Caspian Overview: Iran Mobilises Rig

Iran has started moving the Amir Kabir submersible drilling rig 115 km southeast, from blocks 2-6 to blocks 1-8 in Caspian Sea. This is a new step, as it joins four other Caspian littoral neighbours in exploring for offshore hydrocarbon reserves.

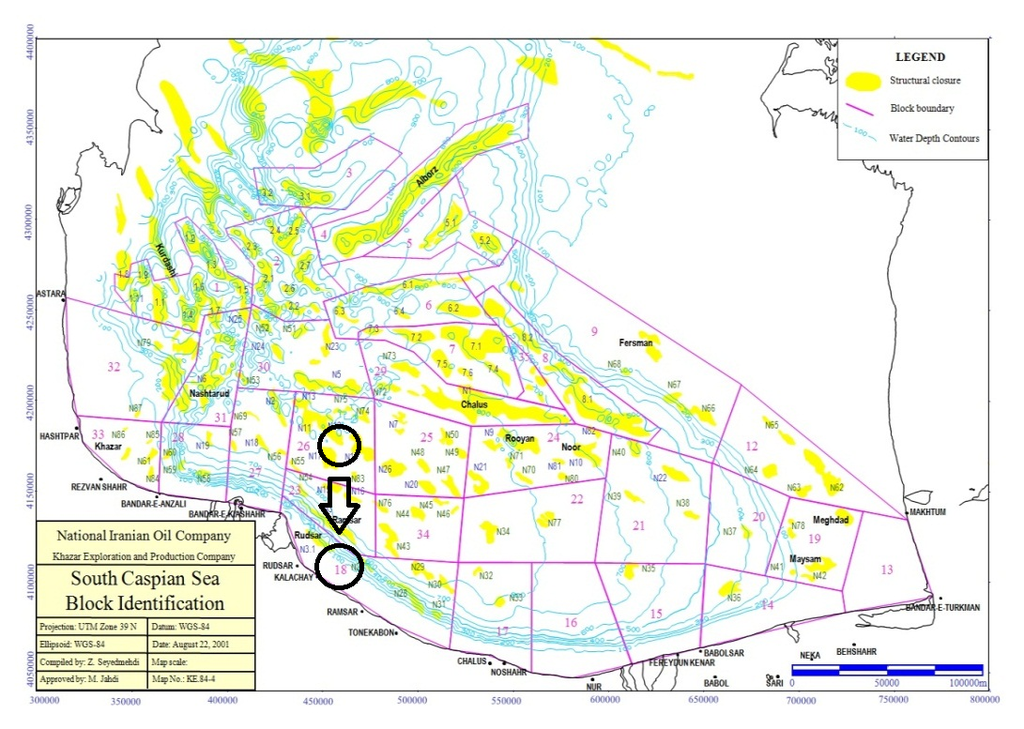

Iran divided its exploration area in the Caspian into 34 blocks (46 structures) of which eight have priority. Iran had carried out 3D seismic operations in 4000 km² at blocks 6,7,8 and 21 from 2003 to 2005.

After several years’ exploration, Iran announced in 2012 that while drilling a 1,000-metre deep well under the Caspian, the Amir Kabir found a gas field at the depth of 700 m. A year later Tehran announced the field (Sardar-e Jangal) was in fact an oil field with 2bn barrels reserves of API 39-quality crude, as well as a gas layer. Iran has drilled two wells in Sardar-e Jangal.

Iran unveiled a new oil and gas contract, called the Iran Petroleum Contract, last November, offering 49 oil and gas fields to foreigners. Among them, were four projects in the Caspian Sea – blocks 24, 26 and 29 and the Sardar-e Jangal oil field, in block 6 (144 km²), lies under water depth of 750 m. Block 24 is 130 km north of Nowshahr under 600-800 m of water and covers 200 km². Block 26 is 100 km northeast of Anzali, under 850-900 m of water and covers 384 km². And Block 29 is 135 km north of Nowshahr, at a depth of 800 m and covering 1028 km².

Azerbaijan

Azerbaijan is the leading offshore oil and gas producer in the Caspian. Since start-up in November 2006 the Shah Deniz field has produced 72bn m3 of natural gas, according to Khoshbakht Yusifzada, vice president of state producer Socar, addressing the Caspian Oil & Gas 2016 conference on June 3.

In the first five months of the year, some 4.5bn m³ of gas and 1mn metric tons of condensate have been extracted from eight wells on the biggest producing gas field in the Caspian Sea.

The first phase of Shah Deniz (SD1) produces 30mn m3/d of gas and 55,000 b/d of condensate. SD2 is expected to produce 16bn m3 by mid-2018, while the development of SD3, the biggest phase with 500bn m³, is expected to start in mid-2020s. The SD consortium has awarded contracts for development of the SD2 project to a total amount of over $13bn, operator BP’s country head Gordon Birrell said on June 2.

Azerbaijan is preparing to export 16bn m³ of SD2 gas to Turkey and EU by 2021 through the Southern Gas Corridor (SGC) project, consisting of the South Caucasus pipeline expansion(SCPX), the TransAnatolian Natural Gas Pipeline (Tanap) and TransAdriatic Pipeline (TAP).

Azerbaijan’s energy minister Natig Aliev told journalists on June 3 that the low oil price had led to a reduction in the cost of SGC : "This is because the cost of some of the building materials, which are used in construction, has gone down. SD2's costs had been estimated at $25bn initially, but now the figure is $23.8bn. The cost of Tanap is now estimated at $9.3bn (earlier $11.8bn) and TAP at $6bn. Thus, currently the cost of SGC is $39.1bn, compared with the earlier figure which was $45bn," he said.

Azerbaijan also extracted 120bn m³ of associated gas and 399mn mt crude oil from Azeri-Chirag-Guneshli (ACG) fields since 1979 to May 2016, Yusifzadeh said.

ACG produces 36mn m3/d of associated gas now, mostly re-injected to oil fields to maintain the crude output.

New upstream projects

Azerbaijan also plans to develop other offshore fields. State Socar company plans to install five new offshore platforms on the offshore field Bulla Deniz, the company announced this week.

“Currently exploration well No 78 with the target depth of 5,900 m is being drilled from the new platform No 6 on the Bulla Deniz field. The project of the field development envisages installation of five new offshore platforms to drill 26 wells from 2016 till 2025”.

Socar also announced that it has extracted almost 1bn m3 gas from the Umid field. Vagif Aliev, the head of state oil and gas firm Socar's investment department, told NGE on June 1 that Azerbaijan is preparing to sign contracts by late 2016 with foreign companies for the development of the Umid and Babek gas fields.

It is planned to build and install four new platforms at Umid to drill 19 operation wells.

Socar’s Turkish IPO

Socar Turkiye Enerji, a subsidiary of Socar, is planning an initial public offering – but not until 2020, its president Zaur Gakhramanov told journalists.

“There is a great interest in shares of Socar Turkiye Enerji at the market. This suits us, because in 2020 we would like to place IPO, Socar is going to preserve 51% of bloc of shares and the remaining 49% will be open for the market. Investors have only 13% shares of Socar Turkiye Enerji,” Gakhramanov said.

Socar Turkiye Enerji holds shares in Petkim Petrokimya Holding complex, the Star oil refinery, which is under construction, the Petlim trade terminal, power-generator Socar Power Enerji Yatirimlari, gas trader Socar Gaz Ticareti, fibre-optical services provider Socar Fiber and oil products trader Socar Turkey Petrol Enerji Dagitim.

Socar Turkiye Enerji plans to buy 7% of the Tanap company by year-end. The market capitalization of Socar Turkiye Enerji has been estimated by Turkish financial specialists at $10bn, as of late 2015.

Turkey

This week, OptaSense, which is a part of the British multinational defence company QinetiQ, jointly with its partner Optilan, have become sub-contractors of Swiss-based ABB to provide security services to Tanap, reported QinetiQ. There have been numerous attacks on Turkish energy infrastructure, for some of which Kurdish separatists PKK have claimed responsibility.

The contract worth $30mn includes the work to determine leaks and damages and services related to Tanap safety, including the protection and monitoring of the pipeline infrastructure over its 1850-km extent; and all related facilities.

ABB will deliver the control systems, telecommunications, monitoring and safety for Tanap and will lay fibre-optic cable to transmit data along the pipeline.

Ashgabad ‘prioritises’ western exports

The export of energy to Europe is among the priorities of Turkmenistan’s international strategy, reported the Turkmenistan government. “The pipeline project to western Europe is a plan of ours and we have started active discussions. Work with our European partners is constructive and it will be continued,” it said.

Turkmenistan also has an 85% share in the Tapi project, aimed to transit 31bn m3/yr of Turkmen gas to Afghanistan, Pakistan and India. State Turkmengaz will receive a loan from the government of Turkmenistan above $45mn to cover the first tranche of the initial phase of Tapi, the Turkmenistan government announced on June 6.

So far the only foreign investor producing significant quantities of gas onshore in Turkmenistan is China, which lent billions to Ashgabad on favourable terms. Western majors have not made progress. Turkmenistan sells its gas at its border, which China then ships across central Asia where it mingles with other molecules such as Lukoil’s production in Uzbekistan.