Can geothermal energy pose a threat to gas? [Gas Transitions]

Remember Al Gore? The former US vice-president, author of the worldwide bestseller An Inconvenient Truth, climate guru (he is currently chairman of “The Climate Reality Project”), is (or was) a huge fan of geothermal energy. In his book Our Choice (2009), the successor to An Inconvenient Truth, he wrote that geothermal energy “is potentially the largest – and presently the most misunderstood – source of energy in the … world today.”

At the time he quoted sources such as the UN World Energy Assessment Report, which stated that “the geothermal resource is roughly 280,000 times the annual consumption of primary energy in the world," and a 2006 report from the Massachusetts Institute of Technology (The Future of Geothermal Energy), which estimated that the “extractable portion” of geothermal energy in the US exceeds 200,000 exajoules, “or about 2,000 times the annual consumption of primary energy in the US in 2005.”

Impressive figures, but the reality today presents a far bleaker picture. Geothermal energy delivers only a fraction of the world’s energy – a lot less than its renewable energy sisters solar and wind power. According to the International Energy Agency's 2018 World Energy Outlook (WEO), geothermal sources produced 87 TWh of power, which was just 1.36% of total renewable power demand and some 0.33% of total power demand. In 2000, the figure was 52 TWh, so growth has been modest. The WEO does not give figures for geothermal heat supply, but in Europe, the share of geothermal energy in total heat demand is roughly 0.6% (see below).

Clearly the discrepancy between the potential and reality of geothermal energy is large. The problem with geothermal energy is that the earth’s heat which it wants to tap into is deep under the ground, requiring expensive drilling operations to get it out. Exceptions are places with geological conditions like Iceland and Turkey, where volcanic activity takes place close to the surface of the earth.

Optimistic

Nevertheless, the geothermal sector remains optimistic about the future. The European Geothermal Energy Council (EGEC) believes that in time a quarter of Europe could obtain its heat from deep geothermal sources, says Thomas Garabetian, policy officer at EGEC.

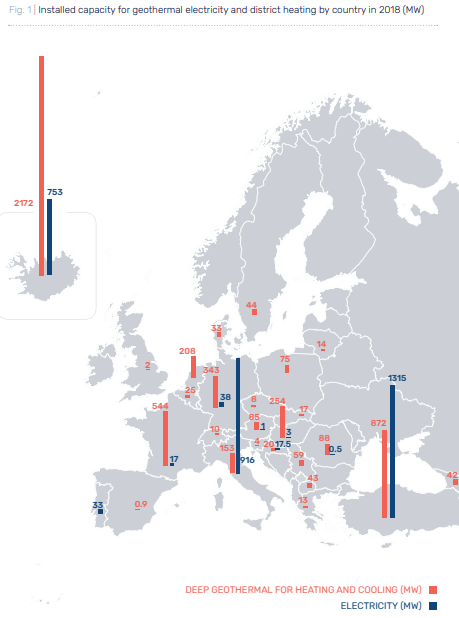

EGEC distinguishes between three types of geothermal energy: geothermal power, deep geothermal heating and cooling, and shallow geothermal heating and cooling. According to the latest EGEC Geothermal Market Report 2018, total installed capacity of geothermal power plants in Europe stood at 3.1 GW from 127 plants, around three thousandths of the total European power generation capacity (930 GW). These power plants were almost exclusively in three countries: Turkey (some 1.3 GW), Italy (around 900 MW) and Iceland (750 MW), all of which have favourable geological conditions.

Although EGEC notes in this report that the geothermal power market “is growing rapidly,” there is obviously no way in which geothermal will become a major contributor to European power production soon. Outside Turkey just one relatively small geothermal power plant was added to the stock in Europe in 2018: a 17.5 MW facility in Croatia.

"The biggest challenge for geothermal energy is not so much technical as economic"

The installed capacity of deep geothermal heating installations, which supply heat mainly to district heating networks, was around 5.1 GW in 2018, according to the report. These produced some 11-2 TWh of heat, says Garabetian. In addition, installed capacity for shallow systems, which make use of heat pumps, was 23 GW of heat by 2018, distributed by over more than 1.9mn GSHP installations. These generated some 27 TWh of heat, according to Garabetian, although he adds that this figures is based on data from a limited number of EU countries.

Total European heat demand is around 6100 TWh (524mn tons of oil equivalent), so the share of geothermal in the total heat market is modest: around 0.6%.

Deep geothermal heating facilities and geothermal power facilities in Europe in 2018. Shallow geothermal systems are not shown. Source: EGEC Geothermal Market Report 2018

Despite these modest numbers, EGEC sees a large potential for geothermal heating in Europe. As indicated above, it believes a quarter of households could meet heat demand with deep geothermal in future. In addition, the report observes that “shallow geothermal resources assisted by heat pumps can be used everywhere in Europe, utilising geothermal energy even at very low temperatures to supply heating and cooling to buildings of all sizes.”

Nevertheless, the report also notes: “Looking at the enormous potential for developing geothermal heat pumps and the challenge of fully decarbonising the heating sector, it is still surprising to see its rather low rate of growth in Europe.”

Greenhouses

So how does the sector think it can accelerate the production of geothermal energy? The country that has in recent times probably shown the most ambition in developing new geothermal energy sources is my home country the Netherlands. Of the nine new deep geothermal heating installations that were started up in the EU in 2018, five were in the Netherlands (with a total of 66 MW capacity). The others were in Serbia, Belgium, Germany and France. France, another country which is quite active in geothermal, also revamped three existing, deep geothermal installations.

Last year, the Dutch geothermal sector jointly produced an ambitious Masterplan Geothermal Energy (in Dutch, we use the descriptive term “aardwarmte”, meaning “earth heat”; “Erdwärme” in German). The plan was the work of four organisations: the Dutch Association for Geothermal Operators (DAGO), EBN, the state-owned company which represents the Dutch government in all oil, gas and other subsurface operations, the “Warmtenetwerk” foundation, a networking organisation for the heating sector, and the “Platform Geothermie”, a networking organisation for the geothermal sector.

The Masterplan shows how geothermal energy could be safely and effectively expanded over the coming decades in the Netherlands. It concludes that under the right conditions geothermal energy should be able to grow from 3.6 PJ (petajoule) today to 50 PJ in 2030 and “more than 200 PJ” in 2050. Of the 50 PJ to be produced in 2030, 60% would be used in the horticultural sector and 40% in the building sector.

“Geothermal does not have the possibilities for scaling up and reducing cost as e.g. the offshore wind power sector has”

To put these figures into context: total heat demand in the Netherlands is 960 PJ, of which about half goes to the building sector and the rest to industry (40%) and agriculture (10%). The expectation is that demand will decline somewhat over the coming decades. This implies that according to the Masterplan by 2050 somewhere between a quarter and a fifth of total heat demand would come from geothermal energy. The share in buildings and agriculture would be even higher. That’s a huge leap from today: the current share of geothermal in heat consumption is only around 0.4%. Incidentally, the official government target for 2030 is 15 PJ: considerably less ambitious than the Masterplan.

If these targets were realised, this would have some effect on gas demand. Currently about 90% of heat demand in the Dutch building sector and 40-50% in industry is met by natural gas. In 2018, total gas demand in the Netherlands was around 36.5bn m3 (1285 PJ), of which 22.85bn m3 (805 PJ) went to the heating sector. Dutch success in the geothermal energy sector would also send an important message to the rest of Europe.

Earthquakes

Unfortunately for geothermal enthusiasts, however, the expansion of geothermal energy in the Netherlands is turning out to be more challenging than was expected. In an article for the Dutch energy website Energeia, published on 12 August 2019, energy expert Jilles van den Beukel, a geophysicist and freelance author who used to work for Shell, concludes that based on present experience it is unlikely that the ambitious targets in the Masterplan will be realised.

Van den Beukel, who has also written on recent developments around the giant Groningen gas field, points to a number of difficulties operators are encountering. A geothermal installation consists of two wells (a doublet), one through which hot water is pumped up, and one through which cold water is injected back into the ground. Geological conditions in the Netherlands are suitable for wells with a depth of some 2-3 km, writes Van den Beukel, which produce water with temperatures of 60 to 100°C: suitable for space heating, but not warm enough for industrial heating.

Virtually all of the 25 or so new projects that have been undertaken over the last decade were used to heat greenhouses in the economically highly successful Dutch horticultural sector. These installations have been running on average for five years, and already more than a quarter of them have had major technical problems, notes Van den Beukel. The biggest problems are scaling and corrosion, caused by the transport of the very salty water. To combat these problems, writes Van den Beukel, “more robust designs are needed (for example wells with double-casing instead of single), as well as better materials and expert monitoring.”

He adds that progress has been made, but improvements do come at a cost. “The biggest short-term challenge”, writes Van den Beukel, “is probably not to make the wells cheaper, but to ensure that they last for a number of decades.”

Another problem of deep geothermal energy, notes Van den Beukel, is the risk of earthquakes – a sensitive topic in the Netherlands, where people in the gas producing region in the north of the country have suffered from induced earthquakes for many years. Earthquakes can happen in particular in areas with high seismicity, when wells are drilled near a fault line. In the most active regions in the Netherlands, in the western part of the country, this risk is minimal, according to Van den Beukel, but in other parts of the Netherlands – and Europe – it is quite real. At the Balmatt project in Belgium, where research organisation VITO is building six deep geothermal wells, induced earthquakes have already occurred in the test phase. “This is not looking good for this project”, says Van den Beukel.

“The geothermal well needs to be connected to a district heating network, but the business case for district heating networks is at least as challenging as for geothermal installations”

But the biggest challenge for geothermal energy, says Van den Beukel, is, ultimately, the cost. “Geothermal does not have the possibilities for scaling up and reducing cost unlike, for example, the offshore wind power sector,” he writes. In addition, transporting heat is costly and leads to heavy energy losses. This means wells must be built near places where there is high demand. In the housing sector, this means wells must be connected to district heating networks.

However, building new district heating networks is in itself a costly business. What is more, the heat suppliers can choose among various sources of heat, such as natural gas, “green gas” or industrial waste heat, with which geothermal energy has to compete. According to Van den Beukel, geothermal energy will only be able to show substantial growth if it gets considerable government support. “If the government does not take action,” he says, “I believe it is likely we will have some 10 PJ of capacity by 2030 rather than 50 PJ.”

Business case

Frank Schoof, chairman of the “Platform Geothermie”, which represents stakeholders from the entire geothermal energy value chain in the Netherlands, including operators, technical consultants, research institutes, local governments and financial institutions, says he “completely agrees with Van den Beukel’s analysis.”

The biggest challenge for geothermal energy, according to Schoof, is not so much technical as economic. “The geothermal well needs to be connected to a district heating network, but the business case for district heating networks is at least as challenging as for geothermal installations.”

Finding heat sources (geothermal or otherwise) for a district heating network and convincing homeowners to connect to the system is a highly complicated process, says Schoof. “It involves a lot of different questions for the district heating company. How do you compete against other heating methods? What is your backup when you have a temporary outage? What do you do in winter when your water might not be hot enough?”

In the horticultural sector, it is easier to get projects done, says Schoof, although “here too it is difficult to make a good business case. You run into unexpected problems sometimes. There is still a lot we don’t know about subsurface conditions. The oil and gas sector has the same problem. They often drill dry wells. But you know that if you hit oil or gas, you have something that is worth a lot of money. So it’s worth the risk. With hot water, things aren’t that simple.”

Realistically, Schoof does not think that geothermal energy will have a substantial impact on gas demand in the Netherlands, at least for quite some time to come. He admits that the targets in the Masterplan will be “difficult to reach.” Yet he also notes that all alternatives to natural gas will need government support to become feasible and in some cases geothermal energy is the cheapest option to decarbonise heat supply. "In the Netherlands we want to get rid of natural gas not because it's expensive, but because of the climate and other reasons. That means you have to develop alternatives."

What about other parts of Europe? “They are encountering the same problems as we are,” he says. “They are actually looking to the Netherlands as a model. The Dutch government has thoroughly prepared the legislative groundwork to make geothermal development possible and the entire sector is cooperating on this to make it work. It’s a very thorough approach.”

Schoof is convinced that the Dutch approach will eventually lead to positive results. But unlike Al Gore, he says he “does not expect miracles”.

ThermoGIS and Perform

The Netherlands is taking various initiatives to promote the development of geothermal energy.

Research agency TNO has developed a publicly accessible web-based geographical information system, called ThermoGIS, which provides “geothermal performance maps” of all parts of the Netherlands. These are based on a wealth of subsurface data that TNO has available, thanks to its oil and gas activities in the past. Anyone who wants to start a geothermal project in the Netherlands can make use of the system.

TNO is also working with Danish and German research institutions and companies on the EU-sponsored research project Perform, which aims “to improve geothermal plant performance in order to increase energy output and provide economic feasibility to current and future geothermal projects.”

As the Perform website notes, “existing geothermal plants still face a large variety of operational problems caused by flow obstructions and inefficient injection strategies. The project plan is to develop a collective knowledge base by aggregating data and experiences from a range of geothermal doublets at multi-national level. Demonstration of cost-efficient, next-generation technologies and methods (particle filters, CO2-injection, thermal stimulation) will enable the reduction of obstructive elements and resistance to fluid injection. Predictive modelling of physical and chemical processes will permit long-term doublet performance projection. Optimisation strategies will be undertaken at demonstration sites to ensure maximum energy output.”

How will the gas industry evolve in the low-carbon world of the future? Will natural gas be a bridge or a destination? Could it become the foundation of a global hydrogen economy, in combination with CCS? How big will “green” hydrogen and biogas become? What will be the role of LNG and bio-LNG in transport?

From his home country The Netherlands, a long-time gas exporting country that has recently embarked on an unprecedented transition away from gas, independent energy journalist, analyst and moderator Karel Beckman reports on the climate and technological challenges facing the gas industry.

As former editor-in-chief and founder of two international energy websites (Energy Post and European Energy Review) and former journalist at the premier Dutch financial newspaper Financieele Dagblad, Karel has earned a great reputation as being amongst the first to focus on energy transition trends and the connections between markets, policies and technologies. For Natural Gas World he will be reporting on the Dutch and wider International gas transition on a weekly basis.

Send your comments to karel.beckman@naturalgasworld.com