Chevron explores gas asset sales [NGW Magazine]

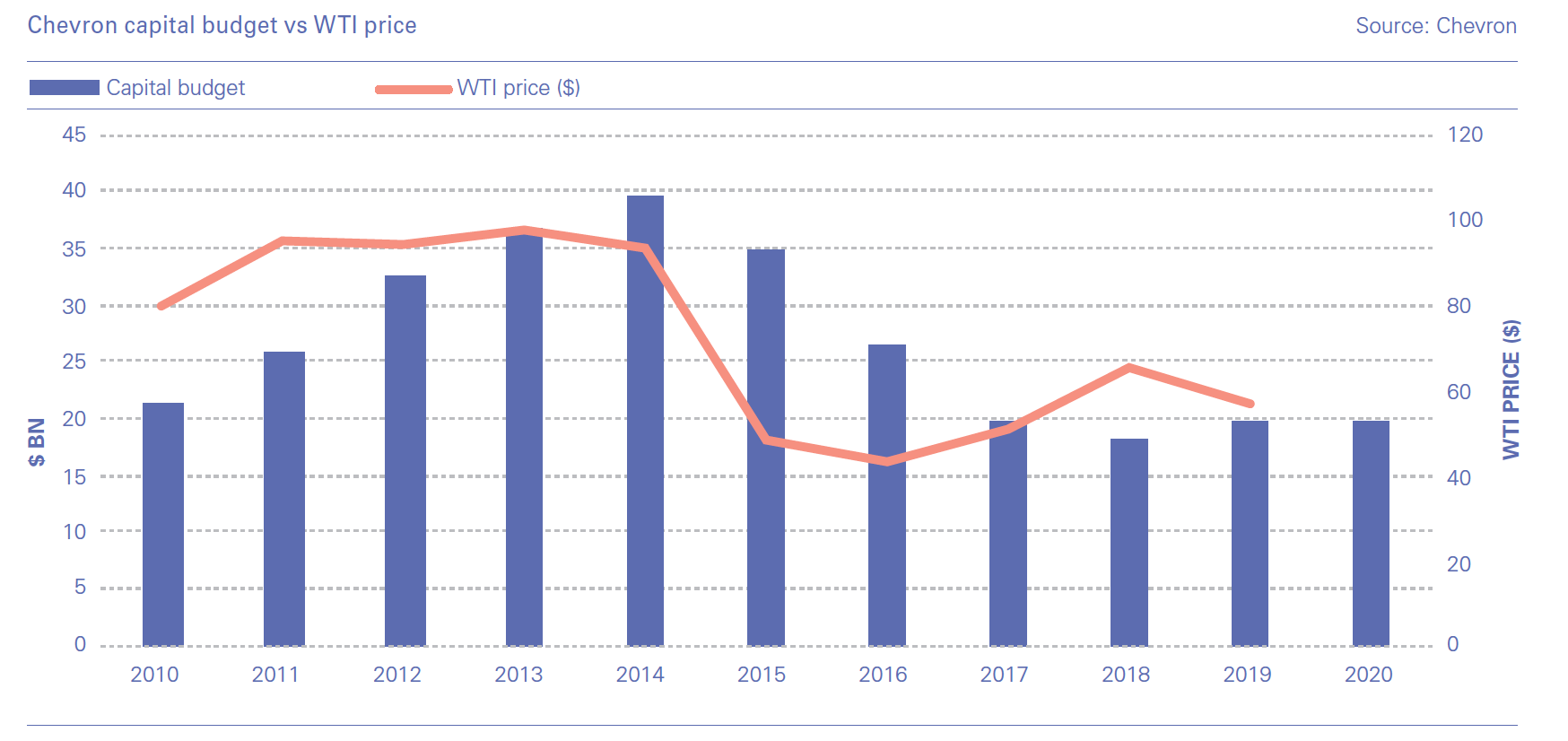

Chevron’s announcement of its capital budget plans for 2020 reflects its increasingly bearish outlook for North American natural gas. California-headquartered Chevron is planning to keep capital spending flat for the third consecutive year at $20bn. It warned, however, that it would reduce funding to certain gas-related opportunities, including its shale assets in Appalachia and its proposed Kitimat LNG project in British Columbia (BC), Western Canada.

“Chevron is evaluating its strategic alternatives for these assets, including divestment,” the company said in a December 10 statement. The plan was attributed to a downward revision in Chevron’s longer-term commodity price outlook, as well as what the company described as its “disciplined” approach to how capital is allocated.

“Although Kitimat LNG is a globally competitive LNG project, the strength of Chevron Corporation’s global portfolio of investment opportunities is such that the Kitimat LNG project will not be funded by Chevron and may be of higher value to another company,” Chevron Canada said in a separate statement.

The warning came alongside news that Chevron expected to record a $10-$11bn impairment charge in its results for the fourth quarter of 2019. More than half of this amount was attributed to Chevron’s Appalachia shale operations, with the company also mentioning that a revised oil price outlook had resulted in an impairment at the Big Foot project in the Gulf of Mexico.

The news illustrates the difficulties that producers are facing as they attempt to keep their North American gas operations profitable in the current price environment. Pure-play gas producers are more exposed to price risk, while integrated majors such as Chevron have the option of shifting their focus to more profitable operations. Indeed, Chevron highlighted its “world-class” position in the Permian Basin, its operations in Kazakhstan and its “advantaged queue” of opportunities in the deepwater Gulf among the areas it would be targeting in 2020. Such projects will produce gas as well as crude, suggesting that natural gas opportunities still exist. Nonetheless, dry gas production is falling out of favour among those that can choose to focus on other operations.

Unfavourable outlook

Chevron’s decision to step back from Appalachia – the location of the Marcellus and Utica shale plays – comes as no great surprise given that the low gas price environment has also been taking a toll on other producers in the region. Indeed, investment bank Morgan Stanley published research in late November, after a meeting with Chevron executives, noting the company’s efforts to offset cost overruns related to the Tengizchevroil (TCO) joint venture in Kazakhstan, in which it holds a 50% stake. “Management does not plan to shift capital from the Permian to offset higher TCO spending, and noted gassier opportunities where returns are not as high could be an option,” Morgan Stanley wrote.

However, the news that Chevron was seeking to sell out of Kitimat LNG came as more of a surprise, at least to some, given the progress being made on that project. Chevron’s announcement came days after the Canada Energy Regulator (CER) approved an expanded export licence for the project, covering 40 years and 18mn mt/year of LNG. This marked a significant increase from the previous licence, which covered 10mn mt/year over a 20-year period. The fact that Chevron and its partner Woodside Energy sought an expanded licence had been welcomed as a positive sign for Canada’s nascent LNG industry. However, the application was made in April, and the outlook for new LNG projects has dimmed since then, owing to low spot prices for the fuel and an increasingly oversupplied global market as new output comes online while demand growth slows.

“We’ve long seen investment in the company’s Appalachian assets as unattractive, and while we’re surprised by the inclusion of Kitimat LNG in this discussion given ongoing permitting of a new, low-emission design, we think investors will welcome stepping away from this project given the oversupplied outlook for LNG and difficulties with executing on such a complex project,” analysts from Tudor, Pickering, Holt (TPH) wrote in an email to clients.

Australia-based Woodside has said that while it was still assessing the implications of Chevron’s decision, it remained committed to Kitimat LNG and would work with any new partner that enters the joint venture. However, in September the company’s managing director and CEO, Peter Coleman, was reported as saying the company was interested in selling a portion of its own 50% stake in the project. The news was welcomed as a sign that the partners were moving closer to allocating capital to Kitimat LNG.

At the time there was speculation that state-owned Asian and Middle Eastern energy companies could emerge as potential buyers. But no interested party has come forward as yet, for either company’s stake in the Kitimat project. Now, concerns over global LNG oversupply could make would-be buyers more cautious, even though a great deal of interest in the LNG industry remains.

At the time there was speculation that state-owned Asian and Middle Eastern energy companies could emerge as potential buyers. But no interested party has come forward as yet, for either company’s stake in the Kitimat project. Now, concerns over global LNG oversupply could make would-be buyers more cautious, even though a great deal of interest in the LNG industry remains.

Chevron and Woodside have both talked up Kitimat LNG’s competitive advantages. These include its proximity to major export markets in Asia, and plans to make it the world’s cleanest LNG project by building an all-electric plant powered by locally abundant hydro power. The two companies will hope that in the long term these advantages will outweigh shorter-term concerns about LNG oversupply for any potential buyers. Chevron has not yet set out a timeline for soliciting expressions of interest for its Kitimat stake. However, Woodside has said the project forms part of its post-2027 growth strategy, suggesting that there is no rush to reach a final investment decision (FID).

Earlier this month, the Oxford Institute of Energy Studies (OIES) said it expected an FID on Kitimat LNG around 2022-23, but it is not yet clear how Chevron’s planned exit from the project will affect the timeline.

Short-term struggles

In the shorter term, Chevron’s impairment charge and shift away from gas does not bode well for other producers. RBC Capital Markets noted that a number of integrated players including Chevron had impaired more than a combined $200bn of upstream assets in the fourth quarter. The investment bank attributed these measures primarily to reductions in long-term oil and gas prices, as well as some asset sales. RBC identified Norway’s Equinor, Spain’s Repsol and London-headquartered BP as the other integrated companies that have recently announced impairment charges.

“In terms of which are the next companies that are likely to impair assets, the answer is…whichever has not already done it so far,” RBC analysts wrote.

Chevron is also expected to find itself under pressure following its fourth-quarter impairment charge. “While the cash flow impact will be modest (we estimate the reduction in DD&A between Appalachia and Big Foot could be ~$100-200mn annually, which could modestly increase cash taxes) and we think the market will understand the company's decision to move away from these projects, it does serve as a reminder of previous poor investment decisions,” Scotiabank analysts wrote in a note. “To compete and attract new investors back into the sector, [Chevron] and the rest of the industry have to improve their execution and FID processes, in our opinion,” they added.

“As Kitimat was the logical successor [major capital project] to follow Tengiz, questions on [long-term] capital allocation could begin to arise,” noted TPH. The bank added that it would continue to favour the company’s shift to relatively stable, short cycle capital.