Coal Demand Decline Lifted Gas Globally in 2015 - BP

BP CEO Bob Dudley summed up the key message of its 65th annual Statistical Review of World Energy as: “Energy in 2015 – slow demand growth amid plentiful supply.”

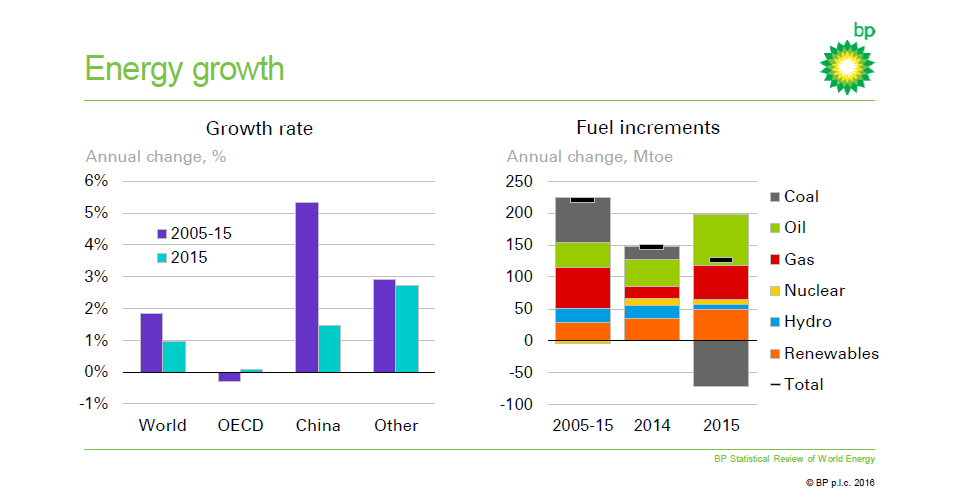

The latest review showed a “gradual deceleration of global energy demand” and indicated that “growth will not be at the same pace as over the past decades.”

World energy demand growth in 2015 was just 1%, much lower than in the past decade, at 13.15bn metric tons of oil equivalent. On a daily basis, that works out at 264mn barrels oil equivalent.

Chinese energy demand growth was its slowest for 20 years, added Dudley. BP chief economist Spencer Dale concurred: “The days of double-digit Chinese demand growth are over.”

Chinese energy demand growth was up 1.5% in 2015 at 3bn tons, the lowest rise in a decade, yet China still remained the world’s single largest growth market last year.

Most fuel types saw global increases in demand last year, with oil up 1.9% at 95mn boe/d, while gas increased by 1.7% to 3.47 trillion m³ (335.6bn ft3/d). The exception was coal (-1.8%) which saw its global primary energy share fall to 29.2%, its lowest since 2005. Prices for oil, gas and coal all fell as a result of ample supply – but responses from suppliers differed from in previous years, said BP chief economist Spencer Dale, chief author of the report.

“Key suppliers did not make offsetting adjustments to help stabilise prices. That is true of Opec’s response to the rapid gains in US tight oil supply. It also appears to be the case for [Gazprom]’s response to increasing competition from LNG … Ceding market share in order to support prices is less attractive when the underlying cause of the imbalance is expected to persist,” noted Dale

Gazprom could see that the oversupply of LNG was not transitory, he added.

Global oil and gas investments fell by $160bn in 2015, said Dale – the biggest fall for decades – which looks set to lead to a tightening of oil, gas and LNG supply in future years, but not yet.

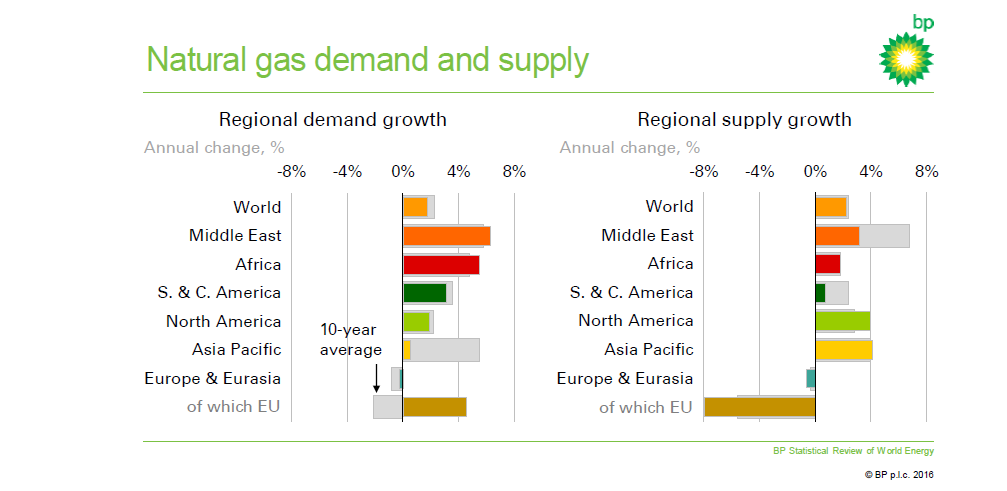

For gas demand, the key source of weakness last year was Asia, where growth in consumption slowed to just 0.5% (3 Bcm), with China acting as the big drag, as its gas demand growth fell to below 5% in 2015, down from double-digit growth in much of the past decade. In the US, the mild winter and weak industrial production meant gas demand outside of the power sector fell in 2015, whereas EU gas consumption bounced back (up 16 Bcm, 4.6%) from an exceptionally mild winter in 2014. The Middle East also recorded strong growth (26 Bcm, 6.2%), as new production sources started up.

In contrast Russia (-5%) recorded the largest volumetric decline, followed by the Ukraine (-21.8%).

On the supply side, the US remained the global powerhouse in 2015, with output growing by over 5% (39 Bcm), accounting for more than half of the increase in world production. All of this increase was driven by US shale gas; conventional US gas production fell. But there were also notable supply increases in Norway (7.7%, 8 Bcm), China (4.8%, 6 Bcm) and Australia (9.4%, 6 Bcm).

Gas eroded coal’s market – in several power markets most clearly in the US, where it overtook coal as the main US power feedstock in 2015. Dale said this was an example of “prices at work.”

Indeed 2015 had been an “annus horribilis” for coal, as US consumption fell by 12%. Unlike in 2012 when US coal consumption fell but the surplus was shipped off to Europe, displacing gas, last year the surplus could not be shifted elsewhere, said Dale.

Chinese coal consumption also fell for the second consecutive year, as it lost out in power generation. Its decline was compounded in 2015 by a sharp slowing in some of China’s most energy-intensive – and coal-intensive sectors -- Iron, steel and cement all fell in absolute terms.

Global carbon emissions were essentially flat last year (0.1%) – the slowest growth in nearly a quarter of a century (other than in the immediate aftermath of the financial crisis), thanks to the shift away from coal toward gas and renewables. On average, over the past ten years, global emissions have risen by 1.5% a year.

China overtook both Germany and the US in 2015 to become the largest producer of solar electricity.

Dale said that, had China’s energy intensity not declined over the past 5 years, global energy demand would have been almost 5% higher – roughly entire energy consumption of France, Germany and Belgium combined – even with the Chinese GDP growth slowdown. Future trends in China’s energy intensity matter as much, if not more so, for energy demand as its economic growth, he said, posing the question: “Have we already seen the peak in Chinese coal consumption?”

Mark Smedley