China Powers Global Gas Demand Growth to 2022, says IEA

(7am GMT, 8am UK time, 9am Paris time)

Gas will grow faster than oil and coal over the next five years, helped by low prices, ample supply, and its role in reducing air pollution, according to the International Energy Agency’s Gas 2017 report. The study, previously known as the Gas Medium-Term Gas Market report, was published July 13. It also forecasts that the recent US shale gas boom "shows no sign of running out of steam."

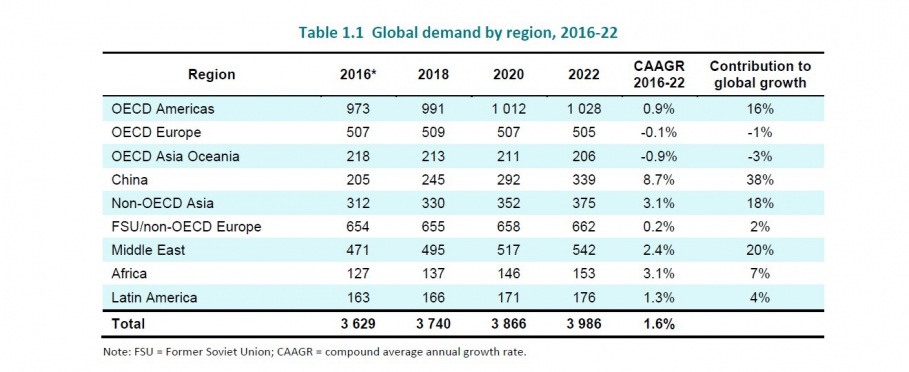

World gas demand will grow at 1.6%/yr on average from 2016-22, a slight upward revision from its similar forecast a year ago of 1.5% (also the average annual growth rate during 2010-16), the Paris-based organisation said.

Ninety percent of that growth of 360bn m3 during 2016-22 will come from developing countries, led by China which alone will account for almost 40% of the global demand increase. Moreover, much of the increased demand will be from industries in China, India and the US – for instance in the petrochemical sector – as use of gas in global power generation will grow by only 1%/yr.

That’s far lower than the gas in power generation growth rate of 4%/yr seen in 2004-10.

Competition from coal and renewables, but also more efficient gas-fired CCGT units, will limit gas in the sector in 2016-22, although gas for power will see stronger growth in China and the Middle East.

Overall demand across the US, Mexico and Canada will surpass 1,000bn m3 by 2022, meaning that one-quarter of global gas will be used in North America, as global demand rises from 3,629bn m3 in 2016 to 3,986bn m3 in 2022. But demand across most of Europe will decline.

Graphic credit: International Energy Agency’s Gas 2017 report

Global gas production is also forecast to rise by 1.6%/yr in 2016-22. The US alone will account for almost 40% of global output growth, which means that by 2022, 890bn m3, or one-fifth of world gas production, will come from the US.

US shale gas still booming

"The US shale revolution shows no sign of running out of steam and its effects are now amplified by a second revolution of rising LNG supplies," said Dr Fatih Birol, IEA Executive Director. "Also, the rising number of LNG consuming countries, from 15 in 2005 to 39 this year, shows that LNG attracts many new customers, especially in the emerging world. However, whether these countries remain long-term consumers or opportunistic buyers will depend on price competition."

Russia, China and the Middle East will also add to production growth.

International gas trade reached 1,060bn m3 in 2016, the IEA’s report notes.

Pipeline-traded gas has gradually lost market share with the rapid development of global LNG trade, with the IEA forecasting that LNG will account for 38% of all traded gas in 2022, and that the world is on the cusp of a “second wave of LNG expansion.”

It expects global liquefaction (LNG export) capacity to reach 650bn m3/yr by 2022 – an increase of 160bn m3/yr -- on the back of additions chiefly in the US (90bn m3/yr) and Australia (30bn m3/yr).

Mark Smedley