Centrica and Bayerngas Norge to Create Upstream JV

The UK and German utilities, Centrica and Stadtwerke Munchen (SWM), have reached an agreement to combine Centrica’s Europe upstream business with Bayerngas Norge – to be 69%-owned by Centrica and 31% by Bayerngas Norge’s existing shareholders (led by SWM and Bayerngas) – which is expected to close in 4Q 2017.

Chris Cox, currently managing director of Centrica E&P, will be its CEO; two-thirds of the new joint venture’s reserves and resources will be natural gas.

The demerger of upstream is part of the European utilities trend away from high risk ventures to focus instead on customer services: the E.ON/Uniper split last year was another example.

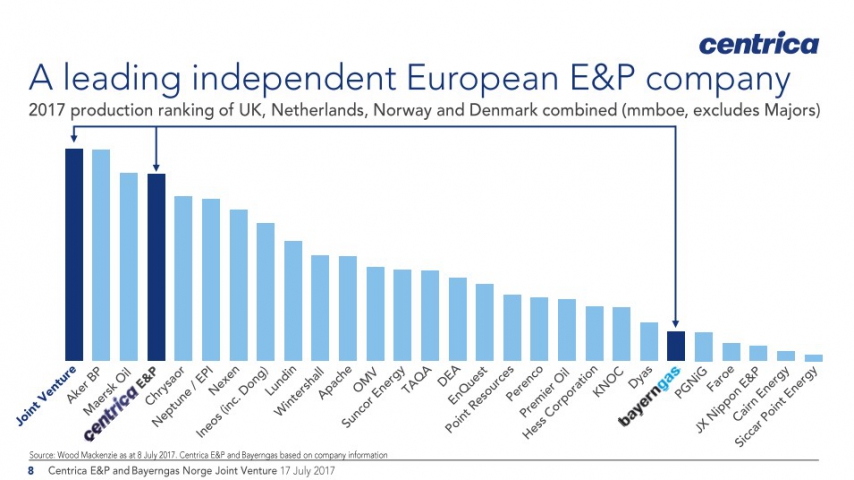

The companies' CEOs stressed the size of the deal and the possible shareholder value: Centrica's Iain Conn said the new company would be "one of the largest independent upstream companies in northwest Europe, able to participate in further consolidation and joint ventures, and creates future optionality for Centrica’s shareholders."

SWM's Florian Bieberbach said the merger of their upstream activities would "create an even stronger and more sustainable business. With its similar background and strategy, Centrica is an ideal partner to develop and grow this joint venture together.”

The joint venture will operate some 22% of its expected 2017 production. Centrica expects to acquire and market all production from the joint venture’s assets under marketing and sales agreements.

It said there is substantial near and medium-term production from established assets including Morecambe, Greater Markham, Kvitebjorn and Statfjord, and from recently on-stream assets Valemon, Cygnus and Ivar Aasen. The JV will also own an attractive collection of development assets, including stakes in Maria, Oda, Fogelberg and Skarfjell in Norway and Hejre and Solsort in Denmark. The firms also expect £100 ($130mn) - £150mn of net present value expected through synergies from cost savings and portfolio optimisation.

At end-2016, the new company's 2P reserves were 409mn barrels of oil equivalent, with 2016 year-end 2C resources of 216mn boe and expected combined 2017 production in the range 50-55mn boe (137-150,000 boe/d) from 27 producing fields.

It will comprise Centrica's assets in the UK, Netherlands and Norway (including one operated UK onshore gas terminal at Barrow, northwest England) and Bayerngas Norge's assets in the UK, Norway and Denmark. Centrica has recently announced disposals of its Trinidad assets.

Centrica will contribute the whole of its European E&P business and make a series of deferred payments totalling £340mn, post tax, to the Joint Venture between 2017 and 2022, in exchange for a 69% share in the JV. Existing shareholders of Bayerngas Norge, led by SWM and Bayerngas, will contribute 100% of the shares in Bayerngas Norge in exchange for a 31% share of the JV, held through Bayerngas HoldCo (the latter 80% owned by SWM and 20% by Bayerngas). Stadtwerke Munchen also owns 56.3% of Bayerngas

Both Centrica and SWM have agreed to restrictions on transfers of interests in the JV for two years following its establishment. After that period, SWM and Centrica will have customary exit rights, including the ability to initiate an initial public offering.

Graphic credit: Centrica presentation 17 July 2017

Mark Smedley