CCUS gaining traction [Gas in Transition]

The COP28 President Sultan Al Jaber said at ADIPEC 2023 that carbon capture, utilisation and storage (CCUS) would have to play a role in helping the world reach net-zero emissions by 2050. “It is one of many solutions we should pursue and we should pursue aggressively.” In May, he said that the climate fight will be lost without major CCUS investment – there is no viable alternative to cutting industrial carbon emissions.

With China supporting a bigger role for CCUS to abate emissions from its continued use of coal in power generation, CCUS is gaining traction.

Alongside renewables, CCUS was also given a boost in the final declaration at the 2023 G20 summit in Delhi. It committed the G20 to “pursue and encourage efforts to triple renewable energy capacity globally through existing targets and policies, as well as demonstrate similar ambition with respect to other zero and low-emission technologies, including abatement and removal technologies, in line with national circumstances by 2030.” It also urged countries to accelerate “efforts towards the phase-down of unabated coal power,” in effect leaving the door open for continued use of abated coal.

Similarly, in a first, the G7 Summit Leaders’ Communiqué acknowledged that CCUS can be an important part of a broad portfolio of decarbonisation solutions to reduce emissions from industrial sources that cannot be avoided otherwise. It added that “the deployment of carbon dioxide removal processes…have an essential role to play in counterbalancing residual emissions from sectors that are unlikely to achieve full decarbonisation.”

Similarly, in a first, the G7 Summit Leaders’ Communiqué acknowledged that CCUS can be an important part of a broad portfolio of decarbonisation solutions to reduce emissions from industrial sources that cannot be avoided otherwise. It added that “the deployment of carbon dioxide removal processes…have an essential role to play in counterbalancing residual emissions from sectors that are unlikely to achieve full decarbonisation.”

Saudi Arabia and the UAE see CCUS as important in ensuring a longer-term future for oil and gas. According to Saudi Aramco CEO Amin Nasser, “CCUS can no longer be the bridesmaid of the transition. It has to have a central role.” He added that CCUS capacity needs to grow 120 times from what today’s levels by 2050, to deliver sufficient carbon removal capacity to achieve net-zero emission goals. The role of CCUS within energy transition has been too marginal. The technology should take a more prominent position as part of governments’ and industry’s plans to decarbonise.

Nasser said “the world deserves a more realistic, more robust energy transition plan. One that clearly emphasises the continued deployment of new energy while recognizing the continued need for conventional energy.”

ADNOC, UAE’s biggest oil and gas producer, is doubling its CCUS target – planning to capture 10mn tonnes/year of CO2 by 2030 – as it works toward boosting its green credentials before the COP28 summit and achieving its net-zero goals by 2045.

In the US, the 2022 Inflation Reduction Act (IRA) has given a clear boost to CCUS. It provides critical tax credits that incentivize CCUS.

In Europe developers have said the rising price of CO2 in the EU's emissions trading system (ETS) – designed to increase the cost of emitting over time and aligned with the ‘polluter pays' principle – is starting to make CCUS projects economically viable.

The EU’s Net-zero Industry Act identifies CCUS as a strategic net-zero technology for which scaling up of manufacturing capacity is critical to reaching the EU’s climate goals. The act proposes to set an EU-wide goal to achieve an annual CO2 injection capacity of 50mn t by 2030.

Norway is well on the way. The first phase of its Northern Lights CO2 storage project is set to start up next year, with commercial agreements already in place with emitters.

The Global CCS Institute released its CCS milestones on the road to COP28 report in July. It states that momentum continues to build for CCUS after progress in 2022, when new projects were announced every month. These milestones include:

- The release of the IPCC AR6 Synthesis Report, that marked CCS as an option to reduce emissions from industry.

- The latest political positioning on CCS issues, including through the Carbon Management Challenge and G7 and G20 activities.

- The IEA’s Credible Pathways to 1.5°C Report, released in April 2023, which puts an emphasis on the need for CCS to tackle emissions from the energy sector.

- The outcomes of the Bonn Climate Conference, where CCS was addressed formally.

The IPCC is clear that CCS and other carbon removal technologies are necessary to achieve the Paris agreement's more ambitious temperature rise limit of 1.5°C.

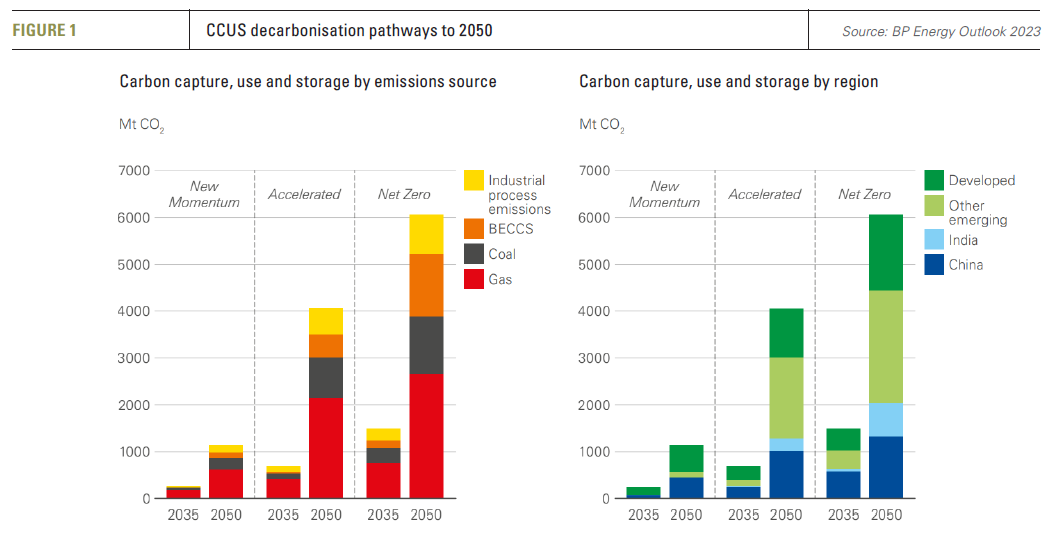

BP’s Energy Outlook 2023 sees CCUS playing a central role in enabling deep decarbonisation pathways all the way to 2050 (see figure 1).

IEA on CCUS

The International Energy Agency (IEA) released a report on Credible Pathways to 1.5°C in April. It outlined a number of actions in the 2020s to keep the Paris Agreement’s target within reach, with significant emphasis on CCUS.

It states that CCUS can play three important roles:

- Providing a solution for hard-to-abate sectors such as cement.

- Contributing to the production of low-emission fuels, including synthetic fuels.

- Removing carbon dioxide from the atmosphere.

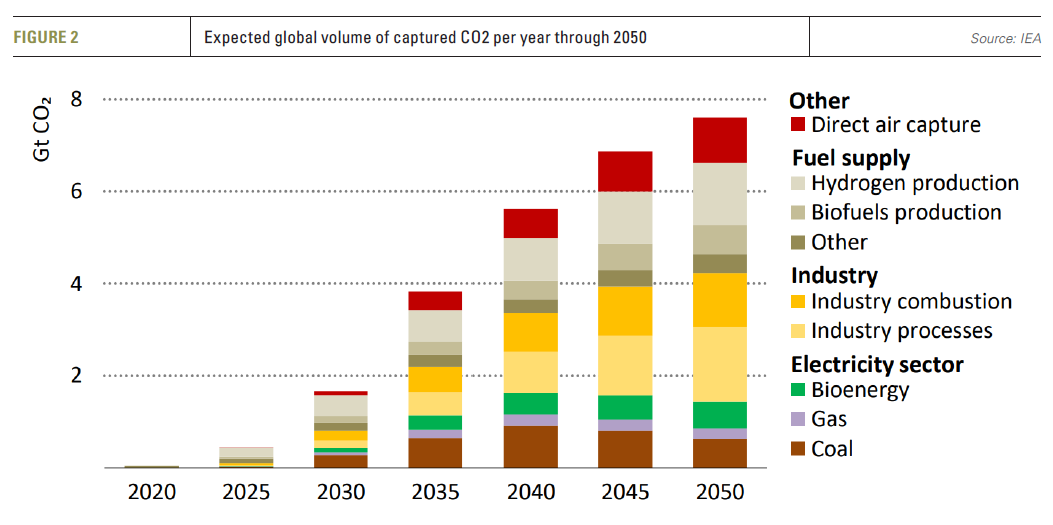

According to the IEA, reaching net-zero will be virtually impossible without CCUS, but rapid progress is needed by 2030, recommending that projects capturing around 1.2bn t of CO2 need to be implemented by then, rising to 8bn t of CO2 by 2050 (see figure 2).

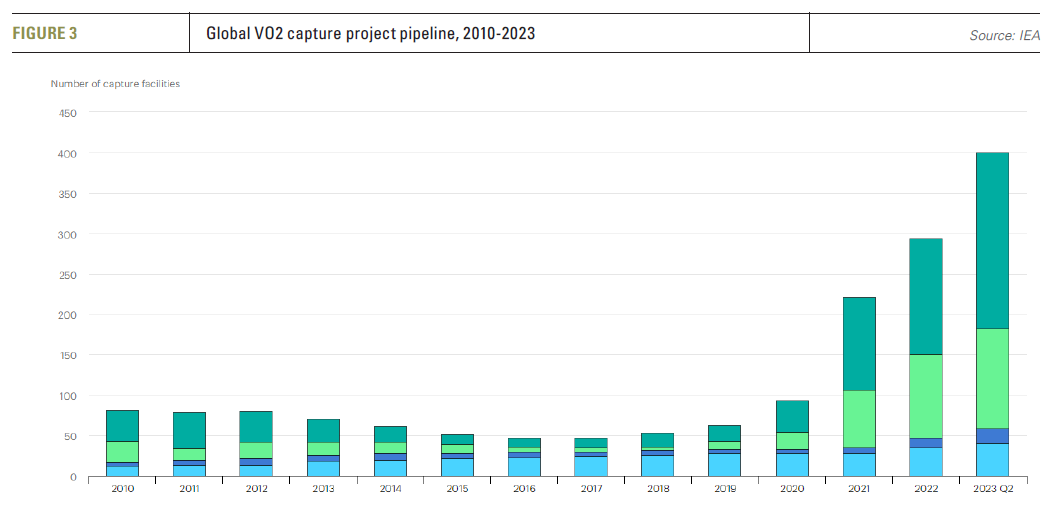

In its 2023 edition of Net-zero Roadmap: A Global Pathway to Keep the 1.5°C Goal in Reach, the IEA states that in recent years the number of announced CCUS projects has increased significantly, with over 400 projects in various stages of development across the CCUS value chain (Figure 3), driven by stronger policy support, particularly in the US.

If all projects in the pipeline were realised, CO2 capture capacity would expand more than eight-fold, rising from about 45mn t/yr today to reach nearly 400mn t/yr in 2030. However, so far only about 5% of announced projects have reached the final investment decision stage. Rapid acceleration is needed.

The IEA says that if left unaddressed, long-lead times for CCUS can put short-term climate targets at risk. It recommends establishing a clear permit approval timeline, a one-stop-shop for all permitting activities and ensuring adequate regulatory support capacity.

So far, despite the rising use of fossil fuels, the use of CCUS in the sector is far too small to make a difference. That is why Al Jaber speaking at ADIPEC called for the oil and gas industry to scale up and commercialise CCUS at scale.

US 2022 Inflation Reduction Act

The US 2022 Inflation Reduction Act (IRA) offers clear tax credits for CCS and direct air capture (DAC) - known as 45Q credits. It increased tax incentives for carbon captured for use in enhanced oil recovery (EOR) or other industrial operations from $35 to $60/t of CO2 and to $85/t for permanently stored CO2. This is particularly important in attracting private investment in the deployment of CCS in the US.

Altogether, the credit enhancements are estimated to cost about $3.2bn by 2030.

The 45Q tax credit is widely considered to be one of the most influential government policies in support of CCUS globally. The credits are expected to help power plants and industrial plants decarbonise. The US is already a leader in carbon capture technology, hosting nearly half of all facilities operating globally.

According to the Atlantic Council, to date, oil and gas companies have been at the forefront of deploying CCUS technologies, and contribute 90% of operational capture and storage capacity. Despite this, oil and gas sector CCUS projects have historically underperformed stated sequestration plans. Nevertheless, the sector is currently the primary user of CCUS, with 15 large CCUS gas processing projects currently operating, and is driving the technology’s progress.

Wood Mackenzie forecasts that CCUS capacity in the US will expand from current operational capacity of around 25mn to around 85mn t/yr by 2030. Over that timeline, carbon capture capacity will target wider applications of dedicated sequestration sourced from a variety of industries including ethanol, LNG, and blue hydrogen.

According to BP chief economist, Spencer Dale, in BP’s Energy Outlook 2023, with the IRA and other incentives, CCS deployment in the US could reach over 100mn t/yr by 2035 and close to 400mn t/yr by 2050.

Challenges

As COP28 approaches, countries are split over the role of CCUS in energy transition.

CCUS remains relatively expensive and at an early stage of deployment. Many climate activists see it “as a distraction that gives fossil fuel companies a licence to keep extracting more climate-harming coal, oil and gas.” Obviously it is not. The aim should be to eliminate emissions. CCUS should be deployed where it makes sense, to reduce emissions, depending on their source, the location of storage sites and the development of the technology.

Nevertheless, it is capital intensive and it adds costs to projects. As an article in EURACTIV said recently, “such an investment would be a major business decision for any company, and if there are any alternative means of achieving the emissions-reduction goals, it must make sense for these to be pursued.”

Nevertheless, it is capital intensive and it adds costs to projects. As an article in EURACTIV said recently, “such an investment would be a major business decision for any company, and if there are any alternative means of achieving the emissions-reduction goals, it must make sense for these to be pursued.”

Another challenge comes from policy obstacles. CCUS developers make it clear that clarity on policy is key to the industry. A clear backing of CCUS at COP28 would help.

The IEA has toned-down hopes for CCUS. It said in October in its ‘Net-zero Roadmap’ that “after years of underperformance, CCUS must now show it can deliver…So far, the history of CCUS has largely been one of unmet expectations. Progress has been slow and deployment relatively flat for years.” The IEA said that only around 20 commercial carbon-capture projects under development have reached FID.

It also said that if CCUS is to make progress, the industry needs to prove that it can operate at scale. “Governments should develop effective support packages to help with operating as well as capital costs and find realistic ways of managing the long-term liabilities associated with CO₂ storage.”

IEA’s views do not necessarily reflect developments in the marketplace, where investment in CCUS has accelerated in most regions since the start of this year. There are also strong policy signals and significant momentum for CCS from governments worldwide.

COP28 is expected to influence the climate trajectory of the oil and gas industry heavily. It will test the sector’s credibility in adjusting to the energy transition, and committing to CCUS, even as energy security concerns have brought a reversal to the industry’s fortunes.