Can Azerbaijan step up as a supplier for southeast Europe? [Gas in Transition]

Azerbaijan is considered as one of the important and reliable gas suppliers for the EU, particularly its members in southeast Europe, many of which have historically been entirely reliant on Russian supply. With the completion of the Southern Gas Corridor at the end of 2020 after years of political tinkering and support, the implicit assumption that the EU would be ready for a diverse source of supply was proved. It demonstrated the potential for these gas volumes to compete with Russian imports.

The European market in general and especially southeast Europe is becoming highly unpredictable and has already experienced many changes recently, in terms of supply/demand dynamics and energy transition objectives. Despite this volatility, which causes uncertainty for both suppliers and wholesalers, the market remains extremely attractive for new suppliers due to the current good returns.

The EU in general and some nation states are in search of new alternatives to Russian gas, in an effort to deprive Moscow of revenues and reduce the political vulnerability associated with those supplies. Countries that are most vulnerable to supply disruptions like Italy, Greece, Bulgaria, the Western Balkans are in talks with both LNG and pipeline gas suppliers in the US, North Africa, the Caspian and elsewhere. In addition, fracking in Europe is back on the agenda. Against this backdrop, European Commission president Ursula Von Der Leyen and energy commissioner Kadri Simson visited Baku on July 18 to strengthen EU energy ties with Azerbaijan and to secure a memorandum of understanding to double EU imports of Azeri gas from 10bn m3/year to more than 20bn m3/yr by 2027. The main question is where this gas will come from – does Azerbaijan have enough reserves to meet this order.

Gas potential of Azerbaijan

Azerbaijan has several discovered promising fields that currently are at different stages of exploration and appraisal that can produce extra gas if market and financing is secured. However, it is important to mention that among discovered fields there are not many that can be classified as proven and probable (2P) reserves, as only one or two wells have been drilled in some of them. More drilling is needed to get more accurate data and classify the gas as proven, which is necessary to seal supply deals with potential buyers. Among the undeveloped discoveries, only Absheron, Umid and Garabagh are proven. The Shah Deniz Stage 3, ACG deep gas and Babek resources are not, although some rough estimates of their production potential can still be made. Firmer data should be available early next year as a result of well and seismic results. The drilling of new wells targeting Shah Deniz Stage 3 and ACG deep gas resources is due to start before the end of the year.

Garabagh is being developed by Azerbaijan’s SOCAR and Norway’s Equinor under a risk service agreement (RSA) and can potentially provide 2bn m3/yr of gas supply at plateau, and the Dostlug field, located in waters contested by Azerbaijan and Turkmenistan, could add up to another 2bn m3/yr. However, the fields are not anticipated online until 2025-2026. The first and second phases of the TotalEnergies-run Absheron field will flow up to 5bn m3/yr, but not until after 2027. The Umid field is currently producing around 1.7bn m3/yr but this could potentially be brought up to 3bn m3/yr. If the adjacent Babek field is also exploited, this could add an extra 3-4bn m3/yr, as its gas resources are significantly larger. But further exploration and appraisal of Umid and Babek and foreign investment, technology and know-how are needed for the two fields to be developed further. But shifting policies relating to the European Green Deal (EGD) could mean EU support cannot be counted upon. The EGD also led to energy companies making plans to divest from fossil fuels in the long-term, but in the short-term, the market’s tightness and high prices has spurred them to expand output.

It seems that for the time being the most realistic options to ramp up gas supply from Azerbaijan are Absheron and Shah Deniz Stage 3. Results from BP’s upcoming well at Stage 3 will make it clearer what the prospects are, and the project’s cost and timeframe. Potentially, though, it could yield 4-6bn m3/yr of supply. All told, there could be 7-10bn m3/yr of exports available by 2026-2028, depending on the pace of exploration, appraisal and development.

Commercial and marketing arrangements

Long-term or medium-term gas sales and purchase agreements are a prerequisite for further development of Azerbaijan’s gas, underpinning investment. Gas transportation agreements are likewise needed to book capacity. Baku wants to replicate the model used at Shah Deniz Stage 2 at other fields, by first signing long-term sales agreements, then securing loans from international banks, and then pushing ahead with development.

Most of the countries southeast Europe, including those already receiving Azeri gas, are or were heavily reliant on Russian gas. Greece and Bulgaria are contracted to get 1bn m3/yr of Azeri gas each, covering a third and a quarter of their consumption respectively. Both countries intend to eliminate Russian gas from their import mix, and will need 2-3bn m3/yr each to achieve this. Italy, which is contracted to receive 8bn m3/yr of gas from Azerbaijan, is looking towards LNG suppliers, North Africa and Azerbaijan to replace the 25bn m3/yr that until recently it received from Gazprom. There is significant market potential for Azerbaijan in the Western Balkans, which could receive as much as 5bn m3/yr once the Ionian-Adriatic pipeline is completed.

The market has changed significantly since Azerbaijan began piping its gas to Europe. Now it is a sellers’ market, where buyers are desperate to replace Russian gas, meaning that Russian gas no longer represents competition. Depending on the pricing mechanism used, Azeri gas would also be competitive vis-a-vis LNG and supplies currently available at European hubs.

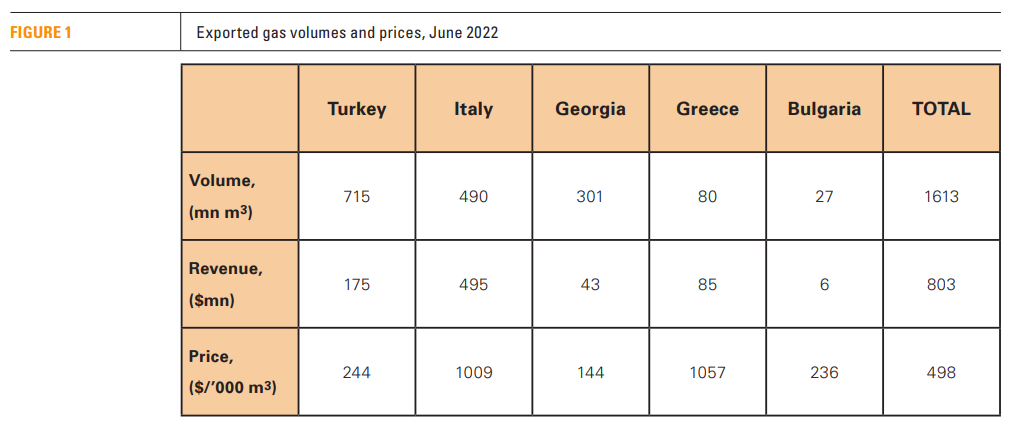

Turkey and Bulgaria currently pay least for Azeri gas because the price is oil-indexed, whereas Greece and Italy are paying standard European market prices. As there is strong competition for LNG cargoes globally, securing them is more difficult, and pipeline gas from an alternative seems out of the competition in Europe.

The role of Turkey

Turkey has a vital role in transiting gas supplies to Europe. Turkey has the right to claim extra gas available for export from Azerbaijan, if it wants more for a favourable price. According to the intergovernmental agreement signed between Azerbaijan and Turkey on the Trans-Anatolian Pipeline (TANAP) section of SGC, “the states expressly agree that all volumes of gas belonging to the Republic of Azerbaijan and planned to be shipped via the TANAP system in excess of an initial volume of 16bn m3/yr will first be offered to buyers in the Republic of Turkey.”

Essentially, this means that Baku cannot send more gas to Europe unless it is first rejected by Ankara. The netback pricing for a producer/supplier in Azerbaijan will be much higher if this gas is only sent to Turkey rather than shipped further to Europe. If Turkey agrees to take more gas beyond the current 8.5bn m3/yr, there will be less gas available for Europe.

Conclusions

High gas prices are going to incentivise importers to engage in term contracts in a suppliers’ market, favouring countries with uncommitted capacity like Azerbaijan, Turkmenistan, Iraq, Egypt, UAE, US, Canada and others in the future to lock in acceptable terms for the medium-term as soon as it would be possible in tight market.

Azerbaijan has a great potential of untapped gas and new commitments from potential European customers are needed to exploise those discovered fields and increase gas export to Turkey and Europe. Securing funding from international banks will most likely be a challenge, given the banks’ policies of reducing financing and investment in fossil fuel projects in line with the climate change objectives – a decision which now looks ill-timed. However, amid the current crisis, with historically higher gas prices and the need to replace Russian gas, such policies can be changed quickly.

Furthermore, an expansion of the Trans-Adriatic Pipeline (TAP) from the current 10bn m3/yr to 20bn m3/yr, can be considered in line with EU climate objectives if the pipeline is later used to pump hydrogen.TAP could bring the EU’s “green” energy discourse to Azerbaijan. Broad discussions around decarbonisation, value chain emissions, methane leakage and other such issues could also impact on the energy sector in Azerbaijan. Baku should be ready to provide a timely regulatory response to the EU’s green policies.

About the Author: Gulmira Rzayeva is a senior research fellow at the Oxford Institute for Energy Studies (OIES), and is a founder and managing director of the London-based Eurasia Analytics Ltd consulting company