Chrysaor spreads its wings [NGW Magazine]

Standing out from the small-fry in the UK mergers and acquisitions arena is Chrysaor, a newly-established entrant to the UK continental shelf. In just a few years, it has used a few billions of dollars of private capital to carve out the kind of diversified position a major could be proud of.

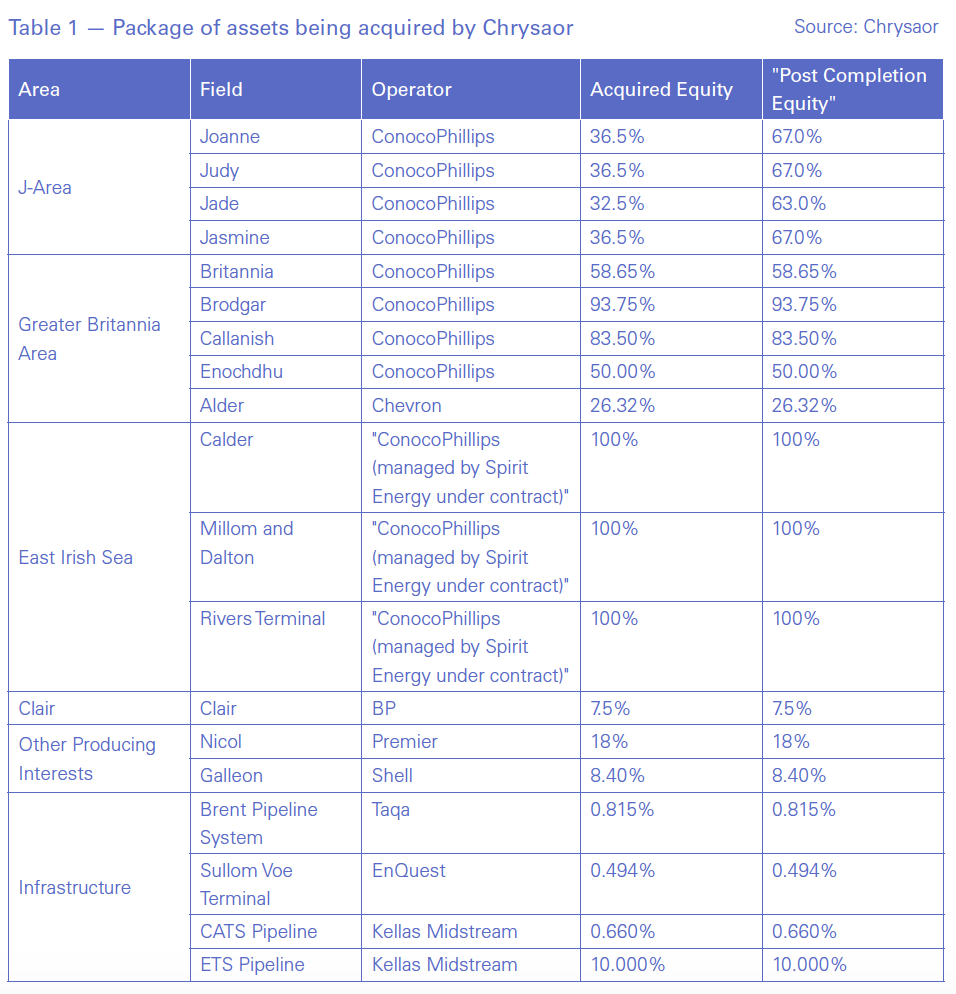

Bought as a job lot from ConocoPhillips for $2.675bn – unlike the selected package of goodies and less exciting offerings that Shell sold it a few years before – the April acquisition brings two new hubs, J-Block and Britannia; as well as more reserves and cashflow in the West of Shetland. As consultancy GlobalData pointed out, it also shifts the buyer’s centre of gravity, from being chiefly an oil company to one with roughly equal oil and gas interests.

In addition to the associated high-quality oil and gas reserve base, these hubs have access to significant contingent resource potential providing near field opportunities for production growth and reserve replacement, Chrysaor said.

The deal almost doubles Chrysaor’s reserves, adding 280mn barrels of oil equivalent (boe) and bringing its total to above 600mn boe, as of January 1, 2019.

Its own forecast production this year will exceed 185,000 boe/day, making it one of the biggest companies in the UK North Sea for the next few years at least. Last year, ConocoPhillips' assets produced 72,000 boe/d, while Chrysaor expects to produce even more this year than last from its own assets. Chrysaor intends to become “one of Europe's leading independent, full cycle exploration and production companies," it said.

The assets it now has are rich in opportunity for discovery and maturing. While the other new entrants are finding and developing assets for production and sale in half a decade, the scale of Chrysaor’s ambition puts it in a different league. It has its eye on the long-term, owing to the time it will take to deliver a worthwhile return after a necessarily substantial investment programme.

Consultancy Wood Mackenzie described Chrysaor's growth as "incredible." It had been a relatively small producer before it acquired a batch of assets from Shell.

There is also the possibility of some further disposals, if there is need to raise capital to finance some of the work. The East Irish Sea assets for example, which ConocoPhillips acquired when it bought Burlington Resources, might be more valued by Spirit, the Centrica-led joint venture that operates the nearby Morecambe Bay fields and the Barrow terminal.

Chrysaor CEO Phil Kirk said the acquisition reflects its continuing belief that the UK North Sea has material future potential for oil and gas production. These assets complement its existing operations and, with operating costs at less than $15/barrel across the enlarged group, its portfolio delivers high margins and significant positive cash flow, he said.

"In the Central North Sea, we will own a range of operated hub infrastructure providing access points in an area with the largest undeveloped contingent and prospective oil and gas resource base in the UK. In the West of Shetland region, we have secured long life cashflows from two world-class fields operated by BP. Chrysaor's West of Shetland position also provides exposure to a developing region with significant interest and momentum from major oil companies. We will seek to build on that through the acquisition of additional interests and acreage."

Kirk said ConocoPhillips' "highly competent workforce" would work with it. "We will have the skills and resources of a major independent oil and gas company and the drive to help ensure the basin's potential is fully realised."

The US major will retain its London-based commercial trading business and its interest in and operatorship of the Teesside oil terminal when the deal completes, which is expected later this year, subject to the usual approvals. Britannia gas flows to St Fergus in Scotland while the J-Block gas flows to Teesside through the independently-owned Central Area Transmission System.

Chrysaor will assume responsibility for an ongoing decommissioning programme on ConocoPhillips' end-of-life assets, which is very well advanced and proceeding in accordance with ConocoPhillips' plans. Chrysaor plans to have materially completed execution of this programme by 2022, and values decommissioning competency as a long-term commercial opportunity and enabler in the UK.

Chrysaor is backed by Harbour Energy, a permanent capital energy investment company managed by EIG Global Energy Partners. Chrysaor will fund this acquisition from existing cash resources and an upsized $3bn reserve-based lending debt facility underwritten by Bank of Montreal, BNP Paribas, DNB Bank, and ING Bank.

Chrysaor chair Linda Cook, formerly of Shell, said Chrysaor would be able to bring “the strategy and capital required for reinvestment and growth. The outcome is a reinvigorated oil and gas sector, an extension of the producing life of existing fields and the maximisation of hydrocarbon resource recovery.”

A case in point is the Greater Armada Area, which Shell was poised to decommission; but into which Chrysaor is now investing time and money to extend its productive life as a hub. “It could take a similar approach here, particularly with it now becoming operator at the Britannia and J-Area hubs in the Central North Sea, which have potential for further growth,” Woodmac said. “Chrysaor also gains a stronger presence in the West of Shetland with a stake in Clair. It already had an interest in the Schiehallion field. There is huge growth potential in the region and it wouldn't be a surprise to see Chrysaor make further moves in the near future, to bolster its mid- to long-term production outlook.”

And from the seller's perspective, Woodmac pointed out, there are lower cost opportunities elsewhere in the world for ConocoPhillips, particularly in the US. "Among such a wider global portfolio, UK fields would have struggled to compete for capital," Woodmac said.

Another consultancy, GlobalData, said: "Chrysaor will be picking up valuable producing assets such as Clair, Brodgar and Britannia, but the lack of planned or announced projects in the region suggest that new investment will be focused on redeveloping existing assets. Value is likely to be added by increasing recovery from the mature 'J-Area', in which Conoco undertook a development drilling campaign last year.

"Looking forward it will be interesting to see how decommissioning liabilities will be dealt with as part of the deal; major facilities are undergoing decommissioning such as the Viking Satellite platforms and its associated infield infrastructure, which come with significant cost. The company was able to avoid around $1bn in decommissioning liabilities associated with the Shell mega deal announced in 2015.”

Right assets in right hands

"Maximising the economic recovery" is the watchword of the UK regulatory authorities, which is to be achieved through the principle of "the right assets in the right hands." New entrants can often appraise assets with a fresh eye, forge new relationships more easily and have lower materiality thresholds than the previous owners. And while they do not have all the resources available to majors, they can at least find their own solution to a technical problem and implement it more quickly.

As the CEO of one UK-focused producer told a conference in London in March that was organised by the Natural Resources Forum: “It is not our ambition to be a late-life asset owner, but we can do things that the current holders cannot do so well. Majors will keep looking for new adventures such as Permian tight oil in the US; but we can focus on things later in life, which is natural turnover of assets.”

Another speaker said that where companies were domiciled could make a difference to their outlook. ConocoPhillips, Chevron and ExxonMobil for example have a predominantly US shareholder base and US companies will most likely continue to retrench; while the UK has European players, especially in the West of Shetland, where there is continuing investment, she said.

For whatever reasons, the landscape of the UK industry continues to evolve. This diversity of players in the basin is helpful to securing a sustainable industry that delivers a domestic supply of oil and gas for decades to come, commented the CEO of Oil & Gas UK, Deirdre Michie.

“ConocoPhillips UK has been a stalwart of the North Sea and this acquisition will help ensure that its legacy continues to be built on,” she said.

M&A back in play

The Chrysaor deal overshadows a number of other, lesser upstream deals done in the previous months, ending a relative drought.

Smaller but still noteworthy as being part of the trend is RockRose’s $140mn purchase of US Marathon Oil’s UK assets, again like the Chrysaor deal, a corporate takeover and hence free from the threat of pre-emption rights.

The deal will be funded from its existing resources and facilities and is expected to close later this year. Marathon holds about 40% and the operatorship of fields in the Greater Brae Area and also oilier stakes in the BP Foinaven assets. And it comes with some stakes in the St Fergus Sage terminal and the Brae-Forties pipeline.

"This acquisition marks a major step change in the group's reserves and production profile. Given the quality of these assets the board's view is this is a good opportunity to make the transition to the role of operator,” RockRose CEO Andrew Austin said.

“We look forward to welcoming Marathon Oil UK employees, who have an excellent track record operating in the North Sea, to the RockRose team at closing,” he said.

And Norwegian DNO’s hostile bid for Norway/UK focused independent, Faroe, also succeeded. After upping its stake in Faroe last year, it capitalised on a series of disappointments and bought the rest of the shares in early 2019. The main reason for that deal was to offset some risk in Kurdistan with more predictable assets that yield cashflow in OECD territory.

RockRose almost added another trophy, in the shape of Independent Oil & Gas, which would have given its Marathon team more to get its teeth into; but it was baulked of that as IOG managed to find enough funding for its near term operations and to postpone some debt repayments. IOG is now able to concentrate on developing its own hub plans in the gassy southern North Sea, with a first well planned for the Harvey field, which it must start drilling by September. Cashflow may then follow. Nearby, ownership of the Thames pipeline gives it a route for its Vulcan field satellites. Using old offshore infrastructure to develop otherwise stranded assets saves money and mitigates risk.

Late last year also saw the completion of Serica’s purchase of Bruce, Keith and Rhum (BKR) stakes, whose reserves are over 80% gas. The company went from 7 to 140 employees last year, and total reserves went from 3.1mn boe to 68.8mn boe. Commenting on its 2018 results, CEO Mitch Flegg said in April that Serica aimed to extend the "field life of the BKR assets by concentrating on enhancing recovery and reducing costs through eliminating unnecessary complexity. The multi-disciplinary team is already delivering exceptional results as demonstrated by the continued strong production during the first four months of Serica BKR operatorship."

Net 2P reserves at year end went up to 68.8mn boe reflecting an increase in Erskine reserves and the addition of Columbus reserves.

CEO Mitch Flegg said the company is also aiming to grow its portfolio around the Central and Northern North Sea and – coupled with tax synergies – this means that the search for new opportunities is focused on the UK.

|

OGUK looks for future growth “Attracting investment is key to securing the potential new generation of production life,” Oil & Gas UK’s market intelligence manager Ross Dornan told NGW. Speaking the day the offshore industry group launched its Business Outlook 2019,he said $200bn will have to be spent upstream in order to realise the production goal and close the gap between the yellow and the lower blue line according to the group’s Vision 2035 (see graph). “This is a challenge as the markets are still uncertain and volatile. Both oil and gas prices are relatively low and I don’t expect to see any significant upside. But being sustainable and competitive is important. Operating expenditure has halved since 2014 and prices have gone down for a range of factors: there is more efficient working across the board; there is more supply of labour. These are transformational changes in the market conditions. “We are also getting towards standardisation of equipment and there is an efficiency task-force. I would not say we are completely standardised, but unit development costs are down by about half, and standardisation has a part to play in that. “Mergers and acquisitions are market driven as companies are looking to right-size their portfolio and there are opportunities in the UK for more activity. The Oil & Gas Authority also plays a part, ensuring assets end up in the right hands, so it is a pro-active regulator as well. Private equity companies have traditionally a relatively short timeline but if they can create real value they could go for an initial public offering or sell their portfolio outright – their assets would be valuable to a new owner too. “So we see there is a benefit for new entrants and all are welcome. There is significant support from the UK government, such as the transferable tax history; and now we are asking the government to stick with the industry and recognise the contribution it has made to the UK economy, to energy security, our balance of payments and employment. We would like it to be recognised in an energy strategy, as it has contributed cumulatively £350bn in direct production tax alone, never mind the countless billions more the industry has pumped into the economy. “Drilling has become more selective, so only the best prospects are being drilled. Investors are still cautious and using technology more cost-effectively and achieving good results despite the fewer wells drilled than in Norway.” Consultancy Westwood though thinks that there are not enough discoveries to close the gap, even if the technical and commercial successes are going up, and even if producers are finding more with fewer wells – while Norway is had the opposite experience owing to its fiscal system where failure is not penalised. The UK, 50 years on, is one of the global hotspots for high-impact discoveries, but companies are recycling just a fifth of the cash they get back from activities, while a healthier recycling rate would be nearer half, according to Westwood’s Keith Myers. He told the same London event that the finance ministry might think about raising the effective tax rate from 10-11% if the industry does not put more back, he said, striking a note of warning in these prolonged pre-Brexit days: “Especially if there is a change of government.” |

.png)