Boom time for LNG carriers [NGW Magazine]

If there is a sector of the shipping industry that is flourishing in an otherwise tough environment it is LNG transportation. Take for example the contrasting fortunes of LNG carrier company GasLog and the more oil-exposed Malaysian shipping line MISC, both of which released their 2018 financial results in February.

GasLog reported record annual revenues and profits for 2018, with a particularly strong fourth quarter. The company saw a 73.1% rise in adjusted annual profits to $134.8mn last year.

MISC, meanwhile, saw a 36% decline in net profits to ringgit 1.28bn ($310mn). Total revenues for the year were down 12.8% to ringgit 8.78bn.

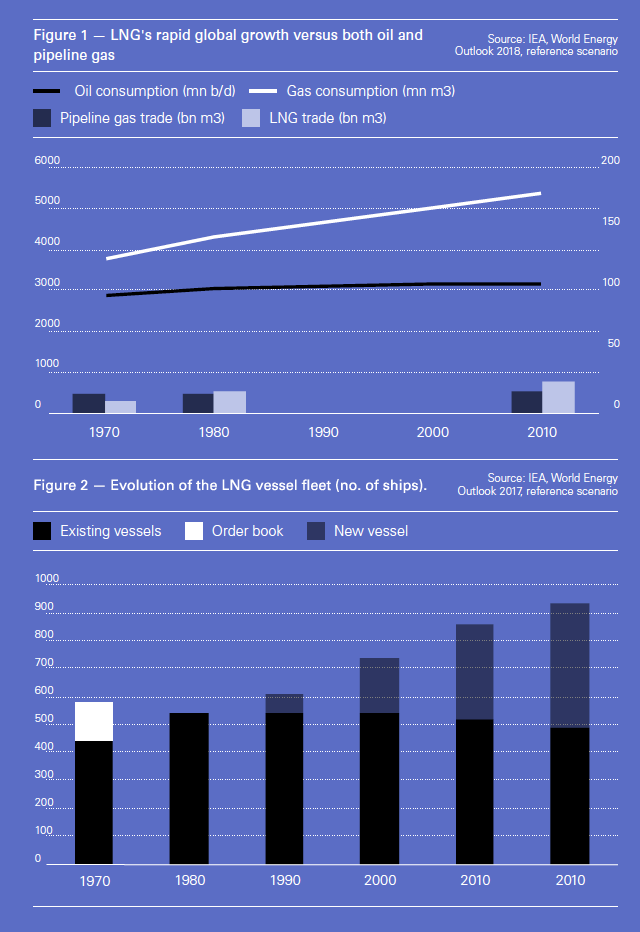

The reasons for the contrast are not hard to see. Global oil demand is forecast to see a compound average annual growth rate (CAAGR) of just 0.5% from 2017 through 2040. In comparison, gas demand is expected to see CAAGR of 1.6%, according to the International Energy Agency’s World Energy Outlook 2018. A CAAGR of 1.6% may not sound overly exciting, but it translates into a 45% increase in demand over the forecast period, in comparison with oil’s 12% rise.

However, the 1.6% CAAGR is not the whole story by any means. The reason why LNG carriers are looking so good is the change in the proportion of gas trade conducted by pipeline as opposed to LNG. In 2017, pipelines accounted for 58% of all gas traded and LNG 42%. By 2025, these proportions should move in favour of LNG with 51%. By 2040, LNG takes almost 59%. Trade in the liquid fuel is forecast by the IEA to rise from 323bn m3 in 2017 to 757bn m3 in 2040, an increase of 134%, compared with gas demand’s overall growth of 45%.

Bright spot in the shipping world

In comparison with the buoyant revenues enjoyed by LNG carriers, oil tankers have something of a sinking feeling. Freight rates have been on a steady downward trend since the end of 2016, while LNG carrier rates hit multiple peaks last year and have continued strong into 2019. For oil tankers, 2018 saw one of the highest scrappage rates in the last decade.

LNG carrier construction has also benefited from the slowdown in new ship orders in other areas such as bulk carriers and containers, which has led to lower construction prices overall. According to the International Gas Union, the costs for tri-fuel diesel electric propulsion and ME-GI engine LNG vessels fell back in 2017 to $1,072/m3 and $1,082/m3 respectively from $1,300/m3 and $1,770m3 in 2014 as South Korea shipyards scrambled to keep the orders flowing in.

Moreover, the outlook for the oil and gas markets could not be more different as oil shipping is buffeted by geopolitical winds from which LNG transport finds itself pleasantly sheltered.

The re-imposition of US sanctions on Iranian crude and oil products last autumn was a blow for oil shippers as it forced them to retreat from all Iranian shipping business. This was followed by Opec and its associated non-Opec oil producers’ decision to take 1.2mn b/d of production off the market from the start of this year. Almost all of this oil trade is seaborne, with the biggest proportion of the cuts being made by Saudi Arabia.

Worse is to follow in 2020, when the International Maritime Organisation’s regulation on sulphur in bunker fuels comes into effect from January 1, reducing sulphur content in bunkers from 3.5% to 0.5%. Shippers will be forced to switch from high sulphur fuel oil to low sulphur fuel oil or marine diesel oil. These are expected to be in short supply as a result of a lack of desulphurisation capacity in the global refining industry. The upshot will be a rise in fuel costs, which shipowners will find difficult to pass on, owing to the market’s surplus capacity.

LNG carriers in contrast come out of this maelstrom scot free, as there are no cartel or sanctions politics influencing gas trade and because LNG carries have the capacity to use the boil-off from their own cargoes as fuel. This automatically puts them below the IMO sulphur cap as LNG contains only trace quantities of sulphur. They will thus escape the anticipated rise in fuel costs likely to affect the rest of the shipping industry.

Positive demand outlook

At the end of 2017, there were 106 LNG carriers on order, 81% of which had charters extending more than a year, meaning that they would roll out of the yards and straight into work. 2018 saw no let up in the enthusiasm for newbuilds, supported by the increase in liquefaction plant coming online in Russia, Australia and the US.

The positive demand outlook has been further buoyed by an upturn in late 2018 and early 2019 in positive financial investment decisions on the next generation of LNG plant. Major projects such as LNG Canada in Kitimat, British Columbia, Golden Pass in the US and perhaps Venture Capital’s Calcasieu Pass LNG in the US will now move ahead. Others, such as Mozambique LNG1, look certain to follow after the announcement of multiple off-take agreements in February.

Given this, and the lid placed on construction costs by the dearth of other new ship building business, it is no surprise that the number of new orders for LNG carriers is bucking the global shipping trend.

Teekay LNG Partners, for example, will take delivery of 15 newbuild LNG carriers over the period 2018-2019, a development which it expects to make a substantial difference to ongoing revenues and profits.

GasLog too is on a rapid expansion path. The company announced seven newbuild orders in 2018, six of which are committed to long-term charters, four with US LNG company Cheniere and two with the UK’s Centrica. “As we look beyond 2020, additional shipping capacity will be required if consensus LNG demand and supply forecasts are realised,” CEO Paul Wogan said in the company’s annual financial results statement in February.

Denmark’s Celsius Tankers is the latest to ramp up its order book, ordering two 180,000m³ LNG carriers from South Korea’s Samsung Heavy Industries January 29. The two ships add to two already on order, all of which are scheduled for delivery in 2020 and 2021.

Qatar, which is as much a driver of demand for LNG shipping as it is shipper itself, is also getting in on the act keen to take advantage of its intended mammoth expansion of liquefaction capacity. The country plans to increase its LNG capacity from 77mn mt/yr today to 110mn mt/yr by around 2023, hugely increasing its LNG shipping requirements.

At the end of January, the country’s energy minister Saad bin Sherida al-Kaabi announced plans to buy 60 LNG carriers from South Korea, adding to the country’s 50-strong fleet.

Qatari shipbuilder Nakilat and US engineering company McDermott also announced in February a joint-venture designed to capture contracts relating to Qatar’s upcoming LNG expansion. Nakilat operates the fleet of Q-Flex and Q-Max tankers, the largest LNG tankers in existence.

In 2018, South Korea’s three main ship builders – Samsung Heavy Industries, Daewoo Shipbuilding and Marine Engineering and Hyundai Heavy Industries Corporation landed orders for over 60 LNG carriers.

Overall, Clarkson Research forecasts that up to 293 new orders for LNG carriers could be made by 2023. The consultants expect that 69 of those orders will be placed this year. This compares with a global fleet of about 452 at the end of 2017. Free of many of the risks faced by the oil industry, it looks like LNG carrier construction will remain a bright spot in shipping for many years to come.