Carbon capture gets down to earth [NGW Magazine]

It is expensive and it still has to answer concerns about long-term risk, but carbon capture and storage looks set to play a critical role in helping countries meet their Paris climate commitments.

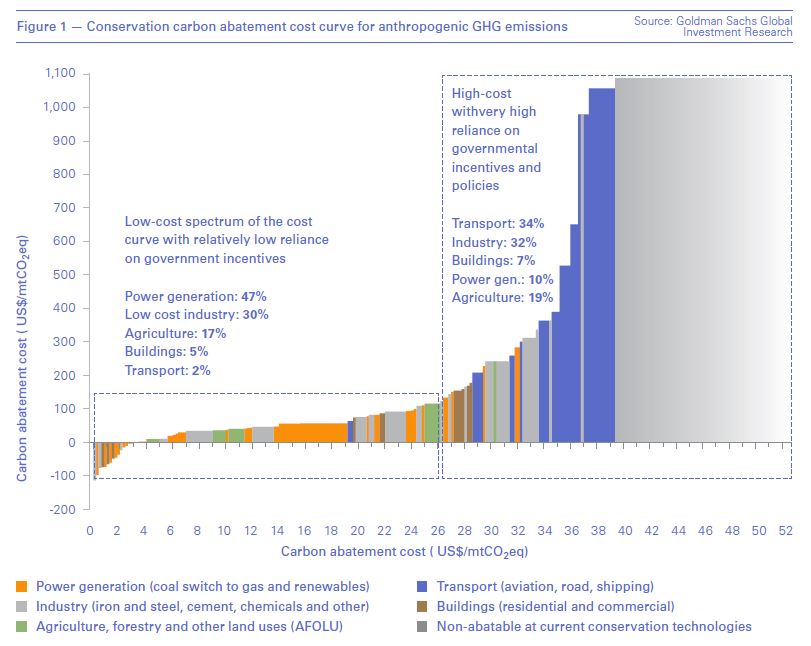

Injecting carbon dioxide into the ground has been common practice for enhanced oil recovery for a few decades, but to reach commercial viability with no by-product, additional policy support or a much higher carbon price is needed. Current costs are significant: capturing a metric ton of carbon ranges from $100 – about three times the present price in the European Trading Scheme – to $600 for innovative direct-air capture, which sucks the carbon directly out of the atmosphere. And in order to claim compensation for doing so, projects need to show that it will stay where it is put.

Ever-tighter curbs on greenhouse gas emissions are forcing the fossil fuel industry to turn to the technology, now usually referred to as carbon capture, use and storage (CCUS) to embrace novel ways of converting the gas into a useful by-product, in order to survive at even a fraction of today’s scale beyond 2050.

There are 21 large-scale CCUS projects already operational around the world with a combined capacity of about 40mn mt of CO2/year. Backed by strong industry and political support, the technology is coming under the spotlight and being embraced at the highest level even in hard-to-abate sectors and countries heavily dependent on oil and gas.

“We believe CCUS has a role to play as a part of the clean energy portfolio and now is the time to accelerate this transition,” said Saudi Arabia’s energy minister Abdulaziz bin Salman Al Saud at a side event as part of the Clean Energy Ministerial (CEM) which was hosted by his country in September this year (see box).

But the lack of a viable business model means that CCUS development is “far from where it needs to be” he said, so development has not yet been scaled up sufficiently to bring costs down.

|

Show me the money A CEM public/private working group on CCUS made up of banks, finance organisations and governments including the UK, the US and Norway set out ten key financing principles in September to establish a business case for CCUS and recommend financing options. Among them, it said, was the duty of governments, industry and the financial sector to communicate the importance of CCUS, and of governments to establish a revenue stream for CCUS to facilitate private sector investment. They should also work on a pipeline of projects. The finance sector should ensure CCUS is eligible for sustainable finance and also come up wih creative ways to finance it. Governments, industry and the financial sector should consider CCUS investment as a means of driving innovation and supporting broader industrial development. |

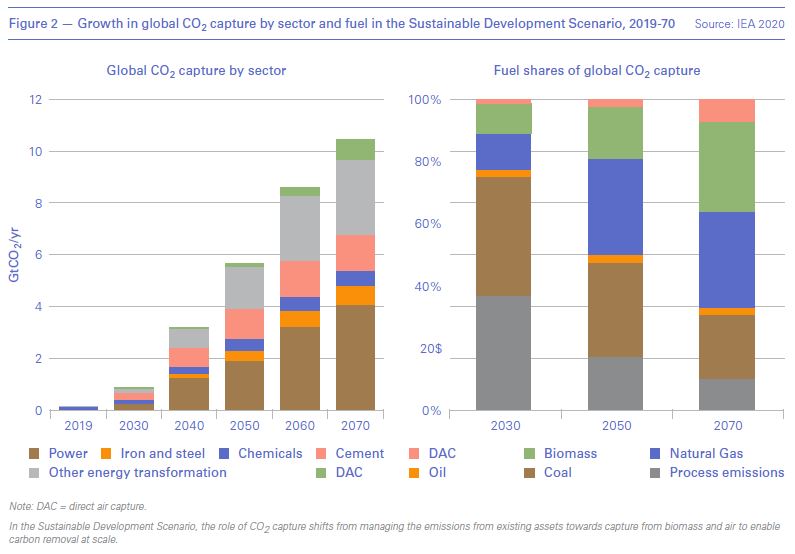

Under the IEA’s sustainable development scenario, CCUS capacity needs to reach 450,000 mt/year by 2030 and 2.8bn mt/year by 2050, but the rate of deployment is “woefully below” reaching this level.

New research from Columbia University and the Global CCS Institute says that CCUS is essential to address climate change, and that a huge infrastructure plan is required including to expand the 8,000 km of CO2 pipelines in North America with a further 35,000 km to maximise emissions reduction.

“The climate action efforts we’re seeing globally, while encouraging, are not enough,” said Brad Page, CEO of the Global CCS Institute. “The sooner we include CCS technologies into the fold of wide-spread decarbonisation initiatives, the more likely we’ll be able achieve Paris Agreement climate targets and get to net zero emissions. Critically, this report reveals that without the accelerated deployment of CCS, global climate targets will be extremely difficult, if not impossible, to reach.”

A professor at the London School of Economics Nicholas Stern told a webinar held to launch the report that private sector companies’ demand for negative emissions has increased by an extraordinary amount this year, which is driving the sense of urgency. “They know the future in which they work is under real risk and they know their customers and potential employees and shareholders all expect them to go net zero. Firm after firm is finding it’s not only the right thing to do, it’s the sensible thing to do for their future as a profitable firm.”

He said the UK prime minister will issue a net zero strategy in the coming weeks that will set out the opportunity for carbon capture, although at time of press Boris Johnson was also struggling with the pros and cons of imposing harsher Covid-19 measures.

The lead author of the report and senior research scholar at the University’s Center on Global Energy Policy, Julio Friedmann, said: "Climate math is merciless: if we're going to avoid the worst impacts of climate change, we have to rapidly reduce the greenhouse gas emissions created by human activity and industry." CCS is the “Swiss army knife” of decarbonisation, he added.

The development of renewable generation tends to dominate headlines about addressing climate change, but emissions from existing fossil fuel plants and hard-to-abate sectors such as transportation, heavy industry and buildings can be more cost-effectively and quickly removed from the atmosphere with CCUS than building wind and solar, according to the report.

There are several other global industry partnerships which advocate for intense CCUS development and a CO2 storage target, such as the Oil and Gas Climate Initiative (OGCI), the Carbon Sequestration Leadership Forum (CSLF), IEA Greenhouse Gas R&D Programme (IEAGHG) and Mission Innovation (MI).

|

EU legal framework The legal framework for CCUS in the EU is established by the directive on the geological storage of CO2 (so-called "CCS Directive") which sets site selection requirements and responsibilities but leaves certain liabilities for regulation at Member State level. The revised Emissions Trading Scheme (ETS) includes CCS, but only considers emissions exempt from needing an allowance if they are transported via pipeline. This is under review to allow transport by other means. But with allowance prices around €30 ($35)/mt, this will not be enough to drive carbon removal projects. Funding for CCS and other clean energy projects is available under the €10bn Innovation Fund, financed from proceeds from EU ETS auctions. The first call for proposals for large-scale projects is open until October 29 through the EU Funding and Tenders portal. Other regulations affecting CCS that may change to reflect the new 2030 climate target include the Effort Sharing Regulation for sectors not covered by the EU ETS and Land Use, Land Use Change and Forestry (LULUCF) Regulation. Under the new Circular Economy Action Plan the European Commission has said it will propose a regulatory framework for the certification of carbon removal by 2023. Now Europe has pledged even greater climate targets, up to $35bn could be spent on carbon removal by 2035, taking as much as 75mn mt of CO2 out of the atmosphere, according to Rystad Energy. Around 10 large CCS projects have a high chance of being operational by 2035, mostly around the North Sea in Norway, the UK, Denmark and Netherlands, and possibly in Ireland and Italy. New business models Significant funding, financial incentives and capital expenditures had been earmarked for CCUS, but the post-Covid economic slump may put some of these in jeopardy. It is not yet clear whether CCUS projects will be a victim of capital expenditure cuts announced by major oil and gas companies. Nor is it clear to what extent CCUS will be included in sustainable economic recovery plans. There are more than 50 active or completed projects and more planned according to the CSLF. An additional 408.6bn mt of CO2 storage is available at up to 525 potential sites, according to the Global Storage Resources Database, a repository for storage resource assessments by the Global CCS Institute and Pale Blue Dot Energy on behalf of the OGCI. New business models are being introduced to scale up CCUS, such as developing hubs or multi-user transport and storage networks. These would allow for economies of scale allow industrial facilities to access CO2 storage without taking on risks and activities outside their core businesses. The CLSF recently updated a report on hubs and clusters in which it concludes infrastructure progress is lagging behind the desired target. It is encouraging the development of networks to spur development. The OGCI KickStarter initiative is setting up five such hubs, the European ones being Northern Lights, Norway; Porthos, Rotterdam, the Netherlands and Net Zero Teesside, UK. Research by consultance Xodus has put the cost of CCS at Porthos at about €50/mt. It said in September that figure was encouragingly close to the government estimate and at most half of the Northern Lights likely cost. Neither has yet got the final go-ahead. The UK has pledged to invest £800mn ($1bn) in CCUS infrastructure to help meet its net zero ambition, including to establish CCUS in at least two locations. The first is likely to be the Net Zero Teesside project, where OGCI Climate Investments has formed a consortium of European OGCI members – Eni, Equinor, Shell and Total, with BP as operator – to accelerate the development. The project plans to capture up to 10mn mt/year of CO2 emissions. Another proposed UK hub is the Humber Cluster Plan (HCP) with eight private sector partner organisations including Drax, Equinor, National Grid Ventures, British Steel, Centrica, Phillips 66, SSE Thermal and VPI Immingham. The Humber is the UK’s most carbon intensive industrial complex, emitting 14mn mt/yr, but the HCP aims to achieve net zero carbon emissions by 2040. |

|

Norway’s ‘greatest climate project’ Europe is pushing CCUS development aggressively with dedicated funding, but the number of projects has failed to achieve previous goals. So far, there are only two operational large-scale CO2 projects operational in Europe, both outside the European Union. They are at Norway’s offshore fields Sleipner and Snohvit, with a combined capacity of around 1.5mn mt/year. Now the government is contemplating a much bigger operation, the NKr 25.1 ($2.6)bn Longship project, aimed for the first time at third-party CO2. The prime minister Erna Solberg told parliament September 21 as she presented the White Paper that the “long-awaited and highly anticipated project” was the “greatest climate project in Norwegian industry ever.” The transport and injection section is known as the Northern Lights project, backed by the European majors Shell, Total and national oil company Equinor. Shell has put a value of €700 ($820)mn on that, or just under a third of Longship’s total. It told NGW it was “very pleased” to learn that the government was proposing o move ahead with it. The CO2 will be injected into an aquifer a few kilometres beneath the seabed, near, but separate from, the giant Troll oil and gas reservoirs. Norway is to fund Nkr 16.8bn, subject to approval by parliament. While therefore it is not a given, it is a 99-1 odds on certainty, according to Nils Rokke of consultancy Sintef. “Norway had been concerned that it might go ahead and nobody would follow, but there is more support now in Europe for funding CCS. It is the only way countries can hope to meet their carbon reduction targets,” he told NGW September 23. “There is no certainty yet that the EU will provide funding for integrated CCS projects. But this could be part-funded from the Innovation Fund together with private and national government funding.” Also, he said, the Norwegian prime minister has said blue hydrogen – produced from natural gas potentially by steam methane reformation – would be very important and it could use the same infrastructure for storing CO2 produced by such processes in future. The upstream section, to reverse the usual terminology, so far consists of Heidelberg cement works, which has over 50 cement plants in Europe. Cement contributes about 6-7% of global carbon emissions. A possible later addition, at a further cost of some Nkr3 bn, is a Fortum-operated waste plant near Oslo, for which there is interest and support. Fortum said it was “in the process of applying for the EU Innovation Fund, and it is important that the EU sees that our project has the backing of the Norwegian government.” Solberg told a webinar hosted by the International Energy Agency September 24 to launch its report on CCS that if Innovation Fund money was forthcoming, then the government could contribute to that plant as well. She joked that longships were what Vikings sailed in, to pillage their neighbours. This Longship would instead take what was not wanted for safe disposal, she said. Rokke said also: “Between half and two thirds of waste is biogenic and so extracting carbon from the decomposition of that is in effect carbon negative: BioCCS will be important for countries with more aggressive carbon reduction targets such as Denmark, Sweden and possibly Finland.” Waste can contribute another 5% to the global carbon emissions. He is in no doubt that all three projects – Acorn and Humber in the UK and Longship – can coexist. “Europe will need to store hundreds of millions of tons/year by 2050 and so there is no competition between Longship and the two UK projects. Longship phase 1 is looking at just 37.5mn mt of CO2 after ten years. Transport capacity of 5mn mt/yr would attract more customers including from mainland Europe and the British Isles,” he said. -William Powell |