becomes a viable commercial proposition.

At the same time as presenting its hydrogen strategy July 8, the EC also released its Strategy for Energy System Integration, which it complements. This states that depending on the chosen decarbonisation pathway, the volume of natural gas consumed in Europe will progressively shrink. By 2050 the share of natural gas in gaseous fuels is projected to be just a fifth of the total, the remainder coming from renewable gas.

But as is often the case with EC, these new strategies raise more questions than they answer. Even though the strategy is a roadmap to accelerate the phasing out of fossil fuels including natural gas, it does not give a timetable of how this will be achieved. Instead it uses generic terms like ‘transitional phase’, ‘acceleration’ and ‘cost-effectiveness’, without specifying what precisely these mean.

Even though the EC admits that “European industry needs clarity and investors need certainty in the transition,” not only is this not provided, but it does not include the natural gas industry. The EC recognises that “this will be a challenge taking a long period of time – the EU will need to plan this transition carefully, taking into account today’s starting points and infrastructure that may differ across member states,” but it proposes to do this by introducing yet more “EU-wide instruments.”

The next two to three years will be crucial in terms of how these strategies develop as the EU comes out of the pandemic – especially as the priorities in EU member states appear to be economic and employment recovery. They will also be crucial for the global gas industry as it grapples with oversupply and low prices. The outcomes will define the direction of EU’s energy industry for the next two or three decades.

Given expectations of global population growth and aspirations for improved living standards, the world will need reliable and affordable energy, especially in Asia and Africa – where often economic factors and security of energy supplies take priority over net-zero emission aspirations.

The Paris Agreement goal of keeping temperature rises to 1.5 °C is widely accepted, but as Birol said: “Setting ambitious climate goals is a courageous policy decision; realising them requires more than courage.” The IEA report is timely in at least pointing out the step-changes needed in clean energy innovation to realise these goals, even if it too has no answers on how to achieve them.