China’s climate envoy says fossil fuel phase-out is unrealistic [Gas in Transition]

China’s special envoy for climate change, Xie Zhenhua, told ambassadors attending the 9th China and Globalization Forum in Beijing late September that “it is unrealistic to completely phase-out fossil fuel energy.” He said oil, gas, and coal will continue to play a crucial role in global energy supply and in maintaining energy security.

Xie Zhenhua will be representing China at the COP28 summit. He has overseen environmental protection, resource conservation, energy saving and pollution reductions and climate change affairs in China.

Despite the massive increase in renewable energy capacity, way ahead of any country in the world, continued growth in energy demand means that China needs to rely on increasing all forms of energy, including coal, oil and gas.

In 2022, China accounted for almost one-third of global renewable power generation and close to 40% of global combined solar and wind energy installed capacity. And yet, that contributed only just over 8% of its total primary energy consumption. The share of coal was over 55%, oil 17.7% and gas 8.5%. According to BP’s ‘New Momentum’ scenario in its Energy Outlook 2023, with China’s primary energy demand growing by 9% by 2050, even with renewables providing 38% of it, fossil fuels will still account for close to 50% of its primary energy.

Xie said “the intermittent nature of renewable energy and the immaturity of key technologies like energy storage means the world must continue to rely on fossil fuels to safeguard economic growth.”

But he also said “China was open to setting a global renewable energy target [at COP28] as long as it took the divergent economic conditions of different countries into account.”

Xie said that “it is essential to prioritise energy transition in emission reduction actions.” Emissions which come from fossil fuel use can be reduced with carbon capture, utilisation and storage (CCUS) technology.

Earlier this year, Chinese state-owned power generator China Energy Investment Corporation started operations at Asia's largest coal-linked CCUS facility at the Taizhou thermal coal power plant. Reuters states that carbon capture has become a focus area for China's major power generators, as the country pursues a plan to achieve a carbon emissions peak by 2030.

This year, lower levels of rainfall across Asia, resulted in the fastest drop in hydropower electricity generation in decades, affecting both China and India, reinforcing their views that -until technologies addressing renewable intermittency fully mature- energy security will require use of fossil fuels for a long-time to come.

In effect, that was the message from Xin Baoan, executive chairman of State Grid Corp. that delivers electricity to more than 80% of China. He said in June that State Grid is focusing on ensuring security of supply over green goals. China will prioritise preventing blackouts over its longer-term goal of decarbonizing the country’s power mix. Xie confirmed this when he said “it is essential to ensure grid stability, safeguard energy supply security, and support socio-economic development.”

In effect, that was the message from Xin Baoan, executive chairman of State Grid Corp. that delivers electricity to more than 80% of China. He said in June that State Grid is focusing on ensuring security of supply over green goals. China will prioritise preventing blackouts over its longer-term goal of decarbonizing the country’s power mix. Xie confirmed this when he said “it is essential to ensure grid stability, safeguard energy supply security, and support socio-economic development.”

India shares similar views

Similarly to China, India is also opposed to setting a deadline for fossil fuel phase-out. This was evident at the 2023 G20 summit, presided by India, where the final declaration avoided such a deadline, referring instead to accelerate “strong, sustainable, balanced and inclusive growth” and pursuing “low-GHG/low-carbon emissions, climate-resilient and environmentally sustainable development pathways.”

In the end, the G20 agreed to push for a tripling of renewable energy capacity by 2030, but made no reference to oil and gas phase-out. Instead, it referred to “accelerating efforts towards phase-down of unabated coal power, in line with national circumstances and recognizing the need for support towards just transitions.”

India’s coal minister, Pralhad Joshi, said in November 2022 that coal “will continue to play a big role in India until 2040 and Beyond.” He referred to coal as an affordable energy source for which demand has yet to peak in India.

Along with China, India has been resisting phase-out of fossil fuels in all climate summits since COP26 in Glasgow. The two countries have cooperated on a number of occasions at international forums to block such moves.

Both countries rely heavily on coal, not just because of its abundance domestically and low cost, but also because it enhances their energy security and independence.

Reliance on gas

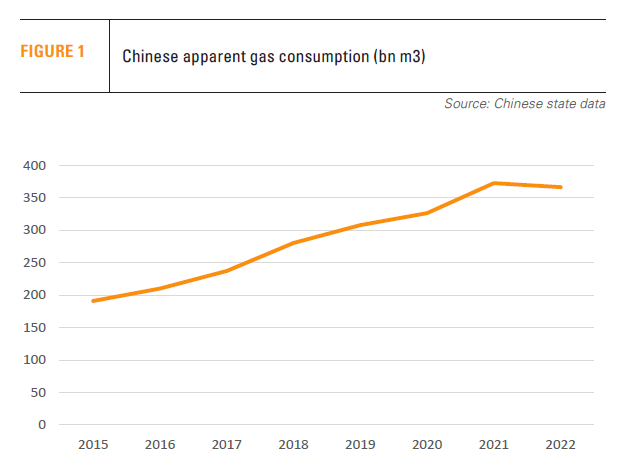

China is the world's third-largest gas market. In 2022 it consumed 365bn m3 gas (see figure 1). The country is also the world’s top importer of LNG, ahead of Japan in 2023. China imports about 41% of its natural gas supplies.

China’s energy security policies are increasingly being shaped by the concern energy security and vulnerability to sanctions. As a result, according to OIES, China is consolidating its relations with friendly energy suppliers. In this respect, the expansion of BRICS to include oil and gas producing countries, Saudi Arabia, UAE, Iran and Egypt -promoted by China- opens new trading avenues, enhances energy cooperation and strengthens their energy security.

Given China’s dominant role in global oil and gas markets, the country’s energy policies have a major bearing on global energy transition.

According to OIES, the Chinese government is favouring use of coal to back up intermittent renewables, due to concerns about gas supply security. However, gas is likely to play a larger role as a balancing fuel in future “if and when gas prices fall or supplies are deemed more secure.”

According to BP’s New ‘Momentum’ scenario in Energy Outlook 2023, China’s natural gas demand will increase from about 8.5% in 2022 to 13% by 2050.

With domestic gas production expected to peak in the mid-2030s, China could become increasingly dependent on imports between now and 2050. Hence its reluctance to abandon coal and the increasing importance it places on CCUS to abate related emissions - shaping its approach to COP28.

Implications for COP28

In an indirect way China’s views are reflected in what Cop28 president Sultan Al-Jaber said recently: “the world needs to phase out fossil fuel emissions rather than fossil fuels themselves.” Adding that COP28 will fast-track phase down of fossil fuels, but “the speed of the transition will be driven by how quickly we phase up zero-carbon alternatives.”

It appears inevitable that the COP28 summit in Dubai could see a repeat of what happened in COP26 regarding the choice of words, between “phase out” or “phase down” of fossil fuels – but also between abated and unabated fossil fuels.

Xie confirmed at the Beijing Forum that “China maintains an open attitude toward formulating a global renewable energy development goal for COP 28, which is acceptable to all parties, considering different national circumstances and combining qualitative and quantitative aspects. A potential solution has been proposed at the recent G20 Summit. The conference should not only set the goals but also consider their achievability and necessary conditions, such that they can truly be implemented.” But it will oppose the phasing out of fossil fuels.

Xie confirmed at the Beijing Forum that “China maintains an open attitude toward formulating a global renewable energy development goal for COP 28, which is acceptable to all parties, considering different national circumstances and combining qualitative and quantitative aspects. A potential solution has been proposed at the recent G20 Summit. The conference should not only set the goals but also consider their achievability and necessary conditions, such that they can truly be implemented.” But it will oppose the phasing out of fossil fuels.

He stressed that a new energy system should be established before the old one is abolished. That is why China is prioritising energy transition in terms of emission reduction actions. But, apart from renewables and EVs, the country is also investing in and developing new technologies such as large-scale energy storage, superconducting electric power transmission, smart grids and microgrids.

In his view, despite their differences and increasing competition, China, the US and Europe complement each other in many ways in terms of green technology and markets, and as a result they have broad prospects for cooperation on renewable energy.

Nevertheless, with China being the world’s top emitter, contributing over 30% of global emissions, these are likely to peak and begin to fall only when China’s emissions start declining - expected after 2030.

In a hopeful sign, this year renewables and nuclear, passed 50% of China’s installed power capacity for the first time, overtaking fossil fuel-based power capacity.

Xie said that he has proposed to John Kerry, the US climate envoy, that he could travel to a third country or the US to meet him to talk about the issues. But that is unlikely to include a compromise on China’s resistance to fossil fuel phase-out.