BP, Eni, Shell Exceed on Greenfield Projects: Rystad

The European majors BP, Eni and Shell are the "best in their class" for new project approvals since the 2015 downturn, according to analysis from Oslo-based consultancy Rystad Energy released July 24.

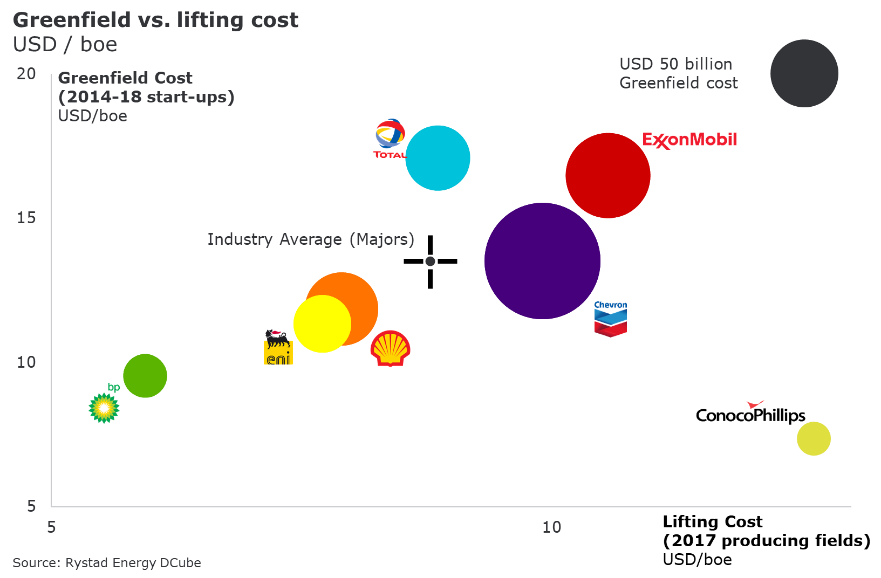

For projects that have started up since 2014, majors have collectively achieved greenfield costs of $13.50/barrel of oil equivalent (boe). Those development costs were in addition to their collective $8.80/boe lifting costs from 2017.

“It is remarkable that BP, Eni and Shell introduced over $109bn of new greenfield projects below the industry average greenfield cost and still were able to still achieve industry-leading lifting costs in 2017. BP’s $6bn investment in the Khazzan Phase 1 and Makarem [gas] projects in Oman highlighted their execution excellence by achieving greenfield costs below $5/barrel of oil equivalent,” said Rystad vice president Matthew Fitzsimmons.

Conversely, despite starting-up nearly $75bn of project investments, ExxonMobil’s greenfield performance on the PNG LNG Phase 1 and lifting cost performance on Kearl Phase 2 meant it now trails the weighted average for majors. “We’ve noticed that ExxonMobil’s greenfield investments have been virtually non-existent since 2014,” adds Fitzsimmons, noting just its $4.4bn Liza phase 1 oil project in Guyana. But Rystad sees Exxon’s greenfield cost performance improve since 2014 as it gears up to take on the challenge put forth by CEO Darren Woods to double earnings by 2025.

BP, Eni and Shell too collectively approved some $64bn of greenfield projects since 2015, with BP alone approving over $27.6bn of those. Fitzsimmons said that BP’s “best-in-class lifting costs” from 2017 of below $6/boe production should give investors confidence, adding that Eni’s recent $25.4bn greenfield approvals have been all offshore projects – including Coral floating LNG, Ghana OTCP (oil and gas), and Zohr phases 1 to 3 (gas offshore Egypt) – signalling the “offshore industry’s attempt to rebound.” (The banner photo shows the Zohr development, seen from the shore, courtesy of Eni)

Collectively, the majors are on pace to approve over $37bn in calendar 2018, of which over $12bn approved in 2Q2018 alone, said Rystad.

It follows a day after Reuters, citing Wood Mackenzie analysis, reported that the majors – particularly Total – have skewed their production profile increasingly towards gas, and away from oil, in recent years.