Brazil maps out its energy future [NGW Magazine]

Brazil’s energy minister Bento Albuquerque and the energy research office (EPE) released February 11 the country’s energy expansion plan (PDE 2029). Updated annually, it indicates the prospects for the development and expansion of the energy sector in Brazil over the coming decade.

Delayed by two years as major scandals rocked the country and its state-owned producer Petrobras, PDE 2029 forecasts that Brazil will experience a 28% growth in final energy demand by 2029, while the share of renewables will be 48%.

It aspires to be a comprehensive document helping plan the energy sector with the goals of more reliability at lower financial and environmental costs.

Oil products are expected to see a small decline from 34% in 2019 to 32% in 2029. Electricity demand however is expected to rise by about 11%, with the installed power capacity increasing by 43%.

PDE 2029 forecasts oil output will go up 70% and gas 74% and oil exports up 130%. Most of the extra will come from the pre-salt basins offshore.

Energy demand

Brazil’s final energy demand is expected to grow by an average of 2.5%/yr over the period. This is slower than the forecast growth of the Brazilian economy, with GDP projected to grow at 2.9%/yr. The reduction in energy intensity reflects efficiency gains and changes in the country’s energy demand profile. Over the same period, the final energy demand per capita is forecast to increase by 1.9%/yr, close to the global average.

Final energy demand is expected to increase by 28%, from 263mn metric tons oil equivalent (mtoe) in 2019 to 336mn mtoe by 2029. The forecast reflects Brazil’s expected economic growth as the population swells from 209mn in 2018 to 224mn in 2029.

Industry and transport are each expected to account for a third of final energy demand (Figure 1).

Energy demand will increase in all sectors. What is remarkable though, is that diesel provides 47% of all fuel consumption in the transportation sector and this is expected to increase to over 50% by 2029, bucking the OECD trend.

In terms of final energy demand, the largest contribution comes from oil and oil products: from 38.9% in 2019, it drops fractionally by 2029 to 36.9% (Figure 2).

Natural gas plays only a modest role, with a 7.5% contribution in 2019, going up to 7.9% in 2029. Sugar-cane biofuel derivatives also seem to have stabilised, contributing 17.9% in 2019 and slipping to 17.3% in 2029.

Electricity use goes up, from 18% of the final mix in 2019 to 20.3% by 2029.

Coal retains a role, dropping only slightly from 5% in 2019 to 4.8% in 2029. However this masks a big increase in outright demand which grows from 13mn mtoe to 16mn mtoe over the period.

Natural gas

PDE 2029 has some positive news for Brazil’s natural gas markets. The gas consumer market is expected to show an average annual growth rate of 1.4% over the decade, with total natural gas demand forecast increase by 5%/yr over the same period. By 2029 Brazil’s total gas demand should reach 142mn m³/day, compared with 91mn m³/day 2019 (Figure 3). The ‘New Gas Market’ programme could add another 24mn m³/day by 2029.

In the electricity sector, natural gas and biogas can be used as back up for hydroelectric production in times of low rainfall and to back up solar and wind power.

Natural gas is expected to increase its share of final energy, from 7.5% to 7.9% in the period (Figure 2). But in terms of installed power capacity, the share of gas plant capacity will double, from 7% in 2019 to 14% in 2029.

A limitation – but also an explanation for its relatively low contribution to the country’s final energy consumption – is that Brazil uses more gas than it produces. As a result, with declining domestic production, by 2024 it could be importing about 30% of its final demand, through three LNG terminals and an overland pipeline from Bolivia.

There is potential to redress the balance by finding ways to use associated gas from the offshore pre-salt fields (Figure 4), where in some cases it represents 30% of the in-place resource. The problem is that pre-salt gas has sulphur and high CO2 content, which makes it expensive both to develop and to transport. An option being considered is the use of floating LNG. But in order to achieve this, further measures are needed to increase viability and competitiveness and provide greater incentives to gas producers.

The plan forecasts that offshore gas production will grow by 5.8%/yr in the period 2025 to 2029, with the potential that towards the end of the period, total domestic gas production may exceed estimated demand, obviating the need for imports. This depends on overcoming offshore production and transportation challenges, particularly in a low gas price environment.

The state-owned company EPE, responsible for drafting the plan, projected a possible additional gas demand of 17mn m³/day until 2029, if actions being undertaken by government are successful. These include using gas to make more methanol, ethylene and propylene; as feedstock for fertilizers; and in energy-intensive industries such as glass, ceramics and mining.

In order to make better use of all the natural gas associated with pre-salt crude, the government proposed a ‘New Gas Market’ programme to promote a larger share of gas in power generation. This was approved in July 2019 by the president, Jair Bolsonaro, and aimed at cutting the domestic price of gas by 40% within two years, guaranteeing participation of new entrants and attracting greater investment to the natural gas sector.

This was considered necessary to justify the investments required for the production of pre-salt associated gas. For this reason, the provisions for natural gas in PDE 2029 have been the subject of intense debate within Brazil’s gas markets. The initial response is that they are out of step with the expectations of the ‘New Gas Market’ programme, leaving investors in thermoelectric generation, suppliers and producers of natural gas with a high level of uncertainty.

A stumbling block appears to be the market dominance of state-controlled Petrobras. This is despite of government efforts to promote competition by forcing Petrobras to divest its gas distribution and transport assets by December 2021. This, however, is moving at snail’s pace.

Brazil’s gas distributors' association, Abegas, says that lack of access to the country’s gas infrastructure, fundamental for gas production, processing and transport – largely owned by Petrobras – remains the primary obstacle to greater competition and the lower prices that should go along with it.

Petrobras’ gas infrastructure divestment must be expedited and take place transparently within clear timelines and rules if the new gas market plans are to take off.

It has been recommended that integrated planning between the electricity and natural gas sectors, addressed through an energy planning study, could also contribute to the increased use of gas.

Oil

PDE 2029 expects oil production to reach 5.5mn barrels/day (b/d) by 2029, which could propel Brazil into the ranks of the top five producers. This is 77% higher than the 3.1mn b/d achieved in December 2019. The pre-salt basins are expected to account for about 77% of this, mainly the Santos Basin.

Brazil’s oil consumption was 3.08mn b/d in 2018. Even though the share of oil products in the country's final energy mix will go up by more than a fifth by 2029 (Figure 2), the expected massive increase in oil production could lead to a 130% increase in oil exports, from 1.5mn b/d in 2019 to 3.4mn b/d in 2029. This could make the country a net oil exporter towards the end of the Plan’s period.

Electricity

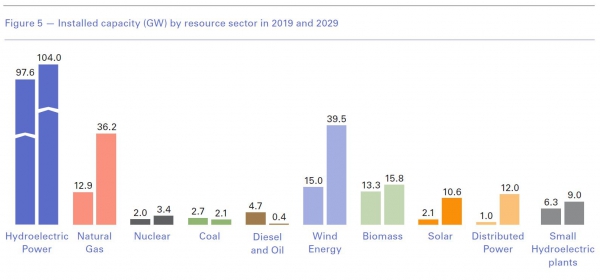

Total power generation capacity will rise 43%, from 176 GW last year to 251 GW in 2029. Electricity demand is expected to rise by nearly 11% between 2019 and 2029.

In order to meet this growth in power demand, the power transmission grid will have to grow 32%, from over 154,400 km in 2019 to more than 203,400 km in 2029.

What is surprising, though, is that according to PDE 2029, the share of hydroelectric plants in installed capacity is expected to drop from an estimated 64% in 2020 to 49% in 2029. In real terms this implies an increase in hydroelectric power capacity of only 6.4 GW over the 10-year period (Figure 5). Brazil is the second largest producer of hydroelectric power in the world, after China.

To compensate for this it will require expansion of electricity capacity in other resource sectors between 2019 and 2029. This is expected to be led by new wind and gas plants, but also solar PV (Figure 5). These can be along the eastern coast where the demand is greatest.

In fact PDE 2029 forecasts a significant increase in the installed capacity of gas-fired power plants, from 12.9 GW today to 35.7 GW in 2029.

Brazil also plans to add 11 GW of distributed micro- and mini-generation capacity, mainly in the form of solar PV.

The problem with hydroelectric plants is that they are in the Amazon River basin in the north, requiring long transmission lines to deliver power to the population and industrial centres. In addition, drought can create uncertainty as happened 2012-18. PDE 2029 is meeting this risk through diversification to other power sources.

Renewables and energy efficiency

PDE 2029 forecasts a 48% share of renewables in the final energy mix by 2029, including 17% of bagasse (sugar-cane fibre), 12% of hydropower, 7% of wood biomass and 12% of other renewables, up from 47% in 2019. In real terms, the increase in renewable energy is quite substantial, up 30%, from 124mn toe in 2019 to 161mn toe in 2029.

Thanks to hydroelectricity, renewables have an even more impressive share in terms of the country’s electricity mix, contributing about four fifths of the total.

The country's energy planning includes, for the first time, the option of offshore wind farms. However, PDE 2029 explains that this would only become a candidate for expansion from 2027, citing high costs. Even so, PDE 2029 points out that offshore wind may become more competitive. According to a study by EPE, Brazil has a technical potential of around 700 GW near the coast, with a water-depth of up to 50 metres. Brazil is considering six offshore wind farm projects, all of which are in the preliminary licensing phase.

For the next ten years, PDE 2029 envisages that wind power could reach a total of 39.5 GW of installed capacity, boosting its share from 9% in 2019 to 16% in 2029. In achieving this ambition it might be helped by foreign upstream investors such as Equinor, no stranger to offshore wind – and even floating wind – power projects.

Given the continuous cost reductions, solar energy is expected to double over the next 10 years to 20 GW of capacity. In terms of distributed generation, the forecast is that solar installations on roofs or remote regions should reach 11.4 GW by 2029.

Brazil has also examined potential gains through adoption of energy efficiency measures. EPE released January 31 its ‘Atlas of Energy Efficiency in Brazil – Indicators Report’, with contributions from the International Energy Agency (IEA). In terms of energy, the report concluded that “despite advances in efficiency gains and public policies, there is still great potential to make efficiency gains, including by using measures that generate financial returns.” One unknown is what efficiency might do. The report recommends that programmes to support the implementation of energy-management systems and training can facilitate major advances.

In the studies that led to preparation of PDE 2029, it was estimated that energy efficiency gains may contribute to the saving of energy equivalent to 21mn toe by 2029 – close to 8% of the 2018 final energy consumption – with the largest contributions coming from industry and transport.

Environmental factors

Despite the recent increase in deforestation, Brazil’s energy-related carbon emissions have remained largely stable, rising by less than 1% between 2018 and 2020, because they are being offset by the large use of clean energy.

However, the share from the destruction of forests (Figure 6) to Brazil’s total emissions is estimated to be 44%, more than the combined contribution from the industrial and energy sectors.

Brazil is ranked seventh in the world’s list of largest emitters, which is led by China followed by the US and the EU. But for deforestation, it would have been doing much better.

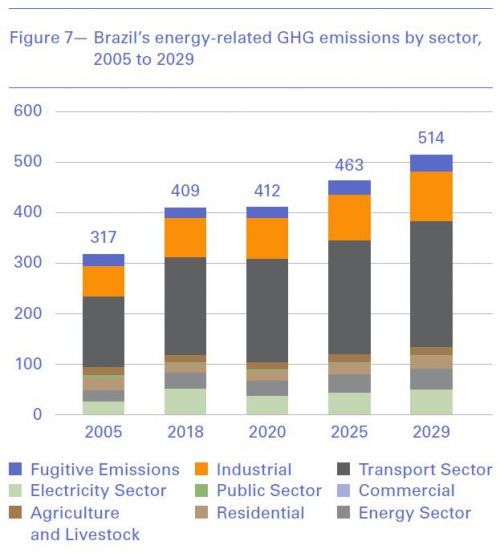

Total energy-related greenhouse gas (GHG) emissions over the Plan’s 10-year period are expected to increase in all sectors (Figure 7). Transport and industry are the biggest, which in 2018 accounted for 46% and 19% of total emissions, respectively. Between 2020 and 2029 energy-related emissions are expected to increase by 25%.

Energy demand per capita over the 10-year period to 2029 increases by close to 30% – as Brazil’s economy and population grow – contributing to the growth in final energy and emissions.

The Brazilian energy sector stands out for having an energy matrix with a large share of renewable sources, a reality enjoyed only in few countries in the world. This means that GHG emissions per unit of energy consumed in Brazil are relatively low.

Nevertheless, the Climate Action Tracker (CAT) is critical of current deforestation policies. It states that with emissions in most sectors expected to rise at least until 2030, the current administration has not implemented any new serious policies to halt emissions growth. Brazil will need to implement additional policies to meet its Paris Agreement NDC targets. It also concludes that even with PDE 2029, unless additional policies are put in place, emissions in the energy sector will continue to rise, leaving the huge national potential for renewable power generation largely untapped.

CAT recommends that Brazil strengthens its climate policy, by sustaining and strengthening policy implementation in the forestry sector and accelerating mitigation action elsewhere.

Complaints are growing that Bolsonaro has presided over an erosion of environmental law. Asset managers, pension funds and international companies are alarmed at the destruction caused by the huge increase in deforestation. In September, 230 funds representing over $16 trillion under management, urged firms to guard against their supply chains being tainted by deforestation.

Even though sugar cane, palm oil, and biofuel crops grown in the Amazon region offer clean energy benefits – because they capture their carbon from the atmosphere – overall, they have a larger carbon footprint. This is because their land use impact can be massive, displacing food crops and often, directly or indirectly, they are linked to deforestation of the Amazon basin.

Nuclear dawn

For the first time in the history of Brazilian energy planning, PDE 2029 gives a clear indication of the intent to build nuclear power plants. It classifies nuclear power as "a technically feasible resource that does not emit GHG", stating also that it may "play a strategic role for the country in terms of technological development."

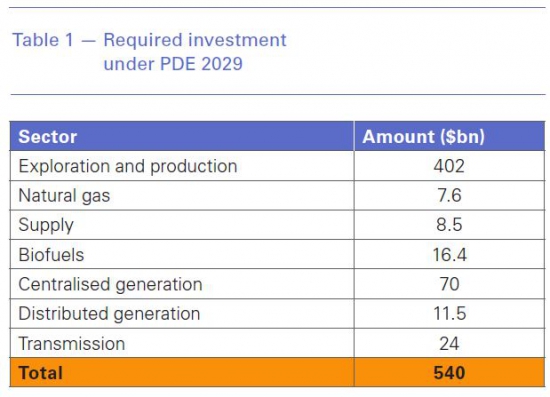

However it is estimated that most investment in Brazil’s energy infrastructure – 77% – will be in the oil and gas exploration and production sector. In ten years it will total $540bn (Table 1).

According to PDE 2029, investments in the expansion of natural gas infrastructure and supply are expected to total over $16bn in the next decade, partly in response to the proposed ‘New Gas Market’ programme.

The biofuels sector is expected to absorb another $16.4bn in investments.

One of the highlights of the plan is $11.5bn allocated for distributed power generation, which should reach 11 GW capacity by 2029, through more than 1.3mn small generators.

Brazil has regulatory and legal stability, with long-term contracts, considered ideal to attract private investment in its energy sector. The current government is well placed to achieve this.

Challenges

However, there has been criticism that the lion’s share of the planned investments are concentrated in the oil and natural gas industry, incompatible with the global push for decarbonisation.

There has also been criticism that PDE 2029 places great emphasis on natural gas, even selling it as part of the solution to reduce emissions.

Another challenge is that the evolving global gas glut and low prices – driven by shale gas production in the US and the global decarbonisation drive – may yet make it harder to develop the pre-salt associated gas that much more difficult. Its sulphur and high CO2 content make gas treatment expensive, exacerbated by the long distance of the pre-salt fields from the shore.

Environmentalists would of course rejoice as this could be replaced by clean energy options, such as cheap renewables and hydropower.

But most of Brazil’s hydroelectric potential in concentrated at the Amazon. As a result, the expansion of this energy source could seriously interfere in protected areas, such as indigenous lands and conservation areas. This has led to calls for PDE 2029 to avoid such projects.

However, the biggest criticism is reserved for what appears to be uncontrollable deforestation of the Amazon basin and its huge destructive impact on the environment. It is steadily weakening the role of the rainforest in stabilising the global climate, with consequences for the rest of the planet. This has led the EU to warn Brazil that inaction on Amazon fires could threaten the Mercosur trade deal being negotiated between the EU and South American countries led by Brazil. Fitch has alreadywarnedthat international concern “will create headwinds to [Brazil’s] export demand and investment inflows.”

Nevertheless PDE 2029 is a step in the right direction, attempting to balance the contribution of energy sources to Brazil’s energy future, while encouraging the exploitation of its pre-salt gas resources and its renewable energy potential.

_f500x417_1583149648.JPG)

_f600x250_1583149675.JPG)

_f600x214_1583149717.JPG)

_f600x298_1583149760.JPG)